Formation of additional sheets in “1C: Accounting 7.7”

Printing additional sheets in a standard configuration is carried out using the “Purchase Book” and “Sales Book” reports. To generate additional sheets, set the group switch “Report generation option” to the “Additional sheets” position (see Fig. 6). In this case, a choice of options for generating additional sheets becomes available:

1. Current period - additional sheets are generated for the current period with adjustments made in subsequent tax periods. In this case, additional sheets are automatically numbered. This technique is intended for the formation of additional sheets “retrospectively”. For example, if January is set as the reporting period, then all additional sheets of the purchase book for January will be generated, which will reflect adjustments made in February, March, etc.

2. Adjusted period - additional sheets are formed for all previous tax periods in which changes were made in the current tax period (the period of formation of the purchase book (sales book)). This technique is intended to generate additional sheets “as they arise.” For example, if in August invoices issued in January and March are adjusted, then when compiling a report for August the following will be generated: an additional sheet of the purchase book (sales book) for January; additional sheet of the purchase book (sales book) for March; the additional sheets generated will reflect the adjustments made in August.

Rice. 6

The documents “Creating purchase book entries”, “Creating a sales book”, “Purchasing book entry” and “Sales book entry” are intended for generating records of additional sheets. In order for a purchase book entry or a sales book entry to be reflected in an additional sheet, special details of the documents “Additional entry” are provided. sheet" and "Additional date. sheet."

Please note that additional sheets are formed on the basis of: documents “Purchase book entry”/”Sales book entry” with the “Additional” flag set. sheet"; lines of the document “Creating purchase book entries”/”Creating sales book entries” in which the “Additional record” flag is set. sheet."

In order for the document line “Creating purchase book entries” or “Creating sales book entries” to be reflected in an additional sheet, you should set the “Additional record” flag in this line. sheet" and indicate the period to be adjusted by filling in the details "Additional date. sheet." To do this, it is recommended to indicate “Additional date” in the details. sheet" date of issue of the adjusted invoice. The specified details are filled in automatically, but their values can be changed by the user.

When filling out the document “Creating purchase book entries”, the checkbox “Additional entry. sheet" is automatically set in the lines that reflect the amount differences that arose when paying an invoice received in the previous period. Props “Additional date.” sheet” is intended to indicate the tax period in which changes are made. To do this, it is recommended to indicate “Additional date” in the details. sheet" date of issue of the adjusted invoice. When filling in automatically, the details indicate the date of the document from the “Invoice” column.

When automatically filling out the document “Creating Sales Book Entries”, the flag “Record additional. sheet" is set in the lines reflecting the amount differences that arose when paying invoices issued in the previous period. In this case, two records of an additional sheet of the sales book are formed:

- the first entry reflects the cancellation of the invoice;

- the second is the registration of the invoice with the changes made to it.

Props “Additional date.” sheet” is intended to indicate the tax period in which changes are made. When filling in automatically, the details indicate the date of the document from the “Invoice” column.

If you need to enter an additional sheet entry manually, you should additionally, at the end of the period, enter a new document “Creating purchase book entries” (“Creating sales book entries”), fill in the corresponding details (the date of the adjusted invoice should be specified as the date of the additional sheet ) and save (without carrying out) (the “Record” button).

The document “Creating purchase book entries” (“Creating sales book entries”) should be used in cases where the adjusted invoice is automatically reflected in the purchase book (sales book).

That is, in the agreement specified in the “Invoice issued” document, the “Use agreement documents to automatically generate a purchase book and sales book” must be checked.

If invoices are reflected in the purchase ledger (sales ledger) manually using the “Purchases Ledger Entry” (“Sales Ledger Entry”) documents, then to enter additional sheet entries, you should use the “Purchases Ledger Entry” or “Sales Ledger Entry” documents, respectively . In order for the document “Purchase Book Entry” to reflect the entry of an additional sheet, you must fill out its details as follows:

- indicate the basis document (supplier invoice);

- set the flag “Add. sheet" in the group of details "Record additional. sheet";

- in the field “Additional date” sheet" indicate the date of issue of the canceled invoice.

Example 3

In May, an invoice was received from the supplier (No. 39 for the amount of RUB 236,971.14, including VAT RUB 36,148.14). The invoice is recorded in the purchase ledger. Let's assume that the supplier canceled this invoice in June.

Since the invoice was received in the previous tax period, its adjustment should be reflected in an additional sheet of the purchase ledger. To do this, in June you should (see Fig. 7):

- Enter the document “Purchase Ledger Entry”.

- Indicate the purchase amount, the amount excluding VAT and the VAT amount with a minus sign.

- Set the flag “Add. sheet" in the "Record additional" group. sheet."

- Indicate the date of the additional sheet. The date of issue of the canceled invoice (in this case) should be indicated as the date of the additional sheet.

Rice. 7

To reflect the entry of an additional sheet of the sales book, you must enter two documents “Sales book entry”. One is for canceling a previously registered sales ledger entry (the amount in the document with a minus sign), the other is for registering an invoice taking into account corrections. Both documents state:

- indicate the basis document (invoice received);

- set the flag “Record additional. sheet as of date" and indicate the date of issue of the adjusted invoice.

Example 4

In April, the buyer (Stroykomplekt LLC) was issued an invoice (No. 18 dated for the amount of 2,360 rubles, including VAT 360 rubles). The invoice is recorded in the sales ledger. In June, corrections were made to the invoice (the invoice amount was increased to RUB 2,950).

Since the invoice was issued in the previous tax period, its adjustment should be reflected in an additional sheet of the sales ledger. To do this in June you should:

- Enter two documents “Sales Ledger Entry”. The first document reflects the cancellation of the invoice (all amounts with a minus sign). The second document reflects the registration of the invoice, taking into account the adjustment. In documents, you should set the “Record additional. date sheet";

- indicate the date of the additional sheet. The date of issue of the adjusted invoice (in this case) should be indicated as the date of the additional sheet.

What is an additional sheet of a purchase book?

Additional sheets to the enterprise acquisition register (finished products, goods, services, consumables) should be generated in each case of changes. It turns out that attachments to the transaction log allow adjustments to be made and confirm their existence.

In this case, amendments are made for past tax periods.

You will find a lot of information on the topic in this video:

Concept and essence

Additional sheets, which are annex to the purchase book, are formed in the current period when the deficiency was discovered. But the period that is adjusted by the sheet is the past. According to the document, you can exclude from accounting already posted invoices for the full value or partially, for which the deduction of value added tax was calculated incorrectly. Also, based on additional sheets to the purchase book, changes are made to existing invoices (text part, organization address and other information).

The essence of the additional sheet to the purchase book comes down to the natural flow of the life of the enterprise. According to the latest changes in current legislation, each issued invoice is reflected in the unified tax service database. For this reason, corrections cannot be made to the documents confirming the accrual of the federal tax. Each change or group is recorded on an additional sheet.

How the issue is regulated

The main document regulating the issues of maintaining a purchase book and additional sheets is Government Decree 1137 of 20011. The regulatory document has been repeatedly amended to address controversial issues.

Thus, for a long time, tax inspectors insisted that corrections to the purchase book should be made during the period of actual adjustment. Thus, taxpayers lost their right to deduction. The courts systematically confirmed the side of business entities until appropriate changes were made to the Resolution.

How many DLs can there be?

According to the definition, there can be one additional sheet in the purchase book. The quantity is timed to coincide with the tax periods for which the organization reports. So, if the value added tax report is submitted quarterly, accordingly, there may be four such sheets in the current year (one for the previous year and three for the current one).

*In practice, there may be several such sheets. The legislator allows this, pointing out the need to generate information in the “TOTAL” field from column 16 of the last additional sheet recorded in the tax period for the purchase book.

When filled

In the practice of business entities, the most common cases of issuing additional sheets are the following:

- As a result of internal self-control, documents were identified that were unlawfully included in the tax base (increased it). Drawing up an additional sheet will allow you to exclude the “presentation” of the counterparty from the period under review;

- The most common case is that the invoice arrived late and it is necessary to include it in the previous period. The adjustment in this case will be accompanied not only by the creation of an additional sheet, but also by the submission of an updated tax return (if already submitted).

Additional sheets in Excel 2007 - topic of the video below:

Highlights ↑

Today, the legislative level has fixed the point according to which it is necessary to generate special invoices when purchasing goods subject to value added tax.

All data about them, as well as other information, must be entered into a special purchase book. It is not recommended to make mistakes in this document.

To avoid this type of incident, you should study the following points in as much detail as possible:

- definitions;

- who needs to lead;

- legal grounds.

Definitions

The purchase ledger is used to store invoice information.

These documents represent legal confirmation of payment of value added tax upon acquisition:

- any services;

- goods.

Also, invoices are subsequently used to determine the amount of the deduction, if its use does not contradict current legislation.

Documents should be indicated in the appropriate section of the book not at the time of their formation, but only when the buyer’s ownership of the goods or services has become valid and realized.

The format for maintaining a purchase ledger is specified in the current legislation - Government Decree No. 1137 of December 26, 2011.

Please remember that the following invoices cannot be recorded in the purchase ledger:

- if goods or any services were transferred free of charge;

- if any currency was purchased through a broker on a financial exchange;

- if the goods or services were received by the sales agent from the principal (committent) for sale;

- reflecting the commissions received by the intermediary during the sale.

It should not be assumed that the above transactions are not included in the declaration. This is an error, if allowed, the person forming it will need to make clarifications.

Who needs to lead

A purchase book must be kept by everyone who purchases goods and services on which they are required to pay value added tax.

VAT payers can be:

- individual entrepreneurs;

- all kinds of organizations;

- individuals transporting goods across the border of the Russian Federation;

- organizations of foreign origin selling their products or services in Russia.

The list of those not paying VAT includes:

- entrepreneurs and legal entities working under a simplified taxation scheme;

- transferring to the budget UTII - a single tax on imputed income;

- enterprises and individual entrepreneurs whose profits for three consecutive months did not exceed 2,00,000 rubles.

The list of exceptions does not apply to excisable goods. All the most important points regarding value added tax are indicated in Article No. 143 of the Tax Code of the Russian Federation.

Legal grounds

The purchase book, as well as various related materials (additional sheet and others), must be submitted on the basis of Order of the Federal Tax Service No. ММВ-7-3 / [email protected] dated 10.29.14.

This order also specifies the formats of documents that must be submitted to the Federal Tax Service.

VAT payers who create a purchase book must study the following materials:

- Chapter No. 21 of the Tax Code of the Russian Federation.

- Decree of the Government of the Russian Federation No. 914 of December 2, 2000

- Decree of the Government of the Russian Federation No. 451 of May 26, 2009

It is also important to remember that the book of purchases from 2021 must be reflected in section No. 8 of the declaration submitted to the tax service (but only for VAT).

How to reflect an adjustment invoice in the purchase book, see the article: advance invoice in the purchase book. Read an example of filling out a purchase book in 2021 here.

Previously, it was acceptable to create this document on a simple paper medium. Today this is not allowed.

The sales book, as well as an additional sheet to it, should be saved in .xml format. It is transmitted via special telecommunication channels, through a gateway.

... sales books

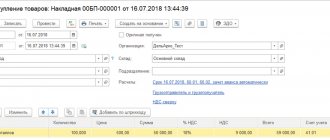

When using the “Manufacturing Enterprise Management” and “Enterprise Accounting” configurations to generate additional. sheets, you must fill out special details in the tabular part of the document “Creating purchase ledger entries”:

- flag “Record additional sheet" - set if this entry needs to be placed in an additional sheet of the purchase book;

- “Adjusted period”—enter a date belonging to the period being adjusted.

For an example of filling out a document, see Fig. 1.

Rice. 1

In this case, in May 2006, it was discovered that back in December 2005, services were sold (the organization determined the VAT tax base “on shipment”), but no entry was made in the sales book, and VAT was not accrued for payment to the budget. Accordingly, the adjusted period is December 2005.

When creating a sales book (for May 2006 and later), it is possible to configure the mechanism for generating (printing) additional sheets. There are two options (see Fig. 2):

- for the current period (in this case, additional sheets are generated for the period of formation of the sales book for all adjustments made in subsequent tax periods);

- for the adjusted period (in this case, additional sheets are generated for all tax periods, adjustments for which were made in the current period, that is, the period of formation of the sales book).

Rice. 2

An alternative option for generating additional sheets (for the adjusted period) is necessary to control changes in purchase/sale books for previous periods. In this case, additional sheets are displayed for the period in which the adjustments were made.

If the “Generate additional sheets” flag is not set, but in the current period there are adjustments from previous periods, or adjustments made in subsequent periods, the user will be given an information message about the possibility of generating additional sheets for the adjusted or current period.

For the first additional sheet for the tax period, the total data of the main section of the sales book is transferred to the “Total” line.

If corrections are made for the same tax period during different tax periods, the total data from the previous additional sheet of the sales book is transferred to the “Total” line of the additional sheet.

VAT accounting in simple words

At the end of the last century, a value added tax was established in our country, which, in fact, replaced the previously applied percentage on sales levied by the state. VAT is an indirect tax; it is levied on any sale at enterprises that apply the general tax system.

For a long time, the tax rate was 18%; from 2021, the rate was increased to 20%.

As with any tax, there is the possibility of preferential rates and VAT exemptions. We will not dwell on this issue in the article; information can be obtained by studying the Tax Code and the relevant acts.

The company, simply put, has the obligation to pay VAT on goods received from the supplier and on products sold by the organization itself. In order to avoid “doubling” tax amounts, a procedure for its calculation has been established. It is shown in the diagram below:

The tax payable is reflected in the KPr, the “input” VAT is reflected in the KP, and the recovered VAT, depending on the situation, can end up in any of the books.

Based on the results of the quarter, the company needs to calculate the tax payable to the budget. If the amount of “input” exceeds the amount of sales tax, then VAT appears for reimbursement. This is the amount that the budget reimburses the organization.

The simplest example:

Sold products - 300 rubles, incl. VAT 50 rub.

We purchased MPZ - 600 rubles, incl. VAT 100 rub.

50 – 100 = -50 rub. for reimbursement from the budget.

Now that the general provisions are clear, we can move on.

Filling out additional sheets

The 2021 uniform hasn't changed much. The 2011 edition of Government Decree 1137 indicates the need to fill in the following register fields:

- Serial numbers;

- Buyer's name (full and abbreviated). Must comply with the constituent documents;

- Taxpayer numbers – INN, KPP;

- The tax period in which the amounts and other information were adjusted. This must be done before making corrections;

- Date of registration.

Erroneous entries in the book itself are corrected differently, depending on whether the quarter has ended or not. Within the tax period, entries should be made in the main register reflecting negative data.

Tax period - month

When automatically filling out the documents “Creating purchase book entries” and “Creating sales book entries”, the flag “Record additional. sheet" is set in the lines that reflect adjustments to invoices received (issued) in previous months.

When generating additional sheets of the purchase book and sales book, the total line indicator of the additional sheet is calculated for each month that is included in the period for which the report is generated, taking into account the adjustments reflected in the previously generated additional sheets.

Return of partial payment made to the counterparty

In practice, it also happens that the acts were issued erroneously; in fact, the warehouses do not have the indicated inventory items. It is possible that an emergency occurred and some of the products were damaged. A situation arises when the contractual relationship is terminated.

In the event that for some reason the contract is terminated and the counterparty demands the return of the partial payment made by him, the following actions should be taken.

In the register, open “Receipt to current account” from this buyer, click “Create based on” and select “Write off from current account”. A window will open in which almost all fields are mechanically filled in. In “Type of operation” there will be about.

To submit the VAT amount from a partial payment for deduction, you must use the “Period Closing” section in the “Operations” menu. Then select the highlighted line “VAT routine operations”. After clicking on “Create” in the window that opens and selecting “Creating purchase ledger entries”, set the date, select the “Advances received” tab and click the “Fill” button.

The table will display information on the returned advance payment. The postings can be seen if you click on “DtKt”.

This operation will be reflected in the CP.

On the one hand, there is a feeling that it is quite difficult to reflect partial payments and control their offset, on the other hand, the 1C program allows you to do this almost automatically.

Formation of additional sheets in 1C:Enterprise 8

Formation of additional sheets in “1C:Enterprise 8”

In accordance with the Decree of the Government of the Russian Federation No. 283, if it is necessary to make changes to the sales or purchases book, the invoice is registered in an additional sheet of the book for the tax period in which the invoice was registered before entry there are corrections in it. The new procedure has been in effect since May 2006 (or the second quarter, depending on what is the VAT tax period for a particular taxpayer).

How to generate an invoice (invoice) for sales?

When selling goods and providing services in 1C: Accounting 8.3, a sales document is created through the “Sales” menu in the “Sales (acts, invoices)” section by pressing the “Sale” button and selecting an object. The “Write an invoice” button appears at the bottom. The automatic formation of the invoice occurs after filling out the invoice (act) and clicking on this button.

After this, a highlighted line with the SF data will appear. Clicking on this line opens the SF, where you can check the information and print it by clicking on “Print”.

In the invoice (act) below, under the line with the SF data, the highlighted line “Start exchanging electronic documents with the counterparty” also appears. Clicking on it will begin the named operation.

The formation of a tax return for retail sales is not provided, due to the fact that tax information is displayed on the receipt. In order for the data on accrued VAT to be reflected in the Sales Book, it is necessary to draw up a Cashier’s Calculation Certificate when generating a cash Z-report at the end of the shift.

In the Sales menu, in the “Retail Sales” section, you must select “Retail Sales Reports”. By clicking on the “Report” button and selecting the “Retail Store” section in the drop-down menu, the “Retail Sales Report” document will open.

After filling out this document, transactions will be generated. In addition, information on sales VAT will be reflected in the “Sales VAT” register and, accordingly, will be included in the Sales Book.

Actions with a corrective invoice are discussed below.

How to fill out additional sheets in the sales book?

In this case, it is necessary to fill out the DL:

- Enter in columns 14 to 19 in the “Total” line:

- information from similar columns on the “Total” line of the book, if the current additional sheet is the very first one;

- information from similar columns in the “Total” line of the previous DL, if the current one is not the first.

- Enter information on the incorrect invoice in columns 13a to 19 with a “–” sign.

The remaining columns must be filled out in the same way as was done in the purchase book.

- Enter information on the correct invoice (issued late) in the additional list.

- Fill in the “Total” column, summing up the indicators in columns 14 to 19, including those reflected in the “Total” line.

The rules of summation are the same as in the case of filling out the DL for the purchase book.

Similarly, the current sheet, certified by the director, must be filed with the book for the reporting period.

How should I fill out an additional sheet of the purchase book?

On the additional sheet you need:

- Copy to the “Total” line:

- indicator from the “Total” column in the book for the reporting period, if the current additional list is the very first;

- indicator from the “Total” column of the previous DL - if the current sheet is not the first.

- Enter in columns 15 and 16 information about the incorrect invoice previously registered in the book, adding a “–” sign before each value in the cell.

The remaining columns for the incorrect account must be filled out in the same way as they were recorded in the book.

- Register - in the same manner as filling out the columns of the purchase book (they are the same in the book and in the additional list), the correct invoice (or the one that arrived late).

- Enter in the “Total” column of the current DL the sum of the indicators in column 16 (including the indicator in the “Total” column).

When summing positive and negative quantities, the usual arithmetic rules apply. For example, the sum of 10,000 and minus 2,000 equals 8,000.

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week. Subscribe I agree with the terms of personal data processing

When additional sheets of the purchase book are being formed, the accountant must have the book itself at hand: the finished sheets must be filed to it. Each sheet must be signed by the director.

Now - about filling out the additional list for the sales book.

... shopping books

The formation of additional sheets of the purchase book is carried out in the same way as the procedure for creating additional sheets. sheets for the sales book - special details are filled in in the tabular part of the document “Creating purchase book entries”:

- flag “Record additional sheet" - set if this entry needs to be placed in an additional sheet of the purchase book;

- “Adjusted period”—enter a date belonging to the period being adjusted.

For an example of filling out a document, see Fig. 3.

Rice. 3

When posting this document, a record will be generated to be placed in an additional sheet of the purchase book for February 2006.

Before generating the “Purchase Book” report (as well as for generating the “Sales Book” report), if there are additional sheets, you can choose one of two options for generating such sheets:

- for the current period (in this case, additional sheets are generated for the period of formation of the purchase book for all adjustments made in subsequent tax periods);

- for the adjusted period (in this case, additional sheets are generated for all tax periods, adjustments for which were made in the current period, that is, the period of formation of the purchase book).

If several corrections are made for the same tax period using different documents “Creating purchase book entries” (for example, if such corrections are made in different subsequent tax periods), separate sheets are generated for each such correction, and in the “Total” line of each subsequent additional sheet (except for the first), the data of the previous sheet is transferred. Separate sheets are generated even if several different documents are generated in the same tax period and for the same adjusted period. It is understood that each such document has its own updated tax return, the figures in which must be justified.

In practice, a situation may arise when, for one reason or another, a deduction was forgotten to be included in the purchase book in a timely manner. The Tax Code of the Russian Federation does not prohibit the taxpayer from submitting in this case an updated tax return for the corresponding period when the error was made (on the contrary, the inclusion of a deduction in the current period in which the error was discovered will most likely be considered unfounded). Accordingly, you can make an entry in an additional sheet of the purchase book with a positive amount of VAT to be deducted. Although this is not directly stated in the Decree of the Government of the Russian Federation No. 283. This possibility is mentioned in the letter of the Federal Tax Service of Russia dated No. MM-6-03. As a general rule, adjustments to previously reflected deductions are made on the additional sheet.

Example 1

On July 1, 2006, the organization Belaya Akatsiya LLC purchased 300 cubic meters of birch boards at a price of 250 rubles/m3 for subsequent sale, and received an invoice. At the end of the month, VAT on purchased valuables was claimed for deduction; the invoice is reflected in the purchase book using the document “Creating purchase book entries.” On August 7, 100 cubic meters of boards were sold for export at a VAT rate of 0%.

In this case, the right to deduct in accordance with paragraph 3 of Article 172 of the Tax Code of the Russian Federation arises upon confirmation of the legality of using the 0% rate, and therefore the VAT previously accepted for deduction must be restored and reflected in the purchase book as a cancellation line. This situation does not fall under the provisions of Article 170 of the Tax Code of the Russian Federation. There are two points of view on how to reflect this event in the purchase book:

- the deduction was initially illegal, therefore, it is necessary to adjust the tax return for the period in which it was applied; accordingly, according to the new rules, an additional sheet of the purchase book is filled out for the tax period in which the deduction was made. It is this position that is supported in the “1C: Accounting 8” configuration;

- it is enough to adjust the deductions in the period when it became known about a different use of the value compared to the original assumption.

In “1C: Accounting 8”, such an operation is reflected in the document “VAT Restoration”, when automatically filled in, the “Record additional. sheet" and the adjusted period is indicated - the date of receipt of sold goods (see Fig. 4). The user can manually clear the “Record additional. sheet”, if it adheres to the second position on reflecting the canceling entry in the current period. To obtain a generated additional sheet in the “Purchase Book” report for July, you need to set the “Generate additional sheets” flag and select the value “for the current period” in the list next to it.

Rice. 4

On September 30, 2006, the legality of applying the 0% rate was confirmed, which is reflected in the configuration by the document “Confirmation of the zero VAT rate”. The document “Creating sales book entries” makes an entry about this in the sales book. The deduction of VAT upon confirmation of the zero rate should be reflected in the main sheet of the purchase book for September.

Example 2

On August 25, 2006, the organization received 70,000 rubles from the buyer towards the upcoming delivery of goods. Since the accounting policy of the organization establishes a tax period for VAT purposes - a month, a declaration was submitted on September 20. On September 23, goods were shipped to the buyer for this amount, and when the advance payment was offset, it was discovered that VAT was not charged on this advance payment.

In this situation, you need to charge VAT on the date the error was discovered, reflect the adjustment in the sales book for August and submit a corrective return. The accrual of VAT must be reflected in an additional sheet of the sales book for the period in which the receipt of the advance is reflected (see Fig. 5).

Rice. 5

The “Registration of advance invoices” processing must create an invoice. The invoice will be created by the date of receipt of the advance payment, which must be manually changed to the date the error was discovered. When filling out the document “Creating sales book entries” for September, the user must manually set the “Additional entry” flag. sheet" and indicate the period being adjusted - August 30, 2006, the last day of the tax period in which VAT was required to be calculated.

First step: accounting policy settings

In order for information from documents prepared in the program to be correctly posted to accounting accounts, it is necessary to configure the accounting policy provisions (AP) in the system.

To do this, select “Settings” from the “Main” menu and click on the “Taxes and reports” line. If you click “Accounting Policy” in the “Settings” section, the accounting settings window will open. To set up tax accounting and reporting rules, you need to go to “Taxes and Reports”.

- In the VAT section, check the boxes opposite those provisions that are established in the enterprise’s UP.

- In the line “Control the share of deductions” it makes sense to indicate 89%. Because one of the risk assessments is the excess of 89% of the share of VAT deductions from the amount of accrued tax. In this case, a period of 12 months is taken, according to Order of the Federal Tax Service of Russia No. MM-3-06/333 dated May 30, 2007. However, the program considers a quarterly period, because reporting is submitted quarterly.

- Next, select the procedure for registering advance invoices. The program provides the following options:

Typically, the choice is made in favor of the first two legally established options, unless otherwise established at the enterprise.

In what cases is an additional sheet of the purchase (sales) ledger formed?

In what cases is an additional sheet of the purchase (sales) ledger formed?

When do you need to fill out additional information? shopping ledger sheets? The sole purpose of such sheets is to document the correction of incorrect invoice data in the purchase ledger, and only if the need for such correction arose after the end of the reporting quarter. This need may arise if, for example:

- it turned out that the invoice reflected in the book contained errors (and the seller sent a corrected invoice instead);

- the invoice arrived late - later than the reporting period;

The procedure for correcting information in this case involves:

- cancellation of an account with an error;

- subsequent registration of the correct account (or registration of an account that arrived late).

Both procedures are carried out using additional sheets (we will look at how exactly later).

When is an additional sheet of the sales book, another accounting document for invoices, filled out? There is an analogy here: if at the end of the reporting quarter the company needs to adjust data on accounts in the sales book, then such an adjustment is carried out using the DL book.

IMPORTANT! If the reporting quarter has not yet ended, then the correction of incorrect data on accounts is carried out directly in the purchase or sales book, without using additional lists to them.

Let's now consider how to fill out additional information. sheet to the shopping book in practice.

The importance of the stages of book formation

Why is there so much emphasis on correctly filling out the checkpoint? The fact is that the Federal Tax Service received the opportunity (see 74 Clause 5.1 Article 174 of the Tax Code of the Russian Federation “Economy and Society” No. 6 (19) 2015) to conduct total desk control by receiving automatic reconciliation of purchase books received electronically and sales of all taxpayers. Previously, the Federal Tax Service could inspect documents only as part of an on-site tax audit.

Consequently, authorities now have more power to hold operating companies accountable for accounting violations.

The most interesting thing is that if tax officials reveal discrepancies in favor of the budget, they may not be held accountable. But if errors underestimated the tax base or overestimated the amount of compensation, then legal disputes cannot be avoided.

Accordingly, steps should be followed in stages, and understanding the process of calculating indirect tax helps to remember the stages.

Firstly, incoming and outgoing acts, delivery notes and invoices should be completed in a timely and competent manner.

Secondly, immediately after completing the documentation, it is recommended to check the generated transactions in the program.

Thirdly, track the formation of entries in the checkpoint for actions taken.

Fourthly, control the timing and amount of payment for issued invoices.

Fifthly, before forming the checkpoint, conduct a check of the entire period and carry out the proposed regulatory operations.

Sixth, go through an express check and correct the information.

Seventh, form a checkpoint in the system.

Compliance with all stages guarantees competent tax accounting and reporting in the organization.

Features of the formation of additional sheets for different tax periods in “1C: Accounting 7.7”

According to Article 163 of the Tax Code of the Russian Federation, the tax period for VAT can be a calendar month or a quarter.

In a standard configuration, the constant “Tax period for VAT” is used to indicate the tax period for VAT when generating additional sheets and when filling out the documents “Creating purchase book entries” and “Creating sales book entries”. Possible values for the constant are “Month” and “Quarter”. The value of the constant is set on the “VAT” tab of the “Accounting Policy” processing (menu “Tools” -> “Accounting Policy”). The default value of the constant is “Month”.

To automatically generate a purchase ledger and a sales ledger, you must enter the documents “Creating purchase ledger entries” and “Creating sales ledger entries.” Regardless of the applicable VAT tax period (month or quarter), these documents should be entered at the end of each month.