Methods for submitting information to the Pension Fund

To make it more comfortable for entrepreneurs, several options for submitting documents are offered:

- Personal visit. The entrepreneur himself comes to the Pension Fund and submits reports to the service employee in paper or electronic form. It should be noted that you can bring paper documents containing information about no more than 50 employees. Otherwise, in accordance with the law, you must submit reports on a flash drive. A few years ago they accepted disks and floppy disks. Today these carriers are no longer accepted. To reflect financial flows electronically, an individual entrepreneur needs to master computer skills using specific programs. An electronic digital signature and a pre-verified agreement with the Pension Fund will be required.

- Sending by mail. This transfer method eliminates the need to wait in line outside the office for a long time. The report is included in the letter. It is recommended to issue it by mail as a registered one. This way, the entrepreneur will receive confirmation that the letter has been delivered personally to the Pension Fund employee. In this case, the date of dispatch is considered the date of submission of documents.

Please note that the postal service may provide reports with a delay. If Pension Fund employees do not receive documents on time, they will send a report explaining the violation. If the payer does not respond in a timely manner, the Pension Fund will block the counterparty's accounts. Therefore, it is better to send reports in advance, and be responsible for sending the information yourself.

Advice! It is best to save your printed and completed forms after submitting your information electronically. The Pension Fund may request documents again to clarify the data.

Terms of provision and penalties

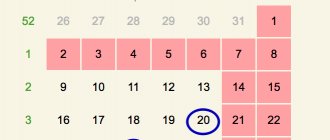

The new amendments will take effect on April 1. The new form must be submitted by the 10th, and you must report every month. That is, the first report this year will need to be submitted by May 10 inclusive. It must be remembered that if the last day for submitting the report is a weekend or a holiday officially prescribed by the state, then the deadline for submitting the report is postponed to the first working day that follows the holiday.

If an enterprise does not provide a report on time or provides it with violations, according to the law it will be liable in the form of a fine. Article 17 of Federal Law No. 27 of the Law on Personalized Accounting provides that its size depends on the amount of contributions. However, since the new report will not contain information on the amount of contributions, legislators supplemented the content of the article and provided for a fine for this violation in the amount of 500 rubles, which will have to be paid for each employee whose information was not provided or distorted. In this case, the fine cannot be less than 2000 rubles.

The introduction of a new reporting form is a transitional stage, with the help of which officials plan to change the reporting period for the provision of all pension reporting from quarterly to monthly.

This innovation awaits all enterprises starting in 2018. Estimate

Why is it better to hire a specialist?

Some difficulties await people who submit documents taking into account the demonstration of the number of hired employees, as well as their age limits. It is very difficult to avoid mistakes. To avoid errors, as well as to avoid fines, it is recommended to hire an experienced specialist. He must have an excellent understanding of the calculation of insurance premiums, amendments, innovations and all existing bills that relate to the Pension Fund service.

It is recommended to discard the idea that if you have crossed the time limit for waiting for papers, then they have forgotten about you. This option is possible when working with non-governmental services. The state apparatus works in such a way that all processes are under strict control. Civil servants receive salaries for regularly researching necessary processes.

Composition of reporting

The following information must be submitted monthly for each employee:

- individual personal account insurance number (SNILS);

- last name, first name and patronymic (full name);

- taxpayer identification number (TIN) (clause 2.2 of article 11 of Law No. 27-FZ).

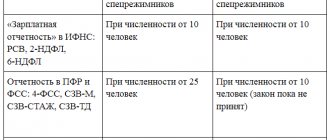

Please note that the full name and SNILS of employees are also indicated in subsection 6.1 of section 6 of the RSV-1 calculation (see “New RSV-1 form: features of filling out and submitting the calculation for the first half of 2015”). However, starting from April 2021, this information, as well as the TIN of employees, will need to be reported additionally. The pension fund must develop a form for a new monthly report, as well as a format for submitting reports via the Internet.

We also note that the commented Law No. 385-FZ does not clarify some issues that may arise when drawing up a new report. In particular, is it necessary to submit information for employees who did not receive insurance premiums in the reporting month (for example, if the employee was on long-term leave without pay or on parental leave)? Should “blank” monthly reporting be submitted if the company has only one director (aka the only founder) with whom an employment contract has not been concluded? If remuneration to an employee under a civil contract concluded for a long term is not paid every month, then how often do you need to submit information: only for the month of payment or for each month of the contract? What to do if the employee does not have a TIN? Perhaps answers to these and other questions will appear in the order of filling out the new report and official explanations for it.

What a sole proprietor needs to know

The individual entrepreneur must provide information about persons who are registered in the Pension Fund system. This makes it possible to monitor the income of those who have already retired. Among other things, the authorities have adjusted the system of liability borne by a payer who fails to provide information on payment of contributions on time. Thus, the government will deprive pensioners of payments if their salary is above a certain level. These documents must be submitted every month. The Ministries of Finance and Labor are going to save budget money on working pensioners. In addition, in the process of calculating pensions next year, the calculation will be for the standard 12 calendar months, and not for the calendar year, which begins in January and ends in December.

Penalty for late submission of reports

The policyholder risks being fined if the deadlines for submitting information are violated or if false or incomplete information is submitted. The size of the sanctions will be 500 rubles. for each employee.

The collection procedure is established by Articles 19 and 20 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

Submit monthly and quarterly reports to the Pension Fund for free

To learn more

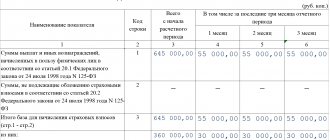

Amount of insurance premiums

The contribution for entrepreneurs in 2021 will be charged at 30%. They are distributed like this:

- 22% will be transferred to the Pension Fund service without distribution into the savings and insurance shares for pension payments. In this case, the KBK participates, the purpose of which is to make contributions to the insurance portion of the pension.

- 2.9% – for Social Insurance Fund assets.

- 5.1% – for FFOMS.

It is worth considering that a tariff of 22% operates until the employee’s contributions do not exceed a certain amount. After this, payments will be made at a rate of 10%. Please note that next year, individual companies will be allowed to enjoy reduced rates for insurance payments.

Who should submit reports and where?

New reports must be submitted by policyholders (organizations and individual entrepreneurs) in relation to all insured persons working for them. Information must be provided, including for those individuals with whom civil contracts have been concluded, if insurance contributions are paid to the Pension Fund of the Russian Federation from remuneration under such contracts (clause 2.2 of Article 11 of Law No. 27-FZ).

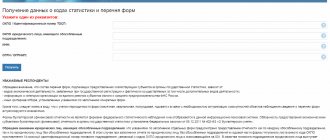

Reporting must be submitted to the division of the Pension Fund at the place of registration of the policyholder (Clause 1, Article 11 of Law No. 27-FZ).

Tariff code in RSV-1 2015

Let's return to filling out section II of RSV-1 . As already noted, it provides an indication of the tariff code.

The tariff code characterizes the application of the desired rate for different categories of payers. For example, policyholders on the general taxation system must indicate the tariff code “01”, on the simplified taxation system – “52”, and tax insurers – “53”.

Due to the fact that for some categories of payers, reduced tariffs have been established, the use of which is possible only during a certain period, some tariff codes cease to be used at the end of such a period. For example, for Unified Agricultural Tax payers, reduced tariffs were in effect until 2015, and the code “04” was entered in the reports, and since 2015, when filling out the RSV-1, such categories of payers are no longer entitled to use the specified code. They are obliged to replace it with the general tariff code “01”. In addition, since 2015, codes “03”, “09”, “18”, “19”, “20” have ceased to be used.

See here for details.

| Tariff code | Payer category |

| 03 | Public organizations of disabled people and organizations making payments to disabled people |

| 09 | Organizations and individual entrepreneurs producing and publishing media |

| 18, 19, 20 | Agricultural producers |

For the indicated codes, it is also necessary to enter the code “01”.

It should be noted that in 2015 new codes appeared RSV-1

- code “23” - for organizations with the status of participant in the free economic zone in the Republic of Crimea;

- code “24” - for organizations located in territories of rapid social development.

What should an accountant tell employees?

There is a high probability that employees will turn to accountants with a request to help them understand the innovations that are associated with the abolition of indexation of insurance pensions. Let's look at some points that make sense to tell employees about.

Legislators provided that from February 2021, the planned indexation of the insurance pension and the fixed payment to it will apply only to those pensioners who, as of September 30, 2015, were not working (did not work on the basis of civil law contracts). The fact that a pensioner is working as of September 30, 2015 will be determined by Pension Fund specialists on the basis of personalized information contained in the RSV-1 calculation for 9 months of 2015.

In case of termination of work in the period from October 1, 2015 to March 31, 2021, the pensioner can notify the Pension Fund of this fact. To do this, you need to submit an application and documents confirming the end of your labor activity (for example, a copy of the work book with a notice of dismissal) to the fund’s division. From the first day of the month following the month in which the pensioner notifies the Pension Fund of the Russian Federation about the termination of work, the fund will begin to pay him an insurance pension, taking into account indexation (clause 3 of Article 7 of the commented Law No. 385-FZ). The form for this application is posted on the Pension Fund website.

Note that a pensioner can confirm the completion of labor or civil law relations in the period from October 1, 2015 to March 31, 2021 no later than May 31, 2021 (clause 2 of article 7 of the commented Law No. 385-FZ). If a pensioner stops working in April 2021 or later, he will no longer have to report this to the Pension Fund, since fund employees will determine all the necessary information based on monthly data provided by policyholders. If it follows from the policyholder’s reporting that the pensioner has retired, then the decision to assign a pension, taking into account indexation, will be made in the month following the month of reporting (Clause 6, Article 26.1 of Law No. 400-FZ), and payment of the pension in the new amount will begin from next month (clause 7, article 26.1 of Law No. 400-FZ). If in the future the pensioner gets a job again, the amount of his insurance pension will not be reduced (Clause 8, Article 26.1 of Law No. 400-FZ).