Business lawyer > Accounting > Taxes > How to round personal income tax when preparing income tax returns

The calculation of the most famous tax, which is calculated on the income of Russian citizens, has some peculiarities. According to the current rule, the resulting tax value must be rounded to the nearest whole value. And this is not at all a whim of the legislator, but the need to bring the calculations of organizations and individuals to a unified order. To enter information into declarations, integer numbers are required.

In order to get rid of doubts about how to round: according to the rules of arithmetic or according to some other algorithms, you need to refer to the Tax Code. Article 52, paragraph 6 provides a detailed description of the production of settlements in relation to full-time employees of enterprises and the features of personalized submission of information.

6-NDFL: with or without kopecks

Income of Ivanov A.P.

amounted to 65,789 rubles, the applicable tax rate was 13%. We will calculate the tax as follows: 65,789 rubles. x 13% = 8552 rubles 57 kopecks. As you can see, it turned out to be more than 50 kopecks. Therefore, we will round the amount to the whole ruble. And it will turn out to be 8553 rubles. This is the amount that should be paid to the budget. Also see “Calculating Income Tax”. When we multiply the amount of income by the tax rate, we can get an amount in rubles or kopecks. However, the tax should be calculated only in full rubles. In this regard, everything that is less than 50 kopecks is discarded, and 50 kopecks and more are rounded up to a full ruble (Clause 6 of Article 52 of the Tax Code of the Russian Federation). Moreover, you also need to pay personal income tax in rubles. Let's explain with an example.

ndfl_s_kopeykami_ili_bez.jpg

Income of an individual – 54,904 rubles. We multiply by the tax rate of 13%, the total will be 7,137.52 rubles. (54,904 x 13%), and as a result of rounding the indicator, the tax is equal to 7,138 rubles. The 52 kopecks formed as a result of a mathematical operation are rounded to the nearest ruble.

Learn more about filling out forms

In the columns of the 2-NDFL certificate, all amounts relating to the income tax of a particular individual should be entered in full rubles in the corresponding lines of the certificate. All other indicators (income, tax base, deductions) are reflected in rubles and kopecks.

As always, we are eager to help you. In the article we will analyze in detail whether to charge and pay basic taxes and contributions with or without kopecks. And below you will find a cheat sheet that will help you not get confused in all these rules.

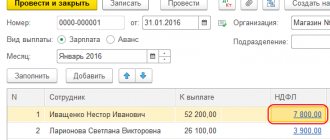

Personal income tax transferred with kopecks

Funds actually received. From this it can be seen that the amounts accrued and paid to employees must be indicated exactly as they are - with kopecks. The ruble amount is entered in the first field, and then after the dot - expressed in kopecks. The calculated and withheld income tax is recorded in 6-NDFL in lines 040 and 140. They provide only one field. Therefore, information reported here is rounded to the nearest whole number. In addition to this obvious fact, personal income tax calculations in whole rubles are required by the provisions of clause 6 of Art. 52 of the Tax Code of the Russian Federation. According to the rules they established, amounts less than 50 kopecks must be discarded, and more must be brought up to a full ruble. Reservations about balances Since 2021, a new form of 2-NDFL certificate has come into force. This document is prepared by tax agents paying employees salaries and other payments subject to income tax in several situations.

In this case, the values of income and base are entered in rubles and kopecks.

- Form 3-NDFL - the amount of tax payments should be indicated in whole rubles, and the cost indicators should be filled in with kopecks. When reflecting income and personal income tax amounts from them received outside the Russian Federation, amounts in foreign currency are first entered, then recalculation is made into Russian rubles with kopecks, without rounding (The procedure for compilation is approved by Order No. ММВ-7-11 / dated December 24, 2014) .

- Form 6-NDFL - when filling out this form, tax amounts are entered in whole rubles (p.

The amounts of taxes and contributions are rounded correctly

Pennies in calculations: to round or not? Arrears may prevent you from obtaining a certificate of no debt to the budget. If prices and costs in invoices are rounded, auditors may refuse to deduct VAT to the counterparty. At the same time, there are several options for rounding in accordance with current legislation: it is possible to round amounts to whole rubles, but it is not advisable in primary documents; rounding cannot be done in invoices and when calculating insurance premiums; amounts must be rounded in declarations; this is required by law. In general, it turns out that an accountant needs to remember and always keep these rules in mind, which are easy to get confused about. Let's look at each of the options, drawing up a reminder of when it is possible, impossible and necessary to round pennies to the ruble. Accounting for property, liabilities and business transactions can be kept in amounts rounded to whole rubles. The resulting amount differences are attributed to the financial results of a commercial organization or an increase in income, a decrease in expenses, etc. Invoices In invoices, rounding kopecks to whole rubles is not allowed. Papers are filled out in rubles and kopecks in a letter from the Ministry of Finance of Russia from

Personal income tax to pay with or without kopecks 2021

Secondly, with attribute “1”, the report is prepared by absolutely all enterprises that made payments to individuals in the previous tax period. It shows information about the income received by employees from the employer for the past year, as well as the amount of income tax calculated, withheld and paid to the state budget during this time.

Tax rounding 3NDFL - these are the rules and requirements for rounding tax amounts received to the full ruble. In the tax return in form 3-NDFL, all indicators must be left in the form in which they were received, i.e. with kopecks, however, there is an exception - the total amount of tax and advance payments are made in rounded form.

Rounding of personal income tax

For example, an employee’s income is 19,567 rubles, and we apply a tax rate of 13%. From here we get the following calculation: 19,567 x 13% = 2,543.71 rubles. or 2,543 rub. 71 kop. By applying the standard rounding scheme, we obtain the tax required to be paid from this employee equal to the amount of 2,544 rubles. And it is this amount that should be transferred to the budget.

2 personal income tax rounding.

Rounding the personal income tax amount is a certain algorithm that must be followed when filling out tax returns. Below are step-by-step instructions that will help you easily fill out all declarations and understand whether the amount needs to be rounded or not.

However, in the first section with general requirements for the order of reporting, it is said that for decimal fractions two fields are used, which are separated by the “dot” sign. First, the whole part of the fraction is reflected, then the fractional part.

Salary taxes - with or without kopecks

Such rounding inevitably leads to “penny” problems with that part of the unified social tax that is credited to the Russian Social Insurance Fund. If you transfer it with kopecks (even though the Tax Code of the Russian Federation prescribes rounding, inspectors will not be able to fine you for payment with kopecks), differences will inevitably arise between the accounting and the figures in the UST reports. If, on the contrary, you pay in full rubles, differences will arise between the values indicated in the 4-FSS RF form and in the Unified Social Tax report.

Interesting to read: Sample application for increasing the amount of alimony in a fixed amount

The situation with the unified social tax and contributions to the Pension Fund is more complicated. Social tax The Tax Code of the Russian Federation requires payment in whole rubles. The tax office also requires pension contributions to be transferred in full rubles. Consequently, deviations inevitably arise between the accrued and transferred amounts. And if in the case of pension contributions this does not cause any special problems, then with the unified social tax questions arise. More precisely, with that part of this tax that is credited to the Federal Social Insurance Fund of Russia.

When filling out declarations, amounts over 50 kopecks will be rounded to the nearest ruble.

Yes Primary documents and invoices In primary documents and invoices, you need to record amounts in rubles and kopecks, letter from the Ministry of Finance from the Ministry of Finance. Register invoices in the books of purchases and sales exactly for the amount that was recorded in them. If there are differences and the tax authorities discover them, they will ask for clarification. Declaration and payments All taxes must be transferred in full rubles. In declarations, indicators are also rounded to whole numbers. The tax amount from the declaration is recorded in the payment order.

Personal income tax changes in 2021-2021

Especially today, in the unstable political situation with the past elections. It’s even scary to imagine what you can count on in 2021. Although for personal income tax the rate will most likely rise further and further. After all, even government organizations are happy to support such reforms.

PFDL is a direct type of tax, which is calculated as a percentage of the entire total income of an individual, excluding some documented expenses. Current legislation prescribes that absolutely all income that a taxpayer receives, be it sales or wages, is subject to personal income tax.

Upcoming possible changes

According to the latest data, from 2021, employed Russians will see an increase in the personal income tax rate to 6 percent. If the introduction of this program is successful, the rate could rise to 19 percent.

This 6%, by which the tax may rise, is planned to be used to create an IPC - individual pension capital. The Main Bank of Russia and the Ministry of Finance jointly developed this project to introduce the IPC and increase personal income tax in March 2021.

Finance Minister Anton Germanovich Siluanov said in a conversation that the introduction of individual capital for retired people and an increase in the personal income tax rate in the future will increase pensions by twenty percent. With the help of this money, the funded part of pension benefits will be formed.

And IPC will be accumulated in other pension funds. The introduction of this program is planned to stimulate employed people to independently save funds for a future pension.

The government of the Russian Federation is preparing a bill that plans to equalize tax rates on profits for Russian citizens and foreigners. Currently the rate is 13 percent for Russians and 30 percent for foreigners. At a meeting on the implementation of the national project, A. G. Siluanov about

Although Dmitry Medvedev previously reported that the leadership does not plan to change the personal income tax for citizens of the Russian Federation. Siluanov called the personal income tax the most collected and stable. At the moment, this is only a bill; it has not yet been sent for signing by the President of the Russian Federation. Whether it will be implemented is unknown to anyone at the moment, but the likelihood of these changes is very high.

This is important to know: Federal Tax Service: personal income tax declaration 3 2021

Details have also not yet been announced. There was no consensus on mandatory payments. Where will the funds for the IPC be sent from: tax contributions may become a mandatory item for employed citizens, or may be without coercion. It is also unclear whether the transfer to the new personal income tax system will be what payments will be each month, whether automatic deductions to the Federal Tax Service are possible.

If, of course, a new taxation system is introduced in the Russian Federation, then this will happen in several stages over a certain number of years. Every year the payments will be higher by one percent. This means that by 2021, personal income tax payments will be 14 percent, and in 2021 15 percent, and in the next year by 2022 the value will be 16 percent, in 2023 - 17 percent, in 2024 - 18 percent, and from 2025 the deduction will be be 19 percent.

Even if this program is implemented, many assume that the general problem of pension transfers will not be solved. And it will not be possible to cover expenses this way. Moreover, if deductions are made at their own request, not everyone will agree to this. And also, many employers deliberately lower the official salaries of their employees in order to pay lower taxes.

It is also possible that a single tax will be introduced for everyone. This means that the percentage of deductions will not change due to the categories of employed citizens. This may attract other foreign workers to come to work in Russia.

Personal income tax with or without kopecks

When calculating taxes and fees, the resulting amounts are often not round. How to correctly make personal income tax accruals - with or without kopecks? In what order are payment and reporting documents drawn up? What to do with any discrepancies that arise? We will answer pressing questions from a legal point of view and analyze the situation using a practical example.

Therefore, when calculating income tax and other payments, the procedure prescribed in the stat. 52, – rounding of amounts to full rubles according to mathematical rules. Regarding personal income tax, it looks like this: tax amounts up to 50 kopecks. are not considered, over 50 kopecks. rounded up. Thus, it is necessary to perform calculations for each employee separately, and not for all personnel as a whole. Also keep in mind that the calculation is made within a calendar month, and not by reporting/tax periods. The obtained values are summarized to calculate amounts for a quarter, half a year, 9 months, and a calendar year.

Reflection order by form

- 2-NDFL. The most popular form, most often requested by employees to submit next-level declarations, as well as applications for funding. Tax values for the year or the period required by the initiator should also be entered in whole rubles. Meanwhile, there is a small clarification that is given in the recommendations for filling out the form. This order was issued by the Federal Tax Service and implemented in the corresponding order MMV-7-3/611 of 2010. According to the by-law, information in the 2-NDFL certificate should be indicated in whole numbers only in those fields that are provided for this. Usually these positions in the form are marked with special marks.

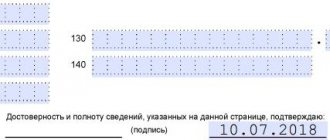

As a general rule, the tax calculated and the income paid should be indicated as is. But in lines 140 and 040, where there are no additional fields, the tax agent’s accounting department should indicate whole numbers, not fractions.

Personal income tax payment deadline in 2021

This paragraph deals with calculated and withheld tax. What does this mean for payroll taxes? This means that there is no need to pay personal income tax on advance payments, since the tax is calculated when income is calculated; for salaries, this means the end of the month; it is the last calendar day of the month that the accrual of salaries is reflected in accounting.

Let us remind you that vacation pay, according to the requirements of the Labor Code, is transferred no later than 3 days before the start of the employee’s vacation. This means that, for example, if an employee goes on vacation from 10/17/2021 to 11/08/2021, then vacation pay must be transferred to him, taking into account weekends, until 10/13/2021, and personal income tax until 10/31/2021.

How to pay personal income tax yourself

If the tax office finds out that a person has not paid taxes, it can charge additional taxes for payment for 3 years - 13% of income.

And the late fee is 1/300 of the Central Bank refinancing rate for each day. Fine. For non-payment of taxes, the fine ranges from 20 to 40% of the unpaid amount. If you receive an income of 30,000 rubles and do not report this to the tax office, the fine for the year may be 18,720 rubles. There is also a fine for unfiled declarations - up to 30% of the tax amount for each year. Criminal.

Criminal liability threatens those who have not paid taxes for a very long time.

Ordinary citizens: freelancers or apartment owners should hardly be afraid, but we are obliged to warn you. If in 3 years the tax debt amounts to 900 thousand rubles and this will be 10% of a person’s total tax obligations or 2.7 million rubles without reference to years and percent, then according to the criminal code they can be forced to pay a fine of 300,000 rubles or be put in prison for a year. Illegal business.

Can there be a 6-NDFL with kopecks or is it issued without them?

As you can see, there are plenty of controversial situations regarding the reflection of amounts with or without kopecks in tax reporting. Understanding this issue on their own, lawyers go to trial. And only in practice does it become clear how to do it correctly.

New report forms usually raise a lot of questions about filling them out. Calculation 6-NDFL, introduced in 2021, was no exception. Its design involves the use of both exact indicators, expressed in fractions, and rounded ones. The difficulty lies in which amounts need to be reflected in full rubles, and which in kopecks.

Interesting read: What to do if you are taken away by bailiffs

Reflection order by form

- 2-NDFL. The most popular form, most often requested by employees to submit next-level declarations, as well as applications for funding. Tax values for the year or the period required by the initiator should also be entered in whole rubles. Meanwhile, there is a small clarification that is given in the recommendations for filling out the form. This order was issued by the Federal Tax Service and implemented in the corresponding order MMV-7-3/611 of 2010. According to the by-law, information in the 2-NDFL certificate should be indicated in whole numbers only in those fields that are provided for this. Usually these positions in the form are marked with special marks.

As a general rule, the tax calculated and the income paid should be indicated as is. But in lines 140 and 040, where there are no additional fields, the tax agent’s accounting department should indicate whole numbers, not fractions.

How to correctly pay personal income tax on wages in 2021

- employees performing their duties on the basis of a patent;

- individuals participating in the state program for the resettlement of compatriots;

- crew members of ships flying the state flag of the Russian Federation;

- highly qualified foreign specialists, regardless of their tax status, with whom the employment relationship is formalized by an appropriate contract or agreement (letter of the Ministry of Finance of Russia dated February 18, 2021 No. 03-04-06/6773);

By the way, if the company violated the deadline for transferring personal income tax from wages in 2021, for example, transferred personal income tax earlier, before the payment of wages, the tax will have to be paid again, even if there is an overpayment (decision of the Federal Tax Service of Russia dated May 5, 2021 No. SA-4-9/). The tax authorities made a decision not in favor of the company in a situation where the company transferred personal income tax from wages before the actual payment of income. After the actual payment of the salary, the tax was not transferred, so the tax authorities added additional taxes. According to the inspectors, it was necessary to withhold the accrued amount of personal income tax only after the actual payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation). The company decided that the obligation to transfer personal income tax was fulfilled ahead of schedule, and this is not prohibited by tax legislation. The Federal Tax Service did not agree with this. According to the department, transferring personal income tax at the expense of the company’s own funds ahead of schedule is unacceptable (clause 9 of Art.

How can a tax agent calculate personal income tax?

But this is not a problem, the difficulty lies elsewhere. If you end up underpaying tax to the budget or do it at the wrong time, the tax agent may be fined. Important: personal income tax can only be withheld within 50 percent of the payment amount (clause

But what is considered a payment in this case - the amount that was accrued, or the amount that the employee has already received in hand - is not defined in the Tax Code of the Russian Federation. If we interpret the law literally, then the payment should be understood as the total amount of income accrued to the employee before tax.

Deadlines for payment of insurance premiums in 2021

Insurance premiums in 2021 are considered paid on the day when an LLC or individual entrepreneur receives a payment order to pay insurance premiums. Such an order for the payment of insurance premiums can be submitted either by the payer of insurance premiums or by any other person: an organization, an individual entrepreneur or a person who is not engaged in business (clause 1 of Article 45 of the Tax Code of the Russian Federation). Of course, there must be enough money in the current account of the organization or other person for the payment, and the order itself must be filled out correctly. In 2021, transfer insurance premiums to the budget without rounding: in rubles and kopecks (clause 5 of Article 431 of the Tax Code of the Russian Federation).

Insurance contributions to the Social Insurance Fund in 2021 Period Payment deadline December 2021 No later than 01/15/2021 January 2021 No later than 02/15/2021 February 2021 No later than 03/15/2021 March 2021 No later than 04/16/2021 April 2021 No later than 05/15/2021 May 2021 No later than 15.06 .2021 June 2021 No later than 07/16/2021 July 2021 No later than 08/15/2021 August 2021 No later than 09/17/2021 September 2021 No later than 10/15/2021 October 2021 No later than 11/15/2021 November 2021 No later than 17 .12.2021

Rebus Company

Tax authorities, when determining the amount of tax to be transferred to the budget and subsequently reflected in the reports 2-NDFL, 3-NDFL and 6-NDFL, proceed from the above administrative documents, as well as the norms of the Tax Code of the Russian Federation, in particular - clause 6 of Art. 52, which regulates the principle of rounding tax values.

Personal income tax to pay with or without kopecks 2020

In addition, changing the tax payment by rounding does not comply with the norms of paragraph 1 of Art. 3 codes that state that everyone is obliged to pay taxes established by law. However, rounding rules must be observed for individual taxes.

123, that is, penalties. This year there are no plans to make legislative changes to the procedure for calculating and transferring personal income tax. This means that in order to calculate the amount of budget payments, it is necessary to determine the tax base and apply the established calculated rates.

Personal income tax in 2021

Currently, there are five interest rates: 9%, 13%, 15%, 30% and 35%, established depending on the type of income and category of taxpayer. However, recently various media have published news that tax rates may increase in the near future.

What's Happening Right Now: Interest Rates in 2021

Taxation is established by the legislation of our country. Of course, profit, which is different for everyone, is not without taxes, and the indicators also differ. In this table we show what amounts of income and in what categories personal income tax is withheld:

| Personal income tax percentage rate | Types of profit that are taxed |

| 13,00% | The first tax applies to people who work under an employment contract, these include citizens of the Russian Federation and other states (these are highly qualified workers who have a non-permanent place of residence in the Russian Federation). Types of categories from which personal income tax taxes are levied:

|

| 9,00% | This interest rate applies to:

|

| 15,00% | Receipt of income by citizens not residing in the Russian Federation from Russian enterprises that took part in their activities (shared construction) |

| 35,00% | This type is suitable for:

|

| 30,00% | Profit received by any citizen who does not reside in the Russian Federation (for example, a foreigner) |

Income tax is not deducted from other categories of citizens, for example, benefits, receipt of child support, reimbursement for payment for services in a medical institution, financial assistance from the state.

It is important to know! There are also other categories of contributions in Russia that are not taxable: pension insurance - 22 percent, social insurance - 2.9 percent, and also medicine - 5.1 percent. All employers are also required to make these transfers.

Rounding up pennies in calculations is dangerous - fines in the thousands are possible

Property tax Tax on a well in a private house. Accounting reporting Deadlines for submitting reports in a year: table. Pensioners Social disability pension per year. Maternity leave On what dates are child benefits transferred per year? Pensioners How to obtain a pre-retirement certificate. Maternity leave Benefits for non-working pregnant women per year. Pensioners Indexation of pensions for working pensioners per year. Pensioners Indexation of pensions for working pensioners after dismissal.

The Ministry of Finance recalled the rules for rounding personal income tax by a tax agent

Income codes in the 2-NDFL certificate for the year. Changes in personal income tax. Changes in personal income tax this year. How to get a 2-NDFL certificate? When generating reports on accrued, withheld and paid personal income tax to the budget, the tax agent must not only correctly calculate, but also correctly indicate the total tax expression. Let's look at how to fill out information lines on tax amounts in personal income tax reports, what to do with kopecks, and also whether, and on what basis, it is necessary to round figures. Let us answer right away: the law does not contain a direct indication of the principle of reflecting values and indicators specifically for personal income tax.

- The first step is to determine all of your income that was received during the tax period (reporting year) and which is subject to income tax.

- The second step is to find out what tax rates apply to them. The personal income tax rate can be 13%, 23%, 9% and 35% (read more about each type of rate in the article Tax rates).

- The third step is calculating the tax base. This is necessary in a situation where there are several rates, in which case each of them will have its own tax base.

- The fourth step is the calculation of personal income tax from each tax base.

Procedure for calculating personal income tax: calculation example

/ condition / Salary E.O. Ivanova is 36,000 rubles. per month. She has a daughter aged 12, due to which E.O. Ivanova is provided with a standard deduction for a child in the amount of 1,400 rubles. per month. In addition, in April she was paid an additional bonus of 12,000 rubles. Let's determine the amount of personal income tax withheld from the employee's income for the month of April.

/ decision / The tax base for personal income tax for January-April will be:

36,000 rub. x 4 months + 12,000 rub. – (1400 rub. x 4 months) = 150,400 rub.

Personal income tax amount for January-April: 150,400 rubles. x 13% = 19,552 rub.

Personal income tax withheld from the employee’s income for January-March:

(36,000 rub. x 3 months – (1,400 rub. x 3 months)) x 13% = 13,494 rub.

Personal income tax withheld from income for April: RUB 19,552. – 13,494 rub. = 6,058 rub.