The seller is a VAT payer.

Until 01/01/2019, clause 31 clause 2 art. 149 of the Tax Code of the Russian Federation, according to which the sale of waste paper was exempt from VAT.

From this date, the norm lost force, as a result of which the sale of waste paper (paper and cardboard production and consumption waste, rejected and out-of-use paper, cardboard, printed products, business paper, including documents with an expired shelf life) fell into VAT-taxable transactions. However, the seller does not calculate and pay the tax in this case; this responsibility is assigned to the buyer (recipient) of waste paper - the tax agent (paragraph 2, paragraph 3.1, article 166, paragraph 8, article 161 of the Tax Code of the Russian Federation).

For your information:

For the purpose of applying paragraph 8 of Art. 161 of the Tax Code of the Russian Federation, the recipients of goods are organizations and individual entrepreneurs who have the right of ownership of the goods, including on a gratuitous basis.

The procedure for calculating VAT by a tax agent is applied when selling waste paper after 01/01/2019, regardless of the fact that this product was purchased before 01/01/2019 or an advance payment for it was received in 2021 (Letter of the Ministry of Finance of Russia dated 01/25/2019 No. 03‑07‑11/ 3969).

But buyers are required to calculate and pay tax to the budget only if they purchase waste paper from sellers - VAT payers, who will inform the buyer about the upcoming “VAT obligation” by issuing him an invoice filled out in a special way. As noted in paragraph. 2 clause 5 art. 168 of the Tax Code of the Russian Federation, when taxpayers sell goods specified in paragraph. 1 clause 8 art. 161 of the Tax Code of the Russian Federation, as well as upon receipt of payment (partial payment) for upcoming deliveries of such goods, he must draw up invoices, adjustment invoices excluding VAT amounts. At the same time, in such invoices, adjustment invoices, the inscription or stamp “VAT is calculated by the tax agent” is affixed (Letter of the Ministry of Finance of Russia dated 02/20/2019 No. 03‑07‑14/10689).

Note:

The corresponding inscription is made in column 7 of the invoice. Columns 8 (amount of tax) and 9 (cost of goods with tax) are not filled in (Letter of the Federal Tax Service of Russia dated January 16, 2018 No. SD-4-3 / [email protected] ).

At the same time, in some situations (as follows from paragraph 1, clause 3.1, article 166 of the Tax Code of the Russian Federation), waste paper sellers will have to calculate and pay VAT to the budget. Such cases are provided for in paragraph. 7 and 8 art. 161, paragraphs. 1 clause 1 art. 164 of the Tax Code of the Russian Federation, as well as when selling the specified product to “physicists” who are not individual entrepreneurs.

For your information:

Regardless of whether waste paper sellers calculate VAT on their own (paragraph 1, clause 3.1, Article 166 of the Tax Code of the Russian Federation) or “transfer” this responsibility to buyers - tax agents, they (sellers - VAT payers) have the right to deduct the amount of "input" tax for goods (work, services) purchased by them, used to carry out operations for the sale of waste paper, regardless of the fact of payment for these goods (work, services). In addition, the need to keep separate records when such taxpayers sell waste paper and carry out other activities subject to VAT is eliminated (letters of the Ministry of Finance of Russia dated November 27, 2018 No. 03-07-14/85348, dated December 3, 2018 No. 03-07-11/ 87234).

How the industry works

The Russian waste paper processing industry consists of 84 enterprises with a total processing capacity of 4.5 million tons per year. About 40% of all paper and cardboard products in the country are made from waste paper. More than 50% of recyclable waste paper is recycled

Recycling of waste paper in Russia and the EU

Source: CEPI, Rosstat, Center for System Solutions

To fully understand the situation, an analysis of the structure of the waste paper recycling industry should be provided. At the top level is a plant where waste paper is converted into various types of paper products (container boards, tissue paper, molded paper fiber packaging, paperboard-based building materials, etc.).

The main supplier of waste paper for factories is production and procurement enterprises (PZP), where waste paper is sorted and product batches are formed. Each plant usually works with several dozen PPPs, says Artem Kiryanov .

The PPP and waste paper generation sites are connected, without exaggeration, by a huge number of primary producers - individual entrepreneurs, micro and small businesses, simply put - drivers with one Gazelle. Tens or hundreds of primary procurers can cooperate with one PPP.

As you can see, one plant completes a chain consisting of hundreds, and in some cases thousands of participants. It is easy to control the payment of taxes by processing enterprises—there are currently 84 of them in the country. It is almost impossible to track all the suppliers. But with Fokin’s VAT, the number of participants in the chain no longer matters: the plant pays the tax for everyone. It is enough to appoint one Federal Tax Service inspector for each of the 84 factories to effectively control the accrual and payment of taxes.

Waste paper balance in 2021

League of Waste Paper Recyclers, System Solutions Center

An important circumstance: the waste paper procurement segment, including primary procurers and PPPs, is a completely small business that has the right to use a simplified taxation system.

Seller is an organization that is not a VAT payer or an individual.

If waste paper is sold by a “special regime” (an organization or individual entrepreneur that is not a VAT payer) or a VAT payer exempt from taxpayer obligations under Art. 145 and 145.1 of the Tax Code of the Russian Federation (here there may also be payers of the Unified Agricultural Tax who have been paying VAT since January 1, 2019, but met the conditions and took advantage of the exemption under Article 145 of the Tax Code of the Russian Federation), buyers do not have duties as a tax agent. In this case, the seller will make an appropriate entry in the contract and the primary accounting document or indicate.

For your information:

Persons exempt from paying VAT do not prepare an invoice; such an obligation is assigned only to the payers of this tax (clause 3 of Article 169 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated February 28, 2018 No. 03-07-11/12711).

When purchasing scrap metal from “physicists” (by virtue of clause 1 of Article 143 of the Tax Code of the Russian Federation, they are not recognized as VAT payers, with the exception of cases related to the movement of goods across the customs border of the Customs Union), buyers of waste paper are also not required to calculate and pay VAT.

This is also confirmed by the Ministry of Finance in Letter No. 03-07-14/85863 dated November 28, 2018: in the case of purchasing waste paper from value added tax evaders, including individuals, there is no obligation to calculate value added tax for waste paper buyers.

Setting up the program

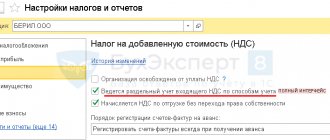

If an organization buys and sells waste paper, then in the settings of 1C: Accounting of a KORP enterprise, you need to check the box for the value “Reverse charge for VAT” ( Main - Functionality - Calculations - Reverse charge for VAT

).

Figure 1 - Functionality in the Main section

Figure 2 — “Reverse VAT charge” setting

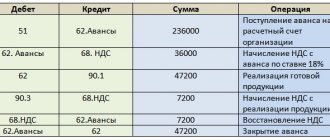

VAT deduction from the tax agent.

Having received from the seller - the VAT payer the corresponding instruction that the tax is calculated by the tax agent, the buyer of waste paper fulfills the obligation assigned to him, regardless of the applied taxation regime, as well as exemption from the obligations of the VAT payer.

At the same time, the buyer (tax agent) has the right to deduct the VAT calculated when purchasing waste paper only if he is the payer and the goods purchased by him are intended for transactions subject to VAT (clause 3 of Article 171 of the Tax Code of the Russian Federation).

In Letter No. 03-07-14/85863 dated November 28, 2018, the Ministry of Finance indicated that VAT amounts calculated by tax agents - buyers of waste paper based on invoices issued by sellers will be deducted in the tax period in which these goods are supplied for registration. As a rule, the tax period in which tax agents calculate tax for the seller - a VAT payer, coincides with the tax period in which tax agents have the right to deduct tax as a buyer.

The Ministry of Finance is killing the industry

Thus, 2021 has placed the industry in extremely difficult conditions. From a simple and understandable system they turned it into a complex and confusing one. “Now we are increasing the number of payers, which increases the burden on administrative authorities, and we cannot expect an increase in revenues, since what was previously collected in one place will be distributed along a long chain. What 80 companies did will now spread across millions. Why was this done? Unclear. And VAT is a tax on which decisions should be made only after in-depth analysis,” says Vladimir Saskov.

The main mistake of the Ministry of Finance specifically regarding waste paper is that waste paper was considered by the department in the same way as other regulated items, in particular scrap metal. In the procurement of scrap metal, there is a period of emergence of a semi-finished product, which can simply be “drawn” on paper, although in reality it will not exist.

New paper machine at Sukhonsky Pulp and Paper Mill (United Paper Mills)

Source: OBF press service

This, on the one hand, is still scrap metal, and on the other hand, it is a semi-finished product, not a finished product. And in a number of cases, industry participants have abused this. They artificially integrated companies into the chains, which seemed to sell them semi-finished products and receive a tax deduction. In the case of waste paper, the ministry, trying to find a similar semi-finished product in the supply chain, had in mind sorted and baled waste paper, that is, raw materials that comply with GOST 10700-97, which producers sell to processors and which, according to law 174-FZ, was exempt from VAT. But industry participants have a logical question: why do they need to manipulate waste paper if this raw material is already exempt from VAT? There is still no answer to it.

Industry participants are sounding the alarm. “We have not yet received requests from the tax office,” says an accountant of one of the PZPs, “but only because the Federal Tax Service itself has not yet understood what is happening.” According to her, there are already known cases when suppliers declared VAT deductible on purchased services.

If earlier this was impossible, because the activities of small distributors of waste paper were not subject to VAT, now they have such an opportunity. And, naturally, the accountant explains, the budget will lose this money.

Large factories have already felt the changes - their work has become more complicated: incoming invoices without VAT may not correspond to reality. You have to constantly call the suppliers and find out what taxation system they use.

There are also purely technical difficulties with accounting. The 1C program currently supports only one version - CORP. And if a waste-generating company needs to take into account even one-time work with waste paper, it must purchase a new program, which costs about 35 thousand rubles. In addition to the costs of the program, the waste generator must also pay for employee training. And all this in order to perform one operation, because VAT must be reported electronically, and the sale of waste paper for the vast majority of waste generators is a non-core job.

But perhaps the most difficult point is that the procurer, as a tax agent, must calculate VAT at the time of shipment, when receiving waste paper. And it must be calculated according to the invoice provided by the waste generator. Accordingly, in the absence of such a document, tax cannot be calculated. What to do about it? Unclear. And since for most waste generators waste paper is a non-core business, it is clear that no one is in a hurry to resolve the issue. The result is obvious: waste paper collection volumes are decreasing.

* * *

We examined the general procedure for calculating VAT by buyers of waste paper - tax agents. The explanations of the competent authorities apply to this situation in relation to all goods specified in paragraph 8 of Art. 161 Tax Code of the Russian Federation.

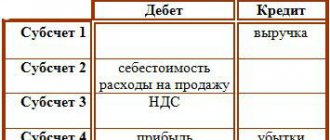

Let's add a few words about the payment of taxes by tax agents. The procedure for calculating the amount of VAT that the tax agent must pay to the budget based on the results of the quarter is established in clause 4.1 of Art. 173 Tax Code of the Russian Federation. The tax is calculated cumulatively in relation to all goods listed in clause 8 of Art. 161 of the Tax Code of the Russian Federation, and in relation to all transactions for the past tax period. The total amount of tax calculated in accordance with clause 3.1 of Art. 166 of the Tax Code of the Russian Federation, increases by the restored amounts on the basis of paragraphs. 3, 4 p. 3 art. 170 of the Tax Code of the Russian Federation and is reduced by the amount of deductions provided for in paragraphs 3, 5, 8, 12 and 13 of Art. 171 of the Tax Code of the Russian Federation, regarding operations carried out by the named tax agents.

As for the VAT return, changes have now been made to the form, format and procedure for filling it out. Now for tax agents specified in paragraph 8 of Art. 161 of the Tax Code of the Russian Federation, a clear procedure is prescribed.

VAT: problems and solutions, No. 4, 2021

The industry is fighting for its salvation

It is already clear that the entry into force of new amendments to the Tax Code has a serious impact on the entire industry and carries significant risks for both the economy and the environment, since up to 50% of the paper industry is dependent on waste paper. And if we talk about the consequences, the most obvious of them seems to be a decrease in the volume of waste paper procurement due to a decrease in the number of producers, says Artem Kiryanov. This will be followed by a decrease in the volume of production and sales of waste paper processing products; a decrease in profitability and a drop in the investment attractiveness of the industry.

The most obvious solution in the current situation, Artem Kiryanov is sure, is to return to the Fokin VAT, which worked well in 2016–2018. This will allow the industry to develop, and the budget to receive VAT in full, while at least not worsening the environmental situation in the country.

It is possible that the amendments will be revised, perhaps all this may even develop into a new separate bill, but with a more detailed analysis from all government departments related to this. But this will not happen instantly, which means that in 2021 time has already been lost and the budget will not receive significant funds, while the industry itself will suffer seriously. One thing is clear: the industry needs Fokine's VAT and it should be returned as quickly as possible.

Destruction of documents

Burn it after reading! Your old documents will not give away a single secret. We actually destroy documents in accordance with European destruction standards and at the same time pay you money for it!

- Shosseynaya st., D 92 building 3.

- We prepare all the necessary documents and the act of destruction.

- You can bring documents in any form.

- For each kilogram of documents (office paper) brought in that are subject to destruction, we will pay you 12 rubles. We unload vehicles free of charge.

If you own information, you own the world.

For some reason, everyone thinks that this saying is about the press. Nothing like this! It's about the prosecutor's office, the tax office, competitors - about all those who dream of taking at least one look at your archives.

And any successful company has a lot of both - both enemies and archives - because in an effective business, the volume of information is enormous. Important, confidential, secret information.

Even storing it is unsettling, not to mention the fact that the papers take up space. Lots of office square meters, for which you pay a hefty rent!

For what?! For what?! Is she as dear to you as a memory? In general, it is best to burn all old documents, especially secret ones, after reading them. And scatter the ashes over the heads of tax inspectors and competitors. Perfect! However, a pedantic leader will immediately have questions. First: having a Pioneer bonfire in the office is not very convenient, and the fire alarm will obviously put a spoke in the wheels.

Second: who will burn? Who can you trust with this time-consuming, risky and, dare we say it, intimate act?

We recommend reading: Loan secured by land VTB 24

What if a trusted person suddenly gives up and, instead of ashes, arranges for the distribution of documents to “competent authorities” and competing organizations? This is even worse than a fire in the office! Conclusion: papers must be destroyed regularly.

It's like washing a car: clean windows - good visibility - safe driving.

In this case, you need to maintain information security.

Do you know what we mean? Don't torment