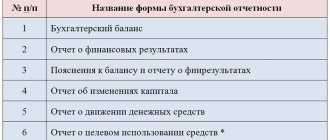

Balance sheet for 2021

The balance sheet form for 2021, the form of which we will look at in this publication, is not that new. It was approved by order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 and has been used since 2011.

An important change this year is the introduction of a new classifier OK 029-2014, and, as a result, a change in OKVED codes. Therefore, when drawing up a balance sheet and submitting reports, companies will have to pay attention to the reflection of OKVED in the balance sheet for 2021 in accordance with the newly adopted collection. Although the codes are replaced automatically, it is better to first check the information about OKVED with the tax authorities. It can be noted that only in this regard has the form of the balance sheet for 2021 undergone changes. The document form can be downloaded below.

Small business: who is it?

Since we are considering such an issue as the financial statements of small businesses 2021, we must at least briefly remind the reader who small entrepreneurs are. Let us note that not long ago the criteria for classifying organizations as small businesses were changed: in particular, the amount of revenue was increased.

As of 2021, there are two types of small businesses: microenterprises and small entrepreneurship.

If we are talking about micro-enterprises, then the number of officially employed employees cannot be more than 15 people. The amount of total income received during the reporting period (we remind you that not so long ago, when determining the amount of income for small businesses, the indicator of total revenue from all types of activities, and not just from sales of products) should not exceed 120 million rubles.

Regarding small businesses, the amount of income should not exceed 800 million rubles, and the number of personnel should not exceed 120 people.

And what is common to both types of business is not to exceed the share of companies in the authorized capital of small businesses, which themselves are not small businesses. This share should not exceed 49%.

More details about which companies can qualify for small status and how this can be done are presented here.

Balance sheet 2021: features

By filling out the form, the company itself details the indicators by item, taking into account the level of materiality of each. Financial statements must be submitted to the regulatory authorities (IFTS and statistical departments) in a form that includes line codes. We will present a sample of filling out the balance sheet for 2021 in exactly this form.

The basis for drawing up a balance are accounting registers, for example, a chess sheet, memorial orders, order journals, a balance sheet or a general ledger.

Filling out simplified reporting forms

A simplified balance sheet has enlarged items that include several accounting objects. The table below shows what is included in each balance line.

| Line title | Explanation |

| Assets | |

| Tangible non-current assets | Fixed assets, unfinished capital investments in them |

| Intangible, financial and other non-current assets | Intangible assets, results of research and development, investments in intangible assets, research and development, long-term financial investments (issued loans, bills, bonds), etc. |

| Reserves | Materials, goods, work in progress, finished products |

| Cash and cash equivalents | Cash in various currencies, converted into rubles, in the bank and at the cash desk. Their equivalents are highly liquid investments that can be quickly exchanged for cash without significant risk of loss, such as demand deposits |

| Financial and other current assets | Accounts receivable, advances issued, short-term financial investments, other immaterial current assets |

| Passive | |

| Capital and reserves | Authorized capital, additional capital, reserve capital, retained earnings. NPOs include in this line target funds, a fund of real estate and especially valuable movable property and other target funds |

| Long-term borrowed funds | Credits and borrowings for a period of more than a year and interest on them |

| Other long-term liabilities | Lender and targeted financing for a period of more than a year, reserves for upcoming expenses for a period of more than a year, etc. |

| Short-term borrowed funds | Credits and borrowings for a period of less than a year and interest on them |

| Accounts payable | Creditor to counterparties, personnel, budget, founders, advances received, etc. |

| Other current liabilities | Reserves for future expenses, targeted financing, deferred income with a period of less than a year, etc. |

The simplified statement of financial results does not highlight the types of expenses for core activities and some other indicators that detail its data when prepared in the usual form. The table below shows the components of this report.

| Line title | Explanation |

| Revenue | Revenue net of VAT and excise taxes |

| Expenses for ordinary activities | Cost, commercial, administrative expenses |

| Percentage to be paid | Interest on received loans and borrowings |

| Other income | Income not related to ordinary activities |

| other expenses | Other expenses less interest payable |

| Profit taxes (income) | Current income tax |

| Net income (loss) | Resulting string = 1 – 2 – 3 + 4 – 5 – 6 |

The form and sample for filling out the balance sheet for 2020 can be downloaded in the article “Balance Sheet for 2021: sample for filling out.”

Balance sheet form for 2021: how the document is structured

The balance sheet of the organization is a table, on the left side of which all the assets of the company are reflected, and on the right side - the sources of these funds. Both of them must be equal, since the value of the property cannot be more or less than the sources of its formation.

The left side is divided into 2 sections, the first contains non-current assets, and the second contains current assets.

The right side of the balance sheet is a liability, divided into 3 parts, in which information about reserves, capital and liabilities is consistently recorded.

Results

Small enterprises have the right to prepare accounting reports in both regular (full) and simplified (abbreviated) form. Simplification is expressed in a reduction in the number of reports themselves, as well as in the consolidation of data on the information reflected in them. However, it should be borne in mind that indicators that are significant and may influence the opinion of users of the statements must be disclosed either as separate lines in the reporting forms or in appendices to them.

Read about the new rules under which you will need to submit reports for 2021 in the article “The procedure for submitting financial statements has been changed.”

Sources:

- Tax Code of the Russian Federation

- Federal Law of December 6, 2011 No. 402-FZ

- Letter of the Federal Tax Service of Russia dated November 25, 2019 No. VD-4-1/ [email protected]

- Letter of the Federal Tax Service of Russia dated July 16, 2018 No. PA-4-6/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for filling out the balance sheet 2021: asset

Fill out the balance form starting with the active part. For greater clarity, we offer a tabular version, which indicates in which line of the balance sheet which indicators should be reflected, as well as the rules for summing the values:

| Line code | Account balances included | |

| D/t | K/t | |

| Section I | ||

| 1110 | 04 | 05 |

| 1120 | 04 | |

| 1130 | 08 s/account for expenses for search work | |

| 1140 | 08 MC expense account for prospecting work | |

| 1150 | 01, 08 s/account for fixed assets, the commissioning of which has not yet been carried out | 02 |

| 1160 | 03 | 02 s/account “Depreciation of assets classified as income. investments" |

| 1170 | 58, 55 s/account “Deposits”, 73 s/account “Loan settlements” | 59 s/account “Accounting for reserves for long-term liabilities” |

| 1180 | 09 | |

| 1190 | amounts not included in previous lines of the section | |

| 1200: Total for Section I | sum of partition rows | |

| Section II | ||

| 1210 | 41,15,16, 97, 10, 11, 43, 45, 20, 21, 23, 29, 44 | 42, 14, |

| 1220 | 19 | |

| 1230 | 62, 60, 68, 69, 70, 71, 73 (excluding interest-rate loans), 75, 76 | 63 |

| 1240 | 58, 55 s/account “Deposits”, 73 s/account “Loan settlements” | 59 |

| 1250 | 50, 51, 52, 55, 57, 55 s/account “Deposit accounts” | |

| 1260 | the value of assets not included in the listed lines of section II | |

| 1200:Total for section II | sum of partition rows | |

| 1600: Total assets | sum of results of sections I and II | |

Filling procedure and balance diagram

Every accountant should know how to fill out a balance sheet. After all, this is the most important form of reporting. The balance sheet is drawn up in the form approved by Order of the Ministry of Finance dated July 2, 2010 No. 66n. The rules establishing the procedure for filling out the balance sheet are described in PBU 4/99, approved. by order of the Ministry of Finance dated July 6, 1999 No. 43n.

IMPORTANT! On June 1, 2019, Order No. 61n of the Ministry of Finance dated April 19, 2019 came into force, amending the accounting forms. A field was added to the balance sheet containing information about whether the company is subject to mandatory audit and the details of the auditing firm. In addition, it is now necessary to indicate OKVED 2, instead of OKVED, and enter the indicators in thousands of rubles, because unit of measurement “million rubles” excluded. See here for details. These changes have become mandatory starting with reporting for 2021

The formation of a balance sheet is the last stage in accounting work, which is possible only on the basis of complete and reliable accounting data. Such data is accumulated in accounting registers. The main register used to fill out the balance sheet is the balance sheet, the final indicators of which are transferred to the balance sheet lines.

ATTENTION! It is not allowed to offset assets and liabilities with each other on the balance sheet. That is, debit and credit balances are displayed in assets and liabilities, respectively.

The form consists of two blocks:

- Assets where balances are displayed (as of December 31 of the reporting period):

- property;

- Money;

- financial investments;

- accounts receivable.

- Liabilities where the final indicators are transferred:

- accounts payable;

- reserves for future expenses;

- loans and credits broken down into long-term and short-term.

The value of an asset is always equal to the value of a liability. Otherwise, an error was made when filling out the form.

The balance sheet diagram looks like this:

Filling out the 2021 balance sheet according to the lines of the passive part

| Line code | Account balances included | |

| D/t | K/t | |

| Section III | ||

| 1310 | 80 | |

| 1320 | 81 | |

| 1340 | 83 s/account “Additional assessment of fixed assets and intangible assets” | |

| 1350 | 83 (except for additional valuation of fixed assets and intangible assets) | |

| 1360 | 82 | |

| 1370 | 84 | |

| 1300: Total for Section III | sum of section III row values | |

| Section IV | ||

| 1410 | 67 | |

| 1420 | 77 | |

| 1430 | 96 | |

| 1450 | amounts not included in the lines of section IV | |

| 1400: Total for Section IV | sum of rows of section IV | |

| Section V | ||

| 1510 | 66, 67 | |

| 1520 | 60, 62, 68, 69, 70, 71, 73, 75, 76 | |

| 1530 | 98, 86 | |

| 1540 | 96 | |

| 1550 | amounts not included in the previous lines of section V | |

| 1500: Section V total | sum of rows of section V | |

| 1700: Total liabilities | sum of row values of sections III, IV and V | |

If all balance lines are filled out correctly, the final results on lines 1600 and 1700 will be the same.

Which organizations will be classified as small businesses in 2017?

The current government cares about the development of small businesses. These organizations are provided with numerous concessions and benefits, among which are: “tax holidays”, simplified accounting and personnel document flow, and abbreviated reporting for small businesses in 2017. But not all organizations can enjoy such benefits, since the law has approved a list of criteria that determine whether a legal entity belongs to this group. So, in order for individual entrepreneurs and organizations to be classified as small businesses and be able to submit simplified reporting for small businesses in 2021, they must meet a number of parameters:

- the average number of employees is less than 100 people;

annual revenue does not exceed 800 million rubles;

the share of other persons in the charter capital does not exceed 25%, the share of foreign companies is less than 49%.

Balance sheet of an enterprise: completed example 2021

A sample of drawing up a balance sheet based on accounting data grouped in the balance sheet of Crocus LLC. To simplify the problem, let’s assume that the company was organized in 2021 and is preparing a balance sheet for 2021 for the first time. The 2017 balance sheet form, a sample of which is presented, involves considering the results of the company’s work for the reporting, last and previous years. In our example, information for 2021:

Account number Balance D/t K/t 01 825 000 02 443 000 04 8700 05 3000 08 32 000 10 50 000 19 10 000 41-2 575 000 41-3 33 000 42 120 000 44 12 500 50 10 000 51 92 000 52 7800 58 5000 60 265 000 62 15 000 66 75 000 68 57 000 69 12 000 70 30 000 71 1900 76 40 000 80 620 900 82 8000 84 75 000 In accordance with the instructions for filling out the form indicated above, we will fill out the balance sheet for 2021 based on the accounting data.

There is a choice

Law “On Accounting” No. 402-FZ allows you to choose which forms of accounting statements a small enterprise will use in its work (Part 4, Article 6). Namely:

- standard general (extended), intended for reporting companies that the law does not classify as small businesses;

- forms simplified in structure and completion.

Of course, the vast majority of small businesses choose simplified accounting. In this case, this decision must be recorded in the accounting policy.

Microenterprises in 2021

According to current legislation, the following criteria are established for small businesses:

- The number of employees is no more than 100 people.

Income for the year no more than 800 million.

The participation rate of third parties is less than 49%.

For micro-enterprises, the criteria are even more stringent: the number of employees is up to 15 people and revenue is less than 120 million rubles. There are exceptions for some companies, so not all organizations that meet the above requirements can be considered a small business and enjoy the corresponding benefits and concessions. Exception companies submit statistical, tax and accounting tests. reporting in full.

The main difficulty in compiling statistics for small businesses is that it makes no sense for a small company to maintain a whole staff of accountants. And one specialist often cannot cope with an impressive amount of information. As a result, claims may arise from regulatory authorities. To avoid such an unpleasant situation, it is wise to contact third-party accountants who will prepare and send any reports. Only qualified specialists can fill out reporting documentation on time and taking into account all requirements.