Home / Taxes / What is VAT and when does it increase to 20 percent? / Exemptions and benefits

Back

Published: December 28, 2017

Reading time: 4 min

0

304

Since 2021, there have been changes in the application of VAT benefits. Now the audit of tax returns is focused on possible risks. This means that the result of a sample of transactions for which supporting documents will be requested will not be all the supporting documents available in the register, but only some of them, the most risk-oriented ones.

- What is the register of documents confirming the application of VAT benefits?

- Sample of filling out the document

In order for the legality of the claim for VAT benefits to be verified according to this new scheme, the payer organization must provide a special register, the data from which will be considered the evidence base for the legality of this. Otherwise, the sample will not be limited, the verification will become complete and will be delayed.

We fill out the register of documents to confirm VAT benefits

“Practical Accounting”, 2021, N 3

The Tax Service is switching to a new methodology for checking VAT returns that claim tax benefits. It is based on the so-called risk-based approach. Not all preferential transactions will be subject to control, but only some of them. But only if the company, along with the declaration, submits to the inspectorate a special confirming register in the prescribed form. Otherwise, the check will be full-scale.

If an organization declares benefits in its VAT return, the tax office has the right to send requests for the submission of documents confirming this right (clause 6 of Article 88 of the Tax Code of the Russian Federation). Now companies will be able to reduce the volume of required documents.

How to reduce taxes without risk

VAT is one of the main sources of budget replenishment. It is not surprising that tax authorities pay increased attention to it, especially when it comes to the application of benefits.

To increase the security of your business, you need to plan all operations taking into account the “fiscal” consequences and use only legal ways to reduce the tax burden. Otherwise, the inspectors’ claims may entail additional charges and penalties, often amounting to millions of rubles.

If a large contract is expected to be concluded, then the help of a tax consultant will be simply necessary. When preparing a transaction, you need to protect yourself as much as possible so that your business looks impeccable in the eyes of the tax authorities. Such work can only be performed by a company with many years of experience in solving problems related to accounting and tax accounting.

We are exploring options for reducing the fiscal burden through benefits and other legal methods, based on the characteristics of the client’s business, as well as taking into account the requirements of Art. 54.1 Tax Code of the Russian Federation.

The essence of the method

Details of the approach being implemented, as well as the forms of the necessary documents, are given in the Letter of the Federal Tax Service of Russia dated January 26, 2017 N ED-4-15 / [email protected] , sent to all territorial inspectorates.

The new verification methodology concerns declarations that reflect transactions that are not subject to taxation in accordance with paragraphs 2 and 3 of Art. 149 of the Tax Code of the Russian Federation, as well as those that claim VAT benefits (clause 1 of Article 56 of the Tax Code of the Russian Federation).

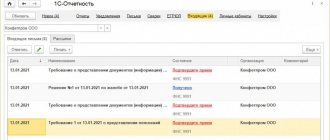

The level of tax risk is assigned by the information system of ASK "NAS-2" taking into account the results of previous audits.

Factors that determine whether the next “camera chamber” will be selective or full-scale, among other things, include:

- the presence or absence of tax violations;

- duration and regularity of VAT-exempt transactions;

- submission or failure by the company to submit a register of documents confirming the validity of the application of the benefit (the recommended form is in Appendix 1 to the Letter of the Federal Tax Service of Russia).

Based on the information about transactions contained in the register provided by the company, the tax office must request documents confirming the validity of the application of benefits. Their volume is determined for each operation code in accordance with the established algorithm (see Appendix 2 on p. 69). At least half of such documents must confirm the largest amounts.

Article 146 of the Tax Code of the Russian Federation

According to paragraphs. 4.1 clause 2 art. 146 of the Tax Code of the Russian Federation does not recognize as an object of VAT taxation the performance of work (provision of services) by budgetary and autonomous institutions within the framework of a state (municipal) assignment, the source of financial support for which is a subsidy from the relevant budget. This norm came into force on January 1, 2012 (Part 2 of Article 6 of Law No. 239-FZ).

At the same time, neither Art. 146, no ch. 21 of the Tax Code of the Russian Federation as a whole do not contain requirements for documentary confirmation of the legality of the application of the benefit in question. To date, there are also no explanations from the authorized authorities on this issue.

In our opinion, the following must be taken into account.

By virtue of clause 3 of Art. 9.2 of the Federal Law of January 12, 1996 N 7-FZ “On Non-Profit Organizations” (hereinafter referred to as Law N 7-FZ), state (municipal) tasks for a budgetary institution in accordance with the main types of activities provided for by its constituent documents are formed and approved by the body performing the functions and powers of the founder.

The regulation on the formation of the state task in relation to federal budgetary and government institutions and financial support for the implementation of the state task was approved by Decree of the Government of the Russian Federation of September 2, 2010 N 671 (hereinafter referred to as the Regulation). The state task in the form contained in the Appendix to the Regulations is communicated to the budgetary institution by the body exercising the functions and powers of the founder.

Financial support for the implementation of state (municipal) tasks by a budgetary institution is carried out in the form of subsidies from the budget (clause 6, article 9.2 of Law No. 7-FZ, clause 1, article 78.1 of the Budget Code of the Russian Federation). The subsidy is transferred in the prescribed manner to the account of the territorial body of the Federal Treasury at the place where the personal account was opened for the federal budgetary institution (clause 14 of the Regulations).

The provision of a subsidy to a federal budgetary institution during a financial year is carried out under an agreement on the procedure and conditions for providing a subsidy for financial support for the implementation of a state task, concluded by the institution and the federal body exercising the functions and powers of the founder, in accordance with the approximate form approved by the Ministry of Finance of Russia. This is established by clause 15 of the Regulations.

Taking into account the above, we can conclude that documents confirming the legality of application of the provisions of paragraphs. 4.1 clause 2 art. 146 of the Tax Code of the Russian Federation will be:

- state assignment drawn up in the appropriate form;

- agreement on the procedure and conditions for providing a subsidy;

- extract from the personal account of a budgetary institution.

About the “camera room” of the VAT return with preferential transactions

Author: Lugovaya N. N. , expert of the information and reference system “Ayudar Info”

How does the tax authority check the validity of VAT benefits? What volume of documents is required? What guides this? The reader must have guessed that this consultation will focus on explanations for conducting desk audits of VAT returns that reflect transactions that are not subject to taxation (clauses 2, 3 of Article 149 of the Tax Code of the Russian Federation). The Federal Tax Service brought them to lower inspections by Letter dated January 26, 2017 No. ED-4-15/ [email protected] By the way, let us remind you: on the topic of VAT benefits (with reference to the indicated letter from the Federal Tax Service) we discussed in the consultation of A. M. Rabinovich “What What is the VAT benefit: is this the end of the controversy? We recommend reading the materials (as they complement each other) in pairs.

About calculating the volume of documents

Examples of filling out the calculation of the volume of documents subject to request in order to verify the validity of the application of benefits in the context of transaction codes are given in Appendix 3 to Letter No. ED-4-15 of the Federal Tax Service of Russia / [email protected]

The inspector himself makes the corresponding calculations, but he will not provide any calculations or information about which risk category the taxpayer belongs to. The controller will only issue a requirement for the presentation of documents in accordance with Art. 93 of the Tax Code of the Russian Federation, and for those operations that interest him (for each operation code). Transactions worth significant amounts, of course, will come under close scrutiny.

Example 4.

Let us turn to the conditions of example 1, clarifying them with the following data.

Let’s assume that the level of tax risk according to the RMS ASK “VAT-2” of the taxpayer is average. There were violations in previous tax returns for this code.

The tax authority will determine the scope of documents to be requested as follows:

At least 50% of the volume of documents subject to request must confirm the largest amounts of transactions for which tax benefits are applied.

Recommendations for preferential transactions

According to tax legislation (clause 6 of article 88 of the Tax Code of the Russian Federation), auditors have the right to control benefits, but (!) only those that fall under the concept of “ tax benefit” , taking into account clause 1 of art. 56 of the Tax Code of the Russian Federation and the position of the Plenum of the Supreme Arbitration Court, set out in paragraph 14 of Resolution No. 33 of May 30, 2014. This applies, for example, to school canteens, organizations of the disabled, bar associations, etc. (Article 149 of the Tax Code of the Russian Federation) - these persons do not pay VAT from sale, and inspectors have the right to demand documents and explanations from them.

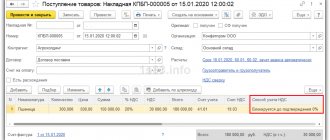

Setting up the program

To use this document and generate a Register of complete customs declarations, transport and shipping documents to confirm the zero percent VAT rate, the program must be configured. To do this, go to the Main

—

Functionality

, go to the

Trade

and check the

Export goods

.

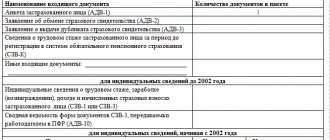

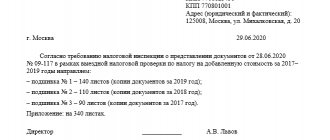

We compile a register of documents confirming the validity of the application of benefits

In accordance with the Recommendations, “beneficiaries” provide explanations in the form of a register of documents confirming the validity of the application of the benefit (Appendix 1 to the Letter of the Federal Tax Service of Russia No. ED-4-15 / [email protected] ).

The procedure for requesting such documents is the same for all categories of taxpayers, regardless of their membership in a tax risk group. Let us remind you that the level of tax risk is assigned by the information system of ASK “NAS-2”, taking into account the results of previous audits (Letter of the Federal Tax Service of Russia dated 06/03/2016 No. ED-4-15 / [email protected] ). There are three groups:

taxpayers with low tax risk - they conduct real financial and economic activities, fulfill their tax obligations to the budget in a timely manner and in full, have appropriate resources (assets), their activities can be checked by scheduled on-site tax control;

taxpayers with a high tax risk - they have the characteristics of an organization used to obtain unjustified tax benefits, including by third parties, do not have sufficient resources (assets) to conduct relevant activities, do not fulfill their tax obligations (fulfill in the minimum amount);

taxpayers with average tax risk – the remaining (not included in groups with high or low tax risk) taxpayers.

Example 1.

An educational institution provides paid educational services, which, in accordance with paragraphs. 14 paragraph 2 art. 149 of the Tax Code of the Russian Federation are exempt from VAT. The educational institution does not carry out transactions subject to VAT.

Income from the provision of educational services for the first quarter is reflected in section. 7 of the VAT tax return according to the corresponding transaction code (1010245 - column 1) in the amount of RUB 156,800,000. (column 2).

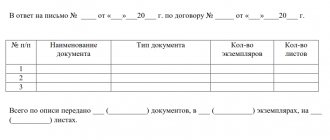

In response to the tax authorities’ demand for explanations about preferential transactions, the institution submitted a register in the form recommended by the Federal Tax Service.

Number of documents listed in the register:

– by main type of education – 12;

– for additional education – 15;

– for advanced training – 20.

Operation code

Including:

Amount of non-taxable transactions by type reflected in the tax return

Contractor's name

TIN

checkpoint

Documents confirming the validity of the application of benefits

type (group, direction) of non-taxable transaction

Type of document (agreement, payment order, etc.)

date

Transaction amount, rub.

1010245 (sales of services in the field of education)

Article 149 of the Tax Code of the Russian Federation

In addition to transactions that are not subject to VAT taxation in accordance with paragraph 2 of Art. 146 of the Tax Code of the Russian Federation, in Art. 149 of the Tax Code of the Russian Federation establishes benefits for certain transactions, as well as the conditions and procedure for their application.

In clauses 1 - 3 art. 149 of the Tax Code of the Russian Federation identifies three groups of operations carried out on the territory of the Russian Federation that are exempt from VAT:

- operations for leasing premises to foreign citizens and organizations accredited in the Russian Federation (clause 1 of Article 149 of the Tax Code of the Russian Federation);

- sale (transfer, execution, provision for own needs) of certain goods, works, services, property rights (clause 2 of article 149 of the Tax Code of the Russian Federation);

- certain transactions with goods, works, services, property rights, exempt from taxation (clause 3 of article 149 of the Tax Code of the Russian Federation).

Attention! Benefits established by paragraphs 1, 2 of Art. 149 of the Tax Code of the Russian Federation are applied when carrying out relevant operations; they cannot be abandoned. There is no requirement to notify the tax authorities about the start and end of using the exemption. Taxpayers carrying out operations specified in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation, has the right, on its own initiative, to refuse exemption from VAT taxation (clause 5 of Article 149 of the Tax Code of the Russian Federation).

Services in the field of education. According to paragraphs. 14 paragraph 2 art. 149 of the Tax Code of the Russian Federation is not subject to taxation (exempt from taxation) sales (as well as transfer, execution, provision for one’s own needs) on the territory of the Russian Federation:

- services in the field of education provided by non-profit educational organizations for the implementation of general education and (or) professional educational programs (basic and (or) additional), professional training programs specified in the license, or the educational process;

- additional educational services corresponding to the level and focus of educational programs specified in the license, with the exception of consulting services, as well as services for leasing premises.

Documentary confirmation of VAT benefits

Since 2021, there have been changes in the application of VAT benefits. Now the audit of tax returns is focused on possible risks. This means that the result of a sample of transactions for which supporting documents will be requested will not be all the supporting documents available in the register, but only some of them, the most risk-oriented ones.

- 8 –Regions

- +7 –Moscow

- +7 –Saint Petersburg

In order for the legality of the claim for VAT benefits to be verified according to this new scheme, the payer organization must provide a special register, the data from which will be considered the evidence base for the legality of this. Otherwise, the sample will not be limited, the verification will become complete and will be delayed.

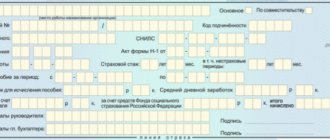

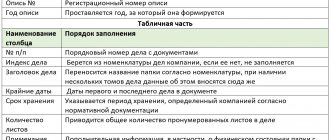

What data should be included in the register?

The register of documents confirming the validity of the application of tax benefits is a table in which the company must enter the following data:

- transaction code (indicated in accordance with Appendix No. 1 to the procedure for filling out the VAT return;

- the amount of non-taxable transactions reflected in the tax return (in rubles);

- name of the counterparty;

- TIN and checkpoint;

- type, number and date of the supporting document.

The organization must attach to the register a list and forms of standard agreements that it uses when carrying out preferential transactions.

From the presented register, the tax inspector will select those transactions that interest him and request documents only for them. First of all, transactions involving large sums will come under close attention.

What is the register of documents confirming the application of VAT benefits?

Value added tax benefits are provided for certain transactions. These include the sale of a certain group of goods (for example, medicines), transportation of citizens, and trade in scrap metal. A detailed list of groups of activities for which benefits are provided is reflected in Art. 149 of the Tax Code of the Russian Federation.

When a company submits a VAT return to the tax office and reflects the presence of non-taxable transactions, inspectors have the right to require confirmation.

This condition is contained in Art. 88 Tax Code of the Russian Federation. Evidence includes licenses, contracts, invoices.

The register of documents confirming the right to receive a VAT benefit is a table, the columns of which reflect the following information:

- benefit code in accordance with the order of the Department of Internal Affairs of the Ministry of Internal Affairs of the Russian Federation No. ММВ-7-3-558 dated October 29, 2014. This code is the same code that is indicated in the seventh section of the VAT tax return;

- type of operation;

- transaction amount (non-taxable total amount for all preferential transactions of the organization);

- type of document that confirms the VAT benefit. Most often, such documents are an agreement or a payment order;

- details of supporting documents: date and number, its amount;

- full name of the counterparty, his details (TIN and KPP).

Thus, the organization is obliged to provide the tax inspector with a register of documents confirming the VAT benefit. Also, the employee of the organization must attach to the register all forms of standard agreements that were used when carrying out preferential transactions with counterparties.

After this, tax officials will conduct a sample, upon which the taxpayer will be asked for specific supporting documents from the register.

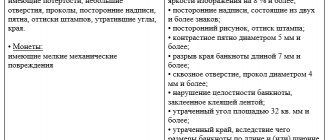

The tax inspector has the right to demand the provision of no more than 40% of the total number of documents listed in the register. At the same time, the number of requested documents should not exceed 500. If there are less than 30 documents in the register for any transaction, the request for provision will apply to all of them.

A sample document can be downloaded from this link.

Full information about the tax when renting out an apartment in our article.

Are you looking for a profitable mortgage program for yourself? You will find an interesting option here.

Providing relief

These benefits are available to every VAT payer, but only in cases where the conditions for providing these preferences are met. Namely:

- A company or individual entrepreneur is exempt from the obligation to act on the basis of articles of the Tax Code No. 145 and No. 145.1.

- Business entities are engaged in the implementation of transactions that are exempt from VAT.

Read below about the rates and benefits for paying VAT that are established in our state.

Exemption factors

In this case, the reasons for such an event are:

- The company does not have sufficient revenue (limit – 2,000,000 million rubles for three consecutive months).

- Organizations and companies participating in the implementation of government innovation projects.

- Importers of products specified in Article 150 of the Tax Code of the Russian Federation (benefits for payment of VAT when importing goods).

Read below about the use of VAT benefits for disabled people and other cases of complete exemption from payment.

Transactions exempt from full payment

The list of such operations is considered in Article 149 of the Tax Code and includes:

- Rent out premises for various purposes to foreign companies and citizens.

- Everything related to medical care and care for the disabled and sick.

- Archival work.

- Services related to transport and mail.

- Renting out real estate.

- Services in the social sphere and related to cultural activities.

- Transactions with authorized capital.

- Work under government programs.

- Charity and gratuitous assistance.

Read below about the document confirming the VAT exemption.

VAT benefits for the distribution of advertising products are discussed in this video: