What is a transaction passport

Over the past few years, the currency control procedure has become increasingly strict. With the increase in the flow of funds that flow abroad, the Central Bank is trying to somehow stabilize this process and establishes its own conditions for transactions between residents and non-residents of Russia.

The transaction passport and currency control are directly related. In order to track the legality of transactions performed, you need some kind of document. And this document is precisely the transaction passport.

A transaction passport is a currency control document that contains a set of information about a transaction made by a resident of the Russian Federation with a person located abroad.

What types of passports are there?

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting of foreign trade activities and ruble transactions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

Passports for export and import transactions were distinguished. An export passport was issued to the exporter and obligated the bank to monitor compliance with the terms of the foreign contract, including payment terms.

An import passport was issued to the importer - the one who imports goods into the territory of the Russian Federation. Such a passport allowed the bank to control the validity of cash settlements with foreign suppliers.

Why does a bank need a currency control transaction passport?

Any credit organization performs the functions of a currency agent. This means that the bank is entrusted with not only the functions of receiving and transferring funds between clients, but also control (whether the money was received legally, whether this transfer abroad is illegal).

The bank carries out several actions with your transaction passport:

- Checks the contract (whether it complies with the legislation of the Russian Federation).

- Looks at how much money was transferred abroad.

- Checks whether the amount of funds corresponds to the quantity of goods that were imported through customs.

In 2015, there was an active discussion between representatives of small and medium-sized businesses, as well as technical support from banks. And the main topic was tightened foreign exchange controls. Credit institutions decided to take on too much and pointed out to entrepreneurs that prices for goods were too high or too low, and therefore refused to carry out transactions. This most often concerned the IT industry, in which it is quite difficult to verify the value of a product.

In 2017, the situation more or less returned to normal. Banks already understand that losing customers due to some kind of speculation no longer makes sense. Therefore, although the currency control procedure has remained quite strict, there is now a great chance of conducting transactions with foreign partners.

Also read: Currency current account: differences from a simple current account, tariffs of the TOP 10 banks + types of foreign exchange transactions

Foreign currency credited - submit documents

When crediting foreign currency to the transit currency account of a company, the resident must submit documents related to the transactions to the authorized bank no later than 15 business days after the date of its crediting, specified in the notification of the authorized bank about the crediting.

Exceptions

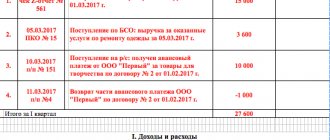

A resident must not submit documents to the authorized bank when carrying out transactions in foreign currency in the following cases (clauses 2.6 and 2.7 of the Instructions):

- recovery of funds from a resident in accordance with the legislation of the Russian Federation;

- acceptance, including acceptance given in advance, between the resident and the authorized bank;

- on transactions between a resident and an authorized bank in which the resident has a current account in foreign currency;

- when a resident writes off foreign currency from his current account and to his current account, to his deposit account...;

- when a resident writes off foreign currency from his current account in favor of a non-resident individual - pensions, compensation, benefits;

- debiting foreign currency using a bank card;

- settlements under a letter of credit, except in cases (Chapter 14 of the Instructions);

- contracts for which the amount of obligations in ruble equivalent is equal to or less than 200 thousand Russian rubles. rub . The obligations under the concluded contract cannot be divided into several payments in the amount of less than 200 thousand rubles. and do not submit anything to the bank. In this case, it is not the amount of a specific transaction that is taken into account, but the total amount of the contract.

Is it possible to do without a transaction passport?

There are a number of situations when you can safely do without the currency control procedure. It is possible to conclude an agreement with a non-resident without a transaction passport in the cases provided for by 173-FZ.

Let's see in what cases it is not necessary to issue a PS:

- The transaction was concluded with an individual abroad.

- If you make a deal with your lender.

- If you are signing a loan for less than $5,000.

- If the contract amount is less than $50,000.

Registration of a PS in 2021 is based on an amount exceeding $50,000.

If you want to export goods without a transaction passport, you will have to enter into contracts worth less than $50,000. But it should be taken into account that this is not the amount of one contract, but all that were concluded with the organization during the reporting period - 1 year.

That is, to issue a transaction passport, your agreement must be:

- With a legal entity abroad.

- In the amount of more than 50,000 rubles.

- Loan agreement for a minimum amount of $5,000.

How to correctly determine the volume of obligations for a PS

As noted above, the contract amount for registration of a PS must be at least 50,000 US dollars in foreign currency equivalent. To understand whether the limit has been exceeded or not, there are certain rules.

1. Date for rate recalculation (according to foreign currency conversion rates against the ruble established by the Bank of Russia [hereinafter referred to as BR]):

- date of signing the contract at its initial conclusion;

- date of signing (entry into force) of the latest changes to the contract, if any.

2. Nuances of choosing a rate: if the contract foreign exchange rate is not established by the BR, the recalculation must be made at the foreign exchange rate established in another way recommended by the BR.

3. When determining the final amount, the total amount of contractual obligations should not include:

- penalties (forfeits, fines, penalties), which may appear in the conditions;

- the amount of taxes, commissions and other similar payments that each party will have to pay during the execution of the contract.

4. When determining the final amount, the scope of contractual obligations includes:

- for agency transactions - the agent’s remuneration (regardless of the method of repayment) and other funds that can be received by the agent under the terms of the transaction (reimbursable expenses, funds transferred by the agent to the principal);

- for loan contracts - the amount of the principal debt.

Where is it more profitable to issue a transaction passport?

The most interesting conditions for processing currency transactions and transaction passports are offered by:

- Bank Point.

- Tinkoff Bank.

- Modulbank.

- Vesta.

Let's talk about each of them in more detail.

Tochka Bank provides a wide range of services for entrepreneurs. As for currency control, Tochka does not stop at simply issuing transaction passports. The bank itself checks the legality of the transaction even before it has been completed, notifies the company of the necessary documents, and carries out the transaction itself. The point really does not control, but helps entrepreneurs make currency transactions.

Tinkoff, unlike the same Point, actually plays the role of a supervisory authority. Registration of a transaction passport takes place within the framework of the tariff for small businesses. That is, if you are serviced by this bank, then other operations will not cost you anything.

The cost of Modulbank's services is quite high. But this is justified by the work they do - in most cases, the credit institution itself will collect all the necessary documents, notify the client of what is required of him, and begin the verification. For the client, working with the bank is quite simple - from submitting an application to open an account to receiving money for the operation, it takes 1-2 hours.

The last one on our list is Vesta Bank. This credit institution is good not so much because it processes currency control transactions free of charge and in the shortest possible time, but rather because of the conditions it provides for currency transactions in general.

The transaction passport is issued free of charge within one day. The bank itself will notify the client about what documents he needs to provide and within what time frame.

As you can see, all banks act not so much as a supervisory authority that monitors the legality of foreign exchange transactions, but rather as an assistant who does their best to facilitate the conduct of foreign exchange transactions for their clients.

There are two more banks that cannot be ignored - Sberbank and Alfa. They are quite popular, but there are still pitfalls in working with them.

Tinkoff's direct competitor, Alfa-Bank, also carries out currency control and issues a transaction passport. The conditions are almost the same, but there is a little more bureaucracy. Sometimes you have to prove to technical support and bank employees that your transactions were carried out legally and this is not money laundering.

In 2021, Sberbank issues transaction passports much less frequently. This is due to the fact that banks, in which the state is involved, are trying to increasingly control the input/output of foreign currency into the country. And that is why many clients may be denied surgery without explanation.

Instructions of the Central Bank of Russia regarding currency regulation

In essence, this is a kind of synthesis of the previously existing Instruction (2004) and the Regulations of our Central Bank (2004) regarding the issue under consideration. In the resulting version, the procedure for registration and transfer of documents by exporters to a specially authorized bank is significantly simplified.

The innovations that occurred in 2012 also affected the transaction passport. The instructions of the Central Bank of Russia contain a number of changes regarding the form and procedure for filling it out. Also, adjustments were made to some certificates (on currency transactions, supporting documents), the codes of transactions carried out with currency, the mechanism of interaction between the authorized financial institution and the resident were revised.

Just as in the previously valid Instructions, a specially authorized bank appoints a responsible employee who has the right to carry out a number of actions on behalf of this financial institution as a currency control agent, including endorsement of documents, certification of them with the appropriate seal used directly for these purposes.

Documents for currency control sent by the bank to a resident in paper form must be signed by the person responsible for this and then certified with the appropriate seal on all pages. If they are sent electronically, then the electronic signature of the designated responsible person (another bank employee) who has such right must be present everywhere.

In other words, the new Instruction assumes the possibility of a complete transition to exclusively electronic document flow carried out between an authorized financial institution and a resident (exporter). This significantly speeds up and simplifies the process of obtaining currency control documents for bank clients. This is especially important for those participants in foreign trade activities who are located quite far from a specially authorized bank.

Also, another important point that simplifies document flow is the emerging opportunity for a resident to grant, by proxy, the right to sign all documents of another entity that did not have the authority of the 1st or 2nd signature displayed in the corresponding card.

An important distinguishing feature of the new version of the Instruction from the previous one is a broader sphere of influence: in addition to residents acting as legal entities (not including credit organizations, state corporation Vnesheconombank) and individuals - individual entrepreneurs, also on individuals who are engaged in private practice as defined by our legislation ok.

In other words, if the last of the above enter into a contract (foreign trade) on their own behalf, the amount of which exceeds 50 thousand US dollars, then they are required to open a transaction passport (currency control is carried out under the same conditions as before).

The new Instruction provided an opportunity for those residents who have separate branches to make payments directly from the branches’ accounts, provided they are all located in the same specially authorized bank. The resident can now, in accordance with this document, delegate the existing responsibility regarding the execution of the transaction passport to its branches.

How to obtain a currency transaction passport

The client can issue a transaction passport for currency control as follows:

- A resident who knows how to make a transaction passport independently provides the bank with a ready-made form.

- Through remote banking applications.

- Entering your data into the prepared form on the credit institution’s website.

- Bank employees fill out the document for the client.

In order to correctly fill out bank documents, you need a sample and all the details that are used in this document. Let's go over what to fill out and how to fill it out.

In the first section, you fill out general information: name of the bank, company, contract date, state registration number, date of entry into the register of legal entities and other general information about the company and bank.

The second section contains information about non-residents with whom the contract was concluded. You will need the name of the company and information about its location and type of activity. If there are several non-residents, data for each is indicated.

The third section is information about the contract. There you must enter the contract number, the deadline for its execution and the amount.

Sections 4, 5 and 7 are filled out by the credit institution independently after it receives the document.

Entering data into the PS: section 2

Section 2 “Details of a non-resident (non-residents)” is filled out as follows:

- In gr. 1 indicates the name of the non-resident who is a party to the contract: In gr. 2 and gr. 3 in accordance with the All-Russian Classifier of Countries of the World (OKSM) the following are indicated:

- for a foreign legal entity - the name and digital code of the country of its location;

- for a foreign individual - the name and digital code of the country of his place of residence;

- for branches and similar structural divisions of a foreign legal entity located in the Russian Federation, the code of the country of location of the legal entity itself is taken. If the foreigner's country is unknown, in gr. 3 indicates code 997;

- for interstate and intergovernmental organizations, their branches and representative offices in the Russian Federation in gr. 3 indicates code 998.

IMPORTANT: if the country of location of the foreign person is not indicated in the contract (loan agreement), in gr. 3 for individuals the code 999 is entered, for legal entities the name and country code are entered, which the legal entity must inform the counterparty in writing.

In cases of presence in gr. 3 codes 997, 998 or 999 gr. 2 remains empty.

- If the parties to the contract are several non-residents, section 2 indicates information about each of them.

Registration deadlines

As for the timing of registration, the organization is obliged to provide the bank with the necessary documents to issue a transaction passport:

- Within 15 days after the goods are cleared from customs;

- Within 15 days from the end of the month in which documents confirming the removal of goods from customs were issued.

Essentially, you have 15 days during which you need to provide the bank with all the documents to complete the currency control transaction.

What has changed: registration of foreign economic contracts

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting of foreign trade activities and ruble transactions, taxes, automatic salary calculation and reporting in one service Get free access for 14 days

As of March 1, 2021, the transaction passport has been canceled, but currency controls remain. Now, instead of a transaction passport, registration of a foreign economic contract is required. The basis for this innovation is Bank of Russia Instruction No. 181-I dated August 16, 2021.

The registration procedure is as follows. The foreign contract and details of the foreign partner are provided to the bank. If other documents are required, employees of the bank where the contract is registered will inform you. Then, within 1 day, the contract is accepted for accounting.

The amount at which contracts need to be registered depends on the type of transaction:

- for export transactions, contracts from 6 million rubles inclusive are subject to registration;

- for import contracts and loan agreements - from 3 million rubles inclusive;

- contracts with smaller amounts do not need to be registered.

The bank has the right to request documents for foreign trade transactions, even if the contract for them does not need to be registered. Only if the amount of the contract with a foreign partner is less than 200 thousand rubles, then there is no need to submit documents.

Important! Not only foreign currency transactions are subject to exchange control. For example, even if you paid a foreign supplier in rubles, this is also a foreign exchange transaction. Simply in the currency of the Russian Federation. Such an agreement is subject to registration with the bank if it exceeds the established limits.

If the bank refuses to issue a transaction passport

Just a couple of years ago, refusals to issue a transaction passport were common. Let's see how things stand now. What can they refuse for and is it possible to do something about it?

First, about the official reasons for the refusal:

- Inconsistency between the data in the transaction passport and the contract. That is, if you write in your passport an amount of $100,000, but the contract says $200, then the bank has every right to refuse you.

- If there are errors in the execution of the transaction passport.

- If there are not enough documents.

Once these official reasons are resolved, you can resubmit the documents to the bank and they will be required to accept the document.

And the bank also has one reason, which is quite controversial - “Carrying out an operation that does not make economic sense.” That is, bank employees assume that some operation of the company will not bring it profit due to the inflated price of the product, low cost, or something similar. And this is a completely official reason why the bank may refuse to carry out a transaction.

Now credit institutions use this reason less often, but if the bank refused you for this reason, it is almost impossible to achieve a positive decision. You will need to look for another credit institution that will carry out the operation.

Results

Registration of a PS is a mandatory action when a resident of the Russian Federation concludes transactions that are foreign trade. When concluding a transaction and preparing to carry out bank settlements on it, a resident must either make sure that this transaction is subject to an exemption from the execution of a transaction agreement, or report the transaction to his bank and begin processing the transaction agreement.

In addition, it should be taken into account that the PS must be drawn up not only in cases of the initial conclusion of a contract, but also when assigning rights and obligations under a foreign trade contract, if such an assignment occurs between two residents of the Russian Federation.

It is also necessary to re-register the PS in cases where a resident party to a foreign exchange contract moves from bank to bank for various reasons. A new bank opens a new PS.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Closing the transaction passport

Closing of the transaction passport for currency control occurs in the following cases:

- The client is transferred to another bank for service.

- The client closed all bank accounts.

- All obligations that were specified in the contract were fulfilled.

- The reasons for obtaining a passport have exhausted themselves. The main example is making adjustments to the contract and reducing the amount from 51 thousand to 49.

- When the right to claim a debt is transferred from one legal entity to another.

- The obligations under the contract were terminated (break of contract).

When closing a transaction passport, you can submit an application to the credit institution requesting closure and indicating the grounds. If you need to close several passports, then you can use one application. The credit institution will be obliged to check everything and, if it considers it justified, close them.

And also, the credit institution itself has the right to close the transaction passport after 180 days from its opening or when it considers that the obligations under the contract have been fulfilled.

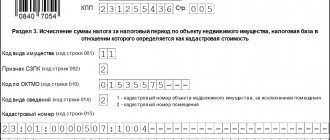

Entering data into the PS: section 3

In section 3 “General information about the contract” (form 1 PS) and subsection 3.1 “General information about the loan agreement” (form 2 PS, sheet 1) the following is entered:

- In gr. 1 — contract number. If there is no number, enter “BN” in column 1.

- In gr. 2 in the format DD.MM.YYYY the latest date is entered: signing of the contract,

- its entry into force,

- its compilation (in the absence of two previous dates).

- In gr. 3 and 4 indicate the name and currency code of the contract, respectively (according to classifiers).

- In gr. 5 in the currency indicated in gr. 4, the amount of obligations stipulated by the contract under which the PS is drawn up is reflected. In this case: under the contract for receiving and issuing a loan, the amount excluding interest is indicated (the body of the loan or the principal debt);

- in the case when a resident draws up a new PS, while continuing to fulfill obligations under the same contract, the amount of unfulfilled obligations is reflected;

- if the contract defines the obligation in several currencies and the total equivalent in one of the currencies is not determined - in gr. 3 and 4, the resident indicates information about any of the currencies that appears in the contract, and in gr. 5 - the amount of the obligation, converted into the specified currency at the exchange rate as of the date given in gr. 2;

Why several currencies may appear in contracts, read: “Sample of a currency clause in a contract and its types.”

- if the contract does not contain data for filling out gr. 5, when registering a PS, it indicates: “BS”.

- In gr. 6 in the format DD.MM.YYYY indicates the end date of fulfillment of all obligations under the contract. At the same time, the resident can clarify it himself, based on the terms of the transaction and the nuances of business transactions known to him.

- In gr. 7 (form 2 PS, sheet 1) reflects the amount of funds that will be credited to the foreign accounts of the resident counterparty for transactions the essence of which is the provision of borrowed funds. In other cases, this column does not need to be filled out.

- In gr. 8 (form 2 PS, sheet 1) reflects the amount of foreign currency earnings (income) that will go to the foreign accounts of the resident counterparty under contracts for the provision of borrowed funds. In other cases, this column is not filled in.

- In gr. 9 (form 2 PS, sheet 1) indicates one of the codes for the deadline for fulfilling obligations under contracts for the provision of borrowed funds:

| Code | Execution deadline: interval in days (inclusive) |

| 0 | up to 30 |

| 1 | 31–90 |

| 2 | 91–180 |

| 3 | 181–365 |

| Code | Execution period: interval in years (inclusive) |

| 4 | 1–3 |

| 6 | No deadline (on demand) |

| 7 | 3–5 |

| 8 | 5–10 |

| 9 | more than 10 |

- Subsection 3.2 “Information on the amount and terms of tranches under the loan agreement” is filled out if the terms of the transaction provide for transfers of funds in tranches: In gr. 1 and 2 indicate the name and code of the currency.

- In gr. 3 reflects the tranche amount (in the contract currency).

- In gr. 4 indicates the code for the deadline for completing the tranche in accordance with the table used when filling out gr. 9 subsection 3.1.

- In gr. 5 - expected date of receipt of the tranche.

- In other cases, subsection 3.2 remains blank.

Changes in 2021

Starting from 2021 (March), the rules on Central Bank passports have been abolished. Now the currency control procedure is carried out directly using the agreement itself.

It is he who is assigned a register number and its records are kept. With the help of this innovation, banks have significantly managed to relieve their paperwork.

If the total cost of the transaction does not exceed two hundred thousand rubles, then no documents need to be provided. In the event that there is a change in the terms of the contract in one part or another, the obligation to notify the bank about this remains.

About all the changes in the video:

List of documents for registration of the agreement

The Central Bank, as the main regulator of currency control activities, has not established a complete list of documents required for registration of an agreement. This is due to the fact that under different conditions and different counterparties, different acts may be required.

In general, these are applications for registration, acts confirming one or another condition of the agreement, annexes to the agreement, etc. By and large, the necessary documents include all those that the parties themselves wish to attach to be reflected in the register.

Sample of filling out the form

The form for the document initially has a paper form. It must indicate the following:

Document's name.- Its number and date of adoption.

- Information about counterparties (here we mean full name, TIN, OGRN, country code, etc.).

- Date and number of the agreement, its amount, indication of the currency.

- Information about the credit institution in which one of the counterparties has an account and which will subsequently become a party to currency control.

Each bank that assumes the functions of carrying out currency control has a form for filling out the PS, which is created on the basis of recommendations issued by the Central Bank of the Russian Federation.

How long does registration take?

It was previously noted that credit institutions were given up to three working days to complete the passport registration procedure. In the case of registration of a contract, these time frames are significantly reduced. Thus, it takes no more than one working day to register an agreement. Moreover, this working day is necessary to assign an identification number, which will be unique.

Over the next two business days after registration, the previous document was sent to the company. Now, due to the lack of passports, the company does not need to send response documentation, which has greatly simplified the activities of both banks and counterparties within the transaction.

Categories

Numerous changes in the legislation of the Russian Federation that have occurred in recent years, as well as the entry of the Russian Federation into the Customs Union, have led to the need to improve the legislation regulating the procedure for carrying out foreign exchange transactions. As a result, instead of Bank of Russia Instruction No. 117-I dated June 15, 2004 “On the procedure for residents and non-residents to submit documents and information to authorized banks when carrying out currency transactions, the procedure for authorized banks to record foreign exchange transactions and prepare transaction passports” (hereinafter referred to as Instruction No. 117-I ) Instruction of the Bank of Russia dated June 4, 2012 No. 138-I was adopted “On the procedure for the submission by residents and non-residents of documents and information related to the conduct of currency transactions to authorized banks, the procedure for issuing transaction passports, as well as the procedure for authorized banks to record currency transactions and control over them carrying out" (hereinafter referred to as Instruction No. 138-I), which came into force on October 1, 2012. In this publication, we will consider in more detail the main provisions of the newly published document concerning the procedure for issuing transaction passports by banks.

General provisions

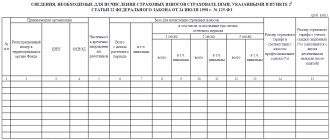

What is a transaction passport? The answer to this question is found in Art. 20 of the Federal Law of December 10, 2003 No. 173-FZ (as amended on December 6, 2011) “On Currency Regulation and Currency Control” (hereinafter referred to as Federal Law No. 173-FZ). In general, a transaction passport is a document that contains information necessary for the purposes of ensuring accounting and reporting and implementing currency control on currency transactions between residents and non-residents. It states:

1) number and date of registration of the transaction passport;

2) information about the resident and his foreign counterparty;

3) general information about the foreign trade transaction (date of the agreement, contract number (if any), total amount of the transaction (if any) and currency of the transaction price, date of completion of fulfillment of obligations under the transaction);

4) information about the authorized bank in which the transaction passport is issued and through the accounts in which settlements for the transaction are carried out;

5) information about re-registration and the grounds for closing the transaction passport.

The procedure for issuing a transaction passport is regulated by the Central Bank of the Russian Federation. In particular, Instruction No. 138-I changed the form of the transaction passport, which was previously determined by Instruction No. 117-I, and also slightly changed the procedure for filling it out and submitting it to the bank. As a result of such changes, the transaction passport is drawn up in the authorized bank on one sheet (with the exception of loan agreements that simultaneously contain elements of both a contract and a loan agreement, when the transaction passport is drawn up on two sheets: in Form 1 and in Form 2).

In accordance with sub. 6.6 Instructions No. 138-I to prepare a transaction passport, the resident simultaneously submits the following documents and information to the authorized bank:

- one copy of the transaction passport (in Form 1 and (or) in Form 2), filled out in the order given in Appendix 4 to Instruction No. 138;

- a contract (loan agreement) or an extract from such a contract (loan agreement) containing the information necessary to issue a transaction passport;

- other documents and information, including documents and information that contain information (including information determined (calculated) by the resident independently) specified by the resident in the completed transaction passport form, including information on the amount of debt on the principal debt under the loan agreement (if its availability on the date preceding the date of registration of the transaction passport).

Foreign trade transactions requiring the preparation of transaction passports

In what situations should a transaction passport be issued? According to sub. 6.1 of Instruction No. 138-I, the need to register transaction passports in authorized banks (which means the bank itself or its branch) arises for residents who are a party to the contract (loan agreement) specified in Chapter. 5 Instructions No. 138-I. In turn, in Sect. 5 of Instruction No. 138-I determines that its requirements apply to contracts, agreements, preliminary agreements, proposals for the conclusion of such contracts (agreements), containing all the essential terms of the agreement (offer, public offer), concluded between residents and non-residents, draft agreements ( contracts, agreements) that provide for the implementation of foreign exchange transactions related to settlements through resident accounts opened with authorized banks and (or) through resident accounts opened with non-resident banks (hereinafter referred to as agreements):

- agreements, including agency agreements, commission agreements, agency agreements, providing for the export from the territory of the Russian Federation or the import into the territory of the Russian Federation of goods, with the exception of the export (import) of securities in documentary form (hereinafter referred to as the contract);

- contracts providing for the sale (purchase) and (or) provision of services related to the sale (purchase) on the territory of the Russian Federation (outside the territory of the Russian Federation) of fuels and lubricants (bunker fuel), food, inventories and other goods (with the exception of spare parts and equipment) necessary to ensure the operation and maintenance of vehicles, regardless of their type and purpose along the route or at intermediate stops or parking points (hereinafter referred to as the contract);

- agreements, including agency agreements, commission agreements, commission agreements, with the exception of the agreements specified in subparagraph. 5.1.1, 5.1.2 and 5.1.4 clause 5 of Instruction No. 138-I, providing for the performance of work, provision of services, transfer of information and results of intellectual activity, including exclusive rights to them (hereinafter referred to as the contract);

- agreements providing for the transfer of real estate under a lease agreement, financial lease (leasing) agreements (hereinafter referred to as the contract);

- agreements the subject of which is the receipt or provision of funds in the form of a credit (loan), the return of funds under a credit agreement (loan agreement), as well as the implementation of other currency transactions related to the receipt, provision, return of funds in the form of a credit (loan) (with the exception of agreements (contracts (agreements) recognized by the legislation of the Russian Federation as a type of loan or equivalent to a loan) (hereinafter referred to as the loan agreement).

It is obvious that the newly issued document, in contrast to Instruction No. 117-I, has significantly expanded the cases when a transaction passport must be issued, including transactions related to the implementation of agency agreements (commission agreements, guarantees), sales (acquisitions) on the territory of the Russian Federation or abroad territory of fuels and lubricants (bunker fuel), food, material and technical supplies and other goods necessary for the operation and maintenance of vehicles, with the transfer of real estate under a lease agreement, financial lease (leasing), etc. This is due to the need tightening control over foreign exchange transactions in order to minimize the risks of implementing “gray” schemes for exporting currency from the country.

Let's consider some issues related to the preparation of transaction passports.

Question: A Russian organization purchased wheat seeds worth $60,000 from a Kazakh company. Payment for the delivered goods will be made in Russian rubles. Due to the fact that Kazakhstan is a member of the Customs Union, is it necessary in this situation for a Russian organization to issue a transaction passport at the bank servicing the account?

Answer: In accordance with clause 5 and sub. 6.1 clause 6 of Instruction No. 138-I, the obligation to prepare transaction passports lies with a resident who is a party to a contract (loan agreement) concluded with a non-resident, provided that the contract provides for the implementation of currency transactions related to settlements through the resident’s account opened in bank and providing for the import of goods into the territory of the Russian Federation when carrying out foreign trade activities.

In accordance with Art. 1 of Federal Law No. 173-FZ, residents, in particular, are understood to be legal entities created in accordance with the legislation of the Russian Federation, and non-residents are legal entities created in accordance with the legislation of foreign states and located outside the territory of the Russian Federation. The same law establishes that currency transactions include the use of Russian currency as a means of payment. Authorized banks in Federal Law No. 173-FZ mean credit organizations created in accordance with the legislation of the Russian Federation and having the right, on the basis of licenses from the Central Bank of the Russian Federation, to carry out banking operations with funds in foreign currency, as well as branches operating on the territory of the Russian Federation in accordance with licenses from the Central Bank of the Russian Federation credit institutions created in accordance with the legislation of foreign states that have the right to carry out banking operations with funds in foreign currency.

Considering that:

1) the Russian organization is a resident, and the Kazakh company is a non-resident;

2) the contract provides for payment for the supplied seed in Russian rubles from the resident’s account opened with an authorized bank;

3) the contract provides for the import of goods into the territory of the Russian Federation,

In this situation, the Russian organization is obliged to issue a transaction passport.

Question: A Russian organization entered into an agreement with a Lithuanian company providing for the supply of metal products to Lithuania. The agreement provides for the following payment procedure for the delivered goods: the Lithuanian party provides services to the Russian organization for the repair, refueling and maintenance of its vehicles on the territory of the Republic of Lithuania for 1 calendar year, and also makes payment for the delivered goods in the amount of 80,000 euros to the account of the Russian organization in authorized bank. Does a Russian organization need to obtain a transaction passport from a bank?

Answer: In accordance with sub. 3 tbsp. 2 of the Federal Law of December 8, 2003 No. 164-FZ (as amended on July 28, 2012) “On the fundamentals of state regulation of foreign trade activities”, a foreign trade barter transaction is understood as a transaction made in the implementation of foreign trade activities and involving the exchange of goods, services, works, intellectual property property, including a transaction that, along with the specified exchange, provides for the use of cash and (or) other means of payment in its implementation. Consequently, the transaction in question falls within the definition of a foreign trade barter transaction.

The need to provide transaction passports and certificates of currency transactions to authorized banks is regulated by Instruction No. 138-I. Chapters 5 and 6 of this Instruction do not provide for the need to issue transaction passports for barter transactions.

Based on the above, a Russian organization does not need to obtain a transaction passport from an authorized bank.

Question: Is it possible to conclude an agreement with the servicing bank in such a way as to delegate to it the rights to fill out the transaction passport?

Answer: Subclause 6.3 of clause 6 of Instruction No. 138-I determines that a resident, on the basis of an agreement concluded with an authorized bank, can grant the authorized bank, in which he will carry out currency transactions related to settlements under a contract (loan agreement), the right to fill out transaction passport on the basis of documents and information submitted by the resident within the established time frame, which contain all the necessary information to be reflected in the transaction passport.

In this case, the resident, along with the documents and information that is necessary for the authorized bank to issue a transaction passport, submits to the authorized bank an application for the execution of a transaction passport, drawn up in a form agreed upon by the authorized bank with the resident.

Question: A Russian organization manufactured and sold promotional products to a branch of a Kazakh organization located in Russia, costing 60,000 euros. The product is subject to distribution in the Russian Federation. Does a Russian organization need to obtain a transaction passport from an authorized bank?

Answer: In accordance with sub. 6.1 clause 6 of Instruction No. 138-I, a resident who is a party to the contract (loan agreement) specified in Chapter. 5 of this Instruction, draws up a transaction passport at the authorized bank.

According to sub. 5.1 clause 5 of Instruction No. 138-I, its requirements apply to agreements concluded between residents and non-residents, which provide for the implementation of foreign exchange transactions related to settlements through residents' accounts opened with authorized banks and (or) through residents' accounts opened with banks - non-residents and providing for the export from the territory of the Russian Federation or the import into the territory of the Russian Federation of goods when carrying out foreign trade activities.

Due to the fact that in the situation under consideration there is no fact of export of goods from the territory of the Russian Federation or their import into the territory of the Russian Federation, there is no need to issue a transaction passport.

As in Instruction No. 117-I, Instruction No. 138-I retains the rule according to which the issuance of a transaction passport for transactions of insignificant value is not required. Thus, a transaction passport is not issued for contracts (loan agreements), the amount of obligations for which does not exceed the equivalent of 50 thousand dollars at the official exchange rate of foreign currencies in relation to the ruble established by the Bank of Russia on the date of conclusion of the contract (loan agreement), in the case if the exchange rate of foreign currencies against the ruble is not set by the Bank of Russia - at the rate of foreign currencies established in a different way recommended by the Bank of Russia (hereinafter referred to as the exchange rate of foreign currencies against the ruble), or in the event of a change in the amount of obligations under the contract (loan agreement) by the date of conclusion of the last changes (additions) to the contract (loan agreement) providing for such changes.

Deadlines for processing transaction passports

Instruction No. 138-I more clearly defined the deadlines for submitting transaction passports to banks. Yes, sub. 6.5 clause 6 of Instruction No. 138-I it is established that for registration with an authorized bank, a resident submits a completed PS form, documents and information on the basis of which the specified form is filled out, depending on which of the following fulfillment of obligations under the contract (loan agreement ) will begin earlier, including the period for their verification by the authorized bank, established by sub. 6.7, 6.11 clause 6 of Instruction No. 138-I, no later than the following deadlines:

- when crediting foreign currency or the currency of the Russian Federation under a contract (loan agreement) from a non-resident to a resident’s account opened in an authorized bank or in a non-resident bank - no later than the deadline established by Instruction No. 138-I for the resident to submit a certificate of currency transactions;

- when writing off foreign currency or the currency of the Russian Federation under a contract (loan agreement) in favor of a non-resident from a resident’s account opened in an authorized bank or in a non-resident bank - no later than the deadline established by Instruction No. 138-I for the resident to submit a certificate of currency transactions;

- when crediting foreign currency or the currency of the Russian Federation under a contract (loan agreement) from a non-resident to a resident’s account opened with an authorized bank or a non-resident bank, as well as when writing off foreign currency or the currency of the Russian Federation under a contract (loan agreement) in favor of a non-resident from a resident’s account opened in an authorized bank or in a non-resident bank in which the amount of obligations is not determined - no later than the deadline established by Instruction No. 138-I for the presentation by a resident of a certificate of foreign exchange transactions when carrying out that foreign exchange transaction, as a result of which the amount of settlements under the contract ( loan agreement) will exceed the equivalent of 50 thousand dollars at the exchange rate of foreign currencies against the ruble on the date of conclusion of the contract (loan agreement), or in the event of a change in the amount of obligations under the contract (loan agreement) on the date of conclusion of the latest changes (additions) to the contract (loan agreement) providing for such changes;

- when fulfilling obligations under a contract through the export from the territory of the Russian Federation or the import into the territory of the Russian Federation of goods, if there is a requirement in regulatory legal acts in the field of customs to declare goods to customs authorities - no later than the date of filing the customs declaration, determined in accordance with the Instructions on the registration procedure or refusal to register a declaration for goods approved by Decision of the Customs Union Commission dated May 20, 2010 No. 262 “On the procedure for registration, refusal to register a declaration for goods and registration of refusal to release goods” (hereinafter referred to as Instruction No. 262);

- when fulfilling obligations under a contract through the export from the territory of the Russian Federation or the import into the territory of the Russian Federation of goods in the absence of a requirement in regulatory legal acts in the field of customs to declare goods to customs authorities - no later than the deadline established by Instruction No. 138-I for the resident to submit a certificate confirming documents;

- when fulfilling obligations under a contract by performing work, providing services, transferring information and results of intellectual activity, including exclusive rights to them, no later than the deadline established by Instruction No. 138-I for the resident to submit a certificate of supporting documents;

- when fulfilling obligations under a contract (loan agreement) in a manner different from those specified in subparagraph. 6.5.1–6.5.6 clause 6, - no later than the deadline established by Instruction No. 138-I for the resident to submit a certificate of supporting documents.

Let's look at these provisions of Instruction No. 138-I using specific examples.

Question: An organization imports a vehicle worth 70,000 euros into the Russian Federation. Are the deadlines for obtaining a transaction passport violated if the transaction passport is issued by an organization after the release of equipment in accordance with the customs procedure for customs transit, but before its release in accordance with the customs procedure for release for domestic consumption?

Answer: According to sub. 6.2 clause 6 of Instruction No. 138-I, in order to obtain a transaction passport in an authorized bank, a resident submits a completed transaction passport form, documents and information on the basis of which the specified form is filled out, when fulfilling obligations under the contract by importing goods into the territory of the Russian Federation no later than the date of filing the customs clearance declaration determined in accordance with Instruction No. 262.

In accordance with Art. 180 of the Customs Code of the Customs Union (hereinafter referred to as the Customs Code of the Customs Union), a transit declaration, like a declaration for goods, falls under the category of a customs declaration. At the same time, Instruction No. 262 determines the procedure for registration (refusal of registration) of a declaration for goods and does not regulate the procedure for registration or refusal to register a transit declaration (they are regulated by a separate regulatory legal act).

Thus, the registration of a transaction passport in a bank after the release of a vehicle in accordance with the customs procedure for customs transit and before its release in accordance with the customs procedure of release for domestic consumption is not a violation of the deadlines for obtaining a transaction passport.

Question: A Russian organization entered into a purchase and sale agreement with a Belarusian company, providing for the supply of Belarusian dairy products to the Russian Federation. When should documents be submitted to register a transaction passport to the bank?

Answer: In accordance with sub. 6.5.5 clause 6 of Instruction No. 138-I, an organization, when fulfilling obligations under a contract by importing goods into the territory of the Russian Federation, if there is no requirement in the regulatory legal acts in the field of customs to declare goods to customs authorities, must submit documents to the authorized bank to register the transaction passport no later than the deadline established by Instruction No. 138-I for the resident to submit a certificate of supporting documents.

In accordance with Art. 179 of the CU TC, goods are subject to customs declaration when placed under a customs procedure or in other cases established in accordance with the CU TC. At the same time, customs legislation (including the Customs Code of the Customs Union) does not provide for the need to place Belarusian dairy products supplied to the Russian Federation under customs procedures and declare them.

Subclause 9.2 of clause 9 of Instruction No. 138-I determines that a certificate of supporting documents and supporting documents are submitted by a resident to the bank no later than 15 working days after the end of the month in which the supporting documents specified in subclause were issued. 9.1.2 clause 9 of Instruction No. 138-I. In particular, sub. 9.1.2 clause 9 of Instruction No. 138-I provides for the provision of the following supporting documents to the bank: transport (shipping, shipping documents), commercial documents, a statistical form for recording the movement of goods established by the Rules for maintaining statistics of mutual trade of the Russian Federation with member states of the Customs Union in within the framework of the EurAsEC, approved by Decree of the Government of the Russian Federation dated January 29, 2011 No. 40 (hereinafter referred to as the Rules), and (or) other documents containing information on the export of goods from the territory of the Russian Federation (shipment, transfer, delivery, movement) or the import of goods into the territory of the Russian Federation ( receipt, delivery, acceptance, movement), executed under a contract and (or) in accordance with business customs, including documents used by a resident to record his business transactions in accordance with accounting rules and business customs.

Thus, documents for registering a transaction passport in relation to dairy products supplied from Belarus to the Russian Federation should be submitted to the bank no later than 15 working days after the end of the month in which the supporting documents specified in subparagraph were issued. 9.1.2 clause 9 of Instruction No. 138-I.

In particular, clause 8 of the Rules establishes that the statistical form is submitted to the customs authority in the region of activity of which the applicant is registered with the tax authority in accordance with the legislation of the Russian Federation on taxes and fees, no later than the 10th day of the month following the month, in which the goods were shipped (received).

Therefore, if dairy products were imported in January 2013, the statistical form was submitted to the customs authority on 02/10/2013, then the transaction passport must be issued no later than 03/15/2013.

Refusal to issue transaction passports

As previously in Instruction No. 117-I, subp. 6.9 clause 6 of Instruction No. 138-I establishes cases when a bank refuses to accept a resident’s service contract (loan agreement) and issue a transaction passport for it. Such cases, in particular, include the following grounds:

- discrepancy between the data specified in the completed transaction passport form, the information and data contained in the contract (loan agreement) and (or) other documents, and information provided by the resident, including due to the lack of grounds for issuing a transaction passport in them ;

- if the transaction passport form is filled out in violation of the requirements established by Instruction No. 138-I;

- due to the resident’s failure to submit to the authorized bank the documents and information necessary to issue a transaction passport, including the submission of an incomplete set of documents and incomplete information.

Question: Does the bank have the right to refuse to issue a transaction passport in the event of late submission of documents for its execution?

Answer: This case is not provided as a basis for refusing to issue a transaction passport. Therefore, the bank has no right to refuse its registration. At the same time, the bank will send information about the untimely execution of the transaction passport to the Federal Service for Financial and Budgetary Supervision to consider the issue of bringing the organization to administrative liability under Art. 15.25 of the Code of the Russian Federation on Administrative Offences.

Closing transaction passports

Instruction No. 138-I, unlike Instruction No. 117-I, sets out in more detail the grounds for closing a transaction passport at the request of a resident. So, according to sub. 7.1 clause 7 of Instruction No. 138-I, the resident submits to the bank an application to close the transaction passport in the following cases:

- when transferring a transaction passport from a bank in connection with the transfer of a contract (loan agreement) for servicing to another authorized bank (to another branch of this authorized bank, from the head office to a branch of this authorized bank, from a branch to the head office of this authorized bank), and also when a resident closes all bank accounts;

- when the parties fulfill all obligations under the contract (loan agreement), including the fulfillment of obligations by a third party - a resident (another person - a resident);

- when a resident assigns a claim under a contract (loan agreement) to another resident person or when a resident transfers a debt under a contract (loan agreement) to another resident person;

- when a resident assigns a claim under a contract (loan agreement) to a non-resident;

- upon fulfillment (termination) of obligations under a contract (loan agreement) under others not specified in subparagraph. 7.1.2–7.1.4 clause 7 of Instruction No. 138-I on the grounds provided for by the legislation of the Russian Federation;

- upon termination of the grounds requiring, in accordance with Instruction No. 138-I, the execution of a transaction passport, including due to the introduction of appropriate changes and (or) additions to the contract (loan agreement), as well as in the event that the transaction passport was erroneously issued in the absence of contract (loan agreement) grounds requiring its execution.

Question: A Russian organization engaged in wholesale trade entered into an agreement with a Latvian company providing for the supply of seafood worth $60,000 to the Russian Federation. After supplying seafood worth $30,000, the Latvian company was declared bankrupt. Accordingly, products will no longer be supplied. In the situation under consideration, is it necessary for a Russian organization to contact the bank with an application to close the transaction passport?

Answer: In accordance with sub. 7.1.6 clause 7 of Instruction No. 138-I, the resident submits to the authorized bank an application to close the transaction passport in the event of termination of the grounds requiring, in accordance with Instruction No. 138-I, the execution of a transaction passport.

In accordance with sub. 6.1 clause 6 of Instruction No. 138-I, a resident who is a party to the contract (loan agreement) specified in Chapter. 5 of Instruction No. 138-I, draws up a transaction passport at the authorized bank. However, according to sub. 5.2 clause 5 of Instruction No. 138-I its norms do not apply to contracts where the amount of obligations does not exceed the equivalent of $50,000.

Thus, due to the fact that the grounds requiring, in accordance with Instruction No. 138-I, the execution of a transaction passport, have ceased, the Russian organization is obliged to apply to the authorized bank with an application to close the transaction passport.

In addition, it should be taken into account that in accordance with sub. 7.4 clause 7 of Instruction No. 138-I simultaneously with the application to close the transaction passport on the basis specified in subparagraph. 7.1.6 clause 7 of these Instructions, the resident submits to the authorized bank documents indicating the absence (cessation) of grounds requiring the issuance of a transaction passport (that is, a document confirming the fact of bankruptcy of the Latvian company).

Conclusion

This article discusses the main changes that occurred in the preparation of transaction passports in connection with the entry into force of Instruction No. 138-I. Practical situations that arise in the activities of organizations when carrying out foreign trade activities and when issuing transaction passports are considered. It is obvious that the changes that have occurred are aimed at further regulating the procedure for issuing transaction passports and ensuring transparency in foreign trade transactions.

Violation of the procedure for issuing transaction passports entails serious economic consequences for organizations. In particular, for violation of the established rules for issuing transaction passports, Part 6 of Art. 15.25 of the Code of the Russian Federation on Administrative Offenses provides for quite serious liability in the form of imposing an administrative fine on officials in the amount of 4 thousand to 5 thousand rubles; for legal entities - from 40 thousand to 50 thousand rubles.