An explanatory note to the balance sheet is a document that was previously part of the annual financial statements of organizations. Now “Explanations” are mandatory: let’s figure out what the difference is and how to fill out the required document.

Currently, current legislation does not provide for the mandatory provision of such a form as an explanatory note to the balance sheet for 2021 as part of the annual reporting. However, in most cases you cannot do without it. There are no special requirements for this document, but it is advisable to compile it without errors. Indeed, if the data does not correspond with those indicated in the report itself, the tax service may have questions. Let's see who, when, why and in what form should draw up notes to the balance sheet?

Explanations to the balance sheet and a note are not the same thing

The explanatory note to the balance sheet 2021, a sample of which can be seen in this article, does not replace the explanation to the balance sheet. By virtue of PBU 4/99 “Accounting statements of an organization”, “Explanations” are a breakdown of the balance sheet items, as well as clarification of individual reporting forms:

- statement of changes in equity;

- cash flow statement;

- other reporting forms and applications as part of the financial statements.

Whereas the note is an arbitrary transcript of the entire financial situation in the organization. It can contain both general information and detailed explanations of the lines of the balance sheet and income statement. According to Article 14 of Federal Law No. 402 dated December 6, 2011 and paragraph 4 of Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010, this document is included in the annual financial statements. In particular, paragraph 28 of PBU 4/99 stipulates that business entities are required to draw up explanations for the balance sheet and Form No. 2 in the form of separate reporting forms and a general explanatory note. Although officials do not put forward any specific requirements for the form and content of this document, all organizations must submit an explanatory note with a balance.

An exception to the general rule are representatives of small businesses, who have the right to prepare and submit accounting reports in a simplified form. They must provide only two mandatory forms: a balance sheet and an income statement. They do not have to decipher the meanings and describe their financial situation. However, if such a desire arises, it is not forbidden to draw up this document.

Why explain the balance?

Reporting must be reliable and complete and provide the user with a clear picture of the financial position of the organization.

In the balance sheet and Form 2 we present generalized indicators, from which, as a rule, it is difficult to draw comprehensive conclusions. This means that they need to be explained. IMPORTANT! Accounting statements for 2021 must be prepared using updated forms, and submitted exclusively electronically. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here.

Let’s take the line “Accounts receivable” as an example. To put this figure in the report, you need not only to collect the balances of all settlement accounts, but also to take into account the amount of the reserve for doubtful debts (if any). It is not shown separately in the balance sheet, and interested users (owners, investors, regulatory authorities) need additional explanations in this regard.

For information about the preparation of explanations given in relation to debts, read the article “Deciphering accounts receivable and payable - sample.”

All organizations must formulate explanations, with the exception of:

- small enterprises entitled to simplified accounting and reporting;

- public organizations that do not conduct business activities and have no sales.

Moreover, explaining the balance is in the interests of everyone who cares about their reputation. The more fully the figures from the report are disclosed, the more transparent the company’s activities will appear. Such reporting will help not only strengthen your credibility, but also attract new investors. Explanations on the balance sheet will also help avoid unnecessary questions from regulatory authorities.

ConsultantPlus experts spoke about the nuances of drawing up explanations for the balance sheet. Get free demo access to K+ and go to the 2021 accounting guide to learn all the details of this procedure.

Read about the requirements for accounting in the material “What requirements must accounting satisfy?” .

NOTE! Clause 39 of PBU 4/99 (approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n) stipulates that companies have the right to provide additional information along with reports if it is useful for external users of the reports. At the same time, the Ministry of Finance believes that companies are obliged to disclose information related to accounting reporting (information of the Ministry of Finance dated December 4, 2012 No. PZ-10/2012).

Who needs an explanatory note to the annual report for 2021 and why?

A sample explanatory note to the balance sheet is necessary for all users of financial statements to obtain more complete additional information about the financial and economic activities of a legal entity. Such information, as a rule, cannot be provided in other reporting forms, but it is important and is of interest both to the founders or creditors of the company, and to regulatory authorities. Data in this document can be included based on specific wishes, for example, the board of directors, as well as based on the characteristics of the current economic situation at the enterprise by the end of the year. For example, if the income tax for the reporting period turned out to be significantly lower than the previous one, it makes sense to describe the reasons for this in an explanatory note, since the tax authority, having received such data, will still ask for an explanation. By anticipating this desire, you can avoid not only unnecessary questions from tax authorities and calls to the “carpet” of the inspectorate, but also an on-site inspection, which can be scheduled as part of a desk audit.

What happens if you don’t respond to the Federal Tax Service’s requirement?

No matter how much the inspectorate threatens with punishment, tax officials cannot fine or issue an administrative penalty for the absence of an explanatory note:

- Article 126 of the Tax Code of the Russian Federation is not a basis for punishment, since the provision of explanations does not apply to the provision of documents (93 of the Tax Code of the Russian Federation);

- Article 129.1 of the Tax Code of the Russian Federation is not applicable, since a request for written explanations is not a “counter check” (93.1 of the Tax Code of the Russian Federation);

- Article 19.4 of the Code of Administrative Offenses is not an argument; punishment is applicable only in case of failure to appear at the territorial inspection.

Similar explanations are given in paragraph 2.3 of Letter No. AS-4-2/12837 of the Federal Tax Service of Russia dated July 17, 2013.

Explanatory note to the financial statements

The sample shows what a document might look like, the more precise name of which is “Explanations for the Balance Sheet.” We took the notional organization LLC “Horns and Hooves,” which has been operating since 2005 and is engaged in the production and sale of dairy products. Its chief accountant compiled this document as follows:

Explanations to the balance sheet of Horns and Hooves LLC for 2019

1. General information

Limited Liability Company (LLC) “Horns and Hooves” was registered by the Federal Tax Service No. 1 for St. Petersburg on March 29, 2005. State registration certificate No. 000000000, INN 1111111111111111, KPP 22222222222, legal address: St. Petersburg, Nevsky Prospekt, 1.

The organization's balance sheet was formed in accordance with the rules and requirements of accounting and reporting in force in the Russian Federation.

- Authorized capital of the organization: 5,000,000 (five million) rubles, fully paid.

- Number of founders: two individuals O.M. Kurochkin and I.I. Ivanov and one legal entity "Moloko" LLC.

- Main activity: milk processing OKVED 15.51.

- The number of employees as of December 31, 2021 was 165 people.

- There are no branches, representative offices or separate divisions.

2. Basic accounting policies

The accounting policy of LLC "Horns and Hooves" was approved by order of director Ivanov I.I. dated December 25, 2013 No. 289. The straight-line depreciation method is used. Valuation of inventories and finished products is carried out at actual cost. The financial result from the sale of products, works, services, goods is determined by shipment.

3. Information about affiliates

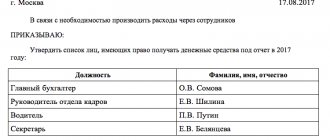

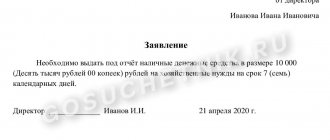

Ivanov Ivan Ivanovich is the founder, 50% of the ownership share in the management company, holds the position of general director.

Kurochkin Oleg Mikhailovich - founder, 30% share of ownership in the management company.

LLC "Moloko" - founder, 20% ownership share in the management company, Russian organization (founders V.P. Petrov and Yu.K. Sidorov).

During the reporting period, the following financial transactions were carried out with related parties:

- On March 12, 2021, the general meeting of the founders of Horns and Hooves LLC reviewed and approved the financial statements of the organization for 2021. The meeting decided to pay a profit in the amount of 3,252,000 rubles to the founders based on their share in the authorized capital based on the results of 2019. The payment (including personal income tax withholding for two individuals) was made on 04/01/2020;

- On May 25, 2021, Horns and Hooves LLC entered into a contract with the founder of Milk LLC, Yu.K. Sidorov, an agreement for the purchase of non-residential premises worth 5,102,000 rubles. The cost of the transaction is determined by an independent assessment of the value of the property. Payments under the agreement were made in full on June 6, 2018, and the transfer and acceptance certificate of the real estate was signed.

4. Key performance indicators of the organization for 2021

In the reporting year, the revenue of Horns and Hooves LLC amounted to:

- for the main type of activity “production and sale of dairy products” - 385,420,020 rubles;

- for other types of activities - 650,580 rubles;

- other income: 170,800 rubles (sale of fixed assets).

Costs of production and sales of products:

- acquisition of fixed assets: 1,410,500 rubles;

- depreciation of fixed assets: 45,230 rubles;

- purchase of raw materials: 110,452,880 rubles;

- wage fund: 137,580,040 rubles;

- travel expenses: 238,300 rubles;

- rental of premises: 8,478,190 rubles;

- other expenses: 532,458 rubles.

5. Explanation of balance sheet items as of December 31, 2019 (using the example of accounts payable)

Availability and movement of accounts receivable

Index Period For the beginning of the year Changes over the period At the end of the year Accounted for under contracts Provision for doubtful debts Received Dropped out Remainder In thousands of rubles with decimal places Under contracts (transactions) Fines, penalties, penalties Redeemed Written off in Finnish result Written off to reserve for doubtful debts Current Overdue Total short-term accounts receivable, including: 2019 25 489,3 (200,0) 15 632,7 300,4 (25 023,2) (102,1) (48,9) 15 726,1 522,1 buyers 20 409,0 (200,0) 10 015,5 300,4 (17 315,3) (87,7) (48,9) 12 750,9 522,1 suppliers 5080,3 — 5617,1 — (7707,9) (14,4) — 2975,2 — Total long-term accounts receivable, including: 2019 50 000,0 — — — — — — 50 000,0 — for interest-free loans 40 000,0 — — — — — — 40 000,0 — TOTAL accounts receivable 30 489,3 (200,0) 15 632,7 300,4 (25 023,2) (102,1) (48,9) 65 726,1 522,1 6. Estimated liabilities and provisions

As of December 31, 2021, the organization formed an estimated liability for payment of regular vacations of employees in the amount of 7,458,000 rubles, the number of unpaid vacation days is 67, the due date is 2021.

The reserve for doubtful debts was formed in the amount of RUB 600,000. due to the presence of overdue and unsecured debt of Girya LLC in the amount of 522,000 rubles.

The organization did not create a reserve for reducing the value of inventories in 2021, since inventories do not show signs of depreciation.

7. Salary

Payables for wages as of December 31, 2018 for the organization as a whole amounted to RUB 3,876,400. (payment for December 2021, due date: 01/12/2020). Staff turnover in the reporting period was 14.88%. The number of employees as of December 31, 2019 is 165 people. The average monthly salary is 25,675 rubles.

8. Other information

(In this section you need to describe all extraordinary facts in the business and economic activities of the organization for the reporting period, describe their consequences. You can also describe all other significant facts that affected the balance sheet in general and, in particular, you can list major transactions and counterparties for them for the reporting period, as well as write a forecast or events that have already occurred after the reporting date and are of significant importance.)

Director of LLC "Horns and Hooves" /signature/ Ivanov I.I. 03/19/2020.

When drawing up an explanatory note, special attention must be paid to information about affiliated persons. It is advisable to document this data in a separate section, as required by paragraph 14 of PBU 11/2008. By law, it is necessary to disclose information not only about the founders of the organization itself, but also about persons associated with them, therefore, if the founders (as our example of an explanatory note to the balance sheet shows) includes a legal entity, its participants or shareholders must be indicated. In addition, information on transactions carried out with related parties during the reporting period must be indicated, as well as, regardless of the transactions, on those legal entities and citizens that are recognized as affiliated.

Obviously, competent preparation of an explanatory note to the financial statements can save the manager and accountant from additional communication with regulatory authorities. It is important to remember that the detail of the information in this document depends only on its compiler - on the intention of the organization itself to disclose or not certain indicators for the year. The main and only requirement that the legislator makes for this document is that the information contained in the explanations must be reliable. The person who signed the document is responsible for its correctness.

Sample of a universal explanatory note form

Legal meaning of explanatory notes

Such notes have significant legal significance, especially when it comes to labor relations. According to the Labor Code of the Russian Federation, employee explanations are a mandatory part of the procedure for bringing to disciplinary liability. Until the explanatory note is received (if the deadline for its provision specified in the previous chapter has not expired), no measures can be taken against the employee.

It is not only the fact of providing an explanation that is important, but also its content. Based on the note, the employer can either apply the maximum possible penalty or cancel the employee’s punishment completely. In other words, if you were late for work or did not complete any assignment for a good reason, then an explanatory note can save you from punishment from the employer.

At the same time, writing an explanatory note is not mandatory for the employee; he can refuse to do so without any legal consequences (except that the employer will make a decision based either only on his own assessment of the situation, or on the assessment of witnesses and other participants in the event ).

Explanation of low wages

In Russia, the process of legalizing wages is underway. The rule has been established that workers for their work must receive no less than the minimum wage approved at the state level. At the same time, in the regions of the Far North or equivalent areas, wages should be calculated taking into account increasing factors.

If the inspector discovers that in the submitted calculation the workers’ wages are below the maximum value, then he has the right to demand an explanation of the discrepancies.

Reasonable reasons for this situation may be:

- due to the difficult situation of the organization, employees were transferred to part-time work, the salary was calculated based on the time actually worked;

- if the employee went on vacation, then this circumstance can be pointed out. Often employees go on vacation for a long period of time, receive vacation pay in one month, and the subsequent period remains without accruals or they are insignificant;

- There may be another situation, for example, a person got sick, issued a sick leave, and handed it over to the accounting department for payment later;

- If tax officials ask to explain the reasons for the discrepancy in wages from industry indicators, then they can write that workers receive according to the minimum wage level. But it is not possible to increase the amount, since the company is still young and production volumes are insignificant.

Any explanations must be supported by documents. In this case, you can attach orders about vacation, about switching to a shortened working day, payslips about accruals, sick leave, etc.

Reasons for requesting clarification from the tax office

When conducting a desk inspection, the inspector has the right to request written explanations from the organization about the identified discrepancies. Clause 3 of Article 88 of the Tax Code of the Russian Federation indicates the main reasons when it is necessary to give an explanation of what happened:

| There are errors in the report | The inspector may send a notice and ask for clarification or provide updated tax reporting. |

| In the updated declaration, the amounts are much lower than in the original document | An employee of a government agency may suspect the company of deliberately understating the tax base and will require written explanations of the changes made. |

| The income statement reflects losses | If the company’s accountant knows that the company is incurring losses, then it is better to prepare a message in advance about the factors that influenced the current situation. |

The company's management must send a reasoned response to the request within 5 days from receipt of the notification.

Writing stages

The process of drawing up explanatory notes is divided into several stages:

- Formation of a plan. Based on it, the optimal text is invented. All items must be placed in strict sequence. Initially, the title page is filled out, after which an annotation is made. After that, the table of contents and introduction are included, and only then comes the main text, divided into separate chapters. All sheets must be numbered, and at the end a conclusion is made and a list of references is left. Applications are attached if necessary.

- Creating a draft. Before creating the actual text, it is advisable to make a draft. It is based on the goals and objectives set when writing the thesis project. The books used by the student must be evaluated and analyzed. The central element of the note is the task of research activity that must be achieved by the graduate. All conclusions contained in the document are supported by diagrams, tables and correct calculations.

- Writing the main text. The lead states the reason for choosing a specific goal and also lists the assigned tasks. The conclusion provides information about achieving the goals of creating the project. Typically, bachelors write a note of 30 pages, and for masters the volume increases to 80 pages. This includes not only the text, but also appendices, title pages, drawings and additional materials.

The perception of the entire work by the certification commission depends on the correctness of the preparation of this document.

Late payment of tax, explanation from the Federal Tax Service

For such reasons, inspectors rarely request clarification; they have the right to send a demand for payment of the relevant tax after the expiration of the regulated period for payment.

What to do if the tax authorities asked to indicate the reasons for the delay in paying taxes?

| Cause | Explanation |

| Technical reason | The company's management may discover that the tax was calculated correctly, but when paying, incorrect details were indicated in the payment documents, for example, in KBK or OKTMO. In this case, you will need to write an application to clarify the payment. If it passes by the current date, and not the actual date of payment, you will have to pay a penalty for late payment. |

| There is a discrepancy between the period of accrual and payment of personal income tax | In paragraph 6. Article 226 of the Tax Code of the Russian Federation stipulates that the taxpayer must transfer the amount the next day after payment of wages. In cases where the salary is transferred on the last day of the reporting quarter, and the tax is transferred in the next period, you will need to explain the situation. But this fact is not a violation of the law. |

In these cases, financial sanctions can be avoided; the main thing is to respond to the notification in a timely manner and take measures to provide explanations.

Individual points: content and main part

If we consider in more detail the individual points of the explanatory note, it should be said that its content should completely coincide with the content of the thesis. As for the main part, only the basic information and conclusions obtained are disclosed here. There is no need to describe the study.

Regarding the introduction, it is appropriate to explain why your choice fell on this particular topic. What's special about it and why are you interested in it? Don't forget to mention why the topic is relevant and valuable.

It would also be a good idea to mention the difficulties you encountered during the research. Tell us how you were able to cope with them and what helped you with this.

To correctly draw up an explanatory note, you must first develop a plan.

By the way! For our readers there is now a 10% discount on