The Federal Tax Service has unhindered, including remote, access to all fiscal data (FD) contained in the database of FD operators, as well as other official information about companies and individual entrepreneurs. This means that, based on the available information, the tax authority can conduct not only a test purchase, but also a remote verification of compliance with the procedure for using cash register systems.

In addition, Federal Tax Service employees are not required to warn about the start date of a cash register audit, and there are also no restrictions on the frequency of such checks. These standards are not provided for by current legislation. In particular, supervision over compliance with the procedure for using cash register systems is not subject to the provisions of the Federal Law of December 26, 2008 No. 294-FZ on the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control.

If you mistakenly did not register a cash register within the prescribed period or otherwise violated the procedure for using cash registers (for example, data from your online cash register was not received consistently), it is in your interests to eliminate all violations as soon as possible. Ilya Antonenko

Ilya Antonenko , certified auditor.

Preferential list of the Law on CCP

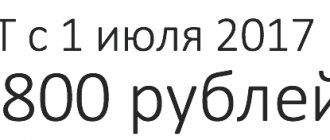

If the activities of an organization or entrepreneur are listed in Art. 2 of the Federal Law of May 22, 2003 No. 54-FZ “On the use of cash register systems”, then from July 1, the use of cash register equipment is not required. These types of activities include:

- sale of printed materials;

- sale of securities;

- sale of transport tickets;

- fair and market trade, etc.

However, if in carrying out these types of activities vending machines, payment terminals are used, or excisable products are sold, you will have to switch to cash registers.

There are two editions of the list: old and current. And if your activity is not found in the latest edition, although it was indicated in the previous one, from July 1 you are obliged to switch to cash register.