Insurance premiums from the Social Insurance Fund against accidents Insurance premiums are mandatory payments that the company transfers to a special account on a monthly basis.

This is monetary compensation to protect the interests of an employee injured at work. Regardless of the fact that payments are regular and made for each employee individually, funds are paid after the occurrence of an insured event.

How the Russian compulsory pension insurance system works

In the Social Insurance Fund, tariffs for accidents in 2021 remain the same as in the previous year, but the administration itself has undergone some changes. Next, we’ll look at the specifics of calculating insurance premiums!

Who is the payer?

Payers of contributions in case of injury are legal entities (enterprises of all forms of ownership) and individual entrepreneurs for their employees. Accrued on the amount of wages.

For employees with whom a GPC agreement is concluded, where the insurance conditions are not specified, the employer is not required to contribute funds.

The list of payments does not include:

- one-time financial assistance;

- sick leave payments;

- severance pay;

- amounts that are paid for damage caused at work;

- some other payments are determined by law.

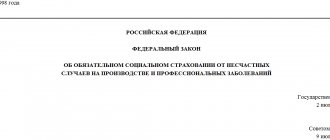

You can find out in detail about the amounts of payments for which contributions for injuries are not calculated by reading Federal Law No. 125.

Deductions for injuries are made for the following types of income:

- salary;

- premium;

- vacation compensation;

- allowances.

No deductions are made for targeted government payments, expenses for staff development, or payments upon liquidation of an enterprise.

What professional risk assessment methods do you use?

Verification analysis and other actions are carried out in several stages. Measurements, calculations using formulas, making lists, classification, etc. are used. Work with typical low-risk companies is carried out remotely.

We will need a report on the labor safety standards, staffing schedule, documentation from the field of labor protection and other documents. Our experts go to OPOs with a high level of professional risk for assessment on the day the application is submitted. I'll tell you about the methods step by step.

- The head of the enterprise, by order, creates a commission of those responsible for labor protection, fire or electrical safety, heads of workshops and departments. This is necessary in order to familiarize our experts with the nuances of production. Who else but them should know the whole “kitchen” from the inside. Joint preliminary work will reduce the time required for the assessment.

- The situation in the workplace is being investigated. A map of occupational risks is drawn up at each workplace. For this purpose, as a rule, the outputs of the SOUT are used.

- Based on the information received and various types of available documents (reports, orders, instructions, journals, etc.), our experts identify and classify potential hazards. Lists of hazardous factors are compiled by level, degree and class.

- The data is analyzed, the assessment of occupational risks at the enterprise is calculated using the Fine-Kinney method, other algorithms and formulas.

- In accordance with the results obtained, safety measures are identified that need to be taken in order to minimize the level of risks, for example, use other personal protective equipment, protective equipment, carry out the prevention of occupational diseases, make adjustments to the operation of equipment, change the work schedule, etc.

- A package of necessary documents is collected, which includes a classification of potential hazards, workplace risk maps, a list of problems, measures to solve them, and other documentation required today.

Assessing the professional risks of workers and the enterprise itself is an important process for every organization. It will help to avoid unnecessary expenses, preserve the health and lives of workers, and report to the inspection authorities. The main thing is to correctly carry out, draw up and formalize this procedure and the papers associated with its implementation.

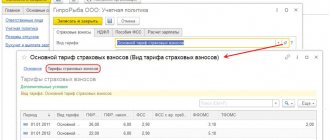

FSS tariffs 2021 from accidents

In order for an entrepreneur to find out what rate of injury he needs to pay, he needs to know the main type of activity of the organization. There are 32 classes in total, which include a list of types grouped according to occupational risk classes. Each one is assigned an individual OKVED code.

Order No. 851N has been in effect since January 1, 2017. It defines new classification rules. The type of activity is confirmed annually. In order for the Social Insurance Fund authorities to set a tariff at which the injury rate will be calculated, you must send supporting documents before April 15 of the current year:

- certificate of approved form;

- supporting statement;

- decoding of the balance sheet for enterprises for the previous period. Individual entrepreneurs are not required to provide reports.

Application forms and certificates can be viewed in the appendices to Order No. 55 of the Ministry of Health and Social Development.

In the Social Insurance Fund, 2021 tariffs for accidents range from 0.2 to 8.5.

If the taxpayer does not provide documents, then the FSS will independently assign a professional risk class, and the highest rate is selected - 8.5. Therefore, documents must be submitted on time, because it will be impossible to challenge the tariff, according to the new rules in force this year.

Taxes for pensioners

What classes, levels and categories of hazards exist?

Hazard identification is primarily carried out after identifying the causes that may cause the problem situation:

- Animals, insects, plants, microorganisms.

- Explosion, violence, collapse, improperly organized production process.

- Testing new material, equipment, product tasting.

- Microclimate, weather conditions, thermal parameters, chemical composition of air.

- Hard work, stress, stress.

- Radiation, waves, ionization, noise, light, vibration, mechanical stress and other physical factors.

- Relief, landscape, features of the area where workplaces are located.

- Aggressive poisons, chemicals, toxicity, etc.

After compiling a list of hazardous factors, the degree of likelihood that this will happen is determined. Assessing the level of professional risk by degree of probability involves several options and is assessed by points. The scores also assess the degree of exposure and possible consequences.

The calculation of the profrisk index is directly proportional to its level and the urgency of the necessary measures.

Calculation method

Accident insurance premiums in 2021 are calculated by an accountant monthly by multiplying the premium base by the tariff rate.

The contribution base is the amount of money that the employee received during the reporting month. This may include not only wages, but also other monetary rewards discussed above. It is calculated as the difference between payments under the employment contract and non-taxable contributions.

Example. The Krasny Luch enterprise is engaged in the extraction of cobalt ore - 07.29.22. This is risk class 32. For this group, a tariff of 8.5 is assigned, since this is a dangerous type of activity; injuries received at work can have serious consequences, entailing large financial expenses. The salary fund for employees in March 2021 is 2.4 million rubles. Some employees were paid financial assistance in the amount of 17 thousand rubles. Based on this:

- contribution base = 2400000-17000 = 2383000 rub.;

- amount of deductions = 2383000 * 8.5% = 202555 rub.

The received amount is transferred by the company to a special account in the Social Insurance Fund.

What's new in 2021

Tariffs, categories of payers and beneficiaries remained the same, but the changes affected the following:

- On December 31, 2021, the deadline for completing the special assessment procedure for working conditions expired - in 2021, those who do not do this will face trouble;

- if a special assessment of working conditions in offices was carried out, data on this must be reflected in Table 5 of Form 4-FSS for the first quarter of 2020;

- do not forget to use this information in the application for calculating the tariff discount (the application for a discount in 2021 must be sent no later than November 1, 2020).

More information about INSURANCE PREMIUMS

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

ConsultantPlus TRY FREE

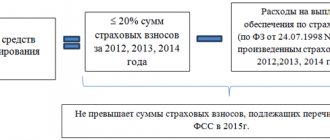

Preferential rates

In 2021, reduced rates continue to apply for some types of activities:

- enterprises that fall into the preferential category - charity, construction, education, healthcare, etc., if they receive an annual income of no more than 79 million rubles;

- pharmaceutical staff;

- an enterprise that conducts financial activities in free economic zones defined by law;

- IT companies;

There are a large number of such categories. The rate ranges from 0 to 2%. The full list is given in Art. 427 Tax Code of the Russian Federation.

Additional fees

In addition to the basic tariffs, Chapter 34 of the Tax Code of the Russian Federation also establishes additional insurance premiums that apply to workers employed in hazardous and hazardous work, namely:

- underground work, in hot shops, in hazardous industries in accordance with List 1 (clause 1, clause 1, article 30 of Federal Law No. 400);

- work with difficult working conditions specified in List 2 (clause 2, clause 1, article 30 of Federal Law No. 400);

- works provided for in paragraphs. 3–18 clause 1, art. 30 Federal Law No. 400 (the so-called “small lists”).

As for the amount of additional contributions, their size depends on a special assessment of working conditions. If it was not carried out, then the tariff is set at 9% for List No. 1 and at 6% for List No. 2 and “small lists”.

If a special assessment was carried out, then Article 428 of the Tax Code of the Russian Federation establishes the following tariffs:

When to expect a decision on a new tariff

Based on the documents received, the FSS of Russia assigns a rate of contributions for insurance against accidents and occupational diseases for the current year. The applicant will be notified of this within two weeks from the date the documents were submitted (clause 4 of the Procedure approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

Situation: how to pay contributions for insurance against accidents and occupational diseases at the beginning of the year before receiving notification of the tariff for the current year from the Federal Social Insurance Fund of Russia?

Until the new tariff is assigned, you pay insurance premiums taking into account the main type of activity that was confirmed in the past year. This is directly stated in paragraph 11 of the Procedure, approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55.

But in any case, take the tariff that is approved for the corresponding class of professional risk for the current year. Now for this purpose they use the Classification of types of economic activities by occupational risk classes, approved by order of the Ministry of Labor of Russia dated December 25, 2012 No. 625n.

When the Federal Social Insurance Fund of Russia establishes a different class of professional risk, the contributions “for injuries” will be recalculated at the new rate. And even if this results in an underpayment to the budget, you will not have to pay penalties and fines. After all, you did not violate anything, but acted in accordance with the established procedure.

Confirmation of the main type of activity[edit]

Organizations and entrepreneurs independently determine their main type of activity (clause 11 of the Rules approved by Decree of the Government of the Russian Federation of December 1, 2005 No. 713).

| The share of a certain type of activity in the total revenue from sales of products (works, services) | = | Revenue (excluding VAT) from the sale of products (works, services) for a certain type of activity of the organization | : | Revenue (excluding VAT) from sales of products (works, services) for all types of activities of the organization | × | 100% |

The activity that has the largest share will be the main activity for the current year.

If several types of activities have the greatest share, then the main activity will be the one that corresponds to a higher class of professional risk. Occupational risk classes are given in the Classification approved by Order of the Ministry of Labor of Russia dated December 25, 2012 No. 625n.

This procedure for determining the main type of economic activity follows from paragraphs 9 and 14 of the Rules, approved by Decree of the Government of the Russian Federation of December 1, 2005 No. 713.

Submit the calculation of the specific weight of activities to the territorial branch of the FSS of Russia in an explanatory note. If the calculation is not submitted, the fund may set a tariff that is provided for activities with the highest possible class of professional risk. Moreover, they can choose any type of activity you have.

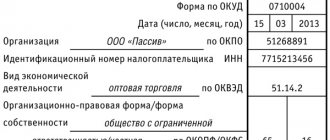

An example of how to determine the main type of activity to set the rate of contributions for insurance against accidents and occupational diseases

Total revenue excluding VAT from sales of products (works) for 2015 amounted to RUB 8,000,000, including:

- from publishing activities (OKVED code – 22.1) – 3,500,000 rubles;

- from furniture production (OKVED code – 36.1) – 3,500,000 rubles;

- from the sale of household furniture under agency agreements (OKVED code – 51.15.1) – RUB 1,000,000.

The share of publishing activities is 43.75 percent (3,500,000 rubles: 8,000,000 rubles × 100%), furniture production activities - 43.75 percent (3,500,000 rubles: 8,000,000 rubles × 100% ), activities of agents in the wholesale trade of furniture - 12.5 percent (1,000,000 rubles: 8,000,000 rubles × 100%).

Two types of activities of the organization have the greatest share. Therefore, the accountant determined which type of activity corresponds to the highest class of professional risk.

In 2021, publishing activities correspond to the 1st class of professional risk, and furniture production activities correspond to the 8th class.

The main activity of Alpha for 2021 is furniture production.

The accountant submitted these documents to the branch of the Federal Social Insurance Fund of Russia in which the organization is registered. The Fund assigned to Alpha a premium rate for insurance against accidents and occupational diseases for 2016, corresponding to the 8th class of professional risk. Its size was 0.9 percent (Article 1 of the Law of December 14, 2015 No. 362-FZ, Article 1 of the Law of December 22, 2005 No. 179-FZ).

Tip: During the year, the main activity of the organization may change from what was originally stated. If the new type of activity corresponds to a reduced rate of insurance premiums, the fund must return (or offset) the insurance premiums paid at the higher rate.

The use of tariffs that do not correspond to the actual type of activity contradicts the essence of compulsory insurance. Therefore, if the tariffs established for the activities that were the main activity last year do not correspond to the activities that the organization is engaged in in the current year, it has the right to revise them.

To do this, you need to submit documents and calculations confirming the actual type of activity to the territorial office of the fund. Fund representatives must review these documents and make a decision regardless of the previously established professional risk class and tariff size. Moreover, if as a result of the revision of tariffs there is an overpayment of insurance premiums, then it must be returned to the organization.

The legality of this approach is confirmed by arbitration practice (see, for example, the ruling of the Supreme Court of the Russian Federation dated September 2, 2015 No. 303-KG15-10066, the resolution of the Arbitration Court of the Far Eastern District dated May 14, 2015 No. F03-1493/2015, the Fifth Arbitration Appeal court dated February 3, 2015 No. 05AP-15626/2014).

Every year, before April 15 of the current year, the organization must confirm its main type of activity. The rules for confirming the main type of activity are set out in the Procedure for confirming the main type of economic activity of the insurer for compulsory social insurance against industrial accidents and occupational diseases - a legal entity, as well as the types of economic activity of the insurer's divisions, which are independent classification units.

If the organization is on the simplified tax system, then the FSS has no right to require either an explanatory note or Form 2. Some branches ask for a copy of the annual declaration under the simplified tax system, which is not legal, but it’s up to you to argue with the FSS or not.

Please note that an individual entrepreneur does not have to annually confirm the main type of activity.

If the organization does not confirm its main type of activity, then for the current year the Social Insurance Fund will establish the highest class of professional risk among the types of activities carried out by the organization.

Insurance subjects[edit]

The insurer for this type of insurance is the Social Insurance Fund. He is responsible for registering policyholders, receiving reports, and monitoring the payment of premiums.

Individuals are policyholders if they employ persons who are insured persons

Insured persons are individuals working under an employment contract. Also, insured persons can be individuals with whom a civil contract has been concluded, which specifies the obligation of the policyholder to pay insurance premiums for NS and PZ.

Tariff for entrepreneurs who employ disabled people

Entrepreneurs who have been working for more than a year are not required to annually confirm the “injury” contribution rate established by them (clause 10 of the Rules approved by Decree of the Government of the Russian Federation of December 1, 2005 No. 713). But if an entrepreneur has changed the main type of activity in the Unified State Register of Individual Entrepreneurs, then a new insurance rate must be established for him, corresponding to the new class of professional risk.

The new tariff may be less than the previous one. However, the FSS of Russia itself will not take into account the changes and will maintain the maximum tariff established earlier. Therefore, in such situations, it is better for the entrepreneur to confirm his main activity for the current year.

Regardless of the main type of activity, entrepreneurs who employ disabled people are entitled to benefits. From payments in favor of such employees, entrepreneurs charge insurance premiums based on 60 percent of the insurance rate established for the main type of activity. This is stated in Article 2 of the Law of December 14, 2015 No. 362-FZ.

Where do you need to pay?

Contributions are sent to the local FSS branch. The funds are paid to the fund in which the company is registered. Payment must be made before the 15th (based on paragraph 4 of Article 22 of the Law). For example, contributions are calculated based on payments made in April. In this case, funds must be sent before May 15. If the 15th falls on a weekend or holiday, payments are made on the next weekday.

The amount of insurance premiums is not rounded. If the company has overpaid, the next payment will be reduced by the corresponding amount. If the company has transferred an insufficient amount of contributions, the difference must be made up immediately. If arrears are detected by the FSS, the company is sent a corresponding notification.