Starting from the new year, the limits for switching to a simplified system have been changed.

Based on Art.

2 and 5 of the Federal Law of July 3, 2016 No. 243-FZ, this limit is set at 112.5 million rubles. Any enterprise can switch from the general taxation system to a simplified one from 2021, but this takes into account the previously established limits, namely 59,805 million rubles. The changes also affected the new income limit, which from 2021 is set at 90 million rubles. and is taken into account when switching to a simplified system from 2021. Individual entrepreneurs do not need to know this information, since income limits are not established for them based on clause 2 of Art. 346.12 of the Internal Revenue Code.

From 2021, such changes will become valid if you switch to the simplified tax system

The new limit for the simplified taxation system is the amount of 150 million rubles.

Any company or businessman can use a simplified system in their activities from 2021 until the income indicator exceeds 150 million rubles.

A number of changes that will become relevant from January 1, 2017

Using the simplified system, you can own the value of fixed assets in the amount of no more than 150 million rubles. (Articles 2 and 5 of Federal Law No. 243-FZ dated 07/03/2016).

At the beginning of the new year (01/01/2017), the amount of fixed assets of an individual entrepreneur or company should not exceed 150 million rubles. if the end of the year shows an amount higher than indicated, then the entrepreneur must switch to the general taxation system from the next quarter after the excess. Let us recall that the amount of fixed assets for simplification in the old year became 100 million rubles.

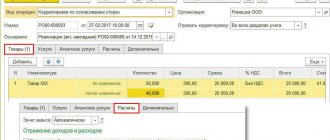

The form of the Accounting Book for entrepreneurs has been changed using a simplified system

For taxpayers who pay special trade tax within Moscow, a new section 6 has been added to the Book, and the procedure for filling out the book has been slightly changed.

Service codes have changed

For 2021, the government has prepared a new list of household services, which all entrepreneurs should use in their work, regardless of the taxation system.

Simplified rates have been changed since January 2021

Rates can be found out individually using the service on the website “Comparison of tax regimes in 2021”

The State Duma should consider a new project to change the maximum tax rates for simplifiers. The law must be implemented from 01/01/2017. Deputies submitted a proposal to reduce the income rate to 1-3% and the rate on expenses to 3-8%.

Important! As of today, this is only a bill, and if it is nevertheless adopted, we will inform you about it on our portal.

Changes to the Minimum Wage and Benefits from 2017

The minimum wage will increase from 2021 by an amount equal to inflation. However, such a change will come into force on 07/01/2017. Today the minimum wage is 7.5 thousand rubles.

There is an increase in benefits from 01/01/2017

In the new year, the order of the billing period and the basis for sick leave will be changed. You can find more detailed information in the article: Social Insurance Fund benefits in 2021: amount, calculation examples, compensation

The government has proposed new options for calculating average earnings on benefits

This procedure will be applied from January 2021. The main reasons for changing the procedure for transferring control over contributions to the Federal Tax Service.

A few more changes that will come into force on January 1, 2017

BCC changes in 2021

List of budget classification codes (can be found in the KBK Generator). Budget classification codes regarding the minimum income in 2021 were canceled based on the order of the Ministry of Finance dated June 20, 2016 No. 90n.

If the results of 2021 bring you to the minimum tax, transfer it to KBK 182 1 0500 110. Previously, simplifiers were provided with two KBK. For advances and taxes - KBK 182 1 0500 110 and for the minimum tax KBK 182 1 0500 110. Therefore, taxpayers were very often confused. The budget classification codes for contributions have also been changed. All contributions for employees and entrepreneurs must be paid according to the new code, which will be approved by the Ministry of Finance before December 1.

Increased the amount of income for the transition to the simplified tax system

Organizations and individual entrepreneurs can change their tax system to the simplified tax system. You can switch to the “simplified” system from the beginning of next year (clause 1 of Article 346.13 of the Tax Code of the Russian Federation). To switch to the simplified tax system, you must submit an application to the Federal Tax Service by December 31 in form No. 26.2-1, approved. by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/829. Also see “Moving from “imputation” to “simplified””.

However, it was previously provided that if an organization wants to switch to the simplified tax system from the new year, then its income for 9 months of the previous year should not exceed 45 million rubles excluding VAT, increased by the deflator coefficient (clause 1 of article 248, clause 2 of article 346.12 Tax Code of the Russian Federation).

For 2021, the deflator coefficient was determined as 1.329 (Order of the Ministry of Economic Development dated October 20, 2015 No. 772). Accordingly, if an organization wanted to switch to the simplified tax system from 2021, then its income for January – September 2021 should not exceed 59,805,000 rubles. (45,000,000 × 1.329).

In 2021, the situation is changing. The indicated limits have been increased. In paragraph 2 of Article 346.12 of the Tax Code of the Russian Federation, a fixed value is fixed - 112.5 million rubles. Therefore, organizations will be able to switch to the “simplified” system from 2021 if their income for 9 months of the previous year did not exceed 112.5 million rubles. Moreover, the deflator coefficient will be suspended until January 1, 2021. Accordingly, there is no need to apply a deflator to 112 million rubles.

The new limit (112.5 million rubles) can be applied from 2021. Accordingly, if an organization wishes to switch to the simplified tax system from 2018, then its income for January – September 2021 will not have to exceed 112.5 million rubles. It turns out that more organizations will be able to switch to the “simplified” system from 2021. Please keep in mind that individual entrepreneurs have the right not to take into account the restrictions on limits in order to switch to the simplified tax system. The increase in the said limit is provided for by Federal Law No. 401-FZ of November 30, 2016 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation.”

Briefly about the conditions of the simplified tax system-2017

A simplified tax regime in 2021 can be applied by individual entrepreneurs and organizations, for which a number of the following conditions will apply:

- annual income not exceeding 120 million rubles;

- fixed assets valued at no more than 150 million rubles;

- staff of no more than 100 people;

- participation in other companies should not exceed one fourth of the capital;

- maximum profit for switching to the simplified tax system – 90 million rubles;

- the activities of an individual entrepreneur or organization are not included in the list of restrictions provided for in Part 3 of Art. 346.12 of the Tax Code of the Russian Federation.

FOR YOUR INFORMATION! The given figures are valid without taking into account the deflator coefficient for 2021.

Two forms of the simplified tax system are still valid, differing in tax base:

- 15% (income minus expenses);

- 6% (income).

NOTE! A bill has been prepared for consideration that proposes to reduce the rates on these forms of taxation: to 3-8% instead of 15 and to 1-3% instead of 6.

For reporting purposes, it is necessary to maintain an Income and Expense Accounting Book (KUDiR), which does not need to be submitted, but at the end of the year, submit a reporting declaration to the tax authorities (no later than March 30 of the next year for organizations and April 30 for individual entrepreneurs).

There are 3 advance quarterly tax payments and one final payment based on the results of annual reporting.

The simplified tax system can be combined with the patent system and UTII.

The deadline for submitting a notification about the transition from UTII to the simplified tax system has been established

As we have already said, as a general rule, organizations and individual entrepreneurs switch to the simplified tax system from the beginning of the calendar year (clause 1 of article 346.13, clause 1 of article 346.19 of the Tax Code of the Russian Federation). However, special rules are provided for taxpayers switching to “simplified taxation” from another special regime – UTII. They can work for the simplified tax system from the beginning of the month in which the obligation to pay the “imputed” tax ceased (paragraph 2, paragraph 2, article 346.13 of the Tax Code of the Russian Federation). To make the transition to the simplified tax system, organizations and individual entrepreneurs need to submit to the tax authority a notification about the transition to the simplified tax system, the form of which is approved by Order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/829.

The deadline for submitting the said notification about the transition to the simplified tax system was not previously determined by tax legislation. Therefore, legislators made changes to paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation and stipulated that starting from 2021, a notification must be submitted no later than 30 calendar days from the date of termination of the obligation to pay UTII. Previously, the issue of the deadline for filing a notification was regulated only at the level of explanations from financiers (Letter of the Ministry of Finance of Russia dated September 12, 2012 No. 03-11-06/2/123). The amendment is provided for by Federal Law No. 401-FZ of November 30, 2016.

Increased the amount of income to maintain the right to the simplified tax system

The Tax Code of the Russian Federation provides that if, after the end of the reporting (tax) period, the income of an organization or businessman exceeds a certain amount, then it is impossible to continue to apply the simplified tax system (Letter of the Ministry of Finance of Russia dated July 1, 2013 No. 03-11-06/2/24984).

The maximum income limit in 2021 was previously specified in paragraph 4 of Article 346.13 of the Tax Code of the Russian Federation in the amount of 60 million rubles. This amount was required to be increased annually by a deflator coefficient. For 2021, the coefficient was determined as 1.329 (Order of the Ministry of Economic Development of Russia dated October 20, 2015 No. 772). Using the coefficient, the maximum income limit under the simplified tax system in 2016 was RUB 79,740,000. (RUB 60,000,000 × 1.329).

From 2021, the maximum amount of income to maintain the right to “simplified” tax has increased to 150 million rubles. From 2021, you cannot receive more than this amount from business and remain on the simplified tax system. Therefore, companies or individual entrepreneurs need to ensure that their income for the first quarter, half of the year, 9 months, and 2021 does not exceed 150 million rubles. Otherwise, they will be deprived of the right to the simplified tax system from the beginning of the quarter in which income exceeds 150 million rubles. This is provided for by Federal Law No. 401-FZ of November 30, 2016.

Please note that the deflator coefficients have been suspended since 2017 until January 1, 2021. Therefore, 150 million rubles should not be indexed to coefficients from 2021.

If income in 2021 does not exceed 150 million rubles, then in 2021 it will be possible to continue to apply the simplified tax system without submitting any notifications to the tax office (clause 4.1 of article 346.13 of the Tax Code of the Russian Federation).

First (in 2021), legislators increased the income limit for 9 months from 45 to 90 million rubles, and the income limit for maintaining the right to the simplified tax system from 60 to 120 million rubles. We reported about this in the article “STS since 2017: how the limits on income and fixed assets will increase.” But then they changed their minds. And they increased the limits even more: to 112.5 and 150 million rubles, respectively.

For the simplified tax system, by order of the Ministry of Economic Development dated November 3, 2016 No. 698, a deflator coefficient of 1.425 was approved. However, this coefficient only misleads the “simplistic” people. There is no need to apply it in 2021. The fact is that the indexation of the income limit for the simplified tax system was suspended from 2021 to 2021 (clause 4 of article 5 of the Federal Law of July 3, 2016 No. 243-FZ). Therefore, in 2021, the income limit that allows you to remain on the simplified tax system should not be multiplied by a coefficient. From 2021, this limit will be equal to 150 million rubles.

Changes in online cash registers and payments

The Central Bank is making attempts to transfer microbusinesses to non-cash payments

The central bank transfers payments to non-cash payments. A micro-enterprise is considered to be a company with no more than 15 employees. The company's turnover should reach 120 million rubles per year. The Central Bank obliges such enterprises to accept payments from customers using bank cards.

Based on the draft law, the following changes will be introduced from 2021

The timing of the transition to online cash registers has been determined

Businessmen who trade on a simplified taxation system should use online cash registers (Article 1 of Federal Law No. 290-FZ dated 07/03/2016)

Regardless of the type of business, from February 1, 2017, the use of online cash registers is mandatory. If your cash register was registered before this time, then you have the right to use this option until July 2021, after which you will have to exchange the old model for a new one or upgrade this equipment. New equipment must have the function of transmitting data to the tax office online. In some areas, the right to use the old cash register remains and is determined by local authorities.

List of the following innovations from 02/01/2017

Certain types of activities may not use cash register systems, both old and new (Article 1 of the Federal Law of July 3, 2016 No. 290-FZ)

CCTs of any kind are not used by those who:

- sale of newspapers, ice cream, transport tickets, vegetables and fruits (if the sale is not wholesale and in season);

- ensuring the writing of students in different educational institutions;

- trade at retail outlets;

- provision of small household services, such as shoe repair, metal repair, key cutting, supervision or care for children, the disabled or the elderly;

- trade in food and non-food products on passenger trains with hand luggage;

- sales from tank trucks (butter, milk, kvass and other products);

- acceptance of glass containers and other raw materials for recycling;

- sales of folk art products;

- working in gardens or sawing firewood;

- indicating the services of porters at stations;

- renting out housing that belongs to them as property.

The launch date for online cash registers for regions with slow Internet connections has been postponed

Later, those entrepreneurs who work on a patent can switch to using a new type of cash register (Clause 7, Article 7 of the Federal Law of July 3, 2016 No. 290-FZ)

Throughout 2021, such entrepreneurs can work without online cash registers, but from July 1, 2018, the transition is mandatory for them.

The following changes will be made from July 2021

From now on, paper-based strict reporting forms have been abolished

Entrepreneurs and firms that use strict reporting forms in their work can continue to use the paper type until July 1, 2018. From this period, the procedure for obtaining BSO and the method of submitting it to the tax office will be changed. From 2021, this is an electronic submission to the Federal Tax Service.

The limit on the residual value of fixed assets has been increased

In 2021, a company could apply the simplified tax system if the residual value of its fixed assets did not exceed 100 million rubles. This value is determined according to the accounting rules (clause 16, clause 3, article 346.12 of the Tax Code of the Russian Federation). Also see “Accounting on the simplified tax system”.

Organizations both planning to apply the simplified tax system from the beginning of the new year and those already using the simplified system need to monitor the limit on residual value.

| The organization applies the simplified tax system | If, at the end of a reporting period (for example, a quarter or half a year), the residual value limit is exceeded, the organization will switch to OSN from the beginning of the quarter in which the excess occurred. |

| The organization plans to switch to the simplified tax system | To switch to the simplified tax system from the beginning of the new year, it is necessary that the limit on the residual value of fixed assets not be exceeded as of December 31 of the year preceding the start of application of the simplified tax system. |

From 2021, the maximum asset value limit has increased from 100 to 150 million rubles. Accordingly, from January 1, 2017, companies and individual entrepreneurs have the right to rely on the new maximum limit on the residual value of their fixed assets.

Keep in mind that individual entrepreneurs do not have the obligation to control the residual value of their assets when switching to the simplified tax system. But if an individual entrepreneur is already running a business using a “simplified” system, then he is obliged to monitor these indicators on an equal basis with organizations (letter of the Ministry of Finance of Russia dated January 20, 2016 No. 03-11-11/1656).

We summarize the changes in 2017 for the simplified tax system

Let's compare the innovations introduced into business practice regarding the simplified taxation system in comparison with last year. The changes that came into force on January 1, 2021 are shown in the table.

| № | Basis for comparison | 2016 | 2017 |

| 1. | The deflator coefficient by which the maximum amount of amounts must be multiplied to switch to the simplified tax system and maintain this regime. | It was 1.329, indexed every year. | Until 2021, it is not subject to indexation; it is 1, that is, it does not need to be applied to income limits. |

| 2. | Limit amount for switching to “simplified” | 45 million rub. for 3 quarters preceding the transition | 90 million rubles for the same period |

| 3. | Income limitation for simplified taxation system payers | Annual income no more than 60 million rubles. (taking into account the coefficient of 79.74 million rubles) | To maintain the right to "simplified" you need to meet the annual limit of 120 million rubles. |

| 4. | Residual value of fixed assets | 100 million rubles. according to the accounting results of the year | The limit has been increased to 150 million rubles. |

| 5. | Maintaining KUDiR | There is no section for trade tax payers; income from CFC must be indicated; certification with a seal is required. | A separate section has been introduced for trade taxes, and the indication of income from foreign companies has been cancelled. It is not necessary to certify with a seal if the organization does not use it. |

| 6. | KBK for payment of the minimum tax | 182 1 05 01050 01 1000 110 | 182 1 05 01021 01 0000 110 |

| 7. | Cash control | Regular cash registers | It is obligatory to switch to a cash register with online control |

| 8. | Insurance deductions | Sent to the Pension Fund and the Social Insurance Fund | Transferred to the jurisdiction of the Federal Tax Service |

| 9. | Report submission deadlines | Until the 10th | Until the 15th |

| 10. | Hired personnel accounting | Must be maintained in all organizations that have employees | Micro-enterprises are allowed not to adopt local regulations and make entries in the work book of employees |

The procedure for recognizing expenses for taxes, fees and insurance premiums has been clarified

Organizations and individual entrepreneurs using the simplified tax system with the object of taxation “income minus expenses” have the right to reduce income by certain expenses when determining the tax base. Until 2021, it was envisaged that expenses incurred for paying taxes, fees and repaying debts on them could be written off as expenses (clause 3, clause 2, article 346.17 of the Tax Code of the Russian Federation). So, in particular, the costs can take into account:

- “input” and “import” VAT on purchased goods (works, services);

- other taxes (advance payments thereon) and fees paid in accordance with the legislation of the Russian Federation or additionally accrued as a result of an audit. For example - personal income tax, property tax, land tax, transport tax, state duty and trade tax. Starting from 2021, two important amendments have been made to this norm.

Amendment 1: Recognition of premium expenses

From 2021, insurance premiums come under the control of the Federal Tax Service and its inspectorates. See "Insurance premiums from 2021: overview of changes."

In 2021, insurance contributions (for example, pension, medical, or contributions for temporary disability and maternity) can be taken into account when calculating the simplified tax system. In subparagraph 3 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, legislators prescribed the procedure for recognizing expenses for the payment of insurance premiums and debts on them. Starting from 2021, expenses for taxes, fees and contributions must be recognized in the following order:

| Type of consumption | Procedure for recognizing expenses |

| Expenses for paying taxes, fees and insurance premiums. | Taken into account in the amount actually paid by the taxpayer. |

| Expenses to pay off debts for taxes and fees. | They are taken into account within the limits of actually repaid debts in those reporting (tax) periods when the taxpayer repays the specified debt. |

Amendment 2: recognition of expenses incurred by third parties

In 2021, taxes, fees and insurance premiums for organizations or individual entrepreneurs (including those using the simplified tax system) can be paid by third parties. Legislators made such an amendment to Article 45 of the Tax Code of the Russian Federation. Previously, it was provided that the taxpayer was obliged to fulfill the payment obligation independently. Also see “What will change in 2021: taxes, insurance premiums, benefits, reporting, accounting and online cash registers.”

It is possible that in 2021 a third-party organization, individual entrepreneur or individual will pay his taxes, fees or insurance premiums for the “simplified person”. Will it be possible to take such payments into account when calculating the “simplified” tax? No, starting from 2021, third party payments for taxes, fees and contributions cannot simply be attributed to expenses. However, in subparagraph 3 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation, legislators provided that expenses can be recognized after repayment of the resulting debt to a third party. Let us explain the procedure for recognizing such expenses in the table.

| Type of consumption | Procedure for recognizing expenses |

| Payments by a third party in favor of the simplified person for taxes, fees and insurance premiums. | They are taken into account in the amount actually paid when the “simplified” person repays the debt to a third party that arose in connection with his payment of taxes, fees or insurance premiums. |

| Payments by a third party in favor of the simplified person to repay debts on taxes, fees and insurance premiums. | They are taken into account within the limits of the actually repaid debt in those reporting (tax) periods when the “simplified” repaid the debt to a third party, which arose in connection with the payment of arrears on taxes, fees and contributions. |

Thus, in order to take into account payments from third parties in expenses from 2021, it will be necessary to return to these persons the amounts they spent on paying taxes, fees and insurance premiums (or debts on them). This is provided for by Federal Law No. 401-FZ of November 30, 2016.

You can take into account the costs of an independent assessment

Since 2021, the Federal Law of July 3, 2016 No. 238-FZ “On independent assessment of qualifications” has come into force. See Independent Workforce Assessment: What You Need to Know.

From 2021, organizations and individual entrepreneurs using the simplified tax system with the object “income minus expenses” will be able to take into account the costs of an independent assessment of the qualifications of employees in expenses (clause 33, clause 1, article 346.16 of the Tax Code of the Russian Federation). For these purposes, the rules will be applied according to which the cost of such an independent assessment is taken into account in income tax expenses. That is, in particular, the organization and individual entrepreneur will have to have documents confirming an independent assessment. For more information about this, see “STS: accounting for the costs of an independent assessment of qualifications in 2021.”

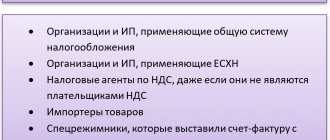

Who does not suit the simplified tax system?

If you are on this list, you will not be able to switch to the simplified tax system:

- annual income above 200 million rubles,

- LLC with branches,

- banks and microfinance organizations,

- organizations in which more than 25% of the authorized capital belongs to another organization,

- pawnshops,

- insurers,

- companies with more than 130 employees,

- organizations with fixed assets worth more than 150 million rubles,

- non-state pension and investment funds,

- professional participants in the securities market: brokers, dealers, securities managers and others from Chapter 2 of Law No. 39-FZ,

- organizations and individual entrepreneurs that produce excisable goods, extract and sell minerals, except for common ones,

- gambling organizers,

- notaries and lawyers,

- participants in production sharing agreements,

- payers of the single agricultural tax,

- state and budgetary institutions,

- foreign organizations,

- outstaffing companies.

We clarified the conditions for combining the simplified tax system with UTII or the patent system

Until 2021, it was stipulated that when combining the simplified tax system and UTII, it was necessary to keep separate records of income and expenses for each applicable tax regime. If it is impossible to organize such accounting, then when calculating the tax base, expenses must be distributed in proportion to the shares of income under different regimes (clause 8 of Article 346.18 of the Tax Code of the Russian Federation).

From 2021, exactly the same procedure will be used not only for UTII, but also in the case of combining the simplified tax system and the patent taxation system, which individual entrepreneurs can apply. At the same time, it is clarified that income and expenses under UTII and the patent system do not need to be taken into account when calculating the tax base under the simplified tax system. This is provided for by the new wording of paragraph 8 of Article 346.18 of the Tax Code of the Russian Federation. Thus, revenues from a patent or “imputed” single tax under the simplified tax system will not increase. These amendments to the Tax Code of the Russian Federation since 2017 are provided for by Federal Law No. 401-FZ dated November 30, 2016.

Changes to the simplified tax system in 2021

Previously, a taxpayer lost the right to the simplified tax system when income exceeded 150 million rubles or the number of employees became more than 100. Then it was necessary to switch to a general taxation system. But some pleasant changes have been made to the Tax Code.

Now, with income from 150 to 200 million rubles and with the number of employees from 100 to 130, the business does not lose the right to the simplified tax system. It’s just that the rate becomes higher: 8% for the simplified tax system “Income” and 20% for the simplified tax system “Income minus expenses”. The increased rate is applied from the quarter when the business has exceeded the previous limits.

And only with an income of more than 200 million rubles and the number of employees more than 130, there is no way to escape from the general system.

We clarified how individual entrepreneurs can reduce the single tax on insurance premiums

Until 2021, individual entrepreneurs (IP) without employees using the simplified tax system with the object “income” had the right to reduce the amount of “simplified” tax (advance payments) on insurance contributions paid “for themselves” to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund in a fixed amount (clause 3.1 Article 346.21 of the Tax Code of the Russian Federation). However, the wording “at a fixed rate” has often caused controversy among the accounting community. The fact is that individual entrepreneurs’ insurance premiums “for themselves” are formed from two values:

- a fixed amount of contributions, which is calculated based on their income not exceeding 300,000 thousand rubles per year;

- the amount of contributions, which is calculated at 1% of income exceeding 300,000 rubles.

Some accountants believed that the amount of contributions from an income of more than 300,000 rubles is a variable value and cannot be called “fixed contributions.” Hence, disputes arose about whether the “simplified” tax could be reduced by such amounts of contributions.

From 2021, disputes in this regard should disappear, since the provisions of Article 430 of the Tax Code of the Russian Federation will clearly establish that the entire amount of individual entrepreneurs’ contributions “for themselves” is fixed. In paragraph six of clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation, which allows individual entrepreneurs to reduce the tax under the simplified tax system on insurance premiums “for themselves”, from 2021 it was prescribed that the single tax can be reduced for pension and medical contributions. The mention of “fixed size” has disappeared from this norm. Accordingly, the simplified tax system can be reduced by the entire amount of contributions that the individual entrepreneur transfers “for himself.” Also see “Insurance premiums of individual entrepreneurs “for themselves” in 2017: how much to pay to the Federal Tax Service.”

Developed a new form of income and expense accounting book

Starting from 2021, organizations and individual entrepreneurs on the simplified market must keep an updated book of income and expenses, approved by Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n. The updated book has a new section V, in which taxpayers using the simplified tax system with the object “income” must show a trade fee that reduces tax under the simplified tax system. Previously, there were no special lines in the book for trade collection. In addition, starting from 2021, it will be necessary to affix a stamp in the book of accounting and expenses if the organization, in principle, has such a stamp. That is, the presence of a seal will become optional. Also, in column 4 “Income” of Section I of the book, there is no need to indicate the profit of controlled foreign companies. More information about this will appear in the order in which you fill out the book. You can familiarize yourself with the draft of the new book of accounting and expenses under the simplified tax system by following the link.

The updated book must be used from January 1, 2021. There is no need to redo the book of income and expenses that was kept in 2016. Order of the Ministry of Finance, which made changes to the book of accounting of income and expenses according to the simplified tax system - dated December 7, 2010 No. 227n. For more details, see “New form of book for accounting income and expenses under the simplified tax system from 2021: what has changed.”

The BCC for the minimum tax under the simplified tax system has been abolished

From 2021, a separate BCC for the minimum tax paid by companies using the simplified tax system with the object “income minus expenses” has been abolished (Order of the Ministry of Finance of Russia dated June 20, 2016 No. 90n).

BCCs used in 2021 to pay the single tax, arrears and penalties under the simplified tax system will be used from 2021 also to pay the minimum tax. In connection with this change, the minimum tax for 2021 will need to be transferred to the KBK for the usual “simplified” tax - 18210501021011000110. See “KBK according to the simplified tax system in 2017”.

Note that previously for companies on the simplified tax system with the object “income minus expenses” there were two separate codes. This caused confusion. If a company mistakenly transferred advances to the minimum tax KBK, then inspectors assessed penalties. This, of course, was unfair. See “The BCC will be abolished for paying the minimum tax under the simplified tax system.”

Read also

19.01.2017

Two types of simplified tax system

Types of simplified taxation system differ in the amount on which tax is paid.

- STS "Income". Tax is paid on all money received. Costs for the purchase of goods, equipment, and employee salaries are not taken into account. In most regions the tax is 6% of income. But some have a reduced rate - from 1% to 6%. For example, in Crimea 4%. When the amount of income exceeds 150 million or there are more than 100 employees, the rate will increase to 8%.

- USN “Income minus expenses”. Tax is paid on the difference between income and expenses. Here the tax rate is higher - from 5% to 15%. It is established by regional laws:

- The simplified tax system rate in Moscow is 15% for everyone, 10% for those who do business in the field of social services, sports, livestock farming and others from the law of the city of Moscow.

The simplified taxation system rate in St. Petersburg is 7% for everyone.

- The simplified taxation system rate in Yekaterinburg and the Sverdlovsk region is 7% for everyone, 5% for those doing business in the field of education, healthcare, sports and others from Article 2 of the law of the Sverdlovsk region No. 31-OZ.

In any region, the rate will increase to 20% if you earn more than 150 million in a year or hire more than 130 employees.

Important: the simplified tax system “Income minus expenses” cannot be lower than 1% of income. Even if the year was unprofitable, you will have to pay this minimum tax.

Elba will calculate the tax on the simplified tax system “Income” and “Income minus expenses”. Get 30 free days when you sign up and try it yourself. If you are using the simplified tax system “Income” and all payments are sent to your current account, use our free service.