In order for the FSS to correctly assign the accident insurance rate for calculating premiums, business entities are required to annually send confirmation of their main type of activity to the FSS. The most convenient way is to confirm the main type of activity in the Social Insurance Fund electronically.

We will tell you:

- how to correctly prepare in 1C the documents necessary for confirmation and send them to the Social Insurance Fund through the State Services portal - quickly and without queues;

- how to get an answer online - Notification of the amount of insurance premiums for personal insurance and personal insurance;

- what needs to be checked in the Notification received from the FSS;

- Is it possible to submit Confirmation of the main type of economic activity to the Social Insurance Fund from 1C.

Where can I see the amount of contributions?

- Find in the table the type of economic activity for which you had the most income over the past year.

- Using the same table, determine the professional risk class of your business. The higher the class, the higher the fees.

- Look at the law for the contribution rate.

For example, for risk class 1 the minimum contribution rate is 0.2%. This means that from an employee’s salary of 20 thousand rubles you will pay 40 rubles in injury contributions per month.

Risk class 1 includes most businesses: cafes, clothing repair, hairdressers, almost all wholesale and retail trade, software development, consulting, photo services, passenger transportation, couriers, hotels, food delivery, education and other businesses.

How to determine your insurance premium rate yourself

The payer can independently determine the tariff for insurance premiums. But this does not negate the need to provide the necessary documentation within the time limits established by the administrative act of the Ministry of Labor.

The insurance rate depends on the field of activity, in accordance with the list approved in December 2016 by Order No. 851n of the above department.

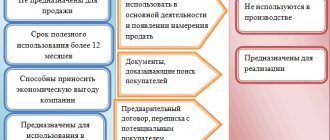

To determine the main direction of work for organizations operating in the commercial field, it is necessary to analyze the origin of most of the profits received over the previous year. This area is the main one.

For non-profit organizations, the number of employees engaged in certain functions is taken into account.

Depending on the class (out of 32 provided), which affects the degree of professional risk for the organization’s personnel, the likelihood of an accident and the scale of injury, the rate for contributions to the Social Insurance Fund can range from 0.2 to 8.5 percent.

Examples of filling out the documents required to receive a notification from the Social Insurance Fund can be found on thematic resources on the Internet or you can obtain the required explanations from fund employees.

How to determine the main activity?

This is the one for which you received the most income last year.

For example, Katya has a beauty salon, an online cosmetics store and courses for hairdressers.

Her income for 2021 is 3.6 million rubles excluding expenses. Here's how income is distributed across different businesses:

- income from a beauty salon - 2.5 million rubles

- income from the online store - 800 thousand rubles

- income from courses for hairdressers - 300 thousand rubles.

Katya's main activity is a beauty salon. The share of income from this business is 69.4%.

If several types of business have the same shares of income, the main one will be the one with the higher risk class.

Discounts or surcharges to tariffs

The FSS of Russia can set a tariff for an organization taking into account a discount or surcharge. To do this, labor safety indicators in the organization are compared with industry average values.

Industry averages have been approved:

- for 2021 - by resolution of the Federal Social Insurance Fund of Russia dated May 26, 2015 No. 72.

The following criteria are compared:

- the ratio of the expenses of the Federal Social Insurance Fund of Russia for the payment of all types of provisions for all insured events with the employer and the total amount of accrued contributions for insurance against accidents and occupational diseases;

- number of insurance cases per 1000 employees;

- number of days of temporary disability per insured event.

This procedure is provided for in paragraph 3 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524.

Discounts and surcharges on tariffs are determined by the territorial branches of the fund according to the Methodology approved by Order of the Ministry of Labor of Russia dated August 1, 2012 No. 39n.

In addition to the main indicators specified in paragraph 3 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524, when determining the amount of a discount or allowance, the results of a special assessment of working conditions are also taken into account. Information about mandatory preliminary and periodic medical examinations of employees is also taken into account. This is provided for in paragraphs 2.4 and 2.5 of the Methodology, approved by order of the Ministry of Labor of Russia dated August 1, 2012 No. 39n.

How to confirm the main type of activity?

From January 1 to April 15, send to the FSS at the place of registration of the LLC:

- statement

- confirmation certificate

- a letter about the absence of an explanatory note to the balance sheet is not necessary, but it is better to be safe.

If April 15 falls on a holiday or day off, the deadline is moved back to the next working day.

If you register an LLC in 2021, you will first confirm the type of activity only in 2021. For the entire 2021, pay contributions for the main type of activity, which is indicated in the Unified State Register of Legal Entities.

Arbitrage practice

Currently, judicial practice mainly refers to the previous Procedure and Rules. Previously, until 2021, if companies did not timely confirm the type of economic activity and the FSS determined it according to the Unified State Register of Legal Entities, without finding out whether such activity was actually being carried out, the organizations successfully argued in court that the Fund must choose from the types of activities actually carried out, referring to the Resolution of the Presidium Supreme Arbitration Court of the Russian Federation dated July 5, 2011 No. 14943/10. According to the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, the main activity is considered to be the activity actually carried out by the organization, and not just indicated in the Unified State Register of Legal Entities.

Thus, the conclusion in favor of the policyholder was made in the Resolution of the Autonomous Region of the Moscow Region dated May 2, 2021 No. F05-5041/2017 in case No. A40-174139/2016. The organization won the dispute, proving that it carried out a single type of activity, and the FSS did not provide evidence from which it follows that the company actually carried out the type of economic activity based on which the Fund chose the insurance premium rate.

In the Resolution of the Eleventh Arbitration Court of Appeal dated February 16, 2021 No. 11AP-18753/2016 in case No. A65-18430/2016, the court, in addition to considering the issue of the actual activity of the insured, took into account the insignificance of the delay in documents confirming the main type of activity, and the fact that the FSS at the time of the decision had information about the main type of activity of the organization.

The court indicated that the establishment of an increased insurance rate based on the maximum class of professional risk is provided for by law only in the case of failure to provide documents confirming the type of activity carried out by an insured who carries out several types of activity.

The Arbitration Court of the East Siberian District considered case No. A33-13023/2017, in which the organization in 2021 did not timely confirm its main activity in the Social Insurance Fund due to the illness of the chief accountant. In this regard, the fund determined the insurance tariff based on the highest class of professional risk from the types of activities specified in the Unified State Register of Legal Entities, and set the contribution rate for the type of activity to which the maximum tariff corresponds.

The organization, having decided that the notification received by the Fund dated April 24, 2021 was illegal and violated its rights, filed a corresponding application with the Arbitration Court, since the reason for the untimely submission of papers confirming the main type of economic activity was the temporary disability of the chief accountant responsible for the submission of this reporting to the Social Insurance Fund. In confirmation, along with explanations, the organization submitted a certificate of temporary incapacity for work.

The Arbitration Court of the East Siberian District, in a ruling dated February 15, 2021 No. F02-7552/2017 in case No. A33-13023/2017, overturned the Fund’s decision. Due to the fact that documents confirming the type of activity were received on May 23, 2021, and the activity in the type chosen by the FSS was not actually carried out, the court concluded that the indication in the Unified State Register of Legal Entities of data on different types of activities does not indicate their actual implementation and does not exclude carrying out other work not specified in the Unified State Register of Legal Entities. The notification of the FSS about the establishment of an increased class of professional risk due to the failure to submit documents on time to confirm the main type of activity was declared illegal.

The court rejected the Fund’s argument that there was no obligation to request documents, since the Fund must prove the legality and validity of the decision to set the insurance premium rate, which directly depends on the actual activities. According to the court, late submission of documents is not a basis for establishing an increased tariff. The court concluded that the Fund, exercising its powers in the event of failure by the policyholder to provide documents, if necessary and lacking information, has the right to request the necessary documents from the policyholder.

note

After changes in legislation that came into force in 2021, it is normatively established that the Social Insurance Fund has the right to choose the type of activity from those contained in the Unified State Register of Legal Entities. Therefore, it is better not to violate the established deadlines.

How to fill out a confirmation certificate?

Provide information about the organization: name, tax identification number, address, full name of the director and chief accountant. If the organization does not have a chief accountant, indicate the director instead. Calculate the average number of employees - read the article on how to do this.

Fill the table:

- Your OKVED codes according to the extract from the Unified State Register of Legal Entities.

- Decoding of OKVED codes is in the same wording as in the extract from the Unified State Register of Legal Entities.

- Income for each OKVED code excluding expenses. Important: indicate income in thousands of rubles. For example, write 1 million like this - 1,000 thousand rubles.

- Do not fill out the fourth column if there was no targeted income - for example, grants and subsidies.

- Calculate the share of income for each OKVED as a percentage.

- Do not fill out the sixth column, it is only for non-profit organizations.

In paragraph 10, write the type of economic activity for which the share of income is greater, indicate its OKVED code.

Sample confirmation certificate

How to get a discount

A discount on the tariff can be obtained if the organization:

- registered and actually valid for three years or more;

- pays current premiums for insurance against accidents and occupational diseases in a timely manner;

- on the date of filing the application has no debt on insurance premiums for insurance against accidents and occupational diseases;

- does not have insured fatalities.

The discount amount is calculated based on the results of the organization’s work over three years.

This follows from the provisions of paragraph 1 of Article 22 of the Law of July 24, 1998 No. 125-FZ and paragraphs 3, 4 and 8 of the Rules approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524.

To receive a discount for the next year, submit an application to the territorial branch of the FSS of Russia no later than November 1 of the current year.

Discounts are established taking into account information about a special assessment of working conditions, based on the results of workplace certification. The results of mandatory medical examinations of employees as of January 1 of the current year are also taken into account. Previously, this information had to be submitted along with the application. Now they are reflected in Table 10 of Section II of Form 4-FSS, so they are not additionally required to be submitted (paragraph 2, clause 5 of the Rules approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524, clause 29 of the Procedure approved by order of the FSS Russia dated February 26, 2015 No. 59).

The tariff assigned to the organization, taking into account the discount, is calculated as follows:

| Tariff set by the organization for the current year (%) | = | Tariff corresponding to the main type of activity of the organization for the current year | × | 100% – discount (%) |

The decision to establish a discount on the tariff for the next year must be made by the FSS of Russia no later than December 1 of the current year. Over the next five days, the FSS of Russia is obliged to notify the organization about the establishment of the discount.

This is stated in paragraphs 7 and 9 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524.

Discounts on contribution rates for 2021

You can receive a discount of up to 40% on accident insurance premiums by filling out a special form established by FSS Order No. 231 dated April 25, 2021. The employer could submit an application between August 10 and November 1, 2021.

Conditions for receiving a discount:

- company registration until 2021;

- injury rate is below industry values;

- there are no debts in the Social Insurance Fund;

- there were no fatal accidents at the company in 2021.

You could submit an application directly to the Social Insurance Fund, through a multifunctional center, by mail or electronically through State Services. The decision on granting a discount will be made by the fund before December 1.

In any case, it is mandatory to pay accident insurance premiums for employees. It is important to comply with the deadlines for submitting reports and paying payments.

Reduced insurance premiums - rate values

The total rate of insurance premiums regulated by the Tax Code of the Russian Federation is 30%. In this case, it is divided into:

- 22% - for contributions to compulsory pension insurance (OPI);

- 5.1% - for contributions to compulsory health insurance (CHI);

- 2.9% - for contributions in case of temporary disability and in connection with maternity (VNiM).

Reductions in insurance premiums up to 15% are divided as follows:

Important! Reduced rates may not apply to the entire amount of income calculated in favor of an individual. For monthly income within the established minimum wage, contributions will have to be accrued in the same manner, i.e.

e. at rates of 22%, 5.1% and 2.9%.

Reduced rates apply to the amount of excess monthly remuneration over the minimum wage.

In what cases can the FSS of Russia establish a tariff surcharge?

The Federal Social Insurance Fund of Russia can independently establish a tariff premium if the employer’s injury rate over the previous three years was higher than the industry average (Clause 1, Article 22 of Law No. 125-FZ of July 24, 1998). The amount of the bonus cannot exceed 40 percent of the tariff established for the employer (paragraph 2, paragraph 1, article 22 of the Law of July 24, 1998 No. 125-FZ).

The tariff assigned to the organization, taking into account the surcharge, is calculated as follows:

| Tariff set by the organization for the current year (%) | = | Tariff corresponding to the main type of activity of the organization for the current year | × | 100% + surcharge (%) |

The FSS of Russia must establish a tariff surcharge for the next year by making a decision no later than September 1 of the current year. The FSS of Russia is obliged to notify the employer about this within the next five days after the decision is made.

This is stated in paragraph 9 of the Rules, approved by Decree of the Government of the Russian Federation of May 30, 2012 No. 524.