In “1C: Accounting 8”, starting with version 3.0.65, you can reflect the gratuitous transfer of goods - gifts, winnings, prizes, promotional items, etc. - using the “Gratuitous Transfer” document. We also talk about the taxation of transactions involving the gratuitous transfer of property.

On the legal regulation, personal income tax taxation of gifts to employees and the procedure for reflecting income in the form of gifts in the 1C: Salaries and Personnel Management 8 program, edition 3, see the article “Gifts to employees: how to register and reflect in 1C.”

We come across the gratuitous transfer of goods, work results and services quite often. These are situations when the following are transmitted:

- gifts for employees and (or) their children;

- gifts to employees of counterparty organizations;

- winnings and prizes in competitions, competitions, games and other events;

- product samples for potential buyers, including food products for tasting;

- printing and souvenir products for advertising purposes;

- goods (work, services) for charitable purposes;

- bonus products;

- stationery and printing products at seminars, conferences and symposiums.

This list can be continued. Sometimes such transfers are due to business customs and traditions accepted in society. Sometimes directly related to economic benefits that can be obtained in the future. In any case, gratuitous transfers allow you to create a positive image of the company.

Let's look at how gratuitous transfers are regulated by civil and tax laws, as well as accounting regulations.

Free transfer: legal regulation, accounting and tax accounting

A gratuitous agreement is an agreement under which one party undertakes to provide something to the other party without receiving payment or other consideration from it (Clause 2 of Article 423 of the Civil Code of the Russian Federation). A gift agreement, an agreement for gratuitous use, a gratuitous agreement for the provision of services - all these are examples of gratuitous agreements. So, for example, under a gift agreement the donor (clause 1 of Article 572 of the Civil Code of the Russian Federation):

- transfers free of charge or undertakes to transfer to the donee an item of ownership or a property right (claim) to himself or to a third party;

- releases or undertakes to release the donee from a property obligation to himself or to a third party.

Donations between commercial organizations are not allowed (clause 4, clause 1, article 575 of the Civil Code of the Russian Federation), and this restriction also applies to individual entrepreneurs (IP) (see Resolution of the Federal Antimonopoly Service of the Central District dated April 16, 2014 in case No. A08-8252/2012 ).

The exception is gifts worth up to 3,000 rubles. (for example, flowers, sweets, business souvenirs, printed products, etc.) transferred to business partners in accordance with business customs.

In accounting, the cost of gratuitously transferred property is recognized as part of other expenses and is reflected in the debit of account 91.02 “Other expenses” in correspondence with the accounts of the transferred property (clauses 11, 17, 19 PBU 10/99 “Organization expenses”, approved. by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n; Section VIII of the Instructions for the application of the chart of accounts, approved by order of the Ministry of Finance of Russia dated 10/31/2000 No. 94n).

In general, the transfer of ownership of goods (results of work, services) on a gratuitous basis is recognized as a sale and is subject to VAT taxation (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). The exception is when such transfer:

- is not recognized as an object of taxation, for example, the gratuitous transfer of objects of social, cultural and housing and communal services to state authorities and local governments (clause 2, clause 2, article 146 of the Tax Code of the Russian Federation);

- exempt from VAT taxation, for example, gratuitous transfer of goods (work, services, property rights) within the framework of charitable activities (clause 12, clause 3, article 149 of the Tax Code of the Russian Federation);

If goods (products) are distributed for advertising purposes, then the object of VAT taxation arises only if the advertising materials meet the characteristics of a product, that is, property intended for sale in its own capacity. If advertising materials (flyers, catalogues, brochures, etc.) are transmitted that do not have the characteristics of a product and are part of the activities to promote manufactured and (or) sold goods on the market, then the object of VAT taxation does not arise regardless of the amount of expenses for their acquisition (creation) (clause 12 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33, letters of the Ministry of Finance of Russia dated December 23, 2015 No. 03-07-11/75489, dated December 19, 2014 No. 03-03-06/1/ 65952, dated October 23, 2014 No. 03-07-11/53626).

In accordance with the Tax Code of the Russian Federation, the tax base for VAT is defined as the cost of the transferred property (work, services), calculated on the basis of market prices (Article 105.3, paragraph 2 of Article 154 of the Tax Code of the Russian Federation). VAT should be charged on the day of shipment (transfer) of goods (work, services) to the recipient (clause 1 of Article 167 of the Tax Code of the Russian Federation).

VAT to the budget is paid at the expense of the transferring party (letter of the Ministry of Finance of Russia dated April 16, 2009 No. 03-07-08/90). At the same time, VAT accrued upon gratuitous transfer cannot be taken into account in income tax expenses (clauses 16, 19 of Article 270 of the Tax Code of the Russian Federation).

As for the input VAT presented by the supplier, the tax is subject to deduction in the general manner when the property is accepted for accounting on the basis of the supplier’s invoice and in the presence of primary documents, since the acquired property is used for a VAT-taxable transaction (letter of the Ministry of Finance of Russia dated August 18, 2017 No. 03 -07-11/53088). If, during the gratuitous transfer of property, the donor does not have an obligation to charge VAT (for example, when transferring goods to charity), then the input VAT accepted for deduction when purchasing property is subject to restoration (clause 2, clause 3, article 170 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated November 4, 2012 No. 03-07-09/158).

For the purposes of corporate income tax, the gratuitous transfer of property, unlike VAT, is not recognized as a sale, therefore the transferring party does not generate income (letter of the Ministry of Finance of Russia dated October 27, 2015 No. 03-07-11/61618). At the same time, the cost of gratuitously transferred property and expenses associated with such transfer are not taken into account in income tax expenses (clause 16 of Article 270 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 18, 2017 No. 03-03-06/1/59819 ).

Since the procedure for recognizing expenses for the gratuitous transfer of property in accounting and tax accounting is different, there will be a permanent difference in the assessment of these expenses, which will lead to the formation of a permanent tax liability (clauses 4, 7 PBU 18/02 “Accounting for income tax calculations of organizations ", approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n). As amended by PBU 18/02, approved. By order of the Ministry of Finance of Russia dated November 20, 2018 No. 236n, instead of the concept of “permanent tax liability” (PNO), the term “permanent tax expense” is used.

| 1C:ITS For information on the gratuitous transfer of goods, works and services for VAT purposes, see the “Value Added Tax” reference book in the “Taxes and Contributions” section. |

Accounting at actual cost

In this case, materials received by the enterprise will be credited directly to the debit of the account. 10 at actual cost, which includes all costs actually incurred by the enterprise for their acquisition, minus VAT.

Costs include:

- directly the cost under the purchase and sale agreement;

- costs of third-party services related to the acquisition of materials (for example, information, consulting);

- transportation and procurement costs (TZR);

- costs associated with bringing material assets to a state in which they can be used.

This list can also include other costs that arise in the process of acquiring materials and bringing them to a suitable condition.

Receipt of materials from the supplier is carried out on the basis of a power of attorney to receive goods and materials, form M-2 or M-2a. A sample of filling out a power of attorney for goods and materials can be downloaded. Form M-2a is usually used for frequent, constant receipt of valuables. Form M-2 is usually used for one-time receipt. The main difference between these two forms is the presence of a counterfoil in the M-2 form, which, when issuing a power of attorney, remains in the accounting department and is filed in the appropriate folders. This counterfoil contains the necessary information about the issued power of attorney and allows the accountant not to make additional manual entries. The use of these forms is relevant if the person receiving the goods and materials from the supplier or carrier who delivered the goods and materials is not the head of the organization or an individual entrepreneur.

Postings

When receiving inventory items from a supplier, the following entry is made in accounting: D10 K60 for the amount of actual costs associated with the acquisition, minus VAT.

VAT on purchased goods and materials is allocated to a separate account 19 “Value added tax on acquired assets” by posting D19 K60, after which VAT is sent for deduction to the debit of account 68 “Calculations for taxes and fees” subaccount “VAT” - posting D68.VAT K19. Read more about VAT in this article.

Payment to the supplier from the current account is made by posting D60 K51.

The above accounting entries can only be made if there are supporting documents:

- commodity or delivery note from the supplier;

- invoice with allocated VAT from the supplier;

- invoice and invoice for other costs associated with the purchase and transportation;

- payment documents confirming the fact of payment of all expenses by the buyer.

When accepting inventory items, the document data is checked, the actual availability of materials is verified with what is indicated in the documents, if there are no discrepancies, then a receipt order form M-4 is issued. If during the inspection process discrepancies in quantity or inadequate quality are identified, then an acceptance certificate form M-7 is issued.

Postings for accounting for materials upon receipt at actual cost:

Example

An organization buys 1,000 inventory items for 118,000 rubles, including VAT of 18,000 rubles. Delivery costs amounted to 11,800 rubles, including VAT of 1,800 rubles. Inventory and materials are accounted for at actual prices. Delivery costs are reflected in a separate subaccount of account 10 – 10.ТЗР. 500 pieces were sent to production. Inventory

Postings:

★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased

You can get an answer to your question by calling the numbers ⇓ Free consultation Moscow, Moscow region call

One-click call

St. Petersburg, Leningrad region call: +7 (812) 317-60-16

One-click call

Accounting at discount prices

Inventory and materials can be taken into account at accounting prices; usually this method is used if the receipt of valuables is regular.

In this case, auxiliary accounts are used to record inventory. 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets.”

Before entering the 10th account, materials are accounted for in the debit of the account. 15 wiring D15 K60 at the cost indicated in the supplier’s documents, excluding VAT.

VAT is allocated separately to account 19: D19 K60, after which it is sent to deduction D68.VAT K19.

After which the inventory items are debited to the account. 10 at discount prices: D10 K15.

The difference between the actual price indicated on the invoice. 15, and accounting reflected in the account. 10, reflected on the account. 16.

If the actual price is greater than the accounting price, then posting D16 K15 is performed by an amount equal to the difference between the purchase and accounting value. At the same time, on the account. 16 a debit balance appears, which at the end of the month is written off to those accounts to which materials are written off. The amount to be debited from the account. 16 at the end of the month is determined by the following formula:

(Balance on debit account 16 at the beginning of the month + turnover on debit account 16 for the month) * turnover on credit account. 10 per month / (balance on debit account 10 at the beginning of the month + turnover on debit account 10 per month).

If the actual price is less than the accounting price, then posting D15 K16 is performed. The credit balance formed on account 16 is reversed (subtracted) at the end of the month, the amount to be reversed is determined by the formula:

(Loan balance account 16 at the beginning of the month + loan turnover account 16 for the month) * loan turnover account. 10 per month / (balance on debit account 10 at the beginning of the month + turnover on debit account 10 per month).

Postings upon receipt of materials at accounting prices:

Example

An organization buys 1,000 inventory items for 118,000 rubles, including VAT of 18,000 rubles.

Inventory and materials are accounted for at a book price of 120 rubles. a piece. 500 pieces were sent to production. Inventory

Postings:

In addition to the fact that materials can be supplied to the enterprise from a supplier, they can also be made in-house from other materials, they can also be contributed to the authorized capital of the organization or received free of charge.

Other methods of receiving materials

Manufacturing

When producing material assets, the cost at which they will be credited to the warehouse is the sum of all actual costs incurred during the production process. This may include: the cost of raw materials, depreciation of fixed assets used in production, staff salaries, overhead costs and other direct costs.

All production costs are collected on the account. 20 “Main production” or 23 “Auxiliary production”, after which they are written off to the account. 10 Materials.

Postings:

Contribution to the authorized capital

If material assets come from one of the founders in the form of a contribution to the authorized capital, then it is necessary to evaluate them, agree on the value with all founders, and, if necessary, use an independent examination.

Also, transportation and procurement costs may be included in the actual cost.

The posting for accounting for receipt of materials in this case will look like: D10 K75.

Free admission

If materials are supplied to an organization under a donation agreement (free of charge), then their actual cost is assumed to be equal to the average market value. This also includes transportation and procurement costs.

Gratuitous receipt is reflected by the posting: D10 K98.

As material assets are written off for production, the amounts for materials received as a gift are written off from the debit of account 98 “Deferred income” to the credit of account 91/1 (recorded as part of other income).

Postings for free receipt of materials:

The gratuitous transfer of material assets is different in that VAT is not allocated in this case, even if the supplier has provided an invoice.

Video - accounting of materials in 1C:

>Issue November 15, 2013

(see also issues for other days)

>Account correspondence schemes

Selection based on materials from the information bank “Correspondence of Accounts” of the ConsultantPlus system

Transfer of gifts to individuals

So, donation between a commercial organization and an individual who is not an individual entrepreneur is not prohibited by current legislation (clause 4, clause 1, article 575 of the Civil Code of the Russian Federation). Transfer of a gift worth up to 3,000 rubles. can be committed orally (clause 1 of article 574 of the Civil Code of the Russian Federation).

The cost of gifts received by an individual from organizations or individual entrepreneurs does not exceed 4,000 rubles. per year, not subject to personal income tax (clause 28, article 217 of the Tax Code of the Russian Federation). For a certain category of citizens (for example, for veterans and disabled people of the Great Patriotic War), the cost of gifts, which is not subject to personal income tax, is 10,000 rubles. per year (clause 33 of article 217 of the Tax Code of the Russian Federation).

To receive a tax deduction provided for in paragraphs 28 and 33 of Article 2021 of the Tax Code of the Russian Federation, the transfer of a gift must be confirmed with documents (letter of the Ministry of Finance of Russia dated August 12, 2014 No. 03-04-06/40051). In this case, for personal income tax purposes it does not matter:

- whether the gift is money, a gift certificate or other property;

- whether the recipient is an employee of the organization or not.

It’s a different matter if the gift is an employee’s incentive for conscientious performance of job duties. In this case, the gift is an incentive payment (bonus), which is part of the remuneration (Part 1 of Article 129, Article 131, Article 191 of the Labor Code of the Russian Federation).

A gift within the framework of an employment relationship is subject to personal income tax in full without applying a deduction as income in cash or in kind (clause 6, clause 1, article 208 of the Tax Code of the Russian Federation, clauses 1, 3, 4 of article 210 of the Tax Code of the Russian Federation, p. 2 Article 211 of the Tax Code of the Russian Federation).

An organization does not have an object for taxation of insurance premiums if gifts to employees are transferred under a gift agreement in writing, the value of the gift does not matter (clause 4 of Article 420 of the Tax Code of the Russian Federation, letter of the Ministry of Labor of Russia dated September 22, 2015 No. 17-3/B -473, letter of the Ministry of Finance of Russia dated January 20, 2017 No. 03-15-06/2437).

If the transfer of gifts is carried out within the framework of labor relations, is part of the remuneration system (remuneration for specific labor results) and is of an incentive nature, then the cost of gifts to employees of the organization is subject to insurance contributions (Definitions of the Supreme Court of the Russian Federation dated March 6, 2017 No. 307-KG17-54 in case No. A44-1285/2016, dated 08/27/2014 in case No. 307-ES14-377, A44-3041/2013).

Let's look at how 1C: Accounting 8 (rev. 3.0) reflects the transfer of gifts to individuals.

Example 1

| Modern Technologies LLC applies OSNO, the provisions of PBU 18/02, and pays VAT. In March 2021, the management of Modern Technologies LLC decided, in honor of International Women’s Day, to present gifts to its employees and employees of the partner organization (10 gifts in total) at an official event. The decision was formalized by order of the head. The cost of each gift is RUB 1,200.00. (including VAT 20% - RUB 200.00). |

The receipt of goods (materials), which are subsequently used to be transferred to individuals as gifts, is reflected in the standard accounting system document Receipt (act, invoice) with the transaction type Goods (invoice) (Purchases section). Let's say an organization purchased 50 ready-made gift sets. After posting the document, the following entries are entered into the accounting register:

Debit 41.01 Credit 60.01 - for the amount of purchased gifts (50,000 rubles). Debit 19.03 Credit 60.01 - for the amount of VAT (10,000 rubles).

For those accounts where tax accounting is supported (in this case, these are accounts 41 and 60; tax accounting is not supported for account 19), the corresponding amounts are entered into special resources of the accounting register for tax accounting purposes (Amount Dt NU and Amount Kt NU).

To register an invoice received from a supplier, fill in the Invoice No. and from fields, then click on the Register button. In this case, the document Invoice received is automatically created, and a hyperlink to the created invoice appears in the form of the basis document. In the form of the document Invoice received by default, the flag Reflect VAT deduction in the purchase book by the date of receipt is selected, which allows you to include the tax amount in VAT tax deductions immediately after gifts are accepted for accounting. If the flag is not set, then the deduction is reflected in the regulatory document Formation of purchase ledger entries.

Starting from version 3.0.65 in 1C:Accounting 8, you can reflect the gratuitous transfer of goods (materials, products) using the Gratuitous Transfer document (Sales section), which allows you to:

- indicate either a specific recipient (for example, when transferring a bonus product to a buyer) or not indicate it at all (for example, when distributing materials for advertising purposes to an indefinite number of people);

- automatically reflect the cost of the transferred property in expenses. The cost account and VAT account are indicated by default as 91.02 “Other expenses” with the analytics Expenses for the transfer of goods (work, services) free of charge and for one’s own needs (profits not accepted for tax purposes);

- charge VAT, which goes into the sales book and into the VAT return. If an organization maintains separate VAT accounting and enters a rate Without VAT, then the data can be reflected in Section 7 of the VAT return;

- reflect the reversal of paid expenses in the book of income and expenses of organizations and individual entrepreneurs using the simplified tax system (KUDiR);

- print documents (Demand-waybill (M-11), Invoice, Consignment note (TORG-12), Universal transfer document (UDD)).

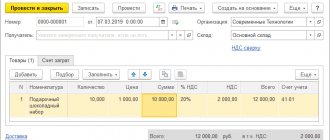

Let's create a document Gratuitous transfer according to the conditions of Example 1 (Fig. 1).

Rice. 1. Document “Free transfer”, tab “Products”

Despite the fact that gifts are transferred to certain individuals specified in the manager’s order, the Recipient field is not required to be filled in. When selling goods free of charge to individuals, there is no need to issue invoices to each of them, since individuals do not deduct VAT.

To reflect accrued VAT in the sales book, it is enough to draw up an accounting statement or a consolidated invoice (letter of the Ministry of Finance of Russia dated 02/08/2016 No. 03-07-09/6171).

On the Products tab, you should specify information about the products transferred for advertising purposes. As the market value of goods in the program, the sales price for the last document is automatically filled in. If the sale price is not determined, then the purchase price is filled in. In Example 1, this is 1,000 rubles.

Since the cost of gifts and the amount of accrued VAT are not taken into account in income tax expenses, on the Cost Account tab you should leave the cost account and VAT account set by default by the program in the appropriate fields (Fig. 2).

Rice. 2. Accounts for expenses when transferring gifts

After posting the Gratuitous Transfer document, the following accounting entries are generated:

Debit 91.02 Credit 41.01 - for the cost of gifts (10,000 rubles). Debit 91.02 Credit 68.02 - for the amount of accrued VAT (2,000 rubles).

For tax accounting purposes for income tax, amounts are entered into special resources of the accounting register:

The amount of Kt NU 41.01 is for the cost of gifts (10,000 rubles). Amount Dt PR 91.02 - for the amounts of permanent differences (10,000 rubles and 2,000 rubles).

If the organization decides to issue a consolidated invoice, then simply click on the Issue invoice button. In the automatically created invoice, dashes are placed in the lines “Consignee and his address”, “Buyer”, “Address”, “TIN/KPP of the buyer” in accordance with the recommendations of the Ministry of Finance of Russia set out in letter dated 02/08/2016 No. 03-07- 09/6171.

A consolidated invoice issued for the gratuitous transfer of goods will be registered in the sales book with the transaction type code “10”, which corresponds to the value “Shipment (transfer) of goods (performance of work, provision of services), property rights on a gratuitous basis” according to the Appendix to Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected]

In the month of transfer of gifts, after processing the Closing of the month and performing the regulatory operation Calculation of deferred tax according to PBU 18, a constant tax expense will be recognized:

Debit 99.02.3 Credit 68.04.2 - in the amount of 2,400 rubles. (RUB 12,000 x 20%).

In the income statement, the cost of the gift transferred and the amount of accrued VAT will be automatically reflected in line 2350 “Other expenses”.

| 1C:ITS For information on how to reflect an individual’s income in the amount of the cost of a gift in 1C solutions, see the reference book “Personnel records and settlements with personnel in 1C programs” in the “Personnel and remuneration” section. |

Who has the opportunity to transfer property free of charge?

Transferring anything free of charge is a fairly common occurrence in budgetary institutions.

There are several sources of transfer of property to an institution:

- Property can be transferred from one institution to another

- It may come from commercial organizations. An interesting fact is that donating property between commercial companies is illegal and is not used, but you can transfer property to a budget organization free of charge

- The receipt of property can be made from an ordinary person, that is, an individual

- Probably the most common way to receive property for a budget organization free of charge is its transfer by the owner of the institution. In this case, the transferred property is assigned to the institution

Receiving property from companies and individuals is their kind of charitable gesture. At the same time, it may be stipulated how the transferred property should be used .

Transfer of winnings and prizes to competition winners

The transfer of winnings and prizes to individuals based on the results of contests, competitions and other events is also recognized as a gratuitous sale and is subject to VAT. In this sense, prizes are no different from gifts.

For profit tax purposes, expenses for the acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns are considered standard advertising expenses (Clause 4 of Article 264 of the Tax Code of the Russian Federation). Such expenses will be recognized in an amount not exceeding 1% of sales revenue, determined in accordance with Article 249 of the Tax Code of the Russian Federation.

If the holding of a contest or competition does not pursue advertising purposes, is not provided for by a collective agreement and is not included in the remuneration system, then the cost of winnings will not be included in expenses.

As for personal income tax, the cost of winnings and prizes received in competitions, competitions, games is taxed at the following rates (clauses 1, 2 of Article 224, clause 28 of Article 217 of the Tax Code of the Russian Federation):

- 35% - in terms of exceeding 4,000 rubles, if the event is held for the purpose of advertising goods, works and services;

- 13% and without applying a deduction of 4,000 rubles, if the event is held for other purposes (letter of the Ministry of Finance of Russia dated August 20, 2018 No. 03-04-05/58919);

- 13% - in terms of excess of 4,000 rubles, if the event is held according to decisions of the Government of the Russian Federation and representative authorities (letter of the Ministry of Finance of Russia dated November 14, 2018 No. 03-04-06/81966).

Let's look at how in "1C: Accounting 8" (rev. 3.0) you can reflect the transfer of prizes to the winners of a drawing held as part of an advertising campaign.

Example 2

| Modern Technologies LLC is participating in the exhibition in March 2021, where it is holding a prize draw among visitors for advertising purposes. A total of 10 prizes worth RUB 1,200.00 are being drawn. (including VAT 20% - RUB 200.00). The winners are determined by random sampling using a computer program. According to tax accounting data, the amount of expenses for holding prize draws does not exceed 1% of sales revenue for the current reporting period. |

It is also convenient to reflect the transfer of prizes using the Gratuitous Transfer document. The procedure for filling out the Products tab is similar to the procedure described in Example 1. Since prizes are given to an indefinite number of people, the Recipient field also does not need to be filled out.

On the Cost account tab in the Cost account field, you should independently set the required account (for example, account 44.01 “Distribution costs in organizations engaged in trading activities” with the expense type Advertising expenses (standardized)).

According to the Ministry of Finance of Russia and the Federal Tax Service of Russia, expenses in the form of VAT amounts paid by an organization when distributing advertising products free of charge cannot be taken into account when calculating income tax (letter of the Ministry of Finance of Russia dated March 11, 2010 No. 03-03-06/1/123, dated November 20, 2006 No. 02-1-07/92). This conclusion can be extended to the transfer of prizes to the winners of a drawing held as part of an advertising campaign. Therefore, in the VAT Account field, you should leave account 91.02, which is offered by the program by default (Fig. 3).

Rice. 3. Cost accounts for the transfer of prizes as part of an advertising campaign

After posting the Gratuitous Transfer document, the following accounting register entries are generated:

Debit 44.01 Credit 41.01 - for the cost of prizes (10,000 rubles). Debit 91.02 Credit 68.02 - for the amount of accrued VAT (2,000 rubles).

For tax accounting purposes for income tax, amounts are entered into special resources of the accounting register:

Amount Dt NU 44.01 and Amount Kt NU 41.01 - for the cost of prizes (10,000 rubles). Amount Dt PR 91.02 - for a constant difference (2,000 rubles).

In the month of transfer of prizes, after completion of the month-closing processing and completion of the regulatory operation Calculation of deferred tax according to PBU 18, a constant tax expense will be recognized:

Debit 99.02.3 Credit 68.04.2 - in the amount of 400 rubles. (RUB 2,000 x 20%).

The settlement certificate or summary invoice issued upon transfer of prizes will be recorded in the sales book with the transaction type code “10”. The cost of the prizes issued will be included in indirect expenses, which are reflected in the income tax return on line 040 of Appendix No. 2 to Sheet 02.

In the statement of financial results, the cost of prizes is reflected in line 2210 “Business expenses”, and the amount of accrued VAT is reflected in line 2350 “Other expenses”.

| 1C:ITS For information on how to reflect the accrual of VAT for advertising distribution of goods, see the reference book “Accounting for Value Added Tax” in the “Accounting and Tax Accounting” section. |

Early termination of a free use agreement

The lender has the right to demand termination of the agreement for gratuitous use unilaterally in the following cases:

- use by the borrower of state property for purposes other than those specified in the agreement;

- failure by the borrower to fulfill obligations to maintain the property and maintain it in proper condition;

- transfer by the borrower of property received under the right of gratuitous use to a third party without the consent of the lender;

- significant deterioration in the condition of the property due to use by the borrower.

In turn, the borrower also has the right to terminate the agreement for gratuitous use unilaterally. The reason for this could be:

- the fact of discovery of deficiencies that do not allow the property to be used fully for its intended purpose, and about which the borrower was not informed at the time of concluding the agreement;

- impossibility of using the property, as the subject of the agreement, for its intended purpose due to circumstances that have arisen for which the borrower is not responsible;

- the fact that third parties have rights to this property, about which the borrower was not warned when concluding the agreement;

- failure by the lender to fulfill the terms of the gratuitous use agreement for the transfer of property and related documents, according to the acceptance certificate to the borrower.

Reflection of the donation of goods to charity

Charitable activity is considered to be the voluntary activity of citizens and legal entities for the disinterested (free of charge or on preferential terms) transfer of property (including funds) to citizens or legal entities, the disinterested performance of work, the provision of services, and the provision of other support (Article 1 of the Federal Law of 11.08 .1995 No. 135-FZ “On charitable activities and volunteering (volunteering)”). Charitable activities do not mean sending funds or providing assistance in other forms to commercial organizations, political parties, movements, groups (Clause 2, Article 3 of Federal Law No. 135-FZ of August 11, 1995).

The transfer of goods (performance of work, provision of services) within the framework of charitable activities is exempt from VAT in accordance with subparagraph 12 of paragraph 3 of Article 149 of the Tax Code of the Russian Federation. The list of documents confirming the charitable purposes of the gratuitous transfer is not established by law. The Ministry of Finance recommends providing the following documents to confirm the benefit:

- agreement on the provision of charitable assistance with reference to Federal Law dated August 11, 1995 No. 135-FZ;

- an act or other document on the acceptance of property (work, services), signed by the recipient of charitable assistance;

- an act or other document on the intended use of goods (work, services) received (accepted) within the framework of charitable activities.

Amounts of VAT that were previously lawfully accepted for deduction when purchasing goods that were later transferred for charitable purposes are subject to restoration in connection with the use of these goods in activities that are not subject to VAT (clause 2, clause 3, article 170 of the Tax Code of the Russian Federation). For the amount of tax to be restored, an invoice is registered in the sales book, on the basis of which VAT was accepted for deduction (clause 14 of the Rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

In general, amounts of recovered VAT are taken into account as part of other expenses in accordance with Article 264 of the Tax Code of the Russian Federation. But since the restoration of VAT in this case is not related to production and sales, expenses in the amount of the restored VAT are not taken into account for profit tax purposes on the basis of paragraph 16 of Article 270 of the Tax Code of the Russian Federation. The taxpayer has the right to refuse VAT exemption when transferring goods to charity by submitting a corresponding application to the tax authority no later than the first day of the quarter from which he intends to refuse the exemption. At the same time, refusal of VAT exemption for a period of less than one year is not allowed (clause 5 of Article 149 of the Tax Code of the Russian Federation).

Let's look at how “1C: Accounting 8” (rev. 3.0) reflects the restoration of input VAT on property transferred for charitable purposes.

Transfer of property from the founder free of charge

Very often, property is transferred to a budget organization from its founder.

In order for the transfer to take place, the founder draws up a notice. Its form is regulated by order No. 173n. Based on the available primary documents, the recipient fills out his part of the notice and sends it back.

Property received free of charge must be accounted for at book value, taking into account depreciation.

Let's give an example. The founder donated 20 pairs of roller skis to the budgetary institution. They were registered in the amount of 180,000 rubles, and an entry was drawn up D 1 101 36 310 K 1 401 10 190.

In the event of such a transfer, there is no obligation to pay VAT.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Agreement for the free use of property 1”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Agreement for the free use of property 1” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

Accounting for the consumption (issue) of materials into production. Accounting entries

The release of materials into production means their release from the organization's warehouse (shops) directly for the manufacture of products (performance of work, provision of services), as well as the consumption of materials for the management needs of the organization.

The release of materials to the warehouses of departments (shops) of the organization and to construction sites is considered as internal movement.

As materials are released from the warehouses of departments (shops) to workplaces, they are written off from the material asset accounts and credited to the corresponding production cost accounts. The cost of materials released for management needs is charged to the appropriate accounts for accounting for these expenses.

The primary accounting documents for the release (consumption) of materials from the organization's warehouses to the organization's divisions (shops) are a limit-fetch card (standard interindustry form N M-8), a demand invoice (standard interindustry form N M-11), an invoice (standard interindustry form form N M-15).

Accounting for the sale of materials. Accounting entries

When an organization sells materials to individuals and legal entities, the sales price is determined by agreement of the parties (seller and buyer). The calculation and payment of taxes is carried out by the organization in the manner prescribed by current legislation.

The sale of materials is formalized by issuing an invoice for the release of materials to the third party, on the basis of contracts or other documents and an invoice. When transporting goods by road, a consignment note is issued.

The following are accounting entries reflecting the sale of materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Sale of materials with payment after shipment (transfer) | ||||

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 90.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials (amount including VAT) | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT on materials sold is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 51 | 62.01 | The fact of repayment of the buyer’s debt for previously shipped materials is reflected. | Selling cost of materials | Bank statementPayment order |

| Sale of materials on prepayment | ||||

| 51 | 62.02 | The buyer's prepayment for materials is reflected | Advance payment amount | Bank statementPayment order |

| 76.AB | 68.2 | VAT is charged on advance payment | VAT amount | Payment orderInvoiceSales book |

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 91.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials. Value with VAT | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged on materials sold | VAT amount | Invoice (TMF No. M-15) Invoice |

| 62.01 | 62.02 | The previously received prepayment is offset against the debt for the transferred materials. | Advance payment amount | Accounting certificate-calculation |

| 68.2 | 76.AB | VAT is credited from the prepaid payment | VAT amount | InvoicePurchase book |