Tax reporting: features of formation and submission to the Federal Tax Service

Main features that determine the reporting procedure

According to Article 313 of the Tax Code of the Russian Federation, the tax reporting regime is determined by each economic entity, based on a convenient tax policy, goals and specifics of conducting economic activity. However, this does not mean that every organization can report to the Federal Tax Service in the way that is convenient for it. It is necessary to comply with certain requirements, namely to ensure that regulatory authorities are able to:

- chronological display of accounting information, continuous and complete;

- determination of all essential facts of economic activity of an economic entity;

- systematization and analysis of accounting data;

- adequate assessment of income and expenses of an economic entity;

- calculate the amount of income tax of a business entity.

The organization of the tax accounting system is initially independent, since it is not subject to the same strict rules and requirements as the accounting system. Thus, regulatory authorities do not require enterprises to submit tax reports according to any unified forms and standards.

Thus, legal entities and individual entrepreneurs can organize tax accounting in the following ways:

- Autonomous method of tax accounting.

This system has nothing to do with accounting. All significant business transactions are reflected in tax accounting registers.

- Formation of a tax accounting system based on accounting data.

For many enterprises, this method is more appropriate, since it fully complies with the requirements of Article 313 of the Tax Code of the Russian Federation, and also takes significantly less time from accountants.

Article 313 determines the taxable base precisely on the basis of tax accounting data. At the same time, Chapter 25 of the Tax Code clearly separates the concepts of accounting and tax accounting, defining for the latter a special procedure for systematizing data and business transactions.

If the rules for maintaining tax and accounting records within one business entity coincide, the taxable base is determined precisely on the basis of accounting data. In this case it is necessary:

- Clearly define the objects of tax accounting according to NU and BU data. Distinguish between objects for which the accounting rules for both systems differ.

- Determine the procedure for using information to calculate the taxable base from accounting data.

- Determine the forms of analytical registers for each of the tax accounting objects.

- Determine the objects of separate taxation when applying any special taxation systems.

If an accountant or other specialist of the organization was able to properly organize the tax accounting system, this will greatly simplify the process of generating and submitting tax reports to the Federal Tax Service.

Interim financial statements

Interim accounting reports are prepared only within the company for its internal users. For simplified reporting, special simplified forms have been developed, both for small businesses.

| Preparation and submission of reports for individual entrepreneurs and LLCs Cost of reporting

|

Tax reporting: what is it?

Entrepreneurial activity cannot be carried out without control by the state, represented by authorized authorities.

Tax authorities are called upon to perform the following functions:

- control over compliance by tax agents and taxpayers with the tax code;

- checking the correctness of the calculation of taxes payable;

- control over the completeness and timely fulfillment of obligations.

Therefore, every tax payer is obliged not only to transfer them to the treasury, but also to report on their accrual to the relevant authorities.

Reporting on the OSNO tax system

Companies on the general taxation system (OSNO) are required to submit the following reporting forms:

- VAT declaration. Rented quarterly until the 25th day of the month following the reporting quarter.

- Profit Declaration. Available until the 28th of the month following the reporting quarter.

- Calculation of insurance premiums. Due by the 30th day of the month following the reporting quarter;

- Calculation of 6 personal income tax. Due by the 30th of the month following the reporting quarter

LLCs that own vehicles are required to charge and pay transport tax and submit a transport tax return. The transport tax declaration is submitted at the location of the vehicles.

LLCs that own land plots are required to charge and pay land tax and submit a land tax return. The land tax declaration is submitted at the location of the land plot.

In the event that a company does not conduct business activities, but has not yet been liquidated, it is required to submit zero reports on the same forms.

Fines for violating the reporting method

The regulatory authority will fine the taxpayer if he submits a paper version of the declaration instead of the required electronic one.

In most cases, sending a paper report will not cost much - only 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

If you violate the method of filing a VAT return, the fine will directly depend on the amount of tax. After all, the tax inspector will equate paper reporting with non-filing (clause 5 of Article 174 of the Tax Code of the Russian Federation). The fine will be 5% of the VAT amount declared in the declaration. Penalties have restrictions - the fine cannot be less than 1,000 rubles, and also should not exceed 30% of the tax.

When submitting your tax returns, check the acceptable method of filing.

How can I submit reports?

You can submit your tax returns yourself, send them by mail, send them by email, or have a representative submit them to you. In some cases, the method of delivery is established by law. However, the main thing in filing reports is to do it on time, as well as to prepare tax documents correctly.

Errors in tax reporting are common and costly for both organizations and entrepreneurs. So, if due to an error the amount of tax was reduced, both the company and the accountant face serious fines, which can reach 20% of the underpaid tax. In all other cases, it is not so much the mistakes that are scary as the violation of deadlines for filing declarations, which, again, leads to fines and penalties.

By law, the tax office may refuse to accept returns if they are submitted in the wrong format. In practice, this leads to the fact that documents may not be accepted without a stamp, with a facsimile signature instead of a regular one, or in paper format, if the law requires reporting to be submitted electronically.

All these mistakes, blots and omissions lead to financial losses and force entrepreneurs to waste time and nerves. If you have the opportunity, it is much more profitable to entrust the submission of reports to professionals who do not make mistakes, and who are liable to you in rubles for violation of deadlines.

Legal Company Business Consulting LLC will be happy to answer all your questions about accounting outsourcing with the help of an online consultant, as well as by calling the phone numbers listed on the website.

Composition of financial statements

Accounting statements should consist of:

- Balance sheet (Reporting Form No. 1);

- Report on the financial activities of the enterprise (reporting form No. 2);

- Statement of changes in capital (form No. 3);

- Cash flow statement (reporting form No. 4);

- Appendix to the balance sheet (reporting form No. 5) and auditor's report (required only for those who are required to conduct annual audits).

Simplified reporting for small businesses consists of:

- Balance sheet (Reporting Form No. 1);

- Report on the financial activities of the enterprise (reporting form No. 2).

Also, in addition to accounting, company managers are required to submit tax reports.

Tax reporting is submitted to the territorial tax authority quarterly, regardless of the results of your activities, i.e. the concept of zero reporting is also present.

Depending on the taxation system, the types of tax reporting submitted may differ.

Tax reporting and the procedure for submitting it

The Federal Tax Service reports are provided on paper or in accordance with the established form in electronic form with all the attachments provided for by the Tax Code of the Russian Federation when submitting tax calculations.

A subject of the Russian Federation engaged in commercial activities, the average number of employees of which for the past reporting period exceeds 100 people, as well as newly created (including as a result of reorganization) companies, the number of staff units of which exceeds the specified limit, submit reports to the Federal Tax Service exclusively in electronic form. form.

Information must be submitted to the regulatory authorities at the place of registration of the enterprise before January 20 of this year, in the case of creating a new company - no later than the 20th day of the month following the month in which the reorganization was carried out.

It is important! Based on the Tax Code of the Russian Federation, Article 119.1, violation of the procedure and deadlines for providing payments in electronic form, sanctions are provided, including a fine of 200 rubles.

The declaration can be provided by the tax agent personally or through a third party, as well as through postal services in a letter with a declared value and with an inventory of the contents, or transmitted via telecommunication systems.

The date of submission of reports through the post office is considered to be the day the valuable letter was sent. When sending a document via TKS, the day of its provision is the date of sending.

The Federal Tax Service does not have the right to refuse to accept a tax calculation provided in accordance with the established form. At the request of the taxpayer, an employee of the authorized bodies is obliged to put his signature on the copy of the document and the date of receipt of the calculation, when submitting the declaration in person on paper, or send a receipt for receipt of the calculation in electronic form through TKS.

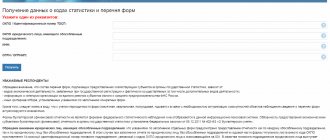

What can you find out about your counterparties?

The Federal Tax Service announced the opening of access to data from the financial statements of Russian enterprises for 2021:

- free if you are interested in data on a specific organization;

- for a separate subscription fee, if you are interested in analytics by industry or group of companies - now the price of a subscription to access the service via API is 200,000 per year.

“For the convenience of users, the accounting (financial) statements of organizations are available for download for the first time with an electronic signature of the Federal Tax Service of Russia with the same legal significance as certified by the seal of the tax authority,” says the Federal Tax Service website.

Tax officials believe that the availability of balance sheet data will help Russian companies significantly reduce risks by eliminating the possibility of economic relations with unreliable or unscrupulous entrepreneurs.

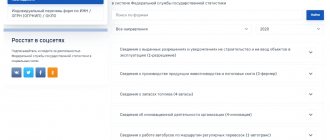

What counterparty data can be found on the GIR BO portal (bo.nalog.ru)

Reporting on the simplified taxation system

Companies with a simplified tax system of 6% or 15% are required to submit a Declaration under the simplified tax system once a year. Due date is March 30 of the year following the reporting year.

Companies with a simplified tax system of 6% or 15% are required to submit a calculation of insurance premiums once a quarter. Due date is the 30th day of the month following the reporting quarter. In addition to reporting submitted to the tax authority, LLCs are required to submit quarterly reports to the territorial body of the Social Insurance Fund. Even if they have no employees (in this case, zero reports are submitted).

Form 4-FSS is submitted to the FSS by the 20th day of the month following the reporting quarter.