Official registration of an individual entrepreneur (IP) with the tax service is the legal basis for starting his business activities.

If such an entrepreneur accepts cash from individuals as payment for work, services, or goods, he must take into account the funds received by properly preparing payment documents.

If an individual (buyer) pays for a product, service, or work in cash or, as an option, with a bank card, the individual entrepreneur is obliged to issue him a cash (fiscal) receipt generated using a cash register device (CCT).

However, individual entrepreneurs (sellers), under certain circumstances, have the legal opportunity not to use cash registers, but to draw up and issue so-called strict reporting forms (SRF) to individuals (buyers).

Such BSOs are full-fledged substitutes for fiscal receipts in terms of accounting for cash proceeds and confirming the fact of payment for the purchase.

The features of registration of BSO by individual entrepreneurs should be considered in more detail.

What is the BSO strict reporting form?

Strict reporting of forms lies in the requirements that are put forward to them. Special requirements apply not only to the production of documents. They must be properly processed and stored. Federal authorities may approve BSO forms for entrepreneurs engaged in certain types of activities.

This term means a specific document. It can be produced not only using printing equipment, but also on computers and other automated systems. Such documents include coupons, tickets, receipts, etc. The law does not provide a single list for such forms. Therefore, there are quite a large number of them.

The form often acts as a receipt that is issued when using a cash register. It confirms that a payment transaction has been made for any product or service. Entrepreneurs have the right to choose whether to use a cash receipt or BSO.

If the company independently developed the form, it must be approved. This is necessary so that the tax authorities have the opportunity to control the activities of the organization, namely, its cash flow. If forms that have not been registered are used, the company faces a fine.

After the form has been developed, it is recommended to check whether all the necessary details are indicated in it. The company then issues an Order to accept the BSO. In addition, the persons who will be responsible for recording, acquiring and storing documents are indicated. These same employees will be required to provide forms to the tax office for registration. In this case, you need to have the following package of documents with you:

- Company Charter;

- certificate of state registration of the company;

- a list of forms that the organization wishes to use in carrying out its activities;

- paper samples of the forms you are going to approve;

- extract from the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities.

After submitting all necessary documents, registration of forms in the register is carried out within five working days. After the end of this period, an individual entrepreneur or company representative receives a document confirming the registration of the BSO.

BSO forms

Budgetary organizations use special forms, which at the same time serve as powers of attorney. They are issued to employees who can purchase and receive material assets, food and other products for the organization. When a document is issued, information about it is entered into the registration journal. Such forms are issued against signature.

Advantages of BSO over a cash register and their disadvantages

Pros:

- Easy to purchase and use. There is no need to incur large costs for purchase, maintenance, and maintenance of technical condition, as is the case with a cash register;

- Easy to transport. When performing an on-site service, it is easier to bring forms with you than a cash register;

- Easy accounting. If a document is damaged, you can cross it out, add it to the documentation and draw up a new document. If there is an error in a cash receipt, you must fill out an explanatory statement and obtain a signature from a special commission.

Minuses:

- Strict reporting forms can only be used when providing services to individuals and individual entrepreneurs;

- Filling banks manually is often inconvenient when there are a large number of customers;

- It is necessary to keep strict records and store copies (stubs) of forms for 5 years;

- It is regularly necessary to order forms from a printing house.

How to fill out a strict reporting form

You can fill out the form in free form, taking into account the characteristics of your company. Regardless of which form was chosen to draw up the document, you need to remember that it must consist of two parts. When receiving a product or any service, the client receives one part of the form. It is the part that is handed over to the buyer that is called the main part. The second half, the “stub,” remains with the company or individual entrepreneur who provided the service. However, not all entrepreneurs are allowed to use the free form of BSO. There is a list of forms that are approved in accordance with the type of activity carried out by the company.

What they include:

- Tickets for passenger transportation using public transport. This includes rail and air transportation, wheeled transport. Using these forms, the transport company keeps records of clients and passengers served and controls the proceeds.

- A receipt confirming the acceptance of baggage, or confirming permission to carry hand luggage.

- Tourist and excursion packages. They are used by companies that sell tours and organize trips to different cities and countries.

- Theater tickets. This includes all subscriptions and tickets issued by various cultural institutions.

- Receipts issued by pawn shops. A company engaged in this type of activity keeps records of cash spent and jewelry purchased.

( Video : “Strict reporting forms”)

Forms

BSO accounting involves the use of certain documents. But what about this? The list of all forms is truly huge: it has more than one hundred options.

The document must comply with the requirements of the unified documentation system

They are established by the Ministry of Finance of the Russian Federation and are mandatory for use in certain areas and in specified cases. BSOs are approved by regulatory documents and are differentiated by the types of services provided to the population. If a new form is created, then after the publication of the act regulating its use, it is mandatory for use by all enterprises and individual entrepreneurs that provide services to the population.

If the availability of forms is not provided for a certain service, you are allowed to independently determine what the issued receipt will look like from the number of developed forms. Additionally, it is stipulated that in the absence of clear regulation, independent development of BSO is considered acceptable. But this is only on condition that all mandatory fields provided for in clause 3 of regulation No. 359 are included.

Who can apply

Various companies and individual entrepreneurs have the right to issue BSOs, because these documents are equivalent to checks issued by cash registers. Most often, BSOs are used when conducting activities aimed at providing services to the population.

The company must complete the form before receiving funds. The form is also properly completed in the case when the money transfer is carried out using payment cards or bank transfer. However, this rule does not apply to all tax payers. BSO is used by those individual entrepreneurs and companies that are legally allowed to conduct their activities without using cash registers.

Do not forget that BSOs should be used by organizations that carry out cash payments. Whether it is a seller or a buyer does not matter. Thus, organizations that also act as buyers must also apply SSR.

Not long ago, the law defining the rules for the use of BSO was adjusted. According to the old rules, you can use forms instead of cash receipts until July 2021. Currently, online cash registers are being widely introduced, which obliges companies and private entrepreneurs to process documents using automated systems.

Required details

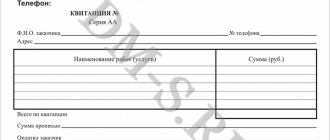

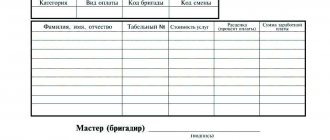

As already mentioned, many individual entrepreneurs and companies have the opportunity to use BSO developed independently. However, the law obliges all mandatory points to be included in the document:

- what is the name of the document, for example, is it a ticket, coupon or receipt;

- the document must be assigned a series and number of six digits;

- name of the company or full name of the individual;

- TIN of the company or individual entrepreneur;

- the type of services for which the customer pays;

- cost of services or goods;

- the total amount that the customer pays in cash or via bank transfer;

- calculation characteristics - return, income, expense;

- data of the person who is responsible for the correct execution of the document. This includes full name, position, personal signature;

- if a document is drawn up by an organization, it is certified not only by the signatures of the responsible persons, but also by a seal;

- list of services and goods, their quantity and cost, taking into account markups or discounts.

Do not forget that companies do not have the right to personally develop forms if the law obliges them to use only approved forms. When developing your own form, the head of an organization or an individual entrepreneur has the right to enter additional data. Perhaps with their help it will be possible to characterize as accurately as possible the specifics of the services or goods provided.

Of course, many organizations already use automated systems to generate forms. Otherwise, a printed form is used. In this case, the document must contain detailed information about the printing house, its tax identification number, address, year of execution and order number, circulation size.

Reporting on the movement of strict reporting documents

To record the issuance of strict reporting forms, it is necessary to maintain a special registration log. After a document is issued to the client, data about the issued document must be entered in this journal.

Despite the fact that keeping a journal is allowed in any form, it must contain comprehensive information about the circulation of strictly reporting documents. Therefore, a certain number of requirements still exist.

The first requirement is the numbering of the sheets of such a magazine. In addition, it must be stitched and sealed with a seal.

The second requirement is the presence of a date, the beginning of the use of strict reporting documents and the data of the responsible person.

And the third requirement is that data on the movement of forms must be entered every day.

Fines for failure to issue BSO

In all cases where the issuance of BSO is necessary, it must be carried out. Otherwise, regulatory authorities will equate this to failure to issue a cash register receipt. If for any reason the seller does not issue a correctly executed strict reporting form in paper or electronic form, he faces penalties. There are different fines for specific situations:

- for individual entrepreneurs, a fine is charged in the amount of 1/4 to 1/2 of the transferred amount. But the fine cannot be less than 10 thousand rubles;

- for legal entities 3/4 of the amount. In this case, the minimum fine is 30 thousand rubles.

In addition, the law provides for punishment if the seller repeatedly commits these offenses. So, if the total amount of funds received without registering a BSO has reached 1 million or more, sanctions are provided:

- officials on the seller's side are suspended from fulfilling these obligations for a period of up to two years;

- Legal entities and individual entrepreneurs will be prohibited from conducting this activity for three months.

Penalty cannot be avoided if, at the buyer’s request, the form is not handed over or sent by email. Here the seller faces:

- the official is issued a fine in the amount of 2 thousand rubles. In addition, the culprit receives an official reprimand and warning;

- if the violation was on the part of the organization, there is a warning and a fine, the amount of which can reach 10 thousand rubles.

BSO are documents that must not only be prepared properly, but also stored correctly. If regulatory authorities reveal a violation of the rules for storing and recording BSO, a fine of 2-3 thousand rubles is provided.

Do not forget that these forms refer to documents that require strict reporting. That is why a special book is used to record them. All actions performed with the forms are monitored by a responsible employee. In case of violations in accounting and storage, responsibility falls not only on the shoulders of the manager, but also on the employee who is responsible for the forms.

Frequently occurring violations in the sphere of BSO turnover

The most common violations are:

- there is no order appointing a person responsible for the circulation of BSO forms;

- there is no data on the write-off of BSO in the report log;

- There is no evidence of strict accounting of strict reporting forms.

A sample of the BSO, like the entire circulation of the BSO, must be stored in an accounting safe or a room specially designated for this purpose, where the likelihood of their theft or damage will be minimized. If a minimum number of BSOs is used, they can be stored at the cash register.

Appearance

To use BSO without CCP, you must have the required details provided for by the requirements. These include:

- Name of the form.

- A digital code containing the number and series of the form.

- The name of the counterparty who issued the form.

- Taxpayer code.

- Name of the service and price of provision.

- The actual location of the company that issued the document.

- Payment date and amount.

- Information about the employee (IP) who received the funds and his signature.

- Stamp, provided it is used.

Sample strict reporting form

All these details must be filled in with reliable data. Additionally, firms are required to conduct regular inventory of their SSBs.