Concept and legislative regulation

The invoice form is prepared by the seller.

The 2021 Invoice Log displays information about these activities.

If manipulations are subject to tax, then this is also done using books to record purchases/sales.

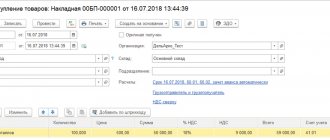

The invoice form has a standard template; it is written out by the seller and provided to the buyer after receipt (shipment) of the goods and materials.

The invoice sample has no significant changes since January 1, 2021.

Invoice form

The main legal acts on the issue under consideration, approved standard forms and Rules on how to maintain a journal for registering invoices in 2021, as well as reflecting the changes that have appeared:

- Tax Code of the Russian Federation;

- Resolution No. 1137.

A sample invoice in 2021 may change its external form, provided that the order in which the indicators are displayed and their number compared to the standard form are not violated.

In the process of purchase and sale, two parties interact: the seller, who also acts as a contractor or executor obligated to pay VAT, and the buyer/customer.

It is the latter who receives the document after receiving the goods or services performed. The first party also keeps one copy.

Important: An invoice in 2021 is the basis for the client to accept the amounts of value added payments presented by the seller for deduction.

The 2021 invoice sample is a form with a table indicating the list of goods/services, their price, rate and tax amount, as well as excise taxes, digital codes, details of customs documents, inventory codes and their calculation measures.

The invoice form also comes in different types: for advance payments, corrective.

Information about issued and accepted invoices forms the Purchase/Sales Book

back to menu ↑

What is prescribed regarding the registration of documents of the past period

If you find unregistered received invoices drawn up in previous reporting periods, you must enter them in part 2 of the form in the period to which they were dated (clause 12 of the Journal Rules, letter of the Ministry of Finance of the Russian Federation dated April 26, 2018 No. 03-07- 09/28450). The entry is made in a new journal line for the period corresponding to the invoice date.

For example, you are an intermediary, and you discover in April 2021 that you have not registered the March invoice. You must make adjustments as follows: register the “lost” document not in the current second quarter, but in the previous one - the first.

Moreover, if the “missing document” is shown in the journal after the VAT reporting date (for the 2nd quarter - after July 25, 2021), then you will have to submit an update to the tax office taking into account the changes made to the journal.

How to make adjustments to the journal? There is no need to cross out anything. The adjustment is performed in two lines: the first one reverses the previously made entry, the second one enters the correct value. If you need to cancel an invoice, then one entry is made - a reversal with a minus sign.

Latest changes and news

Starting from January 1, 2021, the invoice has some improvements in its appearance and in the standards for filling it out (Resolution No. 1137):

- the sample invoice in 2021 is supplemented with a column for the code of the type of goods and materials, which is filled in by organizations supplying them to the EAEU (Eurasian Economic Union);

- the invoice from January 1, 2021 must have the location of the parties entered in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs;

- for import, not a serial number is entered, but the registration digital value of customs declarations;

- For the sale of scrap metal in 2021, the invoice is issued in accordance with changes in legislation, since such commercial activities have become taxable. An invoice is created from January 1, 2021 for transactions with them;

- The invoice for 2021, the sample of which has undergone some innovations, has also changed the form of VAT declarations.

back to menu ↑

Errors in invoices

Errors when preparing an invoice can be divided into two categories:

If an error is discovered, you should rewrite the document or create a correction invoice. Otherwise, problems with the tax office cannot be avoided.

clubtk.ru

Application example

Enterprises whose activities include the sale of scrap metal in 2021 must issue an invoice.

These changes in the invoice are due to the fact that the benefits for such transactions have been canceled (Federal Law No. 335 of November 27, 2017).

When scrap metal is sold in 2021, the invoice is issued by the seller, as with regular goods and materials.

Let's consider several nuances of the process of its registration, depending on who pays VAT.

When purchasing scrap from a VAT payer, the client is obliged to perform the functions of a tax agent for this tax and the provisions of the law do not exempt sellers from creating an account. When the specified payment must be made by the tax agent (client), the seller-taxpayer issues an invoice for scrap metal in 2021 from o. This tax on such transactions is not calculated by the seller.

For his part, the acquirer must charge the specified duty (18%) and reflect this in the sales books.

An invoice in 2021 will allow him to deduct this payment when using the general tax regime.

This is why you need an invoice for scrap metal in 2018.

It should be noted that when applying the special regime n/a, the buyer must also calculate VAT on the price of scrap, but in this case it is impossible to apply for a deduction.

If the buyer is an individual, then the seller must decide on the value added payment himself and pay it to the budget.

For him, this will be a transaction subject to the specified tax. After such a sale of scrap metal is carried out in 2021, an invoice is created according to standard rules.

back to menu ↑

Instructions for filling

In accordance with Article 169 of the Tax Code of the Russian Federation, as amended on January 1, 2018, when trading goods or transferring property rights to other persons, the following data must be indicated:

- Number and date of compilation.

- Name, address and identification numbers of the parties.

- Number of the payment document, if available.

- List of goods for delivery and unit of measurement, if possible.

- The volume of goods supplied, based on the units of measurement adopted for it, if it is possible to indicate the name of the currency.

- The price or tariff per unit of measurement specified in the contract excluding tax, if it is possible to provide this information.

- The cost of goods that transfer property rights without taxation for the entire volume of goods provided.

- Amount of excise taxes.

- Tax rate.

- Tax amount.

- The cost of the total quantity of goods indicated in the invoice, the transferred rights to property, taking into account the amount of tax.

- The country that produced the product.

- Customs declaration number.

- Product variety code in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the EEC.

The information displayed in paragraphs 13 and 14 is indicated if the country of origin of the item of sale is not Russia. For indicating false information in the ESF and accompanying documents, the taxpayer bears responsibility as provided for by the legislation of the Russian Federation.

An electronic invoice is signed with an electronic signature established by the Ministry of Finance of the Russian Federation. Only authorized persons have signature rights: the head of the organization and persons entrusted with this right.

Read more about what an electronic invoice is and what its advantages over the paper version are here, and from this article learn how to issue a document.

Peculiarities

| Parameter | Meaning |

| Who issues it and why? | The invoice for scrap metal in 2021 is issued by the seller. Sales of scrap in 2021 are displayed in invoices according to standard rules, as for ordinary goods and materials. The obligation to pay VAT lies with buyers. But this does not apply to cases when it is purchased from individuals who do not have individual entrepreneur status. The purchaser purchasing from a VAT payer pays the specified payment, regardless of whether he himself has the status of a taxpayer, and he needs an invoice in 2018 in order to reimburse the tax paid. That is, entities on special regimes and exempt from non-taxation must still pay VAT when purchasing goods, but only if they bought from an entity that is a payer of this tax. |

| Example | If the receiver of recyclable materials accepts it from an individual who is not an individual entrepreneur, there is no need to pay VAT to the collection point. Similarly, when a plant buys from non-paying counterparties who, for example, are on the simplified tax system (Simplified Taxation System). |

| Mark if purchased from a defaulter | It is important for the client to have confirmation of what he is purchasing from the defaulter, therefore such an invoice for scrap metal in 2018 contains the indication “Without tax” (paragraph 6, paragraph 8, article 161 of the Tax Code). |

| Peculiarities | The invoice from January 1, 2021 is issued by the seller. When the client is a VAT payer and pays it upon purchase, the seller, if he also has taxpayer status, is obliged to invoice it. This sample invoice in 2021 has the indication “VAT calculated n/a”, since it is the client who makes the payment. The above fully applies to partial payments, then the invoice is issued against future shipments, and the invoice adjustment form is also used. In this case, all numerical values can be changed, but this must be confirmed by primary documents justifying the change in the quantity of goods and materials, prices (for example, confirmation of an increase in the cost of consumables, electricity). |

| Export | During export manipulations, the sale of scrap in 2021 will issue an invoice at zero rates. |

So, let’s summarize and derive the features that the 2021 scrap invoice has:

back to menu ↑

When to exhibit and when not to

Let's consider when a document is indispensable and when it is not required:

| Required | Not required |

| The invoice form does not require filling out for transactions without VAT, except for goods and materials sold to the EAEU region. | |

| For all transactions with VAT, including receipt of advance payments on transactions subject to it. | The buyer or customer is not a VAT payer and has a non-invoicing agreement with the seller. |

| In commercial relations with interdependent persons, the seller increases the cost to the market level and adjusts the tax base. |

When goods and materials exempt from taxation are sold, the invoice is issued at the request of the seller.

That is, it is not required, but it is not prohibited to issue it, for example, if the client requires it.

At the same time they put about. The register of invoices in 2021 should be maintained as usual.

back to menu ↑

Issuance procedure

A sample invoice in 2021 is created both on paper and through electronic forms.

The prepared invoice form is handed over or sent to the counterparty during the process of receiving the goods or immediately thereafter.

For this purpose, the law establishes special deadlines and rules.

The invoice form prepared electronically is used when there is mutual agreement and the availability of compatible technical means.

Such invoices must be sent only through certain operators of this type of document flow; their list is on the Federal Tax Service website.

Important : The rules for filling out invoices allow them to be issued simultaneously on paper and electronically. Accounts are drawn up for each primary document, but it is not prohibited to combine transactions for several such documents in one form, indicating the total number of inventory items.

back to menu ↑

Deadlines

The rules for filling out invoices have their own deadlines, limited to a period of 5 days (calendar) from the date of advance payment or acceptance of the completed goods, or shipment of the goods.

The last day in the last two cases is considered to be the time of issuance of the first primary paper.

If the deadline is the same for several such documents, then they can be combined in one form.

| For goods | For services |

| 5 days from the date of | 5 days from the date of |

| Shipment or transfer of rights to an object. | Signing acts confirming acceptance of works/services. |

| Receiving an advance payment (the invoice for advance payment for 2021 has separate rules for filling out) | Receiving an advance |

| The deadlines are counted from the date following the date when the shipment (transfer of rights) or receipt of the advance occurred. | The deadlines are calculated from the day following the day when the act was signed or when the money arrived in the executor’s account. |

This can be done if the relationship between the counterparties is carried out on an ongoing basis (for example, daily sales to the same entity). The sample invoice from January 1, 2021 allows you to issue one general document for all goods and materials sold at the end of the month.

In the case of an account, it is created every month before the 5th day.

An invoice prepared as one form is possible for many transactions, if during the 5-day period after the first transaction several more sales agreements for the same client are drawn up. One account will be issued within the specified period.

When trading retail, if payment is made in cash, the rules for filling out invoices allow you not to indicate VAT in a special line on price tags and other forms.

It is included in the price and the formation of the document in question is not required.

Important : For multiple non-cash transactions, the document can be created in one form at the end of the tax period.

back to menu ↑

Who exhibits

The account is drawn up, as well as the journal for registering invoices in 2018, by the following entities:

- suppliers;

- companies performing construction and installation work for their own needs or when they performed work (services) for intra-organizational needs, the costs of which are not taken into account when calculating income tax;

- tax agents for VAT. That is, companies purchasing inventory and materials from foreign legal entities not registered for tax purposes in the Russian Federation, including tenants of state real estate and buyers of such objects not assigned to state organizations;

- intermediaries on their own behalf, but using the customer’s funds, if such a person applies the general taxation regime;

- forwarders organizing transportation for customers using third party resources, as well as developers or customers performing their functions;

- those involved in organizing construction work for investors by attracting contractors;

- suppliers of goods to the EAEU exempt from VAT.

back to menu ↑

How to fill out

The sample invoice for 2021 contains the following fields to fill out:

At the very end, the sample invoice for 2021 is certified by the signature of management and an accounting specialist; if the latter is not at the enterprise, then only the former.

The completed invoice is affixed with the organization’s seal from January 1, 2018; a sample of it, as before, is issued to the buyer.

The registration details of the enterprise must be indicated.

The rules for filling out invoices must be observed - this is the basis for subsequent accounting actions when calculating VAT.

back to menu ↑

Rules for filling out invoices in 2021

Related publications

The invoice form has a regulated structure, which was approved by government decree No. 1137 dated December 26, 2011 (as amended on August 19, 2017). The form is necessary to organize accounting for both parties to the transaction - buyers and sellers. It confirms several operations at once:

With its help, not only the transfer of products to the customer is recorded, but also its valuation. When an invoice is filled out, the sample cannot be changed by the company itself. All adjustments to the form can be carried out only at the legislative level. If the template is incorrectly designed and the data reflected in it is inaccurate, the buyer may face the problem of non-recognition of the claimed VAT deduction.

How to number

The invoice from January 1, 2021 does not have an officially established number format.

The numbering of invoices is established by the organization itself and is enshrined in its internal documents (by order of the enterprise management).

The main thing is that the details (numbers) have a high degree of uniqueness.

It is recommended to use end-to-end order for them, in ascending order. Numbering of invoices, if done correctly, will eliminate backdating statements.

Composite numbers are used in the following circumstances:

- exhibiting as separate parts of organizations;

- if commerce is carried out by managers under trust agreements or members of a simple partnership.

In other cases, a dividing line can also be used - this will not cause a refusal to deduct - but it is not advisable to do this.

Numbering of advance invoices is carried out for all accounts in the company; if necessary, “AB” is added to the numbers of such forms.

Important : Incorrect numbering of invoices does not entail any liability if this does not prevent the authorized bodies (tax inspectorate) from identifying information when conducting audits. This applies to all errors, not only in numbering, and this is also not a reason for refusing to accept a document for deduction (clause 2 of Article 169 of the Tax Code of the Russian Federation).

Corrections

The seller must make changes to the invoice. This is done by drawing up new s/f - already correct ones.

This also applies to cases where the buyer submitted a clarifying document electronically.

In this case, changes to the field of the original form “Invoice No. ..., from ...” are prohibited.

The field “Correction No...., from...” is filled in with the serial number of the correction and its date.

So, the first copy of the paper account is issued to the client. The second one remains for the seller.

It is generated for each document when selling inventory items subject to VAT.

Its correct formation is a guarantee of tax deduction.

back to menu ↑

Again a new invoice

Invoice header

- Line 1 is intended for entering invoice details: serial number and date. Field 1a must be completed if corrections have been made. If necessary, their number and the actual date of adjustments are reflected here.

- Field 2 indicates the full name of the seller in accordance with its statutory documents. If the executor of the delivery is an individual entrepreneur, then his full last name, first name and patronymic are entered. Line 2a indicates the location of the seller, and line 2b indicates his tax identification number and checkpoint.

- Line 3 is intended to indicate the shipper. If the supplier and shipper are the same, you can enter “same”.

- Cell 4 - reflect the full and short name of the consignee and his address. Next, the payment and settlement document is indicated (if necessary); if it is missing, dashes are added.

- Field 6 (6a, 6b) – organizational data of the buyer: name, address, tax identification number and checkpoint.

- The 7th cell is intended for the code and name of the calculation currency.

- The 8th line is filled in if there is a government contract identifier.