Accounting for VAT on payment and shipment in 2021 has not changed. In letter No. 03-07-11/3850 dated January 24, 2019, the Ministry of Finance of the Russian Federation once again clarified how VAT is accounted for on shipment before receiving payment. Such transactions are rare, but various agreements occur in the economic life of a company. The seller is obliged to charge VAT “on shipment” or “on payment”, taking into account whichever comes first, since Art. 167 of the Tax Code of the Russian Federation determines the moment of formation of the tax base.

Therefore, the moment for determining the tax base in a “shipment without payment” situation is the day of shipment, regardless of the terms of the contract, which means that the supplier has an obligation to immediately charge tax, although payment for the transferred goods has not yet been received. In the future, when receiving funds, he will not have to recalculate the base. Let's figure out how to take into account such transactions between the supplier and the buyer.

VAT postings. Basic Rules

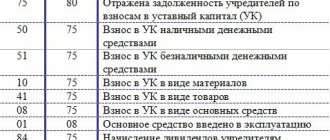

Enterprises in their economic activities face VAT when selling products, goods, providing services, performing work to their customers and contractors (and then it is necessary to charge VAT on their cost), as well as when purchasing goods, works, services from suppliers (taking VAT as a deduction ).

In general, VAT calculation on sales will look like this:

Debit 90 Credit 68 (if account 90 “Sales” was used when selling the asset).

Debit 91 Credit 68 (if the sale was carried out through account 91 “Other income and expenses”).

As we can see, VAT payable to the budget actually accumulates in the credit of account 68.

When we purchase a product, we have the right to reimburse the tax from the budget. In this case, the rules for accounting for VAT are as follows: the tax is allocated from the purchase amount and is accounted for in account 19 “VAT on purchased assets.” The wiring looks like this:

Debit 19 Credit 60 - VAT on purchased assets is reflected.

Debit 68 Credit 19 - VAT is deductible.

Thus, the refundable VAT is collected in the debit of account 68. And as a result, the amount of tax to be transferred to the budget is formed, defined as the difference between debit and credit turnover on account 68: if credit turnover is greater than debit, then the difference must be transferred to the budget, if vice versa - the difference is subject to compensation by the state.

We talk about typical transactions related to the deduction of VAT in the special material “Posting “VAT accepted for deduction”: how to reflect it in accounting?” .

Typical VAT entries for purchased assets

VAT on purchased assets and services is accounted for using the following entries:

Debit 19 Credit 60 - reflection of the “input” VAT on purchased fixed assets, intangible assets, materials, goods, capital investments, works, services. Posting is done based on the received invoice.

Debit 68 Credit 19 - reflection of VAT deductible on inventories and services, including in the case of confirmation of the fact of export. Posting is done on the basis of invoices, and when confirming exports, after submitting the documents listed in Article 165 of the Tax Code of the Russian Federation to the Federal Tax Service and receiving the appropriate decision.

See also “What are VAT tax deductions?” .

In some cases, “input” VAT cannot be deducted.

For more information about situations when VAT deduction is impossible, and how to take it into account for tax purposes, read the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

In accounting, tax that is not deductible is written off to cost or financial results accounts:

Debit 20 (23, 25, 26, 29, 44) Credit 19 - write-off of VAT on acquired assets and services that will be used in transactions not subject to VAT. The posting is made on the basis of an accounting calculation prepared by a certificate.

Debit 91 Credit 19 - write-off of VAT on other expenses if the invoice from the supplier was not received, lost or filled out incorrectly.

See also the material “What are the grounds and how to write off VAT on 91 accounts?” .

Debit 20 (23, 29) Credit 68 - restoration of VAT previously claimed for reimbursement of inventories and services used for transactions not subject to VAT. The basis of the posting is again a reference calculation.

For reasons for VAT restoration, see this material.

If you have made an advance payment to the supplier, you can see what transactions should be made for VAT in the Ready-made solution from ConsultantPlus experts. Get a free trial access to K+.

Algorithm of the seller’s actions when receiving an advance from the buyer

If payment is made in installments, VAT calculation becomes more complicated:

- When receiving an advance, the seller must calculate VAT on the day of receipt.

- On the day the goods are shipped, this tax should be deducted.

- Then you need to calculate the new VAT, based on the sales value.

In this case, the cost is taken including value added tax.

Typical entries for accounting for VAT on sales

Debit 90 Credit 68 - VAT accrual on sales of assets, works, services. The basis of the entry is the outgoing invoice.

Debit 76 Credit 68 - accrual of VAT on advances received. The basis is an advance invoice.

Debit 68 Credit 76 - reflection of the offset of VAT on advances upon completed shipment (performance of work, provision of services). The basis is the issued invoice.

Debit 08 Credit 68 - accrual of VAT on construction and installation works carried out in-house. The basis is an accounting certificate.

Debit 91 Credit 68 - VAT accrual for gratuitous transfer of assets. The posting is made on the basis of the issued invoice.

Debit 68 Credit 51 - VAT debt has been repaid. The basis is a bank statement.

If you have received an advance from the buyer, you can see what entries should be made for VAT in the Ready-made solution from ConsultantPlus experts. Get a free trial access to K+.

If VAT is calculated by tax agents

Example 1. Lease of state property:

Debit 20 (23, 25, 26, 44) Credit 60 (76) - accrual of costs for renting state property.

Debit 60 (76) Credit 68 - VAT accrual from the tax agent.

Debit 19 Credit 60.76 - accrual of input VAT specified in the agreement.

Debit 68 Credit 51 - reflection of VAT transferred to the budget.

Debit 68 Credit 19 - VAT on rent to be refunded at the time of tax payment.

See the material “ Tax agent for VAT in transactions with state property ” for more details.

Example 2. Services provided by a foreign company on the territory of the Russian Federation:

Debit 44 (20, 25, 26) Credit 60 (76) - a reflection of services provided by a foreign company to a Russian organization in the Russian Federation.

Debit 19 Credit 60 (76) - accounting for VAT paid on the income of foreign legal entities.

Debit 60 (76) Credit 68 - VAT withholding from a foreign partner.

Debit 68 Credit 51 - VAT paid by the tax agent.

Debit 68 Credit 19 - VAT of the tax agent to be deducted after its payment.

See also the material “ How can a tax agent deduct VAT when purchasing goods (work, services) from a foreign seller .”

Sale of seized property

Situation: who must pay VAT when selling the organization’s seized property?

The answer to this question depends on who made the decision to sell the seized property.

Property can be seized either by court decision or by decision of other authorized bodies (for example, tax inspectorates or customs service). In this case, the property can be sold by bailiffs or specialized organizations authorized by the Federal Property Management Agency.

If property is seized by a court decision, then the duties of a tax agent are performed by organizations authorized to sell the said property. For example, the duty of a tax agent may be assigned to bailiffs (clause 2 of Article 12 of Law No. 118-FZ of July 21, 1997). They must withhold the amount of VAT from the proceeds from the sale of property and transfer it to the budget. This conclusion follows from the provisions of paragraph 4 of Article 161 of the Tax Code of the Russian Federation and is confirmed by paragraph 7 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33.

If property is seized by decision of other authorized bodies, the provisions of paragraph 4 of Article 161 of the Tax Code of the Russian Federation do not apply. This rule regulates the procedure for taxation of transactions related to the sale of property seized only on the basis of court decisions. Therefore, if bailiffs (specialized organizations) sell property seized, for example, by decision of the tax inspectorate or customs, then VAT must be paid by the owner of the property (debtor in enforcement proceedings). Similar explanations are contained in letters of the Ministry of Finance of Russia dated June 18, 2009 No. 03-07-11/163, Federal Tax Service of Russia dated April 1, 2011 No. KE-4-3/5132 and in paragraph 7 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 city No. 33.

The obligation to pay VAT does not arise for either property owners or tax agents:

- if the seized property belonged to persons who are not recognized as VAT payers (for example, organizations or entrepreneurs applying special tax regimes) (letter of the Ministry of Finance of Russia dated November 1, 2012 No. 03-07-11/473);

- if the sale of seized property is exempt from taxation in accordance with Article 149 of the Tax Code of the Russian Federation. It is necessary to take into account that if the activity of selling property is subject to licensing (for example, the sale of medical goods by their manufacturers (subclause 1, clause 2, article 149 of the Tax Code of the Russian Federation)), then the tax agent is exempt from the obligation to pay VAT only if if the owner of this property has a license for the specified activity (clause 6 of Article 149 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated January 16, 2012 No. 03-07-07/01).

Typical VAT transactions when returning goods

From 2021, postings for returning goods depend on how the return occurs: within the framework of the original contract or as a resale under another contract, and does not depend on whether the goods are returned of high quality or defective.

If the item is returned under the original contract, the postings will be as follows.

Important! ConsultantPlus warns If you are returning a product for which “input” VAT was previously deducted, the tax must be restored. This is done on the basis of the seller's adjustment invoice or primary documents on the reduction in the value of goods shipped, whichever came first. See K+ for more details. Trial access is available for free.

From the buyer:

Debit 60 Credit 76 - adjustment of settlements with the seller.

Debit 76 Credit 41 - return of defective goods to the seller.

Debit 76 Credit 68 - restoration by the buyer of VAT previously accepted for deduction, attributable to the cost of the return.

From the seller:

Debit 62 Credit 90.1 - reversal of revenue.

Debit 90.2 Credit 41 - reversal of cost.

Debit 90.3 Credit 19 - reversal of accrued VAT on returned goods.

Debit 68 Credit 19 - deduction by the seller of VAT on the returned goods.

In case of reverse sale, taxation will be the same as for a regular sale, only the buyer and seller change places.

Example. Postings when returning goods of proper quality from ConsultantPlus The organization received 100 units of goods worth 120,000 rubles, including VAT - 20,000 rubles. Of these, 10 units were returned to the supplier for 12,000 rubles, including VAT - 2,000 rubles. You can view the entire example in K+, getting free full access.

Deadline for payment of VAT in 2021 by legal entities

As a general rule, VAT taxpayers must pay the calculated tax at the end of the tax period in 3 equal payments: no later than the 25th day of each of the 3 months following this period (clause

(346,500 + 240,000). Based on this, the amount of accrued VAT for this month will be 105,570 rubles.

1 tbsp. 174 of the Tax Code of the Russian Federation). And the tax period for VAT is a quarter (Article 163 of the Tax Code of the Russian Federation). If the deadline for paying VAT falls on a weekend or a non-working holiday, then the last day on which you can still pay VAT is the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). Thus, the deadlines for paying VAT for the 4th quarter of 2021 are 1/3 of the tax amount no later than January 25, 2021, February 25, 2021 and March 25, 2021.

Also see:

- ““;

- ““.

We recommend reading: Arrange public transport

VAT payable for the 3rd quarter of 2021 – RUB 185,260. When dividing the amount by three, the result is 61,753.33 rubles. (RUB 185,260 / 3). VAT must be paid within the following terms:

- no later than November 26, 2021 – second payment 61,753 rubles.

- no later than October 25, 2021 – first payment 61,753 rubles.