For any reporting form, there are control ratios. That is, the values of a certain row must correspond to another row, the sum of the rows, be greater or less than some indicators, etc. Form 6-NDFL is no exception - there are also control ratios for it. 6-NDFL and 2-NDFL, 6-NDFL and RSV - tax authorities compare the indicators of these forms with each other. Any discrepancies will raise questions from the Federal Tax Service. To avoid claims, you should check 6-NDFL according to the approved ratios.

It is easy to find control ratios - they are in letters from the tax inspectorate No. BS-4-11/ [email protected] and No. BS-4-11/4371, dated 03/10/2016 and 03/13/2017, respectively. In them, accountants learn about the actions of inspectors in each case of identifying inconsistencies. Also in the letters, the Federal Tax Service gives all references to the Tax Code of the Russian Federation, justifying its position.

Reflection of the amount of calculated income tax

In the Calculation form, line 040 is allocated for the group of calculated taxes. This amount shows the amount of income tax, the basis for determining which is the total from column 020 (taxable income) minus deductions (cell number 030). Based on the number of tax rates applied by the tax agent in the reporting period, the number of completed Sections 1 will be displayed. Each copy displays information on only one of the personal income tax rates.

The tax imposed on the amount of dividend income must be reflected separately. Line 045 is intended for it. This indicator is calculated by multiplying the tax rate and the amount of accrued dividend income. When entering information about calculated personal income tax, it is necessary to ensure compliance with the following requirements:

- tax is shown subject to the actual receipt of income by an individual;

- accrued payments for which the payment deadline has not yet arrived are not taken into account.

For accruals in the form of earnings for time worked, the date of receipt of income is the last day in the month for which calculations are made. In relation to bonuses, the rule applies to identifying the date of actual receipt with the day of transfer of money to an individual. When dismissing, you need to focus on the last shift worked (or the date of termination of the employment agreement with the employee).

Nuance 3: relationship between lines 070 and 080 of the 6-NDFL report

If during the year the tax agent was unable to withhold accrued personal income tax from income paid to an individual, then for such tax, instead of line 070 in the 6-NDFL report, line 080 will be used, intended to reflect the personal income tax not withheld by the tax agent.

The inability of a tax agent to withhold personal income tax from the income of individuals may arise, for example, in the following cases:

- The employee received in-kind income from the company and then quit. At the same time, the dismissal amount was not enough to withhold personal income tax from the value of natural income.

- Former retired employees were given anniversary gifts (worth more than 4,000 rubles). At the same time, no other monetary income was paid.

- A company employee received an interest-free loan, but is on long-term leave without pay. At the same time, he receives monthly income from interest savings (material benefits), with which the employer is unable to withhold personal income tax due to the lack of income paid to the employee.

For explanations from tax officials on filling out lines 070 and 080, see the publications:

- “Annual 6-NDFL will not agree with 2-NDFL certificates regarding the amount of tax withheld”;

- «New explanations from the Federal Tax Service to line 080 of form 6-NDFL".

Important nuances

Equality of indicators for calculated and withheld tax is not mandatory. If in 6-NDFL the amount of tax withheld is greater than calculated, this is not considered an error. This position is substantiated by a letter issued by the Federal Tax Service on May 16, 2016 under No. BS-4-11/8609. The reason for the discrepancies in the total values in different approaches to determining the date of formation of the accrued tax and the withheld tax for the tax agent.

If questions arise regarding differences in indicators, the tax agent draws up an explanatory note with the regulatory authority. When in 6-NDFL the amount of calculated tax is less than the withheld tax or vice versa, the accountant must double-check that the form is filled out correctly. Provided that no errors have been identified, it is necessary to prepare a documented justification for the reasons for the nonconformity.

Read also

14.09.2016

Location and explanation of page 070 in the 6-NDFL report

In 6-NDFL, line 070 “Amount of tax withheld” is included in section 1. 15 cells are allocated for it, as for most of the total lines of this report.

The decoding of the contents of line 070 is given in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected] It is prescribed:

- reflect in the specified line the total amount of personal income tax withheld;

- determine this amount on a cumulative basis from the beginning of the tax period.

The indicator in line 070 is combined, not only because the 6-NDFL report summarizes the indicators for all employees, but also because it must reflect all amounts of tax withheld upon payment. Let us remind you that the date of calculation and withholding of tax does not always coincide. For example, tax on wages is calculated on the last day of the month, and is withheld when it is actually issued. Including this can happen in parts if the payment is made in installments.

To calculate the figure reflected in line 070, you will need to sum up all the data included in line 140 of section 2 on a cumulative basis from the beginning of each reporting period. That is, for the report:

- for the 1st quarter, line 070 will consist of the amounts of lines 140 reflected in section 2 of the same report;

- half-year - from the amounts of lines 140 reflected in section 2 of the half-year report, and the amount shown in line 070 of the report for the 1st quarter;

- 9 months - from the amounts of lines 140 reflected in section 2 of the report for 9 months, and the amount shown in line 070 of the half-year report;

- year - from the amounts of lines 140 reflected in section 2 of the report for the year, and the amount shown in line 070 of the report for 9 months.

However, for data falling on the border of periods, the amount calculated in this way must be adjusted taking into account the fact that actual payments with tax withholding on them could have been made in one period, and the deadline established for paying tax on them, due to the coincidence with a weekend in the afternoon moves on to the next period. In such a situation, lines 020, 040 and 070 in section 1 must be filled out in the period of actual payment, and section 2 will contain data related to this operation in the next reporting period.

Read more about such situations in the publications:

- «6-NDFL and 2-NDFL: how to show January vacation pay issued on December 30?;

- «December sick leave in 6-NDFL: in what period should it be shown?.

Let us remind you that section 1 of the 6-NDFL report is filled out with a cumulative total, and section 2 contains data only for the last quarter of the reporting period.

For information on how to reflect bonuses, gifts, vacation pay and other various payments in the calculation of 6-NDFL, see the Ready-made solution from ConsultantPlus. Get trial online access to K+ for free right now.

Read about the principles of filling out 6-NDFL in the material “Report on Form 6-NDFL for the year - an example of filling out.”

We remind you that the deadline for submitting 6-NDFL for the year has been reduced by a month. You must report for 2021 no later than 03/01/2021. For details, see the material “The deadline for issuing 6-NDFL and 2-NDFL has been shortened.”

Fines

The deadlines for submitting the 6-NDFL report are established by law, and it is not recommended to violate them, otherwise, penalties will be imposed on the company. For failure to submit reports, in addition to a fine of 1,000 rubles for each month of delay, the organization faces the possibility that the company's current account will be completely blocked and unblocked only after the report is submitted. It seems possible to avoid penalties if the organization independently corrects errors and submits clarifications before the inspector identifies the inaccuracies. For submitting a report containing errors, the organization will be fined, and the tax office will require clarification.

Requirements for filling out 6-NDFL for 2021

Requirements for drawing up and filling out the 6-NDFL report are given in Order No. ММВ-7-11/ [email protected] :

- We enter information from left to right, starting from the first familiarity. We put a dash in empty cells.

- We always fill in the details and total indicators, but if there is no value for the total indicators, we put “0”.

- Page numbering is continuous and starts from the title page.

- When filling out the report, you cannot use correction tools.

- Each page must be printed on a separate sheet; duplex printing is not permitted.

- We fasten the sheets so as not to damage the paper, so you cannot use a stapler.

- When filling out the report by hand, we use only black, blue or purple ink.

- When filling out on the computer, set the Courier New font to a height of 16-18 points.

- We fill out the report separately for each OKTMO.

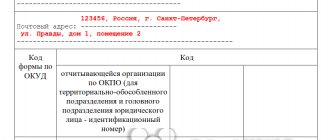

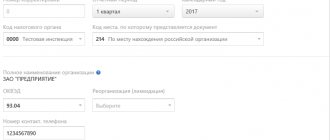

Fill out the title page 6-NDFL

On the title page please include:

- TIN and checkpoint.

We indicate them according to the tax registration certificate. Individual entrepreneurs do not have a checkpoint; they do not indicate it in the report.

- Correction number.

If 6-NDFL is submitted for the first time during the reporting period, the value “000” is indicated, indicating the initial calculation. If a clarification is submitted, indicate its number: 001, 002, etc.

- Presentation period.

For the annual report, enter code 34. If you are submitting the report during liquidation or reorganization, enter the value “90.” Codes for other periods, including during liquidation (reorganization), are given in Appendix No. 1 to the Filling Out Procedure, approved. Order No. ММВ-7-11/ [email protected] .

- Taxable period.

The year during which the report is submitted is entered. When submitting 6-NDFL for the periods of 2021 (including at the end of the year), we indicate “2020”.

- Submitted to the tax authority.

We put the code of the Federal Tax Service to which the report is submitted.

- At the location of the account.

We take the value for filling this line from Appendix No. 2 to the Procedure. For example, individual entrepreneurs (who do not use PSN or UTII) indicate the code “120”; organizations, if they are not the largest taxpayers, enter code “214”, etc.

- Tax agent.

Organizations indicate here their short name, which is reflected in the charter. If there is no short one, write the full one. Individual tax agents indicate their full names without abbreviations.

- OKTMO code.

Since 6-NDFL is compiled separately for each OKTMO and KPP code, you need to generate the number of calculations that corresponds to the number of your OKTMO/KPP.

- Contact phone number.

Here, please enter a current telephone number so that the inspection inspector, if necessary, can contact you and clarify any questions he may have.

- Reliability and completeness of information...

If the tax agent submits the report personally, enter “1”, if his representative – “2”. The lines below indicate the full name of the representative or the name of the representative organization.

Filling out Section 1

In this section we transfer information about all income, including allowances, bonuses and cumulative payments from the beginning of the year ─ for the period from January to December. It also needs to reflect data on other income paid to “physicists”, for example, dividends. Section 1 is completed separately for each tax rate applied.

- Line 020.

Interrelation of indicators within the form

Inspectors look at a few lines on the form.

We will show you what to check when sending a report by writing down control ratios in the form of formulas.

Correct: line 020 => line 030. If the data matches the formula, then you can safely submit the report to the Federal Tax Service.

Error: line 020 < line 030. If you find this discrepancy, double-check that all digits are spaced correctly.

Correct: line 040 = ((line 020 - line 030) x line 010): 100. If the data matches the formula, then you can safely send the report to the Federal Tax Service.

Error: line 040 ≠ ((line 020 - line 030) x line 010): 100. If you find this discrepancy, double-check that all the numbers are spaced correctly.

When comparing line 040 with the specified calculation formula, it is important to remember the rounding error. Due to rounding, line 040 may differ slightly from the value calculated by the formula.

Example : Snegir LLC employs 27 people. The total income of employees of Snegir LLC from January to September (line 020) is 317,214 rubles. Employees of Snegir LLC were provided with tax deductions of 32,000 rubles. Calculated personal income tax - 37,070 rubles.

The personal income tax determined by the accountant of Snegir LLC when checking the report is equal to 37,078 rubles. ((317,214 - 32,000) x 13%). The calculated figure turned out to be 8 rubles higher than the actual figure (37,078 - 37,070). If Snegir LLC filled out four lines under number 100 in the calculation of 6-NDFL, the acceptable error is 108 rubles (27 people × 1 ruble × 4).

8 < 108 - it turns out that 6-NDFL was filled out without errors.

Fill out and submit 6-NDFL reports online without errors. 3 months of Kontur.Externa for you for free!

Try it

How to avoid mistakes when filling out lines 040 and 070 of the 6-NDFL form

It is better to pay off tax debts before May 1. Otherwise, potential and existing counterparties will see information that the company owes to the budget for a whole year. <... Submission of SZV-M for the founding director: the Pension Fund has made its decision The Pension Fund has finally put an end to the debate about the need to submit the SZV-M form in relation to the director-sole founder. So, for such persons you need to take both SZV-M and SZV-STAZH! <... When paying for “children’s” sick leave, you will have to be more careful. A certificate of incapacity for caring for a sick child under 7 years of age will be issued for the entire period of illness without any time limits. But be careful: the procedure for paying for “children’s” sick leave remains the same! <... Income tax: the list of expenses has been expanded. A law has been signed that has amended the list of expenses related to wages.

At the same time, in accounting, the deduction posting is usually made on the last day of the paid month. Should lines 040 and 070 match in 6-NDFL? In practice, fields 040 (calculated tax) and 070 (withheld) almost never coincide. This is fine. Find out further how to explain such inconsistencies and what follows them.

Attention

Situation 1. Line 040 is greater than line 070 Line 070 reflects the tax that the company withheld in the reporting period. That is, when the fact of withholding entered the corresponding tax register. If the tax has been calculated but not yet withheld, it does not fall into field 070.

And it settles only on line 040 (calculated tax). Therefore, these figures may not be the same. And this is not some exception to the rule. This is common. After all, for example, wages for a month worked are usually issued at the beginning of the next month.

When the values match

The indicators reflected in lines 040 and 070 can only be equal in the following cases:

- According to the local act, wages to employees are paid on the last day of the month for which they are accrued. Then the value in cell 040 should equal row 070;

- in the current period, the employer made only those payments that are accrued at the time of payment;

- in the current period there are no situations to transfer dates to the next month.

If the salary is calculated every month and issued on the last day of the month, then the date of accrual of personal income tax and the date of deduction will coincide. Then the indicators in 6 personal income taxes for 040 and 070 will also have to match the lines.

On a note! A discrepancy between the control ratios in 6 personal income taxes on line 070 and lines 040 and 070 will not be an offense. Inspectors will not be able to find fault with this nuance. The employer does not face any unpleasant tax consequences.

The table below shows the dates when personal income tax is calculated and personal income tax is withheld:

| Type of payment | Date on which income tax is calculated | Date on which the camp fee is deducted |

| Remuneration for work | Last day of the month | The day of its issue or the next day |

| Funds for dismissal of an employee | His last day at work | Likewise |

| Payments for sick leave or annual leave | On the day the funds are received by the employee | On the day the funds are received by the employee |

| Dividends | Date of receipt by the employee | Date of receipt by the employee |

| Business trip expenses | Last day of the month when the advance report is signed | Date of receipt of funds by the employee |

| Income paid in kind | The date on which the income is transferred to the employee's hands | The day on which the next payment of income in cash occurs |

Lines 010 - 030 6 Personal income tax: what is included there, nuances of filling out the report

Example

In a certain company, wages are paid on the 5th of the next month.

The indicators are:

- January – 12,400;

- February – 16,200;

- March 15,100.

No deductions were presented.

Then section 1 of the personal income tax calculation for the six months is filled out as follows:

| Cell number | The indicator that is reflected in it |

| 010 | 13% |

| 020 | (12 400 + 16 200 + 15 100) = 43 700 |

| 030 | – |

| 040 | 43,700 * 13% = 5,681 (calculated tax amount) |

| 050 | – |

On a note! If an employee received income during the reporting period that was taxed at a rate of 35% rather than 13%, then 2 declarations are prepared. And personal income tax on dividends paid to individuals is reflected in line 045.

How to check the accuracy of the accrual. The indicator in line 070 will be greater than line 040 in the case when personal income tax on a December salary is accrued in December, and income is paid in January of the next year.

Methods for submitting 6-NDFL

You can submit a report to the Federal Tax Service:

- On paper.

You can submit it yourself, through a representative, or by sending it by registered mail with a list of attachments.

Be careful: a paper report can be submitted in 2021 only if the number of employees does not exceed 10 people. (Letter of the Federal Tax Service dated November 15, 2019 No. BS-4-11 / [email protected] ).

If there are more employees, you will have to report electronically. You may be fined for submitting a report on paper when you are required to submit it in electronic format.

- In electronic form.

Explanations for data discrepancies

If during the inspection the inspector finds errors, he has the right to charge additional mandatory contributions to the state treasury, apply administrative penalties in the form of a fine or penalty, or request an explanatory letter.

The inspector has the right to send a request for explanations even if he has not identified any serious errors. Inconsistency of data when reconciling control ratios may be the subject of an explanatory note, but is not considered a violation. Such discrepancies are often caused by carryover payments in the form of accrued but not transferred fees under contract agreements, for example. The tax office's request must be responded to within 5 business days. In case of delay in explanation, a fine of 5,000 rubles may be assessed.

Having mastered the principle of working with control ratios, an accountant will be able to identify miscalculations before submitting reports to the Federal Tax Service and protect the company from the application of penalties.

Withheld tax: filling out section 2

The information in section 2 indicates the dates of income payments, divided into accrual periods.

The indicators of section 2 are grouped into blocks along lines 100-140:

- page 100 date of actual receipt of income (determined in accordance with Article 223 of the Tax Code of the Russian Federation);

- page 110 day of tax withholding (on the day of payment of income to an individual);

- p. 120 the deadline for transferring personal income tax to the budget (the next day after withholding, and for vacation and sick leave - the last day of the month in which the income was paid);

- p. 130 amount of income received;

- page 140 amount of personal income tax withheld.

It should be taken into account that even if the amounts of income are paid to individuals on the same day, the timing of tax transfers may differ. For example, for wages the payment deadline is no later than the next day after payment, and for vacation pay paid on the same day - the last day of the month. When filling out the form, you need to take this into account and indicate such income in separate blocks.

The value of line 070 of section 1 can be equal to the sum of lines 140 of section 2 only for the 1st quarter, since section 1 is filled in incrementally from the beginning of the year, and section 2 - only for the last three months of the reporting period.

Checking against Control Ratios

By the second commented Letter, No. BS-4-11/ [email protected] , the Federal Tax Service of Russia sent to its subordinate tax inspectorates the Control ratios of the indicators of the form for calculating personal income tax amounts. Control ratios are approved in order to improve the quality of filling out tax returns, reduce the number of updated tax returns, and also to optimize the work of tax inspectorates.

Please note that the commented Letter was sent to replace the previously issued Letter of the Federal Tax Service of Russia dated December 28, 2015 N BS-4-11/ [email protected] , which has become invalid. The New Letter includes a revised table containing:

- links to sheets and calculation lines;

- control ratio formulas;

- formulations of possible violations with references to the norms of the Tax Code of the Russian Federation;

- actions of the inspector in case of failure to comply with control ratios.

The table contains intra-document and inter-document control relationships.

And although this is the second Letter, which was intended to eliminate the initial shortcomings, they nevertheless remained. As the editors learned from the authors of the Letter, these are not the last changes. In the near future, it is quite possible that more amendments will be adopted, which should simplify the verification of calculation indicators for both tax inspectors and tax agents and will allow the latter to avoid errors and omissions in its preparation.

The KS table includes 4 sections.

Section 1 is devoted to control relations within the calculation (intra-document control relations).

Sections 2, 3 and 4 define control relationships between forms. A comparison is made between the calculation data in Form 6-NDFL and the indicators reflected in the following forms:

- KRSB tax agent (KRSB NA) (the card is maintained at the tax office) (section 2);

- information on the income of an individual (approved by Order of the Federal Tax Service of Russia dated October 30, 2015 N ММВ-7-11/ [email protected] “On approval of the form of information on the income of an individual, the procedure for filling out and the format for its presentation in electronic form” (form 2- Personal income tax)) (section 3);

- journal “Patent for Foreign Citizens” (approved by Order of the Federal Tax Service of Russia dated November 19, 2015 N ММВ-7-11/ [email protected] “On the creation of the Journal “Patent for Foreign Citizens”) (section 4).

Where is 6-NDFL submitted?

6-NDFL is submitted to the Federal Tax Service:

- organizations - at the place of their registration;

- Individual entrepreneur - at the place of registration (except for special UTII and PSN regimes);

- separate subdivisions (SS) - at the place of registration of each separate unit;

In 2021, companies with OPs are given the right to choose a tax office for filing reports if the parent organization and OPs are located in different municipalities. To do this, you need to notify all the Federal Tax Service Inspectors with which the parent company and the OP are registered about this decision. The notification form was approved by Order of the Federal Tax Service dated December 6, 2019 No. ММВ-7-11/ [email protected] It must be submitted no later than the 1st day of the tax period for which you will report according to the new procedure.

- the largest taxpayers and their OP - at the place of registration of the “head”;

- Individual entrepreneur on UTII and PSN - at the place of registration as a payer of imputation or patent.

Where is it located in section 1?

Line 040 is located in section 1 of form 6-NDFL. The name of this field is “Amount of calculated tax”.

That is, this is a tax on personal income (the so-called income tax), which is calculated on the accrued income of personnel for a certain period of time. In this case, it is important to take into account the amount of deductions required that reduce personal income tax withholding.

We recommend reading:

- Rules for filling out the 6-NDFL calculation.

- Report submission deadlines.

The current 6-NDFL form can be downloaded in excel format here.

Calculation submission date on the title page

Let's start with the title page. In it, inspectors will first of all check the date of submission of the calculation . It must comply with the deadline established in paragraph 2 of Art. 230 of the Tax Code of the Russian Federation - no later than the last day of the month following the corresponding period. This means that the calculation must be submitted for the first quarter - no later than April 30 (in 2021 - May 4), for the six months - July 31 (in 2016 - August 1, since July 31 is Sunday), for 9 months - October 31. And the calculation for the year must be submitted no later than April 1 of the next year (for 2021 - April 3, 2021, since April 1 is a Saturday).

You can transfer the tax earlier. This conclusion can be drawn from the control ratio date on line 120 of the calculation > date of transfer according to the KRSB NA data (date of payment of the personal income tax amount). Let's say that on line 120 the deadline for submitting the report is the 4th, and the tax agent was able to transfer the tax on the 1st. It turns out that 4 > 1, which means that the CS is satisfied and there is no violation. It will be worse if in the calculation the tax agent indicates the submission date later than the deadline established in the Tax Code of the Russian Federation. For example, in line 120 the deadline for submitting the calculation is the 4th, and the tax is transferred on the 6th (4 < 6). Tax officials will regard this as a possible violation - failure to submit a calculation within the deadline established by the Tax Code of the Russian Federation . When establishing such a fact, the tax inspectorate must draw up a report in the manner prescribed by Art. 101.4 Tax Code of the Russian Federation. Based on the act, a decision will be made to hold the tax agent accountable in accordance with clause 1.2 of Art. 126 of the Tax Code of the Russian Federation. According to this article, failure by a tax agent to submit calculations to the tax inspectorate at the place of registration within the prescribed period entails a fine from the tax agent in the amount of 1,000 rubles. for each full or partial month from the day established for its submission .

Interrelation of 6-NDFL indicators and calculation of insurance premiums (DAM)

Both 6-NDFL and RSV are reports on people. It is quite logical that some equalities should also be satisfied between these forms. Moreover, since 2021, contributions from wages and other income are at the mercy of the Federal Tax Service. The Federal Tax Service offers only two verification formulas to companies.

Firstly, the difference between lines 020 and 025 of the 6-NDFL calculation should not be less than line 050 of subsection 1.1 of section 1 of the RSV. Equality is also allowed.

Secondly, if a company submits 6-NDFL, it is also required to submit the DAM.

Most accounting programs check the relationship of all indicators within the form. However, the program is not able to check the relationship between two different forms - these actions can only be done by specialists who prepare reports. Tax authorities recommend using approved verification formulas to report without errors. Keep in mind that going against the recommended ratios is not always a mistake. There are cases when the indicators will not coincide with the verification formulas.

Purpose of line 070

The employer calculates the tax and withholds it.

The procedure for filling out the cell is as follows:

- The values are included there on an accrual basis;

- this includes the amount of tax that the employer withholds from employees.

The date of payment and withholding of income taxes sometimes does not coincide. For example, when paying wages, tax is calculated on the last day of the month when the wages were paid. The retention date is somewhat different - upon issuance or the next day (deadline). Then there will be a difference in performance.

Example: Personal income tax on wages for January is calculated on January 31 of the current year. The local report indicates that payments occur on the 07th of the next month. Tax deduction takes place on 07.02 or 08.02.

Correct filling of line 090 in report 6 personal income tax

Purpose of line 040

In cell number 040 of the calculation in form 6 of personal income tax, the employer indicates the amount of tax that was calculated from labor payments to employees.

In Art. 210 of the Tax Code of the Russian Federation states that tax, including income tax, as well as the calculation of profit tax, comes from the tax base. In this case, the taxpayer’s income reduced by the amount of deductions that are also provided for by the Tax Code of the Russian Federation.

The assessed tax is calculated using the following formula:

(Taxable income received is a legal deduction) * at the specified interest rate

On a note! The tax is calculated only in rubles. According to the rounding rule, if the indicator is below 50 kopecks, then it is discarded. If it is more, then rounding occurs upward. Therefore, a discrepancy of one ruble per employee is allowed.

Line 020 6 Personal income tax: what is included there on an accrual basis

Who reports

Only a tax agent – an employer with at least 25 employees – reports using this form.

For the work of employees, the employer pays remuneration. It is the employee's responsibility to pay tax on this remuneration.

But, since they are officially employed, the responsibility for calculating, withholding and depositing tax into the budget rests with the employer. The employer reports for these amounts in Form 6 of the personal income tax.

The purpose of submitting the report is to provide reliable information to the tax authorities on manipulations that the employer has the right to do with income tax.

Line 070 of personal income tax declaration 6: what is included there on an accrual basis

To ensure that the report is filled out correctly and the employer is not fined, information from tax registers is used. The use of these registers is the responsibility of the employer.

The tax agent has the right to use a unified report, or develop it independently, having previously notified the Federal Tax Service about this through the accounting policy.

Calculation according to Form 6 personal income tax consists of two sections:

- In the first section, information is shown as a cumulative total from the beginning of the calendar year;

- in the second section with quarterly gradation.

Correctly filling out line 050 of the calculation in form 6 personal income tax

What is included in line 070 of the 6-personal income tax calculation in 2021

If personal income tax is not only withheld incorrectly, but also calculated incorrectly, then you will have to submit an adjustment on line 040. Moreover, field 070 does not need to be touched. In the return period, simply fill in line 090 as we already said. How to check indicator 070 in 6-NDFL All withheld personal income tax, which you reflected in line 070 for the reporting period, must be paid to the budget. That is, the equality must be satisfied (where line 090 is the returned tax (if any)): Paid tax Line 070 - Line 090 Otherwise, if the moment of tax withholding and its payment differ greatly in time, provide an explanation (we provided a sample).