A statement of transactions involving settlements with the budget is important and necessary information for every taxpayer. It allows you to control the correct reflection of calculations for taxes and fees in the payer’s records, as well as in the accounting registers of tax authorities. How to verify the data of the tax authorities and your own, what certificates the Federal Tax Service provides, how to obtain them - our article is about all this.

A quick assessment of mutual settlements with the Federal Tax Service will allow you to obtain a certificate on the status of settlements with the budget (KND form 1160080). And if more detailed information is needed on a specific type of fiscal fee, then it is possible to obtain an extract of transactions for settlements with the budget (form KND 1166107).

Extracting transactions for settlements with budgets - what is it?

A statement of transactions for settlements with the tax office is a formalized document provided by the tax office. It contains information on all accrued and paid taxes, penalties and fines. If there are discrepancies between the data of the taxpayer and the Federal Tax Service, this document will help to verify.

To control the payment of taxes, it is recommended to order a Certificate of Payment Status and such a statement regularly after each payment. This will ensure that the payment has actually been accepted by the tax office. The certificate shows whether the individual entrepreneur has a debt or overpayment of taxes in one line for each tax. The statement contains detailed information and will help you understand the reason for the debt or overpayment.

What is a balance?

Balance is the difference between income and expenses calculated for the reporting period.

The balance can be positive, that is, greater than zero. This indicates that the enterprise's income exceeds its expenses. The balance can also be negative - less than zero. This indicates that expenses exceed income.

Balance is used in many areas. Its characteristics differ from the area in which it is used. The balance is relevant when calculating the following indicators:

- Trade balance.

- State balance of payments.

However, the indicator is mainly used in accounting. Its total value must be reflected in the amount of the funds balance at the beginning and end of the period that is the reporting period.

How to order a Budget Statement

You can receive a tax statement electronically or personally contact the inspectorate with an application. The application indicates the details of the taxpayer, the name of the tax for which information is needed and the period of time. A sample application is in this document at the link https://iphelper.ru/wp-content/uploads/2018/02/Zayavlenie_na_vypisku_po_raschetam_s_budjetom.docx.

Accounting balance

The account balance will be the indicator under consideration. The difference between debit and credit will be the balance of the following types:

- Debit balance. Formed in a situation where the debit is greater than the credit. Displayed in the balance sheet asset.

- Credit balance. Formed in a situation where credit exceeds debit. Records the status of the sources through which funds are received. Displayed on the passive.

The difference between debit and credit (that is, between income and expense) can be zero. In this case, the account will be closed. In some cases, accounting has accounts that have both debit and credit balances.

When considering accounting for the reporting period, the following can be noted:

- Opening balance. Another name for it is incoming. This is the account balance. Calculated at the beginning of the reporting time. The calculation is made based on those transactions that were performed by the enterprise before the time in question.

- Debit and credit turnover. For calculations, only those operations that were performed at the time in question are taken.

- Balance for the period. It represents the total result of the enterprise’s actions during the reporting period.

- Closing balance. The second name is outgoing. Represents the balance available in accounts at the end of the month or other reporting time.

We invite you to read: Sample application for employment during the vacation of the main employee - Togliatti Lawyers

The reflection of the balance depends on its type. Calculations must be made regularly. This is important for tracking dynamics.

How to order a budget statement through your personal account

There is an option to order the document through the taxpayer’s personal account on the tax website. To connect to your personal account, you need to contact any tax office with your passport. You will be given a username and password to log into the system.

You can also log in to your personal account using an electronic signature. You can issue a signature at the certification center using the link.

After logging into the personal account of an individual, it is necessary to activate the entrepreneur’s personal account. Through the individual entrepreneur’s account you can order a Statement of settlements with the budget.

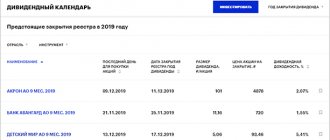

The statement is generated in the section My taxes, insurance premiums -> All obligations -> Statement of transactions for settlements with the budget.

Click image for a larger view

Select the item “Statement of transactions for settlements with the budget” at the bottom of the page

Next, select the reporting year. The statement includes information for only one year. If you want to check the last three years, you need to order an extract for each year separately.

Specify the grouping of payments, your tax number and the format of the statement.

Next, click the double arrow to select all taxes.

We sign and send.

The answer will arrive in a few days in the section on the main page “Notifications...”

Next, select “Information about documents...”

And there will be an answer

After receiving the extract, we proceed to deciphering and analyzing the information.

Functions

The balance is extremely important for analyzing the activities of an enterprise. It is required to find out the current financial condition of the company. Based on the indicator, the following points can be determined:

- profitability of the enterprise;

- stable functioning of the company;

- analysis of the organization's profitability for different periods.

For example, an enterprise recorded balance indicators throughout the entire period of its activity. The company has opened a new direction. Previously, the balance was closer to zero, but after the introduction of the new direction it began to grow sharply. This indicates that the innovation increased the profitability of the enterprise.

Example

On March 30, the organization received 500,000 rubles. On the same day, funds were spent on renting premises in the amount of 100,000 rubles. The opening balance on April 1 will be 400,000 rubles.

How to read a budget statement

The extract contains the date and period that covers the information provided. Below it contains information about taxpayers and inspections: TIN, full name, address and Federal Tax Service number.

The table shows the basic calculation information.

Columns 1 and 2 indicate the dates the transaction was entered into the card and the payment deadlines. In this example, the first date, January 10, 2021, is the date when the individual entrepreneur submitted the declaration for 2021. The dates in column 2 correspond to the accrual of advance tax payments from the submitted declaration: April 25, July 25 and October 25.

Column 3 indicates the name of the operation. We see two transactions: “paid” and “accrued by calculation”. There are other operations, for example, “additional penalty for recalculation was accrued programmatically”

“Paid” – individual entrepreneur’s payments to the tax office.

“Accrued by calculation” is the tax that must be paid. The tax office makes accrued payments according to the declaration, from which it finds out when and how much the individual entrepreneur must pay.

Columns 4-8 indicate information about the document on which the entry was made. So, for a declaration, the date of submission to the tax office is indicated, and for a payment order, the date of debiting from the current account. The “Type” column contains encrypted documents:

RNAlP - accrued by calculation (information from the declaration or tax calculation).

PlPor - payment order.

PrRas - software calculation of penalties.

PS - collection

Column 9 “Type of payment” can include tax, penalties and fines.

Columns 10-12 indicate the amounts. The entrepreneur’s payments go into the “Credit” column, and the accrued tax goes into the “Debit” column.

Columns 13 and 14 “Balance of settlements” summarize the debt or overpayment on an accrual basis. The “+” sign indicates the taxpayer’s overpayment, and the “–” sign indicates the taxpayer’s overpayment. The settlement balance is divided into two columns: “By type of payment” and “By card payments to the budget.” The first contains information on a specific payment - only for tax, penalty or fine. In the second, the total for the card, taking into account tax and penalties.

A detailed transcript of the extract from the above example looks like this:

The simplified tax system tax extract with the object “income” contains information for the period from January 1, 2021 to October 13, 2021. 1. The balance of settlements as of January 1 in favor of the taxpayer (overpayment) is 82,126 rubles. 2. Based on the results of the submitted declaration under the simplified tax system for 2021, on January 10, 2021, the following liabilities were accrued: - for the 1st quarter of 2021, 1,920 rubles. by April 25, 2021 - for the first half of 2021 RUB 10,295. for the period July 25, 2021 - for 9 months of 2021 RUB 69,911. due October 25, 2021 Total RUB 82,162. The obligations were repaid by the overpayment recorded as of January 1, 2021 and the balance of settlements with the Federal Tax Service is 0. 3. According to payment order No. 47 dated January 10, 2021, the amount of 114,760 rubles was received. in payment of tax. Balance RUB 114,760 in favor of the taxpayer (overpayment). 4. According to payment order No. 11 dated April 7, 2021, the amount of 1,720 rubles was received. in payment of tax. Balance RUB 116,480 in favor of the taxpayer (overpayment). 5. The tax liability for the year according to the declaration for 2021 is reflected in the amount of RUB 114,760. due for payment on May 2, 2021. The obligation was repaid by overpayment. The settlement balance is RUB 1,720. in favor of the taxpayer (overpayment). 6. According to payment order No. 55 dated July 6, 2021, the amount of 7,950 rubles was received. in payment of tax. Balance 9,670 rub. in favor of the taxpayer (overpayment). 7. According to payment order No. 66 dated October 5, 2021, the amount of 81,580 rubles was received. in payment of tax. Balance 91,250 rub. in favor of the taxpayer (overpayment). As of October 13, the tax balance is 91,250 rubles. in favor of the taxpayer (overpayment).

This overpayment does not mean that you can ask the tax office for a refund to your current account. If you look carefully, we see that the balance is 91,250 rubles. consists of three payments: – 1,720 from 04/07/2017 – 7,950 rubles. from 07/06/2017 – 81,580 rubles. dated 10/05/2017. These amounts are nothing more than advance tax payments, which are paid every quarter throughout the year. Before submitting the declaration, these payments are listed on the card as an overpayment, but after tax obligations are completed, they will be offset against the tax payment. The deadline for submitting a declaration under the simplified tax system for individual entrepreneurs is April 30 following the reporting year, so in this example, the overpayment will “go away” after submitting the declaration already in 2021.

KND 1160080

When you need “return of receipt” checks

When issuing money to customers who have returned goods (refused work, services), you need to issue a check with the sign of “return of receipt” calculation. But it is not always clear whether a particular situation falls under this rule. We discussed various cases with a Federal Tax Service specialist.

Hospital benefits 2018: what they will be

According to the Ministry of Labor, the maximum amount of sick leave, maternity benefits, and child care benefits next year will be higher than this year.

How will tax officials prove taxpayer abuses?

Since August 19, 2017, a new article of the Tax Code has been in force, which establishes signs of abuse of their rights by taxpayers. If these signs are present, a reduction in the tax base and/or the amount of tax payable may be considered unlawful. The Federal Tax Service has published recommendations on the practical application of this norm.

Non-taxable amounts are also reflected in the DAM

Despite the fact that insurance premiums are not charged on the amounts paid for travel expenses, as well as on compensation for the employee’s use of his personal car for business purposes, these amounts are still reflected in the calculation of contributions.

Home → Accounting consultations → General tax issues

Current as of: March 3, 2021

The form with KND code 1160080 is a certificate of the status of settlements for taxes, fees, insurance premiums, penalties, fines, interest of organizations and individual entrepreneurs (Appendix No. 1 to the Order of the Federal Tax Service dated December 28, 2016 N ММВ-7-17/). In other words, a certificate about the status of settlements with the budget. It indicates the amount of overpayment (with a plus sign) or debt (with a minus sign) of the taxpayer for specific taxes, contributions, penalties, fines on a specific date of the request. That is, it reflects information on the balance of settlements with the budget.

How to get a certificate with code for KND 1160080

To obtain a certificate about the status of settlements with the budget, you need to make a written request in the recommended form (Appendix No. 8 to the Administrative Regulations of the Federal Tax Service, approved by Order of the Ministry of Finance dated July 2, 2012 N 99n, - hereinafter referred to as the Administrative Regulations) and:

- submit it to the tax office in person. This can be done by the head of the organization (the individual entrepreneur himself), or his representative by proxy;

- send to the Federal Tax Service by mail in a valuable letter with an inventory of the attachment (clause 128 of the Administrative Regulations of the Federal Tax Service).

Download the form for a written request to receive a certificate on the status of settlements with the budget

In addition, the request can be sent to tax authorities electronically (Appendix No. 9 to the Administrative Regulations of the Federal Tax Service) via telecommunication channels, if you are familiar with the procedure for exchanging electronic documents with the Federal Tax Service Inspectorate. You can also generate a request and send it to the tax office using the service “Personal Account of a Taxpayer – Legal Entity” or “Personal Account of a Taxpayer – Individual Entrepreneur” on the Federal Tax Service website. In response to your “electronic” request, the tax authorities will also send you a certificate in electronic form (clause 147 of the Administrative Regulations of the Federal Tax Service, Letter of the Federal Tax Service dated October 30, 2015 N SD-3-3/).

Controllers must issue (send) a certificate within 5 working days from the date of receipt of the request from the taxpayer (clause 10, clause 1, article 32 of the Tax Code of the Russian Federation). If the information specified in it does not coincide with yours, then it makes sense to undergo a reconciliation of calculations.

By the way, do not forget to indicate in your request the date for which you want to receive information about the calculations. Otherwise, the certificate will be drawn up on the date of registration of the request with the Federal Tax Service (clauses 136, 159 of the Administrative Regulations of the Federal Tax Service).

Form with code KND 1166112: what kind of certificate?

An earlier version of the certificate on the status of settlements with the budget had the code KND 1166112 (Appendix N1 to the Order of the Federal Tax Service dated January 28, 2013 N ММВ-7-12/). But today the form with KND code 1166112 is not valid (clause 2 of the Order of the Federal Tax Service dated 04/21/2014 N ММВ-7-6/).

Even earlier, the tax office issued certificates on the status of settlements with the budget in form 39-1 or in form 39-1f (Appendix No. 4, Appendix No. 6 to Order of the Federal Tax Service of the Russian Federation dated 04.04.2005 N SAE-3-01/). They are also not used today.

Also read:

glavkniga.ru

Answers to popular questions

What to do if the tax was paid by payment order with the correct details, but was never received by the tax office?

It happens. You must write an application to the tax office to search for payment. If the payment is not in the card for transactions with the budget, and you have a payment slip in your hands with a bank mark with the correct details, then we write the application in any form. For example, like this:

If errors are made in the payment slip, you can provide the correct details through your personal account in the My Mail section -> Contact the tax authority -> Budget payments -> Application for clarification of payments -> Other payments. In the form that opens, indicate the details of the payment order: number, date and amount.

In the found payment order, you can enter new correct details and immediately generate and send an application for payment clarification.

Still have questions? Need help deciphering your statement? Write to WhatsApp or Telegram and get a consultation.

Balance in foreign trade relations

The indicator is calculated based on relationships with foreign companies. The calculations take into account the following operations:

- Export indicators.

- Import amount.

- Cash receipts from foreign structures.

- Payments to foreign structures.

The trade balance is distinguished, as well as a similar indicator of the balance of payments.

Export and import are the basis of foreign trade. The difference between exports and imports is considered the balance. It must be calculated within the established time frame. The trade balance is divided into different types:

- Positive. This is relevant if the state sells more than it acquires. The balance will be positive if exports are greater than imports.

- Negative. This is relevant when imports are greater than imports. The balance will be negative if the government acquires more than it sells.

Let's take a closer look at the negative balance in the context of the state. This indicator means that the country has a lot of foreign products, but few goods of domestic producers.

Typically this term is used in trade transactions between states. Almost all countries trade with each other. Relationships involve monetary transactions. The balance of payments is the difference between remittances received from abroad. Payments sent to other countries are also included in the calculation.

The balance can be either positive or negative. Let's consider the features of two varieties:

- Positive. The balance can be called positive if there is an excess of payments received from other countries over payments sent to other states.

- Negative. The indicator is called negative if there is an excess of payments from the state over receipts to the state.

That is, the division of the balance into positive and negative is accepted regardless of its type. Determining the type of balance occurs after deducting expenses from income.

Old form

In 2021, the tax office unsuccessfully updated its software and statements began to arrive in a new, unusual format.

In the old statement, payments and accruals for taxes, penalties and fines were conditionally divided into 3 blocks. In the new one they are mixed in chronological order.

How debts/overpayments increased or decreased can be seen in column 13. A positive number is an overpayment, a negative number is a debt. Abbreviations in column 6 will help separate calculations for penalties from calculations for taxes - there will be something with the word “penalty” there.

Now let’s figure out how these overpayments and debts are formed.

The data in column 10 goes to your “minus” - these are tax charges. And at 11, on the contrary, it’s “plus”, these are your payments.

Example

This is an extract from the simplified tax system. The entrepreneur had an overpayment at the beginning of the year, then:

- in April he pays 6,996 rubles, the total overpayment is 71,805 rubles.

- On May 3, he submits a declaration and charges appear in the statement that reduce the overpayment: 71,805 – 4,017 – 28,062 – 8,190 = 31,536 rubles.

- An operation with the description “reduced by declaration” appears. This means that the entrepreneur incurred the main expenses at the end of the year, so during the year he was charged too much tax. Therefore, the accrual is reduced by RUB 10,995. That rare case when a declaration does not add obligations, but vice versa.

- in July, he pays an advance payment for the first half of 2021 and the overpayment at the time of requesting an extract from him is 52,603 rubles.

The article is current as of 02/26/2019

Buy ConsultantPlus systems

The provisions of paragraph 69 of Instruction No. 33n do not establish special requirements for reflecting in the information (form 0503769) indicators for account 0 304 06 000, used when registering a transaction for the transfer of capital investments from KVFO 5 to KVFO 4. Thus, formed on the reporting date indicators for these accounts are indicated in the information in a general manner.

Column 10 indicates the final balance of settlements for tax sanctions (overpayment “+” or debt “-”).

Conduct regular reconciliation with the tax office to keep payments with the state under control and to immediately find out if something goes wrong.