What is OS

The concept of fixed assets is disclosed by PBU 6/01 “Accounting for fixed assets” and the Tax Code of the Russian Federation. OS is the property of an enterprise, repeatedly used in production and economic activity, meeting the conditions:

- intended for long-term use (more than a year);

- not for sale;

- not processed during the production process (like raw materials);

- it is expected to make a profit.

In other words, OS are buildings, equipment, machines, machines, computers, office equipment, household supplies, etc. OS also include animals, fruit-bearing perennial plants, capital communication and transport facilities (communication centers, roads, power grids).

The criteria for fixed assets also include the initial cost, but it is different for accounting and tax accounting. In accounting (BU) (clause 5 of PBU 6/01), the maximum cost of classifying property as MPZ is 40,000 rubles. (accounting policy may establish a smaller amount). Such property is written off as expenses as soon as it is put into production. Anything that exceeds this limit, but meets the above criteria, is taken into account as OS.

ATTENTION! From 2022, the new FSB 6/2020 “Fixed Assets” and FSB 26/2020 “Capital Investments” are mandatory. The provisions of these standards can be applied earlier by prescribing such a decision in the accounting policies of the enterprise.

ConsultantPlus experts explained step by step how to disclose information in reporting when applying FAS 6/2020 “Fixed Assets” and FAS 26/2020 “Capital Investments”. Get free demo access to K+ and go to the ready-made solution to find out all the details of this procedure.

In tax accounting (TA) objects worth up to 100,000 rubles. inclusive, are not considered fixed assets (Article 257 of the Tax Code of the Russian Federation). The assignment of an asset to fixed assets affects the procedure for accounting for its value as part of expenses (fixed assets are subject to depreciation, i.e., they are written off gradually according to the accounting policy of the enterprise, and inventories are written off at a time), as well as the procedure for document flow, inventory and write-off.

Postings upon receipt of fixed assets

Fixed assets are taken into account at their original cost. It is understood as the sum of the cost of purchasing the OS and other expenses associated with this purchase (installation, delivery, customs duties, intermediary commission, etc.).

IMPORTANT! The initial cost of an asset does not include VAT if this tax is refundable for the company (clause 8 of PBU 6/01). Non-payers of VAT (for example, simplifiers) take this tax into account in the initial cost of property (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

The OS is accepted for accounting on the date when it is fully formed, and for NU - when the OS is put into operation.

When an asset is received, accounting records are generated:

- Dt 08 Kt 60 (10, 70, 69) - expenses for the acquisition or creation of fixed assets are taken into account;

- Dt 19 Kt 60 - input VAT is allocated;

- Dt 01 Kt 08 - PS OS was formed.

For information on how to account for VAT on fixed assets, read the article “How to claim VAT on fixed assets or equipment for deduction.”

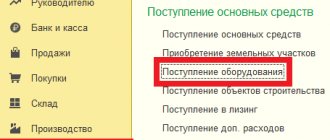

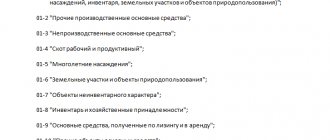

If the OS requires installation, then account 07 “Equipment for installation” will be included in the postings. As a rule, it is used by construction organizations. The account accumulates information about equipment that requires technological installation, connection to networks and communications and is intended for installation in premises under construction. After the costs are fully collected on the account, the amount of the installed OS is written off to Dt account 08 (Dt 08 Kt 07). Next, the same algorithm is applied: amounts from account 08 are written off to account 01, thus forming the initial cost of the asset.

More detailed information is provided in the Guide to the purchase and sale of real estate from ConsultantPlus. Get free trial access to the system and proceed to the materials.

How to correctly write off an operating system from the balance sheet of an enterprise - rules

The procedure for decommissioning an OS contains many nuances. They need to be studied in advance, before the process starts.

Knowing the correct procedure and what entries need to be made by the accounting department, the company will be able to carry out the procedure correctly, which will help avoid problems with regulatory authorities (in particular with the tax office).

Write-offs are carried out by the company only in certain situations.

The main reasons for deregistration of fixed assets:

- sale (features of selling OS to an individual);

- gratuitous transfer to another company;

- exchange;

- breakdown - write-off of operating systems that have become unusable;

- depreciation - write-off of depreciated fixed assets;

- damage due to an emergency;

- theft of an object identified during inventory.

Deterioration of an object can be physical or moral. The first implies breakdowns or failure, in the second case they talk about the obsolescence of the model.

In both situations, further use of the fixed asset for its intended purpose is considered inappropriate.

Important! When moving an object between structural divisions, write-off is not performed.

Here a simple invoice for internal movement is issued. The company's fixed assets still remain on the balance sheet.

Regardless of the reasons, the procedure for writing off an asset from the balance sheet of an enterprise will be identical in all cases.

The procedure itself begins with the approval of the special commission by the head. For this purpose, a corresponding order is issued for the enterprise. The commission consists of at least three people.

The members of the commission are middle managers: Ch. engineer, gl. mechanic, gl. accountant, etc. Specialists should be from different fields, this will help to consider the impossibility of further using the OS from different points of view.

The Commission carries out a number of actions:

- assessment of the possibility of restoring the previous parameters of the object;

- thorough inspection of the OS;

- determination of the reason for liquidation;

- identification of those responsible (in case of theft or breakdown);

- drawing up an inspection report;

- drawing up a conclusion;

- drawing up a defective statement;

- formation of an act on decommissioning of the operating system and protocol.

Only after the commission has completed its assigned tasks does the manager decide whether to write off the fixed asset or not.

If the decision is positive, a special order is issued. It must be signed by all members of the commission, the head of the company and other interested parties.

After issuing the order, the accountant makes the necessary entries and the property is written off. If the OS contains parts that can be used in the future in other property, it is necessary to disassemble and post the parts.

To write off fixed assets, an additional subaccount is opened to account 01.

The initial cost of the object is transferred to it.

The next step is to write off depreciation for the entire period of use of the property from account 02 to an open subaccount to account 01.

After making this posting, a residual value is formed, which also needs to be written off.

The amount of income tax depends on the correct display of entries in accounting.

Accountant mistakes can lead to disastrous consequences.

Let's look at what kind of postings an accountant will make in more detail below.

Causes

The write-off procedure occurs for the following reasons:

- sale of an object to an individual or legal entity;

- transfer of property as the authorized capital of another company;

- transfer of an object by exchange or gift;

- when identifying a shortage of an object;

- upon partial liquidation of the facility.

You can also write off a fixed asset for reasons of moral or physical wear and tear.

In most cases, deregistration occurs after the item ceases to provide economic benefit to the company.

What documents are needed - documentation

The law does not contain a specific obligation to fill out certain forms of documents when writing off property from the balance sheet of an enterprise. Companies have the right to develop them independently, subject to prior approval by order.

In this case, it is necessary to ensure that such documentation contains the required details.

It is allowed to use unified forms of primary documents, as well as altered or independently developed forms.

The main thing is that the forms used are stipulated by the accounting policy.

The list of required documents directly depends on the reason for the write-off.

When selling, fill out the following forms:

- act of write-off of form OS-1 (OS-1a or OS-1b);

- Act of Handover;

- contract of sale

If the main asset has become unusable, use:

- defective statement;

- act of write-off of form OS-4, OS-4b or OS-4a, depending on the type of OS.

Defective statements and acts are filled out by the commission for writing off fixed assets. Errors and clerical errors should not be allowed in such documentation. Otherwise, this may lead to problems with inspection authorities.

Postings in accounting

To remove an asset from the balance sheet of an enterprise, you need to write off depreciation from account 02 and the original cost from account 01.1 to subaccount 01.2 using entries Dt 01.2 Kt 02 and Dt 01.1 Kt 01.2.

After which, a residual value is formed in subaccount 01.2, which must be written off as a debit to account 91 by posting Dt 91.2 Kt 01.2.

When writing off a fixed asset, accounting makes several important entries:

| Postings | Description | |

| Dt | CT | |

| 01.1 | 01.2 | Posting for writing off the initial cost of an object |

| 02 | 01.2 | Write-off of depreciation |

| 91.2 | 01.2 | Posting for writing off the residual value of an object |

| 91.2 | 70, 76, 69 | Costs associated with deregistration are taken into account |

| When worn | ||

| 10 | 91.1 | The capital assets remaining from the write-off of the fixed asset (parts, assemblies) were capitalized |

| When selling | ||

| 62 | 91.1 | The sales price of the fixed asset is reflected |

| 91.3 | 68 | VAT charged on the sold item |

| 91.2 | 10 (20,23,26 …), 60 | Sales expenses are reflected |

| For free transfer | ||

| 91.3 | 68 | VAT is reflected on the market value of the donated OS |

| When contributing fixed assets to the authorized capital of another organization | ||

| 76 | 01.2 | Transfer of fixed assets to the management company of another company |

| 58 | 76 | The debt on the contribution to the capital of another company is reflected |

| In case of shortage | ||

| 94 | 01.2 | Write-off of residual value |

As can be seen from the table, the entries made by the accountant are directly related to the reasons for the write-off: sale, transfer, shortage or wear and tear.

Also, the accountant will additionally make entries for the receipt of parts if the property is being dismantled for spare parts.

This is done after the main object is written off.

Additionally, when the fixed asset is sold at a price below the residual value, the accountant will make an entry to reflect the loss Dt 99 Kt 91.9, and at a price above the residual value, he will show the profit by posting Dt 91.9 Kt 99.

Accounting for depreciation of fixed assets: postings

Unlike materials and inventories consumed in production, fixed assets transfer their cost to company expenses gradually. This process is called depreciation. However, it is not accrued for certain types of fixed assets. Such objects include assets that do not change production qualities during the operation of the enterprise: land plots, cultural heritage sites, art collections, etc.

In accounting, four methods of calculating depreciation are used (linear, reducing balance method, by the sum of the numbers of years of useful life, in proportion to the volume of production), however, for the purposes of accounting, only linear and non-linear methods are used.

IMPORTANT! As a rule, an organization uses one method of calculating depreciation for accounting and financial accounting, since different methods create tax differences that require additional attention of an accountant. Therefore, the linear calculation method is usually used.

Linear depreciation is calculated using the formula:

A = PS / SPS,

Where:

A is the monthly depreciation amount;

PS - initial cost of fixed assets (account balance 01);

SPS is the useful life of the OS.

To calculate it, you need to know the useful life of the asset, established by the Decree of the Government of the Russian Federation “On the classification of fixed assets included in depreciation groups” dated January 1, 2012 No. 1. In accounting, fixed assets can be written off faster than in tax accounting, using other calculation methods and a shorter period of use, but then tax differences are formed, since accounting and tax amounts will differ.

An example of calculating depreciation using the straight-line method was prepared by ConsultantPlus experts. Get trial access to the system for free and proceed to the example.

To account for depreciation, records are kept in account 02 “Depreciation of fixed assets.” Its amounts are debited from the accounts of production and commercial costs (20, 23, 25, 26, 29, 44), forming a credit balance on account 02.

The accountant creates monthly records:

Dt 20 (23, 25, 26, 29, 44) Kt 02 - depreciation has been accrued for fixed assets.

Depreciation of property

Calculating depreciation allows you to gradually transfer the cost of expensive assets to production and selling costs. The rules for the formation of depreciation are reflected in the provisions of PBU 6/01 “Accounting for fixed assets”.

Depreciation charges are made not only by companies that use their own property in production processes, but also by other organizations - lessors and lessors, as well as recipients of this property (if provided for by law or the terms of the contract).

If there is a leasing agreement, depreciation is calculated by the organization on whose balance sheet the property is listed. Moreover, if an asset has already been used before when being leased, when calculating depreciation, its residual value and the useful life of the asset established by the lessor are taken as the basis.

More detailed information on determining the residual value of property can be found in the material “How to determine the residual value of fixed assets.”

If a lease agreement is concluded, the property continues to be accounted for on the balance sheet of the lessor, and it is the latter who accrues depreciation. However, if the tenant makes capital investments that lead to inseparable improvements to the leased property, situations are possible where depreciation will be charged by the tenant (Article 258 of the Tax Code of the Russian Federation).

The choice of depreciation method in accounting and tax accounting should be fixed in the relevant sections of the accounting policy. At the same time, the leased property and the depreciation accrued on it are taken into account separately from other fixed assets that are used in other types of business activities of the company.

Find out about one of the methods for calculating depreciation in the material “Linear method of calculating depreciation of fixed assets (example, formula).”

Accounting entries for the restoration of fixed assets

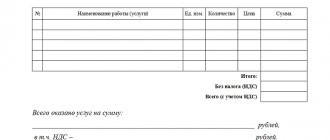

The initial cost may increase if work is carried out to restore the OS (modernization, reconstruction and retrofitting). The accounting procedure for such operations differs depending on whose forces this modernization is carried out: a third-party organization or independently. If the modernization is carried out by a third-party contractor, then the costs of such work are reflected in Dt account 08 in correspondence with account 60 “Settlements with suppliers and contractors”. In this case, the postings are generated:

- Dt 08 Kt 60 - reflects the cost of the contractor’s work;

- Dt 19 Kt 60 - VAT allocated.

If the work is carried out independently, then the costs of additional equipment are taken into account on account 08 in correspondence with the cost accounts (10, 70, 69, etc.). This creates the following records:

Dt 08 Kt 10 (70, 69, etc.) - reflects the costs of upgrading the OS.

Upon completion of the work, the amounts accumulated on account 08 are written off to account 01 Dt, thus increasing the initial cost of the asset.

Read more about the features of accounting and NU OS in the article “Modernization of fixed assets - accounting and tax accounting.”

Methods

Methods for disposal of assets depend on the reasons for deregistration of fixed assets.

OS objects leave the organization for the following reasons:

- physical wear and tear – the object is no longer able to work as efficiently as before;

- obsolescence - the asset does not correspond to modern realities and requires updating;

- complete depreciation - the end of the useful life established for a specific fixed asset when it was accepted onto the balance sheet of the enterprise;

- breakdown, damage – loss of previous performance qualities;

- the object is no longer needed by the organization;

- other reasons.

In accordance with these reasons, the following methods of disposal of fixed assets from the organization are possible:

- Write-off due to wear and tear.

- Sale to another person – transfer for a fee.

- A gift to another person is a gratuitous transfer.

- Contribution to the authorized capital of another organization.

These methods are the main directions for disposal of fixed assets from the company.

Documenting

The disposal process requires mandatory documentation. Any operation must be supported by a document.

Any posting should only be carried out with paper confirmation.

The disposal procedure is usually accompanied by the preparation of the following documents:

- Order - based on the order, a commission is formed that makes a decision on the need to dispose of the fixed asset and the reasons for this.

- The inspection report of a fixed asset is a document drawn up by members of the commission during the assessment of the condition of the asset.

- Defective statement - if the equipment is damaged.

- Write-off act (OS-4, OS-4a or OS-4b) – if the object is subject to deregistration and further dismantling, disposal or destruction.

- Act of acceptance and transfer (OS-1, OS-1a or OS-1b) – if the object is transferred to another person as a gift, sale or contribution to the authorized capital of another company.

- Contract of sale or gift.

- Inventory card (OS-6, OS-6a or OS-6b) – information about the withdrawal of fixed assets from the balance sheet of the enterprise is entered.

It is possible to prepare additional documents depending on the reasons and method of disposal of the fixed assets item.

OS sales

In the case when an organization sells fixed assets, it is obliged to record the cost of sale of the asset and the original cost minus depreciation (residual value). Records are generated:

- Dt 62 Kt 91 - income from sale is recognized;

- Dt 91 Kt 68 - VAT reflected;

- Dt 02 Kt 01 - depreciation written off;

- Dt 91 Kt 01—residual value written off.

Ownership of the asset is transferred on the basis of a deed (Form No. OS-1). If the object of sale is real estate, then the date of transfer of rights is the date of state registration.

Taking into account equipment requiring installation

Some of the equipment that goes into production usually requires installation. This can be production or technical equipment that functions only after its assembly, as well as measuring instruments that are mounted to the main equipment.

Let's look at an example:

in October 2015, JSC Bogatyr purchased equipment at a price of 6,745,000 rubles, VAT 1,030,271 rubles. The equipment was purchased for the purpose of assembling a conveyor line. Delivery services - 41,000 rubles, VAT 6,254 rubles. For installation, the contracting organization Montazh Plus LLC was hired (cost of services 234,000 rubles, VAT 35,695 rubles).

The accountant of Bogatyr JSC made the following entries in the accounting:

| Dt | CT | Description | Sum | Document |

| 60 | Reflection of the cost of equipment requiring installation | RUB 5,714,729 | Sales Invoice | |

| 60 | Reflection of the cost of transport company services | RUB 34,746 | Certificate of completion | |

| 19 | 60 | Reflection of input VAT on the cost of equipment | RUB 1,030,271 | Sales Invoice |

| 19 | 60 | Reflection of input VAT on the cost of transport company services | RUR 6,254 | Certificate of completion |

| 08_3 | Reflection of the cost of equipment transferred for installation of the conveyor line (5,714,729 + 34,746) | RUB 5,749,475 | Equipment acceptance certificate | |

| 68 VAT | 19 | Acceptance for deduction of input VAT on costs of purchasing equipment (1,030,271 + 6,254) | RUB 1,036,525 | Invoice |

| 08_3 | 60 | Reflection of value | RUB 198,305 | Certificate of completion |

| 19 | 60 | Reflection of input VAT on cost | RUB 35,695 | Certificate of completion |

| 01 OS in operation | 08_3 | Acceptance of registration and commissioning of the conveyor line (5,749,475 + 198,305) | RUB 5,947,780 | OS commissioning certificate |

| 68 VAT | 19 | Acceptance of input VAT deduction from the cost | RUB 35,695 | Invoice |

Results

Thus, asset accounting is quite diverse, as it accompanies many situations related to the acquisition, use, write-off, and modernization. Acceptance of an asset for accounting (account 01) occurs through accounts 07 and 08, which accumulate expenses associated with acquisition, installation, delivery, etc. Disposal of fixed assets occurs by writing off the residual value for other expenses of the organization.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Transfer of equipment for rent

Admiral LLC purchased equipment for the purpose of renting it out. The cost of equipment on the balance sheet is RUB 512,000, VAT RUB 78,102.

| Dt | CT | Description | Sum | Document |

| 03 Own property | 08 | Acceptance of equipment for registration | RUR 433,898 | Act OS-1 |

| 68 VAT | 19 | Acceptance of VAT deduction | RUB 78,102 | Act OS-1 |

| 03 Leased property | 03 Own property | Transfer of equipment to the tenant | RUR 433,898 | Transfer and Acceptance Certificate |