Home / Complaints, courts, consumer rights

Back

Published: 11/05/2018

Reading time: 4 min

0

425

Lending money is a common practice. Someone gives a loan “on the promise of repayment,” and someone draws up a receipt for taking the money. The second option is especially relevant when the amount of debt between individuals exceeds ten thousand rubles.

- Debt collection without receipt

- Steps to take when returning Filing a police report

- Going to court

- Other methods of debt collection

However, no matter how the money was given - with or without a receipt, the lender has the opportunity to return his funds.

Returning the borrowed amount with a written receipt involves a more simplified procedure. The most important thing in this situation is to display all the main points and nuances in the design and content of the loan agreement, namely:

- Writing a receipt by hand for the possibility of conducting a handwriting examination.

- Duplicating numeric characters with alphabetic characters.

- Indication of the period of temporary use of money.

- Certification by a notary (if desired).

- Verification of the borrower's signature with his other documents.

To repay the debt under the receipt, the lender can take a peaceful route. To do this, you need to contact the borrower, remind him of the existing debt and find out the reasons for the delay. If the other party makes contact, then, depending on the situation, the parties can renew the agreement for a longer period or break the amount into parts.

If the borrower does not make contact and hides, then the lender needs to draw up a pre-trial claim and send it to the other party, after which a response and refund of funds must follow within 30 days.

But if this action does not lead to the desired result, the lender needs to contact higher authorities and file a statement of claim demanding the return of funds.

What does interest-free loan mean?

An interest-free loan is any transaction in which one party borrows a certain amount of money from another without additional commission. That is, the borrower uses the lender’s funds without paying him any remuneration for it.

Article 809 of the Civil Code defines the main features of an interest-free loan:

- the borrower receives an amount not exceeding 50 minimum wages and uses it for personal (non-commercial) purposes;

- the object of the transaction can be not only money itself, but also property determined by generic characteristics.

The purposes of an interest-free loan can be different: buying a home or car, traveling, etc. The only limitation is that these funds cannot be invested in business. In addition, one of the parties to the transaction can receive a car, computer or any other thing for personal use, and pay for it a loan equal to the value of this property.

It is clear that a bank loan always involves the payment of interest. A loan without a commission is most often received by employees or founders from the company where they work.

Typically, this type of lending is associated with regular payments, the frequency of which is specified in the agreement. A very common option is for a company to provide an interest-free loan to a valuable employee in order to keep him in the organization. By solving an employee’s problem (for example, buying him a home), the company helps the specialist work more efficiently. In this case, part of the cost of the acquired property is gradually deducted from his salary. Also, an interest-free loan is sometimes used as a cover for internal distribution of funds.

Risks of an interest-free loan agreement

An important question for both parties to the transaction is what risks exist in issuing an interest-free loan. First of all, it is worth mentioning the danger of reclassifying such a loan issued to a company by one of its managers or employees as a non-repayable deposit.

If the funds were provided for a period exceeding three years, or the contract was continually renewed, the court may determine that it is a non-repayable loan. Risk also occurs in a situation where, at the end of the transaction, the money remains unclaimed.

A decision to re-qualify the agreement is adopted in court if the circumstances of the issuance and repayment of the loan indicate that the lender did not initially plan to demand the money back. Often the reason for such a decision is such formulations of the purpose of the loan specified in documents as “ensuring economic activity”, “maintaining working capital” or “development of the organization” (for example, the determination of the Arbitration Court of the Khabarovsk Territory dated January 9, 2021, No. A73-18372 /2017).

The risk of an interest-free loan for the lender in this case is obvious: he will lose the legal right to get his money back. The consequences for the firm receiving the loan depend on who the lender was. According to Article 27 of the Federal Law of February 8, 1998, No. 14-FZ “On Limited Liability Companies,” only its participants can contribute to the property of an LLC. Accordingly, if the lender was not a member of the LLC, then the funds that the court qualified as a non-repayable contribution will automatically become part of the company’s income. This is explained in Article 251 of the Tax Code, which defines a limited list of conditions under which funds received by an organization may not be taken into account as part of its income.

Subtleties of design

Repayment of a loan to a citizen of the Russian Federation or a foreign founder, as a rule, is organized without the preparation of additional documents. As soon as the last payment is made, the transaction is closed. By the last day of payment, you must pay off the debt and pay off interest (if provided for in the agreement). If the money is not received, the creditor has the right to apply sanctions - fines, penalties and others. Responsibility for delay is specified in the contract between the parties.

After repaying the debt, the payer receives a document that confirms the payment (cash order or check) or a bank statement confirming the repayment of the loan from the current account. In certain cases, the founder has the right to forgive the debt. In such a situation, a donation agreement is drawn up indicating the date and amount.

Terms and amount of interest-free loan

- Terms There are no direct restrictions in official documents regarding the terms of such a loan. In addition, the Civil Code directly states that an interest-free loan agreement is recognized as legal, even if it does not indicate a period of validity at all. However, such restrictions may be due to other factors, in particular, the statute of limitations. For obligations designated as “perpetual” or “on demand”, it is 10 years, as evidenced by Article 200 of the Civil Code. As a result, the following situation arises: if the owner of the funds really wants to ever get them back, then at the end of this period the loan must be returned and the deal must be concluded again. Otherwise, the statute of limitations will expire, and this creates the risk that the money that was the subject of the contract will never be returned. Thus, loans without a specific period of validity and “on demand” in practice cannot exist for more than 10 years. Still, for the convenience of both parties, it is better to include in the agreement conditions that determine the repayment period of the interest-free loan. The rules of the above article of the Civil Code are not taken into account here. This means that the contract period may exceed 10 years. The statute of limitations in this case is counted not from the time of the obligation to return funds to the lender, but from the date of their violation.

- Sum

Organizations have the right to issue or receive interest-free loans in any amount. The law does not establish a minimum or maximum amount for such a loan: it can range from several thousand to several million rubles. However, there are two significant nuances in this issue. Firstly, we must not forget about the peculiarities of issuing loans in cash. There is Directive of the Bank of Russia dated September 7, 2013, No. 3073-U, which establishes the following limitation: if both parties to the agreement are legal entities or individual entrepreneurs, then they cannot transfer more than 100 thousand rubles in cash to each other as a loan. If at least one party is an individual who is not registered as an entrepreneur, then this rule does not apply. Secondly, the lender must think in advance about the possibility of confirming its financial solvency. When drawing up an agreement, the lender needs to understand: there is always a risk that a dispute will arise between him and the loan recipients, and the matter will go to court. Then he will have to prove that at the time of the transaction he actually had the specified amount of money. Only real evidence of the availability of appropriate financial capabilities guarantees him the right to receive funds back (for example, the resolution of the Arbitration Court of the Far Eastern District dated July 9, 2021, No. F03-2065/2018 and paragraph 3 of paragraph 26 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 22, 2012, No. 35 ).

Refinancing - is it possible in an MFO?

Not knowing how to get rid of debt, many borrowers turn to loan lawyers for help. Legal assistance is a reliable option not only to assess the situation from a legal point of view, but also an opportunity to actually solve the problem.

Refinancing is used to simplify the situation for the debtor and is used in cases of problem debts. This method is a new agreement at lower interest rates. The purpose of issuing such a loan is aimed at repaying an old loan. To receive money, you must write an application requesting a new loan.

MFOs have the right to sell bad debts to third parties. These may include collectors and individuals. Therefore, if the borrower receives calls or collectors come demanding the return of money, it is possible that they were sold for little money. In this case, you need to know the procedure for collecting debt from collectors and try to find a common language with them.

How is a loan refinanced?

To get the desired result of reducing the interest rate on a loan, you need to understand what refinancing is - this is discussed in the video below.

How to get an interest-free loan at work

It is worth immediately noting that in each organization relations with employees are built differently. In some companies, providing interest-free loans to employees is normal practice, while in others such issues are not considered at all.

One way or another, if an employed person needs to borrow money, he or she should always contact the employer first, since such a loan will be much more profitable than a bank loan.

All you need to do is write an application addressed to the head of the company. Indicate the exact amount in it, and also explain for what purposes you need the money and how you are going to give it, so the risk of refusal will be less.

The decision in this case depends entirely on the individual employer. There is no law that in one case or another would oblige a manager to issue loans to his subordinates. Accordingly, the answer can be either positive or negative.

If management has agreed to satisfy your request, the next step is to draw up an order to provide the specified amount. Money can either be issued in cash or transferred to a salary card.

Then a certain portion will be regularly deducted from your salary until the debt to the organization is fully repaid.

You can always find out about the established amount of loan payments from the accounting department. Another option is to indicate in advance on your application what amount of deduction is acceptable to you.

An interest-free loan issued by an employer has significant advantages over a bank loan. In this case, the total amount of deductions completely coincides with the size of the loan; the employee does not pay any additional interest. In other words, this type of lending seems to be the most profitable.

The employer also receives certain benefits from the transaction: there is no risk of losing a specialist until he repays the debt. Therefore, companies are often willing to provide loans to valuable employees whom they want to retain.

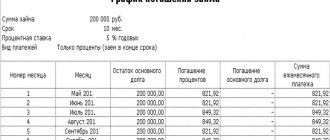

Example 1. Collection of interest under an agreement through the court without accrual of interest for late payment

Danilevsky N.K. (lender) lent Semchenko L.A. (borrower) 150 thousand rubles. for 3 months at 5%. This means that Semchenko L.A. must return the money to him (principal debt 150 thousand rubles + monthly 7,500 rubles) no later than the established three-month period.

However, at the end of 3 months. at the request of Danilevsky N, K., the borrower returned only 150 thousand rubles. (the amount of the principal debt), but there is no interest on it. As a result, the matter went to court: the borrower N.K. Danilevsky filed a lawsuit demanding to collect interest from her. The court upheld his claim, and L.A. Semchenko was charged with the unpaid interest under the agreement.

The lender made no further claims. In particular, the requirement for an additional “percentage” penalty for failure to fulfill a monetary requirement under clause 1 of Art. 395 of the Civil Code of the Russian Federation was not voiced by him in the lawsuit.

Accordingly, only interest under the agreement was collected from the borrower. For your information, this interest is a kind of dividend for the use of funds provided by the borrower. They are subject to payment according to the rules of the principal debt (clause 1 of Article 809 of the Civil Code of the Russian Federation).

Which employee is more likely to receive an interest-free loan?

Each organization has its own rules regarding employee lending. Sometimes small amounts are lent even to beginners. It is believed that this promotes employee loyalty and motivates them to work. Sometimes only those who have completed the probationary period can apply for a loan.

In serious companies, the decision to issue an interest-free loan is made by management deliberately and taking into account many conditions. In addition to the financial situation in the company itself, the characteristics of a particular borrower are also important, such as:

- character traits (degree of responsibility, attitude to work);

- duration of work in the company;

- income level (salary);

- the presence of unpaid loans from banks and other financial institutions;

- characteristics of the employee's immediate supervisor;

- purposes specified in the loan application.

Since the potential borrower is on the staff of a company that can become his lender, the employer can request all the documents necessary for making a decision from the accounting department or the human resources department.

The source of funds that will be issued to the employee may be the personal accounts of the manager, the reserve and authorized fund, as well as the profit of the enterprise, which has not yet been directed to other purposes.

For neither party, the loan may be related to commercial purposes.

Important!

If, in an application for receiving a large sum of money, a specialist indicates exactly why he needs it, the manager has the right to demand the provision of supporting documents. When purchasing a home, this may be a contract of intent; if paid treatment is necessary, a certificate from a medical institution, etc.

Consequences of breach of contract

The question of how not to pay under a loan agreement can only arise if it is declared invalid. In other cases, evasion of payment may result in:

- Application of penalties.

- Increase in debt significantly.

- Legal costs, since MFOs also practice filing claims against their willful defaulters.

- Financial or property losses.

Having signed the contract and read its terms, it is very important to comply with them in order to minimize the likelihood of additional costs and moral turmoil.

Take a short survey

and a statement of claim to the court to challenge the loan agreement.

Competently applying for an interest-free loan at work

When an employer agrees to provide an interest-free loan to an employee, in addition to labor relations, a borrowing relationship also arises between them. In them, one party acts as a lender, and the other as a borrower.

According to Article 807 of the Civil Code, the obligations of the lender include the issuance of an agreed amount of money or items of property, and the borrower, in turn, must return the same amount or things of the same kind in a similar quality within the period specified in the agreement.

If funds are issued by a legal entity, the rights and obligations of the parties to the transaction must be formalized in writing. The Civil Code requires compliance with this rule regardless of the size of the loan provided.

According to Article 808 of the Civil Code, as confirmation of the terms of the loan specified in the agreement, the recipient of the funds can draw up a receipt certifying the fact of transfer of the required amount and agreement with the obligations to return it. Such a document is drawn up by the party who received the loan, and not by the one who issued it.

An employee who plans to request an interest-free loan from an employer may have the following questions:

- Is it possible to get money in cash at the organization’s cash desk if the loan amount is more than 100 thousand rubles;

- is there a risk that the manager will begin to deduct part of the borrower’s salary in order to repay the debt if he has violated his obligations on the terms of repayment of funds;

- Is a loan issued by an employer to its employee subject to personal income tax?

In general, there are two ways to get money as a loan:

- in cash through the organization's cash desk;

- in non-cash form to a salary card.

In the first case, we can assume that the maximum amount allowed for issuance is 100 thousand rubles. This is exactly how much legal entities and individual entrepreneurs can transfer to each other in cash according to the law.

This limitation is enshrined in paragraph 6 of the Directive of the Central Bank of the Russian Federation dated September 7, 2013, N 3073-U: payments under one agreement cannot exceed 100 thousand rubles or an equivalent amount in foreign currency (at the current exchange rate of the Central Bank on the day of the transaction).

However, Article 861 of the Civil Code stipulates two conditions, subject to which it will be legal to issue cash in any amount, including those exceeding 100 thousand rubles:

- if at least one of the participants in the transaction is a citizen who is not registered as an individual entrepreneur;

- if the loan is issued for purposes not related to the creation and development of a business.

This means that when an employee receives an interest-free loan from the company in which he works, more than 100 thousand rubles can be issued in cash.

Another important question is related to what risks exist for the borrower if he is unable to repay the loan provided to him within the period specified in the agreement. Does a manager have the right to begin to withhold part of a subordinate’s salary in order to gradually pay off the resulting debt?

Information on which deductions from an employee’s salary are legal is contained in Article 137 of the Labor Code.

You can withhold money from a full-time employee’s salary to pay off debt in the following cases:

- the employee received an advance on wages, but did not work it out;

- the advance was issued when planning a business trip, transfer to another department of the organization, etc., but the funds remained unspent and were not returned within the prescribed period;

- there was an error in calculations, as a result of which the employee received more money than he was owed;

- a labor dispute arose, during which the specialist was found guilty of failure to fulfill his duties, which led to the need to return part of the salary to the employer;

- the person left his position before the end of the working year, having received annual paid leave, but not having worked it.

No conditions other than those described above imply deductions from salary at the initiative of the company. The exception is situations when the obligation to withhold part of the income of subordinates is assigned to the employer by other federal laws.

The need to return funds issued to an employee in the form of an interest-free loan is not, by law, a reason for cutting wages.

We can conclude that paying less for work in order to pay off the debt is unlawful. Repayment of the loan in this way is possible only with the consent of the employee. In this case, both parties negotiate in advance and stipulate in the contract that in order to gradually repay the loan, the employer will withhold part of the borrower’s salary.

The question of whether personal income tax should be withheld from the amount of a loan issued to an employee is also controversial. In most cases, the answer can be negative, since receiving a loan does not lead to economic benefits, because the funds provided will need to be returned.

The opposite is also true: if the issuance of a loan is associated with a financial benefit for the employee due to savings on interest, then the organization that issued the loan will have to withhold the corresponding tax from the amount indicated in the agreement.

There are two conditions under which there is a material benefit to the borrower:

- the employee received a loan, the interest on which is lower than the refinancing rate established by the Central Bank (depending on the chosen currency);

- The loan does not require interest payments at all (depending on the chosen currency).

These conditions do not include the situations described in Article 212 of the Tax Code, in which there is no financial benefit from saving on interest.

Forbidden ways

It should be taken into account that not all funds can be used when repaying a loan. The prohibitions are stipulated in various instructions of the Central Bank and the government.

By checkout

There is a list specified by the Central Bank Directive dated October 7, 2013, where funds from the enterprise’s cash desk can be spent. Loan repayment is not included in this list. It is possible to cover the debt using funds from the cash register only according to the following scheme:

- Funds are taken from the cash register and transferred to the PC at the bank.

- From the enterprise’s RS, the money is transferred to the lender with the indication “loan repayment.”

It is an offense to take funds directly from a treasury to cover a debt.

Cash

Repayment of debt in cash is prohibited. All transfers must be exclusively non-cash in order to track them. If the company has only cash, they need to be transferred to your PC, and then to the founder’s PC.

FOR YOUR INFORMATION! Some executives repay the loan directly from their salaries. Doing this is not prohibited, but it is not recommended, since the operations performed cannot be confirmed in any way.

ATTENTION! Using proceeds to pay off a debt is an administrative offense that is punishable by a fine.

Interest-free loan: tax risks

The benefits of an interest-free loan for the recipient are obvious, since in essence it is the use of funds in installments. Therefore, when talking about this type of lending, it is necessary to mention the concept of material benefit. It is due to the fact that when receiving a loan without having to pay interest, a person saves significant money.

Legislative acts indicate that the benefit from saving on interest occurs if a citizen receives a loan at an interest rate of less than 2/3 of the current key rate established by the Central Bank. Previously, a comparison with the refinancing rate was used, but now there are no differences between these types of rates.

Keep in mind that the interest must be calculated taking into account the rate in effect at the time the transaction was concluded, and not the one that is set now.

The borrower must pay personal income tax in the amount of 35% on the amount that is the difference between the current key rate and the rate on his loan. The risk of the borrower is especially high with an interest-free loan, because in this case the tax will have to be paid on the entire amount received.

Previously, there was wording in the Tax Code, thanks to which many were able to avoid paying taxes. It said that material benefit arises at the time of payment of interest: this meant that in a situation of an interest-free loan it could not arise.

After amendments were made to legislative acts, it became impossible to avoid tax risks. From 2021, the law requires that benefits be assessed at the end of each month. Income tax is now calculated using the following formula: (loan amount * (2/3 * key rate) / number of days in the year * number of days in the month) * 0.35

For example, if on July 1 a person took out a loan of 400 thousand rubles, then on July 31 he will need to pay personal income tax, the amount of which will be (400,000 * (2/3 * 0.105) / 366 * 31) * 0.35 = 830 rubles.

It is clear that if the loan amount or the key rate increases, the tax will also increase.

Here is a list of goals that give a citizen the opportunity to take out an interest-free loan without tax risks, since it is believed that there is no material benefit here:

- housing construction;

- purchase of living space for living in it, including shared ownership;

- purchase of land for construction;

- acquisition of a plot together with a house located on it;

- refinancing loans for housing, including mortgages.

If the employer receives documentary evidence that the loan was actually spent for the specified purposes, then it will not deduct part of the employee's salary for income taxes. Confirmation is usually a notification from the tax service, to receive which the borrower must prove the fact of the intended use of funds.

We can conclude that an interest-free loan is especially beneficial when purchasing land and housing. It can be taken for other purposes, but then you will have to pay a tax in the amount of 35% of the material benefit received.

Refund methods

The method of repayment of the loan must be specified in the agreement between the parties. Let's look at the most common options.

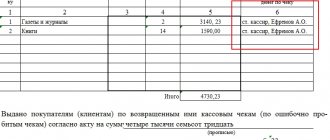

Product

The possibility of repaying debt with goods is stipulated in Article 409 of the Civil Code of the Russian Federation. You can repay the loan using the following types of products:

- A product produced by the company.

- Products purchased by the company for further sale.

The goods, within the framework of the law, are the property of the legal entity. Therefore, when it is transferred, the transaction will be considered a sale and income tax will have to be paid on the proceeds.

IMPORTANT! How to determine the quantity of products to repay the loan? Typically, the purchase price is used in calculations.

From current account to card

The required amount can be transferred to the lender directly to your bank card. The manager of the debtor company must draw up a document indicating the relevant transaction and its purpose (loan repayment). A transfer from a RS can be made not only to a card, but also to the lender’s RS. The choice of payment option depends on the convenience for both parties.

IMPORTANT! The translation must be supported by documents. This is required for accounting and tax purposes, as well as proof of transfer of funds.

Company property

Repaying a loan with the organization's property is subject to the same rules as covering a debt with goods. You will have to pay income tax on each payment, since the transaction will officially be considered a sale.

To make payments, you can use any fixed assets owned by the enterprise:

- Equipment, tools for manufacturing products.

- TS.

- Immovable objects.

The ratio of the loan amount to the fixed asset with which it is planned to repay the debt is determined jointly by both parties to the agreement. For example, the debtor can transfer to the founder a car, the cost of which, taking into account depreciation, is approximately equal to the amount of the debt.

IMPORTANT! You must remember to document the transaction. In particular, it is required to draw up a document on the write-off of fixed assets from the balance sheet of the enterprise to cover the loan. You will also have to pay tax, and therefore, after the payment has been made, a declaration of profit received is submitted.