In the Chart of Accounts, account 90 “Sales” is intended to reflect transactions related to the sale of finished products, goods, and services. Accounting account 90 is complex and has a number of sub-accounts. How are transactions recorded when selling on account 90? How is account 90 closed at the end of the year? We will conduct a detailed analysis of account 90, analyze the implementation process using the example of the sale of finished products and goods, as well as accounting entries for account 90.

As mentioned above, account 90 in the accounting department has several subaccounts; below are the main subaccounts used to reflect sales.

Main subaccounts to account 90

1 – the loan reflects revenue from the sale of goods and products;

2 – the cost of what we sell is entered in debit;

3 – the debit reflects VAT accrued on sales;

9 – at the end of the month, results are summed up in this subaccount: the financial result from sales for the month is calculated, profit is recorded in debit, and loss is recorded in credit.

Let us remember that an accounting account is a two-sided table, the left side of which is called debit, and the right side is called credit. The count of 90 can be represented schematically as follows:

The main distinctive feature of this account is that it closes completely (to zero) only at the end of the year. Throughout the calendar year, a balance accumulates in each subaccount from month to month. At the end of the year, each sub-account is closed, and the total financial result for the year is calculated.

Account Description

Account 90 “Sales” is a special register that stores and summarizes data on the expenses and income of a legal entity associated with ordinary activities. It is also used to determine the financial result of this activity. Based on the turnover of a particular subaccount, it may be classified as passive-active. This may mean that it can fall into both the Asset and Liability of accounting.

The work of accounting is based on the use of various accounts

When recognized in accounting, the amount of income from the sale of goods, provision of services or performance of work is reflected in the credit of accounting account 90 and the debit of account 62 “Settlements with buyers and customers”. At the same time, the cost of inventory, services or work is written off from Kt 43 of the “Finished Products” account, 41 “Goods”, 20 “Main Production” and others in Dt 90 of the “Sales” special account.

For legal entities that are engaged in the production of agricultural products, according to Kt 90, the revenue from the sale of these products, corresponding to account 62, can be reflected, according to Dt - the planned cost of production. The latter is determined during the reporting year, since the actual one may not yet be identified.

One of the uses of 90 accounting is to determine the results of financial activities for the reporting period

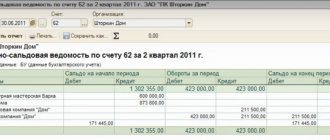

Analytical accounting for special account 90 is carried out separately for each criterion. Among them: inventory items sold, products sold, work performed, services provided and much more. Moreover, analytics on this special account can be carried out by sales regions and other areas that are necessary for the effective management of the organization. For reports, SALT and special account cards are used.

Important! The planned cost of products sold and the amount of differences between the planned and actual costs are written off in Dt 90 “Sales” in conjunction with other accounting accounts in which the products were recorded.

For legal entities engaged in retail trade and maintaining inventory records at sales prices, Kt 90 “Sales” reflects the sales value of products, and Dt - the accounting value of products, corresponding with account 41 “Goods” and at the same time reversing the amount of discounts on sold inventory items (by contacting special account 42 “Trade margin”).

Determining the financial result for special account 90 through the formation of a balance sheet

Sales of goods on account 90

First, let’s look at how, in general, sales are reflected in account 90, and what transactions need to be made.

If the sale being made is a regular activity of the enterprise, then accounting account 90 is used to reflect it (if this is a one-time sale, for example, the sale of a fixed asset, then account 91 is used, which is discussed in detail here).

Sales income is revenue; it is reflected on the credit of subaccount 1 in correspondence with the account for settlements with customers. (The topic of invoice correspondence was discussed in this article). That is, when shipping goods or products to the buyer, posting D62 K90/1 is made, which reflects the proceeds from this sale.