The vast majority of income and expenses of any organization are associated with the sale of goods and/or services. However, activities and financial reporting are not limited to sales alone. There are very significant income and expense items associated with other business processes; they also need accounting.

Let's analyze the specifics of these financial indicators, dwell on the features of their reflection in accounting and in the Tax Code of the Russian Federation, and consider their impact on the amount of income tax.

What income is not realized?

When the definition states that the defined concept includes all indicators except those listed, then the necessary factors can be calculated by the method of elimination. It can be said that all types of income not mentioned in Art. 249 of the Tax Code of the Russian Federation. In turn, in Art. 250 of the Tax Code of the Russian Federation states that all income of an organization is recognized as non-operating, except :

- amounts received as a result of sales;

- tax-free financial income (they are specifically stipulated in Article 251 of the Tax Code of the Russian Federation).

List of non-operating income

Another approach to determining this form of profit is to list the possible types of income that Art. 250 Tax Code classifies as non-operating:

- profit received from equity participation in other associations (if additional shares are purchased with dividends, then this income is excluded from non-operating income);

- paid ]penalties[/anchor], fines, penalties under contracts (or even not yet paid, but only awarded or recognized by the debtor);

- compensation received for damage or loss;

- insurance payments;

- profit from leasing or subletting tangible assets or real estate (except for those situations when this activity is the main activity for the company - then this is already income from the provision of services);

- assets received free of charge, for example, as a gift;

- past profit for the reporting year;

- the cost of surplus property credited to the balance sheet based on the results of the regular inventory;

- payment of debts on loans and deposits, the statute of limitations of which has already expired (“unexpectedly returned debt”);

- profit from differences in exchange rates;

- the result of revaluation of assets;

- some others.

Account 91 - active or passive

Account 91 belongs to the category of mixed, or active-passive. It simultaneously takes into account both assets and liabilities. And its balance is changeable - it can only be debit or only credit.

On credit 91 accounts during the month reflect income from other sources, and on debit - other expenses. At the end of the month, the debit and credit turnovers are compared, the smaller is subtracted from the larger and the result is obtained. If the balance turns out to be a credit balance, income exceeds expenses, and the company generates profit from other activities. If it's the other way around, it's a loss.

There should be no balance left in the account at the end of each month. It is written off to the Profit and Loss account.

Don't forget to include these incomes in non-operating income

Taxpayers often miss out on certain types of profit, which are also considered non-operating, thereby, wittingly or unwittingly, underestimating the tax base. However, these revenues to the organization’s budget are included in non-operating income:

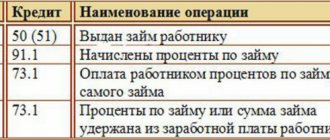

- interest on issued loans, deposits, promissory notes (both in relations with counterparties and with the Central Bank);

- market value of materials obtained as a result of dismantling written-off property;

- charitable contributions received by the company and targeted donations used for the stated purpose;

- assessment of written-off and returned printed products;

- correction of calculated profit due to changes in calculation methods;

- plus the difference between deductions and excise taxes.

NOTE! Understating profits due to the omission of certain items of income, committed due to intent or lack of knowledge, is fraught with troubles on the part of the regulatory tax authorities: this may well be regarded as tax evasion.

What's happened

Non-operating (other) income is those incomes that are received from others not related to the main activities.

For example, a company is engaged in trade and simultaneously rents out storage space. Rental income will be classified as non-operating, and the costs of maintaining the warehouse will be classified as other costs. Non-operating income is taken into account when calculating tax profit, and their list is given in Art. 250 Tax Code of the Russian Federation .

For more information about what relates to non-operating income from the point of view of tax legislation, see the material “Art. 250 Tax Code of the Russian Federation (2ٜ01ٜ5)ٜ: questions and answers.”

In accounting, non-operating income is taken into account as part of other income, since starting from the reporting for 2006 in connection with the adoption of the Ministry of Finance's order No. 116n dated 18/09/06, dividing income (practicum) into non-operating, operations new and emergency ones were abolished.

The list of other income is enshrined in clause 7 of PBU 9/99 and is open. These include, in particular:

- Income from the rental of company property.

- Exchange differences.

- Penalties (fines and penalties) received for non-compliance with contractual obligations.

- Property received free of charge.

- Proceeds from the sale of certain types of assets.

- Interest on credit agreements and bank deposits.

- Capitalization of surpluses identified during the inventory.

- Income from participation in management companies of other companies.

- Other income.

Non-operating income and taxation

The significance of this type of profit is its influence on the formation of the tax base. Non-operating income must be taken into account when calculating the following types of taxes:

- profit tax - types of profit are summed up both from the sale of goods, works, services (under Article 249 of the Tax Code of the Russian Federation), and non-sales turnover (under Article 250 of the Tax Code of the Russian Federation);

- determination of the tax base under the special regime of the simplified tax system (Article 346.16 of the Tax Code of the Russian Federation);

- taxable base for the tax regime of the Unified Agricultural Tax (Article 346.5 of the Tax Code of the Russian Federation).

Cash services and cash collection

Cash settlement services are perhaps the main type of banking services. This is indicated by the fact that a banking service agreement is often referred to as a cash settlement service agreement. Thus, within the framework of settlement and cash services, a credit institution can provide the following types of services:

- maintaining records of funds in the account of a legal entity;

- crediting funds received from counterparties or other persons by bank transfer;

- execution of instructions from the organization to transfer funds to third parties;

- acceptance and issue of cash.

To recognize the costs of settlement and cash services as tax expenses, it is necessary that the terms of the agreement determine the types of services that the bank will provide, the amount of remuneration due, as well as the timing and procedure for its payment.