The VAT reporting has already been submitted, but suddenly you discovered that one of the sales invoices was entered twice, and the paper invoice received from the supplier indicated a later date than you indicated when entering. How to remove the 1C: Accounting 8 program ed. from the information base. 3.0 unnecessary invoices after the end of the reporting campaign?

If, after submitting the declaration, the taxpayer discovers that some information was not reflected in the declaration (not fully reflected) or identifies errors, then, according to paragraph 1 of Article 81 of the Tax Code of the Russian Federation, he:

- is obliged to make changes to the tax return and submit an updated return if errors (distortions) led to an understatement of tax;

- has the right to make changes to the declaration and submit an updated declaration if errors (distortions) did not lead to an understatement of the amount of tax payable.

If the detected errors or distortions relate to previous tax (reporting) periods, then the tax base and tax amount are recalculated for the period in which the specified errors (distortions) were made (paragraph 2, clause 1, article 54 of the Tax Code of the Russian Federation).

This is a general rule. But the taxpayer has the right to recalculate the tax base and the amount of tax liabilities even during the period when errors are identified.

This is possible in two cases:

- if it is impossible to determine the period of commission of these errors (distortions);

- if such errors (distortions) led to excessive payment of tax (paragraph 2, paragraph 1, article 54 of the Tax Code of the Russian Federation).

But when applying these standards, the following features must be taken into account:

- the norm of paragraph 1 of Article 54 of the Tax Code of the Russian Federation does not apply to errors that were made due to incorrect reflection of tax deductions. This is due to the fact that by using tax deductions the taxpayer reduces the amount of tax already calculated from the tax base (clause 1 of Article 171 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 25, 2010 No. 03-07-11/363);

- recalculation of the tax base for VAT in the period of discovery of an error made in previous tax periods is not provided for by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (hereinafter referred to as Resolution No. 1137).

Cancellation of a sales ledger entry

If a correction to an issued invoice is made after the end of the tax period, the registration of the corrected invoice and the cancellation of the entry on the original invoice are made in an additional sheet of the sales book for the tax period in which the invoice was registered before the corrections were made (p 3, clause 11 of the Rules for maintaining a sales book, approved by Resolution No. 1137). And according to the Rules for maintaining a purchase book, approved. Resolution No. 1137, upon receipt of a corrected invoice after the end of the current tax period, the entry on the invoice is canceled in an additional sheet of the purchase book for the tax period in which the invoice was registered before the corrections were made to it (clause 4 of the Rules for maintaining the book purchases, approved by Resolution No. 1137).

Despite the fact that these norms of Decree No. 1137 relate the procedure for correcting the sales book and (or) purchase book only to making corrections to invoices, the use of additional sheets of the purchase book and (or) sales book is prescribed in relation to any changes to the sales book and ( or) purchase books for expired tax periods (letters of the Federal Tax Service of Russia dated 09/06/2006 No. MM-6-03/ [email protected] , dated 04/30/2015 No. BS-18-6/ [email protected] ).

The data from such additional sheets is used to make changes to the VAT tax return (clause 5 of the Rules for filling out an additional sheet of the sales book, clause 6 of the Rules for filling out an additional sheet of the purchase book). At the same time, in addition to those sections that were previously submitted to the tax authority, the updated tax return includes, respectively, Appendix 1 to Section 8 and (or) Appendix 1 to Section 9 (clause 2 of the Procedure for filling out a VAT tax return, approved by order of the Federal Tax Service Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ).

Let's look at the procedure for making such corrections in the 1C: Accounting 8 (rev. 3.0) program using an example.

Example

TF Mega LLC uses OSNO. On October 27, 2015, after submitting the VAT return for the third quarter of 2015, the accountant discovered an erroneously recorded transaction for the provision of advertising services and, consequently, an erroneous registration entry in the sales book for the third quarter of 2015. The accountant decided to correct the accounting and tax data, as well as submit an updated VAT return for the third quarter of 2015.

When is it necessary to restore VAT and reflect the adjustment of receipts in the sales book

It may be necessary to restore VAT and reflect the income adjustment in the sales book for a number of reasons. For example, by agreement between the buyer and seller, the cost of goods for which tax had already been deducted was reduced. VAT subject to recovery (VATvoss) must be determined using the formula:

VATvoss = VAT0 – VAT1,

where VAT0 and VAT1 are taxes calculated before and after the reduction in the value of goods.

Example

Zephyr LLC accepted for deduction VAT in the amount of 379,488 rubles. for confectionery products purchased from PJSC “Rakhat Delight”. Two months later, the seller provided the buyer with a retro discount. The price of confectionery products decreased, the buyer’s deduction decreased to RUB 306,133.

Zephyr LLC must restore VAT in the amount of RUB 73,355. (379,488 – 306,133).

Issuing an adjustment invoice does not lead to the need to clarify the VAT declaration previously submitted to the inspection. The seller reflects the adjustment invoice in the purchase book during the period of its registration. In such a situation, he has the right to deduct VAT.

The buyer's adjustment invoice for the reduction is reflected in the sales book, and therefore there is an obligation to restore the tax previously accepted for deduction.

How to record the service provided

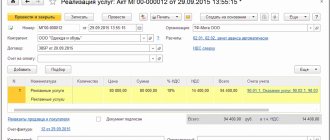

The provision of advertising services to the buyer of Clothes and Shoes LLC in the 1C: Accounting 8 program (rev. 3.0) is registered using the Implementation

(act, invoice) with the type of transaction

Services (act)

(section

Sales,

subsection ->

Sales

, hyperlink

Sales (acts, invoices).

After posting the document, the following entries are entered into the accounting register:

Debit 62.01 Credit 90.01.1

– the cost of the advertising service provided;

Debit 90.03 Credit 68.02

– the amount of accrued VAT.

Receipt is entered into the Sales VAT register

for the sales book, reflecting VAT at a rate of 18%.

The corresponding entry about the cost of the advertising service provided is also entered into the Sales of Services register.

You can create an invoice for the advertising service provided by clicking on the Issue an invoice

at the bottom of the document

Sales

(act, invoice).

Invoice issued

is automatically created and a hyperlink to the created invoice appears in the form of the basis document (Fig. 1).

Rice. 1

In the document Invoice issued

(section

Sales,

subsection

Sales

, hyperlink

Invoices issued

), which can be opened via a hyperlink, all fields are filled in automatically based on the data in the

Sales document (act, invoice).

From 01/01/2015, taxpayers who are not intermediaries acting on their own behalf (forwarders, developers) do not keep a log of received and issued invoices, therefore in the document Invoice issued

in the line

“Amount:”

it is indicated that the amounts to be recorded in the accounting journal (“of which in the journal:”) are equal to zero.

As a result of posting the document Invoice issued

An entry is made in the information register

Invoice Journal

.

Register entries The Invoice Register

are used to store the necessary information about the issued invoice.

Using the Print Document

accounting system

Invoice issued,

you can view the invoice form, as well as print it.

An invoice issued for the provision of advertising services is registered in the sales book for the third quarter of 2015 - see table. 1.

Table 1

The transaction subject to VAT for the provision of advertising services is reflected on line 010 of section 3 of the VAT tax return for the third quarter of 2015 (approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] ) (Fig. 2) .

Rice. 2

Information from the sales book is reflected in section 9 of the VAT return.

Correction of accounting and tax data

Accounting. According to paragraph 5 of the Accounting Regulations “Correction of errors in accounting and reporting” (PBU 22/2010)”, approved. By order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n, an error in the reporting year identified before the end of this year is corrected by entries in the relevant accounting accounts in the month of the reporting year in which the error was identified.

Tax accounting. If errors are detected in the submitted tax return that do not lead to an underestimation of the amount of tax payable, the taxpayer has the right, but is not obliged, to submit an updated tax return to the tax authority (clause 1 of Article 81 of the Tax Code of the Russian Federation).

In the example under consideration, a transaction subject to VAT for the provision of advertising services was incorrectly recorded in accounting; therefore, the discovered error led to an overestimation of the VAT tax base in the third quarter of 2015 and, consequently, the amount of tax payable to the budget.

In accordance with paragraph 2 of paragraph 1 of Article 54 of the Tax Code of the Russian Federation, if errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods, in the current tax (reporting) period the tax base and tax amount are recalculated for the period in which the specified errors (distortions) were made. At the same time, if such errors (distortions) lead to excessive payment of tax, then the taxpayer has the right to recalculate the tax base and the amount of tax in the tax (reporting) period in which the errors (distortions) were identified (paragraph 2, clause 1, art. 54 of the Tax Code of the Russian Federation). However, the rule allowing for the recalculation of the tax base during the period when an error was discovered, i.e. in the fourth quarter of 2015, does not apply to VAT, since Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 does not provide for a mechanism for its implementation.

According to clause 3 and paragraph 2 of clause 11 of the Rules for maintaining the sales book, approved. Resolution No. 1137, if it is necessary to cancel an entry in the sales book after the end of the current tax period, additional sheets of the sales book are used for the tax period in which the invoice was registered. Despite the fact that Resolution No. 1137 correlates this procedure with corrections to the sales book caused by corrections in invoices, the possibility of canceling erroneous registration records is confirmed in the clarifications of the Federal Tax Service of Russia (letter of the Federal Tax Service of Russia dated September 6, 2006 No. MM-6-03/ [ email protected] , dated 04/30/2015 No. BS-18-6/ [email protected] ).

The data from such sheets is used to make changes to the VAT declaration (clause 5 of the Rules for filling out an additional sheet of the sales book).

Correction of a mistake made in reflecting in accounting and tax accounting a fact of economic life that did not take place in the program is registered using the document Operation with the transaction type Reversal of document

(section

Operations

, subsection

Accounting

, hyperlink

Operations entered manually

).

The header of the document states:

- in the from

- the date the error was corrected; - in the Cancelled document

- the corresponding erroneous sales document.

Field Contents

and the tabular part of the document are filled in automatically after selecting the document to be reversed.

On the Accounting and Tax Accounting

The corresponding reversal accounting entries are reflected:

Debit 62.01 Credit 90.01.1

– the cost of services provided;

Debit 90.03 Credit 68.02

– the amount of accrued VAT.

The corresponding reversal account will also be reflected in the Sales of services

(Fig. 3, document

Operation

).

Rice. 3

A corresponding reversal entry is automatically entered into the Sales VAT register indicating the following values:

- in the Additional sheet entry column – “No”;

- in the Adjusted period column there is no value;

- in the Amount excluding VAT column – “–80,000.00”;

- in the VAT column – “–14,400.00”.

Since the cancellation of a registration entry for an erroneously issued invoice must be made in an additional sheet of the sales book during the period of service provision, i.e., the third quarter of 2015, it is necessary to make an adjustment to the VAT Sales register entries:

- in the Additional sheet entry column - replace the value with Yes;

- in the Adjusted period column - indicate any date of the third quarter of 2015, for example, 09/30/2015.

After recording the Transaction document, a record of cancellation for the erroneously issued invoice will be made in the additional sheet of the sales book for the third quarter of 2015 - see table. 2.

table 2

It should be noted that an erroneously issued invoice itself cannot be canceled (withdrawn, destroyed). According to the Federal Tax Service of Russia, establishing a mechanism for canceling invoices is inappropriate, since if an erroneously issued invoice is not registered in the sales book, then it is not accepted for accounting (letter of the Federal Tax Service of Russia dated April 30, 2015 No. BS-18-6 / [email protected ] ).

When making a decision to submit an updated VAT tax return for the third quarter of 2015, it should be borne in mind that such an updated return will include the same sections as the primary return (clause 2 of the Procedure for filling out a tax return). VAT, approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ).

In this case, the title page of the VAT return will indicate the adjustment number “1” and the signature date “10/27/2015”.

In section 3 of the updated tax return, line 010 will reflect the reduced tax base and the amount of calculated tax (Fig. 4).

Rice. 4

In addition, the updated declaration will additionally contain Appendix 1 to Section 9, which will reflect information from the additional sheet of the sales book. Since there was no such information in the primary declaration, the Previously submitted information line will be marked as Irrelevant, which corresponds to the relevance indicator “0” and means that this information under Section 9 was not provided in the previously submitted declaration (clause 48.2 of the Procedure for filling out a tax return for VAT).

Since no changes were made to the sales book itself, the information from section 9 does not need to be re-uploaded to the tax office, for which it is enough to set a check mark in the Previously submitted information line in the Relevant field, which corresponds to the relevance indicator “1” and means that the information presented by the taxpayer previously to the tax authority, are current, reliable, are not subject to change and are not submitted to the tax authority (clause 47.2 of the Procedure for filling out a VAT tax return).

Reversal in 1C 8.3 Accounting

How to make a reversal in 1C 8.3? There are two ways:

- automatically, using standard adjustment documents;

- manually using the Document Reversal .

Automatically

Many errors in primary documents with counterparties are corrected by standard documents - Receipt Adjustment or Sales Adjustment. You can find them in the Purchases or Sales , respectively. But for this they must be provided for by the functionality of the program.

Working with them is not difficult: the data is corrected in accordance with the primary documents, and reversing entries are generated automatically when posting the document. More details Error: the amount of costs when purchasing services is too high. General fix scheme

This is the only option for correct execution of corrections or adjustments, which involves the use of a corrected or adjustment invoice.

These same documents are used to make reversal entries when making adjustments as agreed by the parties. Read more Adjustment of implementation in 1C 8.3: step-by-step instructions.

Manually

Reversal of a document in 1C 8.3 is completed manually when the primary document with the counterparty is completely canceled or the records of other documents for which standard adjustment documents are not intended are reversed.

the Transactions entered manually link Transactions section and create a document reversal .

When you select a Reversed Document, the tabular part is automatically filled in with its reversing transactions.

The accumulation registers will also show “storno” entries.

But cancellation of entries in information registers does not occur. If necessary, make these changes manually.

It is not recommended to reverse routine transactions, since the calculation of amounts does not always depend on account balances and is often performed on the basis of information registers. In this case, changing the amounts in accounting and accounting records does not guarantee correct calculation in the future. More details Is it possible to use the Storno document for a regulatory operation to reduce advance payments of transport tax in previous quarters?

Canceling a purchase ledger entry

When corrections are made to an issued invoice after the end of the tax period, the registration of the corrected invoice and the cancellation of the entry on the original invoice are made in an additional sheet of the sales book for the tax period in which the invoice was registered before the corrections were made to it (clause 3, clause 11 of the Rules for maintaining a sales book, approved by Resolution No. 1137). Upon receipt of a corrected invoice after the end of the current tax period, the entry on the invoice is canceled in an additional sheet of the purchase book for the tax period in which the invoice was registered before the corrections were made to it (clause 4 of the Rules for maintaining the purchase book, approved. Resolution No. 1137).

Despite the fact that these norms of Decree No. 1137 relate the procedure for correcting the sales book and (or) the purchase book only to the introduction of corrections in invoices, the use of additional sheets of the purchase book and (or) the sales book is prescribed in relation to any changes to the sales book and ( or) purchase books for expired tax periods (letters of the Federal Tax Service of Russia dated 09/06/2006 No. MM-6-03/ [email protected] , dated 04/30/2015 No. BS-18-6/ [email protected] ).

The data from such additional sheets is used to make changes to the VAT tax return (clause 5 of the Rules for filling out an additional sheet of the sales book, clause 6 of the Rules for filling out an additional sheet of the purchase book). At the same time, in addition to those sections that were previously submitted to the tax authority, the updated tax return includes, respectively, Appendix 1 to Section 8 and (or) Appendix 1 to Section 9 (clause 2 of the Procedure for filling out a VAT tax return, approved by order of the Federal Tax Service Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ).

Source: buh.ru

Problems of VAT refund in case of bad faith of the counterparty

Currently, the Federal Tax Service of the Russian Federation pays quite a lot of attention to the reality of business transactions of taxpayers with their counterparties. To ensure the purity of relationships between taxpayers and their counterparties, the Federal Tax Service of Russia has taken large-scale measures to identify so-called “unscrupulous” taxpayers in the chain with counterparties who deliberately create fictitious business transactions with the same “unscrupulous” counterparties in order to achieve a single goal - reducing the amount of taxes payable in country budget. [email protected] of the Federal Tax Service of Russia dated December 31, 2015 cites cases of refusal by the tax authority to deduct VAT when the tax authority has proven that the taxpayer has committed actions that are obviously aimed at obtaining an unjustified tax benefit, as well as when the tax authority has evidence of the fact that the taxpayer did not exercise due diligence when choosing a counterparty.

There are often cases when, based on the results of an audit of a taxpayer’s activities, the tax authorities refuse to reimburse him for VAT, subsequently oblige the taxpayer to pay the missing amount of VAT to the budget, charge penalties, and bring him to tax liability, even if the documents submitted by the taxpayer do not contain errors or violations. Tax authorities often justify such decisions by the fact that the taxpayer’s counterparty (supplier, performer) did not actually transfer the amount of VAT paid by the taxpayer to the budget. Also, the tax authorities explain the refusal of the taxpayer to refund VAT by the fact that the taxpayer’s counterparty is not registered as a legal entity, or has been completely liquidated, that is, does not have (did not have) the civil legal capacity to enter into a transaction with the taxpayer. In such cases, the tax authorities establish the nullity of the transaction and the taxpayer’s intent to obtain an unjustified tax benefit - and this is the main reason for the tax authorities to refuse a VAT refund.