Reporting to the Federal Tax Service

We are always in a hurry to deal with tax reports first, so in the first section of our material we have placed a detailed table on reporting for the 2nd quarter of 2021:

* The deadlines for submitting almost all declarations (except VAT) falling in March-May 2020 have been extended by 3 months. The table shows deadlines taking into account their extension.

You can find out more about postponing reporting deadlines in ConsultantPlus:

Get trial access to K+ for free and go to the Ready-made solution.

We are accustomed to the fact that tax reporting forms are regularly adjusted (added and changed). Recently, many tax returns and calculations have undergone such transformations. For example, starting from 2021, a new form of DAM will be used.

Reporting for the 2nd quarter to the Pension Fund and the Social Insurance Fund

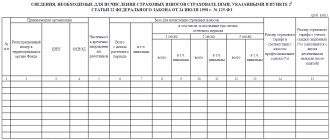

The Pension Fund and the Social Insurance Fund are expecting their portion of reports for the 2nd quarter of 2021. For the necessary information on submitting reports for the 2nd quarter of 2021, see the table below:

We remind you that a report on the use of contributions “for injuries” is a mandatory companion to the calculation in Form 4-FSS for a certain group of policyholders ─ details here .

For the lack of social insurance reporting and for being late with it, financial punishment is provided.

We will tell you about its size using the link .

Do not forget that thanks to the Decree of the Government of the Russian Federation “On interaction between the MFC and government bodies” dated September 27, 2011 No. 797, policyholders now have another way to submit social insurance reports - through the MFC. However, this method has one significant drawback - reporting is accepted without an input check using control ratios. Therefore, submitting reports in this way will require subsequent clarification in the Social Insurance Fund of the absence of errors and confirmation of the fund’s acceptance of the report.

Find out what other documents and information can be sent to the FSS through the MFC from this article.

For those applying for a subsidy, it is advisable to submit the SZV-M form for April and May early. In addition to SZV-M, the SZV-TD form is also submitted to the Pension Fund. Read about the timing of its submission here.

You will find a line-by-line algorithm for filling out this new report in K+. Get trial access and go to the HR Guide.

Responsibility

If an organization misses the reporting date, the Federal Tax Service will impose a fine of 5% of the calculated tax amount. Moreover, 5% is charged for each month of delay. But the fine cannot exceed 30% of the calculated tax for the quarter, and cannot be less than 1000 rubles.

For late payments to the budget, tax authorities will fine you 20% of the arrears. And if Federal Tax Service inspectors prove that the company deliberately underestimated the tax base or committed other illegal actions that led to a reduction in payments, then the penalty is doubled - up to 40%.

Reporting for the 2nd quarter into statistics

The responsibilities of any company and individual entrepreneur include submitting information to statistical authorities. The composition of such reporting must be clarified in the territorial offices of Rosstat.

Even if you are sure what such a kit includes, it would not be amiss to once again clarify the list of reports for the 2nd quarter of 2021 - perhaps you are included in the sample, and you need to submit some of the statistical reports in the near future.

Each report has its own reporting period. For example, for only one deadline, 06/04/2020, the following are submitted:

- Information on the volume of paid services to the population by type (form No. P (services));

- Information on the production and shipment of goods and services (form No. P-1);

- Information on the production of products by a small enterprise (form No. PM-prom);

- Information on the trade turnover of a small enterprise (form No. PM-torg);

- other statistical reports.

You can find out which reports your company is required to submit and within what time frame on the Rosstat website.

How to use this service, see here.

You can view the full calendar for submitting statistical reports for 2021 in ConsultantPlus by receiving free trial access to the system.

Procedure for filling out form 6-NDFL

When filing a 6-NDFL declaration, you should pay attention to the following features:

- When submitting a document in writing, the report is filled out in black, blue or purple ink.

- Rows are filled from left to right. If any data is missing, a dash is placed in the corresponding sections.

- In those lines where there should be values in numbers, a “0” is placed instead of a dash.

- Amounts are recorded in rubles and kopecks. The tax amount is rounded to the nearest ruble.

- Corrections of any kind are prohibited.

- If an error is detected, the report is redone.

Form 6-NDFL must be completed in accordance with legal requirements

Form 6-NDFL consists of a title page and two sections.

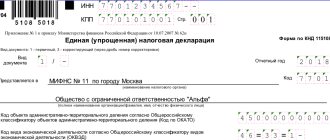

The title page is filled out like this:

- indicate the TIN and KPP of the legal entity (for individual entrepreneurs - only the TIN);

- the correction number is entered (for the primary report it is set to “000”, if an adjustment report is already submitted, then “001”, etc.);

- the code of the period for which the report was compiled is entered (the codes can be viewed in the Appendices to the order approving the form) and the year: if a report is submitted for nine months, then the period code will be “33” and the year “2017”);

- Next, the code of the tax authority to which the report is sent and the code of the place of submission are indicated (can also be viewed in the Appendix): the code of the report is submitted at the place of registration of the legal entity - “212”, if at the place of residence of the individual entrepreneur - “120”;

- the name of the legal entity or full name of the individual entrepreneur is indicated;

- the OKTMO code is set (all-Russian classifier of municipal territories). If there are several codes, then you need to fill out several reports for each code;

- a contact telephone number is indicated, the number of pages of the report and the number of sheets of appendices to it are indicated, if any.

The right side of the title page of form 6-NDFL is filled out by a tax inspector

The lower parts of the title page are filled out as follows:

- the left part is for the person submitting the report to the tax authority;

- the right side is for the tax inspector.

Section 1 of form 6-NDFL consists of two blocks, one of which includes lines from 010 to 050, the other from 060 to 090

Section 1 summarizes the income that employees receive in the course of their work activities. This also includes the total tax amounts that will be calculated based on the employee’s income. Section 1 conditionally consists of 2 blocks.

Table: characteristics of section 1 of form 6-NDFL

| Blocks | Lines and their filling |

| The first block includes lines 010 to 050 | This block is filled out separately for each tax rate:

|

| The second block includes lines 060 to 090 | Regardless of the applicable tax rates, it is filled out only once on its first page:

|

Section 2 reflects the indicators produced over the last 3 months of the reporting period.

Section 2 states:

- all actions to accrue income that will be paid in the reporting period (during the quarter) indicating the date of accrual;

- the amount of tax withheld from each income paid, indicating the date of withholding;

- date of transfer of personal income tax to the tax authority in fact.

Section 2 of form 6-NDFL indicates the indicators of the last three months of the reporting period

Section 2 contains lines 100–140:

- in line 100 - the date of actual receipt of income reflected in line 130. Determined in accordance with Article 223 of the Tax Code of the Russian Federation;

- in line 110 - the date of tax withholding on the amount of income actually received, reflected on line 130. The date of withholding in cash coincides with the date of their actual payment. The date of withholding personal income tax on income in kind and received in the form of material benefits coincides with the date of payment of any income in cash from which such personal income tax is withheld;

- in line 120 - the date no later than which the tax amount must be transferred;

- in line 130 - the generalized amount of income actually received (without subtracting the amount of withheld tax) on the date indicated in line 100;

- in line 140 - the generalized amount of personal income tax withheld on the date indicated in line 110.

Sample of filling out 6-NDFL upon dismissal of an employee.

An example of filling out a report when paying overtime.

An example of filling out a report when wages are delayed.

An example of filling out a report in case of excessively withheld personal income tax.

In Form 6-NDFL, maternity benefits are not recorded due to the fact that these payments do not relate to the salary (or other income) of the employee.

Video: rules for filling out the 6-NDFL declaration

Peculiarities of reflecting payments of “rolling” periods in 6-NFDL

The most controversial issues regarding filling out the 6-NDFL calculation are payments for “transition” periods. They are encountered when wages or bonuses are accrued in one reporting period and paid in another.

“Carryover” payments are reflected in the declaration in the reporting period when the operation is completed.

If an employee’s wages are accrued in one month and made in the next, in the 6-NDFL report this operation is reflected as a “carrying forward” payment

Table: example of filling out a report regarding “rolling over” payments

| Situation | How to fill out the form |

| Salaries for March were issued in April. | The March salary paid in April is reflected in section 1 of the calculation for the first quarter. Only accrued income, deductions and tax are entered (lines 020, 030, 040). In lines 070 and 080, “0” is placed, because the tax withholding date has not yet arrived. Personal income tax from March salaries is withheld only in April at the time of payment. Therefore, it is reflected in line 070 of section 1, and the operation itself is reflected in section 2 of the half-year report. |

| Vacation pay for April was issued in March. | In the calculation for the first quarter, vacation pay is reflected in both sections 1 and 2, since the employee’s income arose in March, when he received the money. The company will have to calculate and withhold personal income tax from vacation pay on the day of payment, and transfer the withheld amount to the budget no later than March 31. |

Checking the correctness of filling out the reporting declaration

The 6-NDFL declaration must indicate only correct indicators. It will be helpful to refer to the benchmark ratios when filling out the form.

Control ratios are used to reconcile indicators, i.e. the values of one line must correspond to another or be greater/lesser, etc.

Reference ratios can be found in the following sources:

- in the letter of the Federal Tax Service of Russia dated March 10, 2021 No. 5C-4–11/3852;

- on the Federal Tax Service website (https://www.nalog.ru/rn92/).

The tax agent must check, based on the control ratios, whether the report is completed correctly

Using the control ratio, the following is checked:

- are there any errors when transferring indicators from registers;

- are all incomes indicated;

- are there any errors in the calculation;

- whether all deductions are provided to employees and whether there are any excess amounts;

- Is tax withheld from all amounts and transferred to the budget?

Results

The timing of reports for the 2nd quarter of 2021 depends on their type.

The bulk of reporting is submitted to the Federal Tax Service (VAT declaration - no later than 07.27.2020, UTII - no later than 07.20.2020, etc.). Reporting to the Pension Fund of Russia in the SZV-M form is submitted monthly no later than the 15th. At the end of the quarter, you should simultaneously send a calculation in form 4-FSS and a report on the use of insurance contributions “for injuries” to social insurance. For a paper report, the reporting deadline is 07/20/2020; for electronic reporting, 5 working days more are given. For statistical reports, separate reporting periods are provided. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Non-production bonus

Non-production bonuses are incentive payments, not rewards for work performed. Therefore, they cannot be equated to wages.

When calculating 6-NDFL, reflect the non-production bonus on the date of payment. On this day, you must simultaneously recognize income and withhold personal income tax (subclause 1, clause 1, article 223, clause 3, article 226 of the Tax Code of the Russian Federation). The monthly non-production bonus in section 2 is distributed as follows:

- on line 100 – date of payment of the premium

- on line 110 - the same date as on line 100

- on line 120 - the first working day after the one indicated on line 110

- on line 130 – bonus amount

- on line 140 – personal income tax amount

An example of reflecting a non-production bonus

On June 8, 2021, the employee received a monthly bonus in the amount of 35,000 rubles for May. Personal income tax on this amount is 4,550 rubles. In section 2 of the semi-annual calculation, the bonus will be reflected as follows: