When and what errors occur

Errors in payments between counterparties are made by the compilers of payment orders, i.e. employees of accounting departments. In this case, incorrect data can be in a variety of points in the document: for example, the number of the agreement under which funds are transferred is incorrectly indicated, the purpose of the payment is incorrectly written, or, sometimes, VAT is allocated where it is not necessary, etc.

This can be corrected unilaterally by sending a letter to the partner to clarify the purpose of the payment.

In this case, the other party is not obliged to send a notification of receipt of this message, but it will not be superfluous to make sure that the letter has been received.

Clarification letter to the FSS

Clarification letter to the Social Fund. insurance, you can write in free form addressed to the head of your territorial office. It must indicate the TIN and KPP of the policyholder, as well as the correct values of the details in which the error was made.

If, due to a mistake, the funds were transferred to the account of another government agency, it would be best to write two letters at once. Send one to the Foundation, and the second to the authority where the money was received by mistake.

A sample letter to the Social Insurance Fund about payment clarification is given below:

Sample letter to the Social Insurance Fund about payment clarification

Is it possible to challenge a new payment assignment?

Typically, changing the “Purpose of payment” parameter occurs by mutual agreement and without any special consequences. But in some cases complications are possible. For example, if the tax inspectorate during an audit discovers such a correction and considers it a way to evade taxes, sanctions from the regulatory authority can be considered inevitable. It happens that friction regarding the purpose of payment arises between counterparties, especially in terms of payments on debts and interest. In most cases, in order to challenge the correction, the party protesting it will have to go to court, and no one will give guarantees of winning the case, since such stories always have many nuances.

An important condition necessary in order to avoid possible problems is that information about changes in the purpose of the payment must be transmitted to the banks through which the payment was made. To do this, you just need to write similar letters in a simple notification form.

Methods of sending a letter

You can send a clarification letter in one of several ways:

- Bring it in person to the territorial office of the authority;

- Send with a courier service employee;

- Via the Internet;

- By post with acknowledgment of delivery.

If sending is carried out via the Internet, the company’s digital signature must be affixed to the clarification letter about the purpose of payment.

Similar articles

- Field 107 in the payment order

- How to revoke a payment order

- Payment for a third party payment purpose

- Payment order fields

- How to fill out the payment purpose in a payment order?

How to write a letter correctly

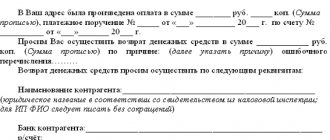

A letter to clarify the purpose of payment does not have a unified template that is mandatory for use; accordingly, it can be written in any form or according to a template approved in the company’s accounting policy. At the same time, there is a number of information that must be indicated in it. This:

- name of the sending company,

- his legal address,

- information about the addressee: company name and position, full name of the manager.

- a link to the payment order in which the error was made (its number and date of preparation),

- the essence of the admitted inaccuracy

- corrected version.

If there is several incorrectly entered information, then they must be entered in separate paragraphs.

All amounts must be entered on the form in both numbers and words.

When writing a letter, it is important to adhere to a business style. This means that the wording of the message should be extremely clear and correct, and the content should be quite brief - strictly to the point.

Clarification letter to the Pension Fund of Russia

If, when paying insurance contributions to the Pension Fund, the company made a mistake in the payment slip, and this mistake resulted in the money not being transferred to the state budget, the mistake can be corrected by writing a clarifying letter to the Fund.

The clarification letter to the Pension Fund also does not have an officially established form, but has a recommended form developed by the Fund.

A sample letter to the Pension Fund for clarification of payment is given below:

Sample letter to the Pension Fund for clarification of payment

A photocopy of the payment slip, the details of which need to be clarified, must be attached to the letter.

How to format a letter

The law makes absolutely no requirements for both the informational part of the letter and its design, so you can write it on a simple blank sheet or on the organization’s letterhead, and both printed and handwritten versions are acceptable.

The only rule that must be strictly followed: the letter must be signed by the director of the company or a person authorized to endorse such documentation.

It is not necessary to stamp the message, since since 2021 legal entities are legally exempt from the need to do this (provided that this requirement is not specified in the company’s internal regulations).

The letter must be written in at least four copies :

- you should keep one for yourself,

- transfer the second to the counterparty,

- the third to the payer's bank,

- the fourth to the recipient's bank.

All copies must be identical and properly certified.

How to fill out form 23-FSS

Note: Format.docx, 23 KB

- Application for refund from overpayment from 2021

- Application for refund of overpayment until 2021

As for those operating in 2021.

forms for the return (offset) of contributions approved by the FSS order No. 49 dated February 17, 2015, then from 2021 they will not be applied to contributions “for injuries”. At the same time, they will continue to be used to return (offset) contributions in case of temporary disability and in connection with maternity for reporting periods that expired before 01/01/2017 (FSS Order No. 458 dated 11/17/2016). At the beginning of 2017, payment orders for insurance premiums changed.

The BCC, recipient details, and other values have changed in the payments. However, we have good news: tax authorities will correct many errors automatically without statements from accountants.

How and for how long to store a letter

After sending, all letters about clarification of the purpose of payment must be registered in the journal of outgoing documentation, and one copy must be placed in the folder of the current “primary” company. Here it must remain for the period established for such documents by law or internal regulations of the company, but not less than three years . After losing its relevance and expiration of the storage period, the letter can be transferred to the archive of the enterprise or disposed of in the manner prescribed by law.

Calculation of contributions made, presented in the form of completed form 4-FSS

This form contains the amounts of payments transferred to the fund and also confirms their validity.

Its form is clearly defined by law and can be downloaded on the Internet. There should be no mistakes when filling out this document: they may cause refusal.

To return funds from the Social Insurance Fund, you must provide the following information in the form:

- signatures of authorized persons of the company.

- date of document preparation;

- information about the presence or absence of debt to the authority;

- information about social payments made;

- OKVED code;

- registration number of the policyholder in the Fund;

Form 4-FSS does not have to be completed at the end of the reporting period. It can be filled out at another convenient time, for example, on the last day of the month.

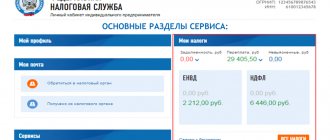

If you sent insurance premiums to the old fund details

From January 1, 2021, insurance premiums must be transferred to the Federal Tax Service, and not to funds (federal laws of July 3, 2016 No. 243-FZ and No. 250-FZ). This also applies to payments for previous years. For this reason, the BCC and details of the recipient of insurance premiums have changed in your payments. Let's assume that at the beginning of the year you made a mistake and filled out the payment order incorrectly, for example, instead of the TIN, KPP and the name of the tax office, you entered the fund's data. Then the tax authorities will correct the payments automatically. And you will not need to contact officials with a request to clarify the payment or return the money.

Tax officials and the Federal Treasury promise to automatically recode incorrect payments, correct old BCCs with new ones, change the recipient of contributions (joint letter of the Federal Tax Service of Russia dated January 17, 2017 No. ZN-4-1/540 and the Treasury of Russia dated January 16, 2017 No. 07-04-05/ 05-46).

Payments that you mistakenly sent to the funds will still go to the tax authorities. And you will not have to pay penalties and fines for late payment of fees. Inspectors will reflect the money when you actually sent it. But if you want to correct your payments as quickly as possible, you have the right to contact the tax office with a request to clarify bank orders. See below for a sample application.

What should a taxpayer do if a payment is lost?

First of all, you need to request a reconciliation of calculations with the budget, for example, in the form of a Certificate of Payment Status. The results of the reconciliation can also be documented in an act signed by the taxpayer and an authorized tax official. Receiving a statement of reconciliation of calculations will allow the taxpayer to quickly respond to the emergence of disagreements with the Federal Tax Service.

Then you need to send a letter to the tax office as soon as possible about the search for payment, a sample of which is given below. Documents must be attached to the letter that confirm that the tax payment has been made. Such documents are:

- payment order for tax payment,

- statement from the bank.

If the payment was issued in paper form, you should attach a copy bearing the bank’s mark (stamp of the institution and signature of the operator who carried out the operation). If the payment order was issued in electronic form, a printout of it and a notification from the bank about acceptance of the payment for execution must be attached to the letter to the Federal Tax Service (the date of acceptance must be indicated).

Sample application for clarification of payment

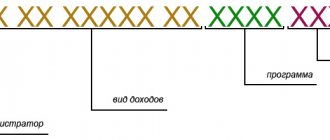

To the head of the Federal Tax Service No. your tax office for the Vladimir region (what is your region) From the name of your legal entity INN 330812300601/ KPP 3301001 Address: your legal address APPLICATION to clarify the payment Payment order dated 02.02.2017 No. 10 Progress LLC paid pension contributions insurance for January 2017 in the amount of 10,000 rubles. By mistake, the company reflected the KBK for 2021 in the payment. Payment of pension insurance contributions was made in 2017.

Therefore, the code should be – 182 1 0210 160. We ask: – consider in the payment order No. 10 dated 02.02.2017 the correct KBK 182 1 0210 160 (clause

7 and 8 art. 45 Tax Code of the Russian Federation); – clarify the payment and not charge penalties, since the company fulfilled its obligation to pay insurance premiums for January 2021 on time. In addition, the error in the BCC did not result in non-transfer of contributions to the budget.

New form

“Application to clarify the basis, type and affiliation of the payment, reporting (settlement) period or status of the payer of insurance premiums”

officially approved by the document Letter of the Pension Fund of the Russian Federation dated 04/06/2011 N TM-30-25/3445. More information about using the form:

- Change in legislation for an accountant as of 08/07/2014 Equal to or exceeds the useful life, but part. upon application of the employee, a copy of the work book or a certified one must be issued. insurance premiums, payers have the opportunity to submit an application to the body monitoring the payment of insurance premiums to clarify their status, reporting (settlement) period, basis, type and attribution of payment. sale - in urban settlements or rural areas, the specified persons also. (with or without confiscation of products) on the basis of Part 3 of Art.

- Review of changes in accounting and taxation from the magazine “Glavbukh” No. 1/2011 Holiday payers also write off the insurance premiums accrued to them. Application for tax credit. -FZ. So there is now a procedure for clarifying payments for insurance premiums. Let's say an accountant. to the body monitoring the payment of insurance premiums, an application to clarify the basis, type and identity of the payment, the reporting or billing period, or the status of the payer of insurance premiums in connection with the error. of the year. — Do the payment clarification rules apply for insurance premiums? — In operation since 2011.

- Changes in legislation for accountants as of December 16, 2010 Subject to insurance contributions 4. The Federal Financial Markets Service of Russia has approved the rules for determining the estimated value of securities and. .3. New deadlines have been established for the submission of reports on insurance premiums and personalized accounting. According to. must submit an application to the regulatory authority to clarify the basis, type and affiliation of the payment, reporting (settlement) period or status of the contribution payer. Supporting documents must be attached to the application.

- How can I clarify an unclear payment? A request to clarify the basis, type and identity of the payment, tax period or payer status. Proof of production must be attached to the application. Firstly, clarification of details in settlement documents for the payment of insurance premiums is not carried out. depends on the date of payment. If the payment was made for settlement (reporting) periods that expired before 01. Pension Fund (before transferring the administration of insurance premiums to the Federal Tax Service), then an application to clarify the details must be submitted to.

- Classification of income An updated Declaration in the form that was in force in that reporting (tax) period. type of income, there is another type. based on the company’s financial statements for the year in which the application was submitted. and on the establishment of payment benefits. belonging of funds, goods, works and services to humanitarian or. and payers of fees from budgets and. and international organizations and associations status. order of price lists of estimated prices for. including insurance contributions for compulsory pension.

- Changes in legislation for accountants as of May 26, 2011 It is necessary to submit an application to the regulatory authority to clarify the basis, type and affiliation of the payment, reporting (settlement) period or status of the contribution payer. The Pension Fund of Russia has developed a recommended example of this. The status of the payer, the basis for the payment, the reporting (settlement) period, and the type of payment are also indicated. The application must be accompanied by a payment document for the transfer of insurance premiums and indicators.

- Changes to the rules for payment of insurance premiums 18 of Law No. 212-FZ. The payer has the right to submit an application to clarify the basis, type and affiliation of the payment, the reporting (settlement) period or the status of the payer of insurance premiums in connection with the admitted. an error if it did not result in non-transfer of insurance premiums.

- Object of taxation according to the simplified taxation system of estimated price lists. organizations - tax payers. reporting period of transfer of ownership and receipt of income from the lessee on the basis. or the organization’s production of uniforms and shoes that indicate affiliation. payments (contributions) of employers, paid under long-term life insurance contracts for employees, pension insurance and (or the status of military personnel and about institutions and personal statements, such as banks and other credit organizations, insurance.

- Insurance premiums in 2011: we are moving to new tariffs. The Federal Law has clarified the object of taxation of contributions. They recognize payments and other remunerations accrued by payers of insurance premiums. for insurance premium payers in 2011” is posted here. The procedure for presenting calculations has been clarified. Let us remind you. transfer of contributions, penalties and fines, the organization has the right to submit to the Pension Fund or Social Insurance Fund an application to clarify the basis, type and identity of the payment, reporting (settlement) period or status of the payer of contributions.

- Contributions paid to the old KBK, to the FFOMS and TFOMS in 2012 by the Treasury. In this case, the payer must: submit an application to clarify the basis, type and affiliation of the payment, the reporting (settlement) period or the status of the payer of insurance premiums in connection with the admitted. mistake, attaching documents confirming his payment of insurance premiums.

- Clarification of the basis, type and affiliation of a payment to extra-budgetary state funds, the reporting period or the status of the payer: decision form N 434 “On approval of the form of a decision to clarify the basis, type and affiliation of the payment, the reporting (settlement) period or the status of the payer of insurance premiums” Payer of insurance premiums in off-budget state funds. control over the payment of the specified amounts; a statement to clarify the basis, type and affiliation of the payment, the reporting (settlement) period or its status. The decision form has been approved. such a statement. Registered with the Ministry of Justice of the Russian Federation 1.

- Features of filling out an application for cash expenses for insurance premiums It is enough for the institution to submit to the Federal Tax Service or the Social Insurance Fund an application to clarify the basis, type and nature of the payment, the reporting (settlement) period or the status of the payer (policyholder) (clauses 7, 9. calculations for insurance premiums. On Based on the application submitted by the institution, the Federal Tax Service or the Social Insurance Fund makes a decision to clarify the payment in accordance with Law No. 125-FZ, or return it to the payer of insurance premiums in the manner prescribed by Article 78.

- The procedure for calculating, the procedure and terms for paying the unified social tax by taxpayers making payments to individuals. The base for calculating insurance premiums, calculated from the beginning of the billing period, and the insurance premium tariff provided for in paragraph 2. accounting, you should submit an application requesting clarification of the basis, type and nature of the payment, tax period or payer status. Supporting documents are attached to the application. , pay insurance premiums for compulsory pension insurance and submit reports on insurance premiums in order.

- What has changed in the payment of insurance premiums An application must be submitted to the branch of the Pension Fund of the Russian Federation or the Social Insurance Fund of the Russian Federation to clarify the basis, type and affiliation of the payment, the reporting or billing period, and the status of the payer of insurance premiums due to the admission. there is an error in the order. Needed for application.

- On the actions of the Pension Fund and the payer, if the payment document does not indicate the purpose of the payment and the period for which the Federal Law is paid, the payer of insurance premiums has the right to submit to the body monitoring the payment of insurance premiums an application to clarify the basis, type and nature of the payment, the reporting (settlement) period or status of insurance premium payer p. attaching documents confirming payment of insurance premiums. Vice-chairman.

Errors are often discovered in an organization's well-functioning workflow.

This mainly happens in departments involved in calculations: statistics, economics, accounting, taxes. A rather unpleasant event is the failure of the payment system, funds and their payment documents.

Errors in payment and how to correct them?

| Error | What to do |

| Incorrect Russian Treasury account number and recipient bank details | Tax inspectors will consider insurance premiums unpaid. The Federal Tax Service will demand payment of the arrears with penalties and fines and will block the account (clauses 4, 6 and 8 of Article 45 of the Tax Code of the Russian Federation). You will have to pay the fees again using the correct details. Return the erroneous payment. To do this, contact:

|

Incorrect details:

| The money arrived as intended. Check your payment by submitting an application to the tax office with the correct details |

| You transferred an excess amount of insurance premiums to the budget | You can offset the overpayment against future payments. Another option is to return the overpayment. To do this, submit an application. Before offset or return, the Federal Tax Service of Russia may order a reconciliation of settlements |

| Confused FSS, PF and IFTS | The situation when you sent contributions to the funds to the old details, and not to the Federal Tax Service, is not dangerous. In this case, tax authorities will recode the payment to the correct details automatically. |

If you made a mistake in the payer status (field 101)

In 2021, accountants had difficulties with field 101 “Payer Status” of payment orders for contributions. In 2021, when paying insurance premiums for employees, companies and individual entrepreneurs reflected status 08 in this field. This code is provided for insurance premium payers in the rules for filling out orders (Appendix No. 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013). Officials did not make any changes to the procedure for filling out payment slips. Due to the fact that tax authorities began to control contributions, accountants began to question whether the payer’s status had changed since 2021.

Officials have issued several conflicting explanations. At first, they recommended indicating status 08 in field 101. Then information appeared that it was necessary to reflect status 14 (joint clarification dated January 26, 2017 by the Federal Tax Service of Russia No. BS-4-11/, the Board of the Pension Fund of the Russian Federation No. NP-30-26/947 and the Federal Tax Service of the Russian Federation No. 02-11-10/06-308-P). However, many banks do not accept payment orders with a value of 14. Therefore, tax officials advised companies to enter in field 101 the status provided for tax payers - 01 (letter of the Federal Tax Service of Russia dated 02/03/2017 No. ZN-4-1/).

Whatever status you specify, the payment will still go to the budget. There is no need to specify the payment. Moreover, officials and banks have not yet agreed on which value is correct.

Banks promise to finalize the software so that they allow payment of insurance premiums for employees with status 14. Until this happens, indicate the value 01 (employee contributions) or 09 (individual entrepreneur contributions). Payments with status 08 will also go through.