The reporting of companies and individual entrepreneurs using the simplified taxation system is somewhat different from the reports submitted by enterprises operating on OSNO. Simplified people do not pay income tax, in most situations - VAT and property tax. And these features affect the package of mandatory reports. Let's figure out what forms are included in the simplified tax system for reporting in 2021, having compiled the information provided in a table for ease of perception - a list of reports that simplifiers must submit to regulatory authorities within the specified time frame.

Annual reporting, mandatory for LLCs and individual entrepreneurs working under the simplified tax system

The set of mandatory annual reports for persons using the simplified procedure depends on whether it is an organization or an individual entrepreneur. Moreover, the differences in these sets are quite significant. They are determined by the following factors:

- An individual entrepreneur, unlike a legal entity, has no obligation to keep accounting (subclause 1, clause 2, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ) and, accordingly, submit accounting reports based on accounting data (clause 1 of Art. 13 of Law No. 402-FZ);

- An individual entrepreneur who does not have employees does not submit those reports that are mandatory for persons making payments to individuals;

- An individual entrepreneur, even if he has objects subject to taxation, does not independently calculate property taxes (on property that is not excluded from taxation when applying the simplified tax system, transport, land).

At the same time, there is reporting that must be submitted by all simplifiers without exception. This is a simplified tax system declaration, generated annually at the end of the year and reflecting the accrual of the main tax for this special regime, replacing (clauses 2, 3 of Article 346.11 of the Tax Code of the Russian Federation):

- income tax for legal entities and personal income tax for individual entrepreneurs;

- property tax (except for that calculated from the cadastral value);

- VAT (except for mandatory payment in certain situations).

Find the declaration form under the simplified tax system for 2020-2021 here.

However, for this mandatory reporting there is a difference, depending on whether the taxpayer belongs to legal entities or individual entrepreneurs. It consists in the deadline for submitting the declaration, the deadline of which, established for the year following the reporting year, will be (clause 1 of Article 346.23 of the Tax Code of the Russian Federation):

- for a legal entity - March 31 (subitem 1);

- for individual entrepreneurs - April 30 (subsection 2).

Find out what annual reports and within what time frame taxpayers submit under the simplified tax system in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The simplified tax system declaration limits the list of reports required for individual entrepreneurs to report to the simplified tax system for the year if the entrepreneur does not have employees. If there are such employees, then he will have to submit the entire set of reports related to their presence.

Do you have any questions when calculating simplified tax or filling out a declaration? On our forum you can get an answer to any of them. For example, in this thread you can find out the main differences between the simplified tax system “income” and “income minus expenses”.

Section 1.1

This part is completed based on the data from sections 2.1.1 and 2.1.2.

| Strings | What to include |

| 010 | OKTMO. If nothing has changed during the year, put a dash in lines 030, 060 and 090. |

| 020 | Advance payment for the first quarter. Line 130 of section 2.1.1 minus insurance premiums from line 140 of the same section and trade fee (if any) from line 160 of section 2.1.2. If the difference turns out to be negative, do not indicate it in line 020. |

| 040 | Advance payment due in 6 months. Line 131 of section 2.1.1 minus insurance premiums from line 141 of the same section, trade fee (if any) from line 161 of section 2.1.2, and the advance paid for the first quarter. If the value turns out to be negative, enter it in line 050, and put a dash in line 040. |

| 070 | Advance payment due in 9 months. Line 132 of section 2.1.1 minus insurance premiums from line 142 of the same section, trade fee (if any) from line 162 of section 2.1.2, and advances paid for the first quarter and half of the year. If the difference turns out to be negative, enter it in line 080, and put a dash in line 070. |

| 100 | Tax payable for the year. Line 133 of section 2.1.1 minus insurance premiums from line 143 of the same section, trade fee (if any) from line 163 of section 2.1.2 and advances paid for 3, 6 and 9 months. If the value turns out to be negative, it means you have an additional tax to pay, enter it in line 110, and put a dash in line 100. |

If the declaration is zero, put dashes in all numeric fields of the section.

This is what the completed section 1.1 looks like:

Start filling out from section 2.2, because... Based on it, the final data in section 2.1 is filled in.

Reporting on payment of income to individuals

The lists of reports and the dates of their submission for mandatory reporting submitted in connection with the payment of income to employees are the same, regardless of who they are generated by (legal entity or individual entrepreneur). This is the reporting:

- personal income tax;

- insurance premiums;

- length of service

IMPORTANT! The report on the average headcount until 2021 was submitted in the form given in the appendix to the order of the Federal Tax Service of the Russian Federation dated March 29, 2007 No. MM-3-25 / [email protected] no later than January 20 of the year following the reporting year (clause 3 of article 80 Tax Code of the Russian Federation). From the reporting campaign for 2021, information is submitted as part of the ERSV. See here for details.

There will be two annual reports for personal income tax. They must be submitted at the same time (no later than April 1 of the year following the reporting year - clause 2 of Article 2340 of the Tax Code of the Russian Federation):

- on the total amounts of tax withheld when paying income - in form 6-NDFL (contained in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] );

- about income paid to each individual and the tax withheld from them - in form 2-NDFL (given in the order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11 / [email protected] ).

IMPORTANT! If it is not possible to withhold tax on an individual’s income, the Federal Tax Service must be notified about this no later than March 1 of the year following the year of payment of such income (clause 5 of Article 226 of the Tax Code of the Russian Federation), reflecting the relevant information in the certificate of Form 2-NDFL.

When reporting for the 1st quarter, information from certificate 2-NDFL must be submitted as part of 6-NDFL.

For what the new form will look like, see the Review from ConsultantPlus. Study the material by getting trial access to the K+ system for free.

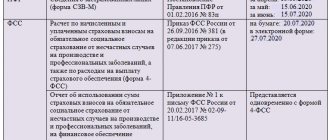

For insurance premiums, you will also need to submit 2 reports:

- in the Federal Tax Service - consolidated, concerning contributions to the Social Insurance Fund (for insurance in connection with maternity and temporary disability), the Pension Fund and the Compulsory Medical Insurance Fund - in the form given in the order of the Federal Tax Service of Russia dated September 18, 2019 N ММВ-7-11 / [email protected] , not later than January 30 of the year that began at the end of the reporting year (clause 7 of Article 431 of the Tax Code of the Russian Federation);

- in the FSS - dedicated to contributions for accident insurance in form 4-FSS, approved by order of the FSS of the Russian Federation dated September 26, 2016 No. 381, no later than 20 (for those submitting a report on paper) or 25 (for those submitting it electronically) January of the year following for reporting (Clause 1, Article 23 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ).

Another report - on the length of service of employees - must be sent to the Pension Fund no later than March 1 of the year following the completed reporting period (Clause 2, Article 11 of the Law “On Individual (Personalized) Accounting..." dated 04/01/1996 No. 27-FZ) , according to the form SZV-STAZH.

The procedure for filling out the simplified taxation system “income” declaration

The procedure for filing a declaration is specified in Appendix 3 to the Federal Tax Service order No. ММВ-7-3/ [email protected]

Let's remember the general rules:

- Amounts are indicated in full rubles, rounded according to the rules of mathematics: 50 kopecks or more are rounded to a full ruble.

- The declaration has continuous numbering.

- We do not provide sheets and sections with no indicators.

- If you fill out the declaration by hand, the ink must be black, purple or blue. You cannot correct errors with the corrector. We recommend that if an error is discovered, you rewrite the sheet where the error was made.

- If you fill out the declaration on a computer and then print it out, then double-sided printing is not allowed. We fasten the declaration sheets only with a paper clip, not with a stapler.

- We fill in the indicators from left to right, starting from the leftmost cell. But if you fill out the declaration using a program for keeping records and submitting reports, align the numerical indicators to the right margin of the report.

- Text fields should be filled in capital block letters.

- If the indicator is missing, put a dash in the corresponding line of the declaration. If a line is not completely filled in, then also put a dash in the unfilled cells of the line.

- On each page of the declaration, indicate the tax identification number (required) and checkpoint (if any).

What else do LLCs submit to the simplified tax system per year?

In addition to the simplified tax declaration and reports related to the payment of income to employees, mandatory reporting for the year for an LLC using the simplified tax system will include:

- accounting;

- declarations for such taxes as property tax, calculated from the cadastral value, land, transport - if there is an object of taxation (transport and land tax declarations are submitted for the last time at the end of 2020).

NOTE! Here we are not talking about taxes that have a quarter as a tax period (i.e., VAT and water tax), reporting for which at the end of the year coinciding with the end of the next quarter, if there are grounds for this, will also have to be submitted.

LLCs operating on a simplified basis, in terms of indicators characterizing the scale of their activities, usually meet the criteria of a small enterprise. And this compliance gives them the opportunity to choose between the usual (full) and simplified forms of accounting and preparation of accounting reports (subclause 1, clause 4, article 6 of Law No. 402-FZ).

A simplified form of reports implies the presence of a smaller number of lines in them and the inclusion in these lines of indicators combined according to certain principles, which are shown separately in full reporting. The procedure for drawing up simplified reporting does not provide for the preparation of explanations for it. With regard to the preparation of explanations for full reporting, small enterprises have the right to choose: explanations can be given if they are essential for the correct interpretation of the reporting data.

Both versions of reporting forms with a description of the filling rules are given in the appendices to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n. Taking into account the fact that LLCs may not prepare explanations for any of these options on the simplified tax system, the following reports are mandatory for submission:

- balance sheet;

- financial results report.

Both of these forms must be submitted to the Federal Tax Service within the period coinciding with the deadline for legal entities to send the simplified taxation system declaration to the tax authority (no later than March 31 of the year following the reporting year - subclause 5, clause 1, article 23 of the Tax Code of the Russian Federation). Starting from 2021, there is no need to submit reports to Rosstat.

You need to report for 2021 on updated forms. Machine-readable forms can be downloaded here. If the company belongs to the SMP, then it is possible to submit reports for 2021 for the last time on paper. From now on, the balance will be accepted only electronically via TKS.

Tax returns (if there are grounds for filing them) will need to be sent to the INFS no later than the deadlines occurring in the year following the reporting year. March 30 (clause 3 of Article 386 of the Tax Code of the Russian Federation) - for property tax, compiled in the form contained in the order of the Federal Tax Service of Russia dated August 14, 2019 No. SA-7-21 / [email protected]

You no longer need to report land and transport taxes. Tax officials will independently calculate the amount of tax and send a notification.

Get free demo access to the ConsultantPlus reference and legal system and go to the Ready Solution to find out all the details of the innovations.

To learn about which objects simplifiers will have to pay property tax, read the material “For which real estate objects is the tax base calculated based on the cadastral value?”

The procedure for filling out the title page of the simplified tax system declaration “income”

When filling out the title page, please indicate your Taxpayer Identification Number and Taxpayer Identification Number. If the report is submitted by the successor organization for a reorganized company, indicate the TIN and KPP of the legal successor, and in the field “Taxpayer” and “TIN/KPP of the reorganized organization” - the name, TIN and KPP of the reorganized company.

If you are submitting a declaration for the first time during the reporting period, in the “Adjustment number” field, enter “0 – -”; if you are submitting an update, indicate the serial number of the update.

The tax period code when submitting the simplified tax system “income” declaration for 2018 is 34.

Also put on the title page:

- the year for which the declaration is provided;

- tax authority code;

- full name of the company or line by line full name of the entrepreneur;

- activity code according to OKVED-2;

- taxpayer's telephone number;

- number of pages in the declaration;

- the number of additional sheets - for example, a power of attorney confirming the authority of the taxpayer’s representative.

If the report is submitted by the head of the company or individual entrepreneur personally, in the field “I confirm the accuracy and completeness of the information specified in this declaration” should be put 1, if the representative - 2.

Also on the title page is the full name of the head of the organization, his personal signature and the date of signing the report. Entrepreneurs do not re-indicate their full name, but only sign and set the date of signing. If the report is submitted by a representative of the taxpayer, then he indicates his full name line by line, signs and dates it. You will also need to provide a document confirming the authority of the taxpayer's representative.

In turn, tax officers on the title page of the simplified taxation system “income” declaration fill out the method of submitting the declaration, the number of pages in it, the number of sheets of attached documents, the date of filing the declaration, the full name and signature of the inspector who accepted the declaration.

Results

Mandatory annual reporting for any simplified tax system is the simplified taxation system (STS) declaration. LLCs always, and individual entrepreneurs if they have hired employees, must submit reports related to the presence of such employees and the payment of income to them. The LLC, in addition, has the obligation to submit accounting reports and (if there are grounds for assessment) - declarations for property tax, calculated from the cadastral value, land and transport taxes.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for submitting the simplified taxation system “income” declaration

You can submit the declaration:

- personally;

- through a representative by proxy - please note that inspections require a notarized power of attorney from the representative of the individual entrepreneur;

- sending by mail - we recommend sending by registered mail with an inventory and receipt of receipt: then in a controversial situation you will be able to confirm to the inspection that you have fulfilled your obligation to submit the report;

- electronically, signing with an electronic signature.

You need to submit a report:

- for an entrepreneur - to the inspectorate at the place of registration;

- for a legal entity - to the inspectorate at the location, that is, at the legal address.

VLSI will not let you get confused in reporting

The SBIS Electronic reporting service will help you avoid getting confused in the forms and deadlines for payment and reporting on the simplified tax system. With it, you can be aware of all the intricacies of this taxation regime, determine the most optimal type of “simplified” taxation for you, and minimize the risk of errors. You will always have up-to-date reporting forms at your fingertips, as well as 24-hour support from specialists who will explain all your questions.

For modern digital communication, you need an electronic signature. It ensures the security of electronic communications. You can order an EDS for any task in our EDS Center. Our specialists are ready to tell you more about all the possibilities of the VLSI system when paying a single tax and working on a simplified system in general.

Rate this article: