The act of writing off strict reporting forms, a sample and form of which are available for download below, is an important document for many organizations. It confirms the fact of the destruction of the BSO.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

A strict reporting form is a paper that confirms the fact of receiving funds from citizens. Payment goes to a legal entity or individual entrepreneur for the services provided. It is strictly prohibited to formalize transactions between BSO legal entities.

Normative base

Order of the Ministry of Finance No. 52n dated March 30, 2015 “On approval of the forms of primary accounting documents and accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions, and Guidelines for their application"

Government Decree No. 359 of 05/06/2008 "On the procedure for making cash payments and (or) payments using payment cards without the use of cash register equipment"

Order of the Ministry of Finance No. 103n dated June 15, 2020 “On amendments to appendices No. 1–5 to the order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n”

IMPORTANT!

The new form of the act, approved by Order of the Ministry of Finance No. 103n dated June 15, 2020, which amended Appendices 1–5 to Order of the Ministry of Finance No. 52n dated March 30, 2015, is applied from September 27, 2021.

How to fix a log error

This document, oddly enough, is where the largest number of errors are often made.

The legislation of the Russian Federation provides for the presence of this document at the enterprise, but does not oblige the employer, represented by a legal entity or in the person of an individual entrepreneur, to enter this register into the production workflow. There is no clearly established form for filling out the register of employment contracts.

The legislation of the Russian Federation provides for the presence of this document at the enterprise, but does not oblige the employer, represented by a legal entity or in the person of an individual entrepreneur, to enter this register into the production workflow. There is no clearly established form for filling out the register of employment contracts. However, this document includes the following entries:

- Date of conclusion/termination of the employment contract, as well as signature.

- Numbers of documents entered in chronological order. It is in this elementary part of the magazine that inexperienced personnel officers make serious mistakes, which can only be corrected by eliminating the current magazine and creating a new one.

- Information about the form of this work: permanent or part-time.

- The structural unit to which the employee belongs.

- Position held, category or rank.

- Additional Information.

- Personal data of the employee (full name, date of birth).

- Dates of contracts and their numbers.

Let's return to the first point - number in order. As was said, this column is the most problematic.

The thing is that, due to inexperience, ignorance or inattention, the responsible employee of the personnel service, instead of the serial number of the entry made, indicates the number of the document: employment contract, agreement, labor, insert into it.

It is clear that the “paper” number does not correspond in any way to a certain chronology of events in the employee’s work life. The only solution to this problem can only be to force the completion of entries in the wrong version of the journal and create a new one. On the last page of the journal, the following entry is made randomly by hand:

“This journal is being closed early due to incorrect completion”

.

The culprit should not be surprised at the disciplinary punishment received. Activities related to the design of a new magazine are not considered illegal.

When is it allowed to write off BSO

In accounting, BSO accounting is subject to a legally established procedure that ensures the safety of documentation.

Strict reporting forms are used for different purposes:

- for carrying out daily work (waybills, certificates of incapacity for work, vouchers, diplomas and others);

- when registering relations with employees of the institution (work books and inserts, certificates, etc.);

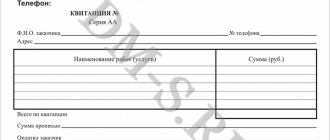

- during settlements with individuals (receipt books, subscriptions and tickets).

Enterprises that use BSO in their activities are periodically required to write off damaged, issued and no longer relevant documents.

IMPORTANT!

If damage or defects are detected, such documentation cannot be thrown away.

The main reasons for deregistration of BSO:

- the end of the established storage period for documents used and damaged during filling;

- other emergency circumstances that lead to the need to write off documentation from accounting accounts (damage, loss, theft).

The document from the MOL, which has damaged the strict reporting form, is marked as unsuitable for use; the details must be read:

- Name;

- series and document number;

- approval information.

When strict reporting forms are changed, the enterprise retains old-style documents, the use of which is prohibited; they are subject to deregistration according to the act form 0504816 upon expiration of the established storage period.

Under what conditions are BSO subject to destruction?

The organization has the right to destroy any of the strict reporting forms only if its five-year storage period has expired. In addition to this, the organization should not conduct an inventory.

According to existing legislation, writing off strict reporting forms is only possible if the inventory was carried out more than a month ago. However, it is precisely the fact of conducting an inventory in practice that serves as the starting point for writing off the stubs of strict reporting forms that have expired.

How is it regulated?

The write-off of BSO is regulated by government decree No. 359 of 05/06/2008, which sets out the details of the procedure. Order of the Ministry of Finance No. 52n dated March 30, 2015 reflects recommendations for working with BSO. Regulatory acts establish a procedure for writing off damaged strict reporting forms, in accordance with which they are subsequently destroyed.

State and municipal enterprises use the OKUD form 0504816 for the procedure, which is approved by law as the only possible one. Commercial firms have the right to independently develop and secure the right to use other forms of the write-off act, which will require including it in the accounting policy.

IMPORTANT!

Organizations often use document form 0504816, accepted by inspection authorities. The act is convenient and has fields for entering the necessary information.

The procedure for destroying strict reporting forms in accordance with Resolution No. 359

In accordance with paragraph 19 of Resolution No. 359, organizations are required to store copies of the SSR or the counterfoils of forms (tear-off parts of the SSR that the service provider retains) in a systematic form for 5 years or more. After the specified period has passed, as well as after the expiration of a month from the date of the last inventory, copies of the BSO or the counterfoils of the forms must be destroyed. The basis for this procedure should be, as we noted above, an act drawn up by a commission, which is formed by the head of the company or individual entrepreneur. A similar procedure has been established for the destruction of incomplete or damaged BSO.

Write-off procedure

By order of the enterprise, a special commission is created, which draws up an act for deregistration of strict reporting documents. The frequency of write-offs is established by the accounting policy of the institution. Before drawing up the document, the commission is obliged to verify the intended use of the forms provided by the MOL for deregistration.

The following are considered confirmation:

- stubs or copies of receipts;

- entries in the accounting book of form 0504045 with the signatures of the recipients;

- employee receipts for receiving a pass or certificate;

- journals for issuing waybills, work books and others.

Is it possible to make corrections to the BSO?

As noted earlier, strict reporting documents are a full-fledged replacement for a cash (fiscal) check in cases where a seller providing any services to the public (with the exception of the catering industry) and accepting cash from individuals as payment does not legally use the device Cash register for recording revenue received and confirming the fact of sale.

It is important to clarify that until July 1, 2019, a number of organizations/entrepreneurs have the legal opportunity to issue a BSO to a client instead of a fiscal receipt generated by an online cash register.

As follows from the general name of this settlement document, any form related to the BSO is subject to strict accounting and careful filling out. ? It also happens that when filling out a strict reporting document form, mistakes are often made, incorrect data is indicated, and blots are made. A reasonable question arises: is it possible to make any adjustments to the document filled out in the form?

A reasonable question arises: is it possible to make any adjustments to the document filled out in the form?

The legislation has a specific answer: it is not allowed to correct the BSO. If a payment document that is subject to strict accounting contains an error or blot, it is considered damaged.

Accordingly, it cannot be used for its intended purpose or immediately.

How to create an order

The order regulating the procedure for deregistering BSO is approved by the head of the enterprise.

The document must contain the following information:

- The decision of the administration of the institution to appoint a commission to write off strict reporting forms, from whose members a chairman is selected.

- A list of reasons for carrying out the procedure, which may indicate an inventory list for BSO.

- Determination of the control powers of the commission. They may be assigned to the chief accountant or the head of the institution.

| LLC "Clubtk.ru" Order No. 11 From September 28, 2021 About writing off strict reporting forms Based on the expiration of the statute of limitations for storing strict reporting forms, which is 5 years, I ORDER 1. Create a commission to write off strict reporting forms consisting of: Chairman: Voronov Andrey Viktorovich (General Director), Members of the Commission: Smirnova Valentina Fedorovna (Chief Accountant), - Ivanov Ivan Ivanovich (Head of Human Resources). 2. Write off strict reporting forms by December 31, 2021. 3. Destroy the written off forms. 4. I reserve control over the execution of the order. A.V. Voronov (CEO) Voronov The following have been familiarized with the order: V.F. Smirnova (chief accountant) Smirnova I.I. Ivanov (Head of HR Department) Ivanov |

Document elements

The act of writing off strict reporting forms is quite simple. At the beginning there is:

- A reference to the legislative act that prescribes its use. It is contained only in those forms that are not formed by organizations independently. The slightest discrepancy with the standard form - and the organization does not have the right to publish a link to the law in the upper right corner.

- Visa of the head of the institution. It includes: signature, transcript of the signature, position of the boss, seal of the organization (if any).

- The name of the document with the number assigned to it. It is this number, together with the date of signing the act, that is its identification mark when entered in subsequent registration documents.

- Mini table with codes. There are located: the OKUD code (it is already entered in the attached form), the date of signing the act, the OKPO code.

- Name of the organization. If necessary, the name of the structural unit. This point is especially relevant when writing off strict reporting forms when conducting an inventory within one division of the company.

- Full name of the financially responsible person, his position.

- Accounting information: credits and debits of the account to which the act is posted. This information is filled in after the act of writing off strict reporting forms is received by the accounting department.

- Listing the composition of the commission. It includes the full name of the chairman (separately) and members of the commission indicating their positions.

The document continues with a reference to the order that formed the listed commission for the destruction of the BSO. The period during which the documents will be written off must be indicated below.

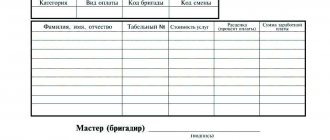

The main part of the act of writing off strict reporting forms is a table listing documents suitable for destruction. The convenience of a table lies in the abundance of data that can be placed in it. Although the table given in the form requires the following to be indicated in each line:

- Numbers and series of the form to be written off.

- Reasons for write-off.

- Dates of document destruction.

The duration of the table is determined only by specific conditions, in particular, the number of SSBs, the difficulty of making a decision on their write-off, etc.

The final part of the document, which can be located either on the same page or at a considerable distance from the beginning (depending on the size of the attached table), is the signature of the commission headed by the chairman. Each signature requires decryption. The positions of everyone who signs their “autographs” are also indicated here.

How to draw up an act

The document records the composition of the commission, the details of the order on its creation and the period for which the write-off is carried out.

BSO are listed in the table with the following marking:

- series;

- numbers;

- reasons for deregistration;

- dates of destruction.

Obsolete and damaged BSO after write-off must be burned in the presence of members of the commission, who confirm the fact of liquidation with signatures. The act is approved by the head of the organization.

IMPORTANT!

Marks and corrections in the documentation are not allowed.

When drawing up an act on the write-off of strict reporting forms (form 0504816), it is required to indicate:

- number;

- date of compilation;

- Name of the organization;

- INN, KPP and OKPO code of the enterprise;

- Full name MOL;

- accounting correspondence.

The most important part of the act is the table

On the next line you need to place a table consisting of 4 columns. The first 2 rows in columns 3 and 4 should be combined. The first 2 columns at row 1 level also need to be merged.

In the first two combined columns, located at line 1 level, you should enter the phrase “Strict reporting form”. In column 1 at the level of line 2 we write the word “Number”, in the 2nd - “Series”. In column 3, at the level of combined lines 1 and 2, the phrase “Reason for write-off” should be entered. In line 1 of column 4 there should be the phrase “Date of destruction (burning).” Columns 1, 2, 3 and 4 at the level of line 3 of the table are filled with numbers 1, 2, 3 and 4, respectively.

In the table you need to create the required number of cells located below line 3. Throughout the table, the text should be centered.

On the next line of the document after the table, you should enter the phrase “Chairman of the Commission”, to the right of it, record a place for the position, signature, and transcript.

In the line below you need to enter “Members of the Commission”, and leave space on the right to indicate the position of each member, signature and its decoding. It is necessary to copy the section of the form located to the right of the phrase “Members of the Commission” several times on the lines below, depending on the number of members of the Commission.

On the very last line of the form, you should indicate a place to indicate the date the document was compiled - this can be on the left side of the page.

Non-governmental organizations that draw up acts of destruction of strict reporting forms on their own have the right to deviate from the option we have considered. However, the general algorithm for compiling this document must correspond to the sample we have considered.

Comments

- 04/21/2014 Nadezhda

Good afternoon! Please help me figure it out. The LLC is located on UTII, provides services to the population (veterinary), we use BSO. Now the director wants to improve the form of payment, namely, not to issue BSO, but to issue self-developed checks indicating a specific service from the NIM, which are not registered with the tax office. I'm a little confused - do we have the right to do this? Or do we have a choice - either BSO, or cash receipts, but at the same time, the cash register must be registered with the tax office? Help, please, I need an answer very urgently.

Reply Link

- 02/06/2015 Victoria

still no answer... a year has passed...

Reply Link

Add a comment

Rating

0 2 2

Procedure for applying BSO

BSO is a primary accounting document equivalent to a cash receipt, generated in electronic form and (or) printed using an automated system for BSO at the time of payment between the user and the client for services rendered, containing information about the calculation, confirming the fact of its implementation and meeting the requirements of the law of the Russian Federation on the application of cash register systems (paragraph 6, article 1.1 of Law No. 54-FZ).

An automated system for BSO is a cash register used for generating BSO in electronic form, as well as printing them on paper (paragraph 2, article 1.1 of Law No. 54-FZ).

Automated systems for BSO are used when making payments in cash and (or) electronic means of payment for services rendered (Clause 1, Article 4.3 of Law No. 54-FZ).

Thus, the BSO is equated to a cash receipt and contains the same set of details that are provided for a cash receipt, Art. 4.7 of Law No. 54-FZ. In addition, BSO, as well as cash receipts, can be in electronic form and sent to the client’s subscriber number or email address.

After the expiration on July 1, 2019, of the transitional provisions established by Part 8 of Art. 7 of the Federal Law of July 3, 2016 N 290-FZ, BSO can only be formed using cash register equipment (including using an automated system for BSO).

In our opinion, from the above date, the Regulations approved by Decree of the Government of the Russian Federation of 05/06/2008 N 359 (hereinafter referred to as Resolution N 359) actually ceased to apply, since the registration of BSO from 07/01/2019 without the use of cash register equipment is no longer a condition for exemption from application of the latter, as stated in Resolution No. 359. The specified Resolution becomes invalid as of 01/01/2021 due to the adoption of Resolution of the Government of the Russian Federation dated 06/18/2020 N 875.