The fixed part of contributions for pension and health insurance for 2021 must be paid before December 31, 2020; accordingly, for 2021, payment of contributions must occur by December 31, 2021. Contributions to the funds in a fixed amount must be paid by all individual entrepreneurs, regardless of the applied taxation regime, the amount of income received and whether financial and economic activities were carried out or not.

The opinion of departments on this issue has already changed, so many businessmen in Russia, in order not to track changes in legislation and other important issues on their own, use a convenient online service. With its help, you can significantly minimize risks and save time.

Contributions to pension and health insurance in 2021

Let us recall that fixed contributions for compulsory pension insurance until 2021 were calculated using the following formula:

Minimum wage at the beginning of the year X Insurance premium rate (26%) X 12.

Starting from 2021, the Russian government decided to increase the minimum wage to the subsistence level and set the minimum wage from January 1, 2021 at 9,489 rubles. With such a minimum wage, fixed contributions calculated according to the previous rules (Article 430 of the Tax Code of the Russian Federation) should have increased significantly. In order not to radically increase the tax burden on entrepreneurs, the country's leadership determined that:

From 2021, fixed contributions are no longer tied to the minimum wage set on January 1. The decision of the Government of the Russian Federation established not a calculated, but a strictly fixed amount for the payment of mandatory pension insurance contributions in 2021 - 29,354 rubles, in 2021 - 32,448 rubles, in 2021 - 32,448 rubles. For 2021, the government decided not to increase the burden on individual entrepreneurs in terms of fixed contributions and their amount remained at the level of last 2021.

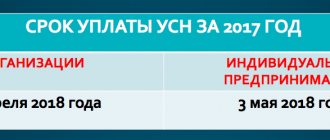

In addition to fixed contributions in a strictly defined amount, until July 1, 2021 for 2021, individual entrepreneurs whose annual income exceeded 300,000 rubles had to pay 1% of the excess amount. For 2021, the deadline for paying the additional pension insurance contribution for 2021 remains the same - until July 1, 2021.

The deadline for paying 1 percent on pension insurance for 2021 is until 07/01/2021 . They need to be listed in the INFS. Moreover, the contribution can be paid in installments, evenly distributing the financial burden.

BCC for this payment: 182 1 02 02140 06 1110 160.

All current KBK 2021 are published on this page.

For health insurance in 2021, premiums are paid only in a fixed amount. Health insurance premiums for incomes over 300,000 rubles do not need to be calculated and paid.

To pay fixed medical contributions to individual entrepreneurs in 2021, as in the case of pension contributions, there is no need to take into account the minimum wage. The government has determined the specific amount of medical contributions. In 2021 it is 6,884 rubles; in 2021 - 8,426 rubles, in 2021 - 8,426 rubles. There will be no increase in the amount of medical contributions, as well as pension contributions, in 2021 compared to 2021.

Let us remind you that the minimum wage in 2021 is 11,280 rubles; in 2020 - 12,130 rubles; in 2021 the minimum wage will increase by 5.5% and amount to 12,792 rubles.

But, as stated above, it does not affect the amount of insurance premiums for the periods 2019 and 2021 and 2021.

Fixed contributions for 2021

| Recipient of contributions | KBK (2020) | Amount of fixed payments for 2021 |

| Inspectorate of the Federal Tax Service for compulsory pension insurance in a fixed amount | 182 1 0210 160 | 32,448 rubles |

| Inspectorate of the Federal Tax Service for compulsory medical insurance | 182 1 0213 160 | 8,426 rubles |

| Total: 40,874 rubles |

Fixed contributions for 2021

| Recipient of contributions | KBK (2021) | Amount of fixed payments for 2021 |

| Inspectorate of the Federal Tax Service for compulsory pension insurance in a fixed amount | 182 1 0210 160 | 32,448 rubles |

| Inspectorate of the Federal Tax Service for compulsory medical insurance | 182 1 0213 160 | 8,426 rubles |

| Total: 40,874 rubles |

You will find more information about fixed payments for pension and health insurance in 2021 in this material.

Is it possible to pay 1% gradually

Yes, as mentioned above, the entrepreneur must pay for the previous year not on April 1st, but before July 1st. Thus, no one will mind if the businessman makes payments gradually. For example, if at the end of the first quarter your income exceeded 300 thousand rubles, you can safely pay, because gradual payment will help reduce the tax burden in the future.

For your information! In 2021, the deadlines for quarterly reporting and payment of taxes are determined by the 25th day of the last month of the quarter; on the same day, you can pay 1% of the Pension Fund. The last months of the quarter are counted from January - April 25, July 25, October 25 and the end of December.

Individual entrepreneur contributions to the Pension Fund for income over 300,000 rubles

If the income of an individual entrepreneur for the billing period is more than 300,000 rubles, then in addition to fixed payments for pension and health insurance in the amount of 36,238 rubles in 2021 and 40,874 rubles in 2021 . The individual entrepreneur must pay the calculated part of the insurance premiums for pension insurance, which is 1% (of the excess amount). The basis until 2021 was clause 1.1. Art. 14. Federal Law of July 24, 2009 No. 212-FZ as amended by Federal Law of July 23, 2013 No. 237-FZ. Since 2021, Federal Law 212 has lost force, but the legislator enshrined this provision in clause 1 of Art. 430 Tax Code of the Russian Federation.

The current legislation of the Russian Federation provides for a limitation on the amount of insurance contributions for pension insurance. Their size cannot be greater than the product of eight times the fixed contribution to pension insurance established by the Tax Code of the Russian Federation. In 2021, the maximum amount of pension contributions is 234,832 rubles; and in 2021 it increased to 259,584 rubles and will remain the same for 2021, since the amount of fixed contributions will not change compared to 2021.

If the entrepreneur’s total income for the quarter exceeds 300,000 rubles, then you can immediately pay 1% to the Federal Tax Service. This will allow you to evenly distribute the load throughout the year. But you can pay 1% before July 1 next year.

Are there any differences if there are employees?

As you know, an individual entrepreneur can work on UTII either independently or hire employees. However, their number should not exceed 100 people, otherwise they will have to switch to another taxation system.

As soon as an entrepreneur hires an employee, he is required to register with the Pension Fund as an employer-insurer. The individual entrepreneur will pay insurance premiums such as:

- pension;

- medical;

- for temporary disability;

- in case of accidents;

- on pregnancy and childbirth.

With the hiring of an employee, all these contributions fall on the shoulders of the individual entrepreneur. However, it's not all bad. If there are employees, the entrepreneur can apply a benefit of 1% from the law of 300 thousand for individual entrepreneurs and not pay an additional contribution.

*Prices are as of July 2021.

Payment of 1% on pension insurance for individual entrepreneurs in 2021 for 2021

Please note that when paying the payment in question in previous years, taxpayers on the General Taxation System (OSNO), as well as entrepreneurs who used the Simplified Taxation System (“income minus expenses” 15%), did not take into account when calculating income for insurance premiums amount of expenses.

Starting from January 1, 2021, the calculation of 1% for individual entrepreneurs on OSNO has changed. Now individual entrepreneurs on OSNO, when calculating 1% for pension insurance, use the law specified in paragraphs. 1 clause 9 art. 430 Tax Code of the Russian Federation. This norm determines income for OSNO in accordance with Article 210 of the Tax Code of the Russian Federation. Those. as the difference between income and professional deductions. Therefore, individual entrepreneurs on OSNO will determine 1% not from income, but from the difference between income and expenses. On October 25, 2016, the Ministry of Finance of the Russian Federation, by its letter No. BS-19-11/ [email protected], confirmed the validity of such a calculation. This rule continues to apply in 2021 and 2021.

If an individual entrepreneur applies several taxation regimes simultaneously, then the income from his business activities is summed up.

Why such joy?

We didn’t just build up all this solemnity and pathos throughout the entire article. The fact is that last Friday we received tax reconciliations for all our Clients (this is a standard procedure in our company, we do this every month), and from the reconciliations we discovered that 1% in the Pension Fund of the Russian Federation for all entrepreneurs on the simplified tax system ( dr) tax assessed taking into account expenses . Those. we did not write any letters or complaints, the tax office itself calculated this contribution for 2021 as the entrepreneurs wanted all this time. Those. at least in St. Petersburg the tax authorities are doing everything right. At the moment, we have reports from Smolensk and the Moscow region that 1% is also calculated taking into account expenses.

KBC for paying 1 percent on pension insurance in 2021

In 2021, for 2021, it is necessary to transfer insurance premiums to the Pension Fund of the Russian Federation from income exceeding 300,000 rubles, when paying 1%, to the following KBK - 182 1 02 02140 06 1110 160 , indicating the details of the Federal Tax Service.

Let's look at examples of how 1% is paid on income over 300,000 rubles in 2021 and 2021 under different tax systems.

IP on simplified tax system 6% (Income) and 1% of excess in 2021

An individual entrepreneur working on the simplified tax system of 6% (Income), who received income over 300,000 rubles, in addition to fixed contributions to pension insurance for 2021 (32,448 rubles 00 kopecks), must pay 1% of the excess amount by July 1, 2021.

The amount to be paid must be calculated using the formula:

(Income – 300,000) x 1%

Let’s assume that an individual entrepreneur on the simplified tax system of 6% without employees earned 700,000 rubles in 2021. He needs to transfer to pension insurance:

32,448 rubles (fixed payment) + (700,000 - 300,000) x 1% = 36,448 rubles.

Thus, an individual entrepreneur on the simplified tax system of 6% pays for compulsory pension insurance in the amount of 32,448 rubles until December 31, 2021, and until July 1, 2021 - 1% of the amount exceeding 300,000 rubles - 4,000 rubles. The total amount that the individual entrepreneur must pay is 36,448 rubles.

Individual entrepreneur on the simplified tax system 15% (“Income minus expenses”) and 1% of excess in 2021

The payment of 1 percent by individual entrepreneurs for compulsory pension insurance in this case until 2021 was slightly different. An individual entrepreneur who uses the simplified tax system of 15% does not take the difference “income minus expenses” for the calculation, but the entire amount earned for 2019. That is, the total income of the individual entrepreneur does not need to be reduced by the expense portion. Despite the fact that for OSNO this rule for calculating 1% was changed for the better in 2017, as described in this article above, for the simplified tax system (income minus expenses), for the purpose of calculating 1%, income is taken in accordance with Art. 346.15 Tax Code.

The Ministry of Finance of the Russian Federation, in its letter No. 03-15-05/63068 dated 09/04/2018, once again confirmed this norm, emphasizing that in order to change the current approach to determining the amount of insurance premiums for individual entrepreneurs on the simplified tax system, it is necessary to make changes to the Tax Code.

But judicial practice was on the side of entrepreneurs (definition of the Supreme Court of the Russian Federation dated 06/03/2020 No. 80-KA19-2; determination of the Constitutional Court of the Russian Federation dated 01/30/2020 No. 10-O), therefore, on September 1, 2020, the Federal Tax Service issued a letter in which it stated, that expenses can be deducted.

Now individual entrepreneurs using the income-expenditure simplified tax system can calculate contributions from the difference between income and expenses. But losses from previous years cannot be considered expenses.

Individual entrepreneur on UTII and 1% of the excess in 2021

To calculate 1% of the amount exceeding the limit of 300,000 rubles, entrepreneurs who work on the Unified Tax on Imputed Income (UTII) take into account imputed income, and not the real amount of profit received.

Let us recall that imputed income for individual entrepreneurs on UTII is determined on the basis of Article 346.29 of the Tax Code of the Russian Federation and is calculated using the following formula:

VD = BD X amount of FP X K1 X K2, where: VD - imputed income; BD - basic profitability; FP - physical indicator; K1 and K2 are correction factors.

To determine the annual income of an individual entrepreneur on UTII, it is necessary to add up the imputed income according to declarations (1st–4th quarter).

If you work for UTII, do not forget to familiarize yourself with the changes to UTII for individual entrepreneurs in 2021. Despite the fact that UTII will not be applied in 2021, 1% for pension insurance of an individual entrepreneur who applied UTII in 2021 will have to calculate and pay 1% for pension insurance.

IP on PSN and 1% of excess in 2021

1% for individual entrepreneurs on the Patent Taxation System is calculated from the potential income from the patent. If a patent is purchased for several months, then the potential income is calculated in proportion to the number of months for which the patent was purchased.

How to pay 1% for pension insurance for individual entrepreneurs in 2020 (for compulsory pension insurance), consider the calculation using the example of an individual entrepreneur on PSN, who provides hairdressing services in the city of Sevastopol and has 14 employees. This individual entrepreneur acquired a patent for a period of 12 months. The patent indicates that the amount of potential income is 1,760,000 rubles. Regardless of the actual income, the calculation is based on the potential income calculated in the patent. Let's calculate how much he must pay for pension insurance, in addition to fixed contributions.

To calculate, you need to subtract 300,000 rubles from the amount of potential income and multiply by 1%, that is:

(1,760,000 - 300,000) X 1% = 14,600 rubles.

Thus, an individual entrepreneur must pay contributions for compulsory pension and health insurance in the amount of 36,238 rubles (fixed contributions for pension and health insurance until December 31, 2021) + 14,600 (1% of exceeding the limit of 300,000 rubles until July 1, 2021) = 46,985 rubles.

What changed?

We have always taken the position that entrepreneurs using the simplified tax system (Dr.) can use expenses when calculating their one percent, but they must be prepared to defend their position in court, because in the end, the tax office will count them in a way that is beneficial to it, and it will have to prove that it is right. But the probability of winning the trial is, if not 100 percent, then something close to it. Some did just that, but others didn’t want to deal with it, and every year they overpaid a tidy sum.

Can this situation be called normal for a right-wing state? Most likely no. Is it possible to do something about this? We always had one answer to this question - we must protect our rights . Among our Clients there was not a hero for whom the amount of overpaid tax would exceed the amount of effort involved in disputes with the tax office. We regularly suggested that entrepreneurs go to court and did not lose hope that there would be a hero who would defend his position to the end, all the way to the Supreme Court, and create a precedent that would force the necessary changes to be made to the legislation. And this hero was found. It turned out to be Svetlana Pavlova from the city of Pervouralsk. We found Svetlana's contacts and this is what we found out.

Svetlana with her store team

Svetlana has been running two stores in Pervouralsk for many years - Products for Women and House of Clothes on Vatutina Street. She also has experience as a chief accountant, thanks to which Svetlana herself returned her pension contributions starting in 2014 and helped other entrepreneurs who turned to her for advice.

Shops Women's Products and Clothing House in Pervouralsk on the street. Vatutina

So what did Svetlana do? Basically nothing new for me. For several years now, she has been going to court every year with the Pension Fund and the Federal Tax Service. You could say that this has become an annual ritual for her. But late last year, a landmark event occurred as her 2021 case reached the Supreme Court. The tax authorities themselves spoke best on this matter, issuing a letter in which they once again prohibited simplifiers from taking expenses into account when calculating the pension contribution.

Letter of the Federal Tax Service No. BS-4-11/ [email protected] dated 09/23/2019

At the moment, a cassation appeal has been sent to the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated 09/03/2019 N 309-ES19-18969 against IP Pavlova S.A. in the case dated November 14, 2018 N A60-65115/2018.

After a decision is made in this case, the tax authorities will be guided in the exercise of their powers by this decision, starting from the day it is posted in full on official websites on the Internet or from the day it is officially published in the prescribed manner.

Those. The tax officials said, “Let the Supreme Court decide, as they say, that’s what we will do.” So what did the Supreme Court decide? He quite expectedly sided with Svetlana. This did not cause much fuss (we found an article from major resources on the website of our beloved Chief Accountant). Few believed that the tax office would keep its word. As it turned out, it was in vain.

But before we continue, a few words about another hero, thanks to whom what we are talking about today became a reality. This is the head of Ekaterinburg Consulting Maxim Stepanov . He personally provided Svetlana with legal support in her disputes with the tax authorities. Maxim specializes in just such “showdowns” with the Federal Tax Service. With his permission, we publish his email here - [email protected] We cannot give a full recommendation to contact him as a specialist, because... We only talked for a few minutes on the phone, but at least because Maxim managed to write his name in the history of Russian entrepreneurship (no matter how loud it may sound), he should be considered as a candidate for protecting interests in a dispute with the tax authorities.

Reducing the advance payment under the simplified tax system by 1%

The advance payment under the simplified tax system can be reduced by 1% of the amount exceeding the limit of 300,000 rubles if the additional contribution was made in the period for which the tax is calculated.

That is, if the additional contribution for the previous 2021 was paid on March 30, 2021, then the individual entrepreneur has the right to reduce the advance payment under the simplified tax system or UTII for the first quarter of 2021, and not for the 4th quarter of the previous year for UTII or not for the entire 2021 for USN.

In 2021, entrepreneurs using the simplified tax system and simplified tax system and who do not have employees can reduce the tax under the simplified tax system or simplified tax system by the entire amount of mandatory contributions. Individual entrepreneurs on the PSN or on the simplified tax system with hired employees reduce taxes by the amount of contributions paid, but not more than 50%.

The material has been edited in accordance with changes in legislation 01/17/2020

What about the Unified Agricultural Tax?

But on this issue, unfortunately, we know nothing. There was the same problem with the agricultural tax as with the simplified tax system (Dr.), it is calculated taking into account expenses, but the tax office calculated 1% without taking them into account. It is quite possible that the tax authorities will reconsider their attitude towards entrepreneurs on the Unified Agricultural Tax too. If you have any information on this topic, we would be glad if you share it in the comments.

We hope you found our article useful. By the way, you can subscribe to our blog, we don’t post something here very often, but we try to make it as interesting as possible. If you have any information on this topic, do not hesitate to tell it in the comments.

This might also be useful:

- Transport tax under the simplified tax system and OSNO in 2021

- Property tax for organizations and individuals

- Transport tax in Moscow in 2021

- Trade fee in Moscow in 2021

- Tax calendar for 2021

- Income codes in certificate 2-NDFL in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How to fill out a payment form for individual entrepreneurs to pay contributions

We have provided instructions for filling out payment slips for contributions for individual entrepreneurs.

Our invented entrepreneur Apollo Buevy decided to pay the insurance premiums himself, without turning to an accountant for help. I went to the Federal Tax Service website, started filling out receipts and got confused in the KBK. We decided to help him and other individual entrepreneurs and compiled step-by-step instructions for filling out payment documents.

See detailed instructions.

Source:

"Clerk"

Heading:

Individual entrepreneur

fixed contributions IP Card file individual entrepreneur instructions for an accountant insurance premiums

- Inna Kosnova, Clerk columnist, accounting and taxation expert

Sign up 7800

9750 ₽

–20%

Comments

View all Next »

Tatyana 02/15/2016 at 11:47 # Reply

I am an individual entrepreneur, a pensioner, I work on the simplified tax system “Income minus expenses” x15%, tell me, is it correct that the Pension Fund tax is 1% on income, all income is taken, excluding expenses. My turnover for 2014 amounted to 11,859,312 rubles, expenses - 10,958,379 rubles, tax base - 900,933 rubles, I paid tax 135,140 rubles and what else do I need 1% - 118,593 rubles. to pay?

Natalia 02/16/2016 at 12:08 # Reply

Tatyana, good afternoon. Working on the simplified tax system, income minus expenses, you calculate tax payments as follows: (income minus expenses) X 15% - the amount of fixed payments paid to the Pension Fund and the Federal Compulsory Medical Insurance Fund. If your annual income exceeds 300 thousand rubles, then by April 1 of the year following the reporting year, you must pay 1% of the difference between all your income and 300 thousand rubles. You apparently made a mistake when you wrote “My turnover is for 2014,” meaning for 2015? Because for 2014 you had to pay the simplified tax system and 1% to the Pension Fund in 2015. And so you calculated everything correctly, except that you did not subtract from 135,140 rubles the amount of fixed payments paid to the Pension Fund and the Federal Compulsory Medical Insurance Fund (18,610.8 + 3,650.58 = 22,261.38). Those. You should have reduced the simplified tax system by 22,261.38. Did you pay fixed contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund in 2015? Payment had to be made by December 31, 2015. I also remind you that the maximum payment to the Pension Fund = 138,627.84 rubles. (fixed and 1%).

03/28/2019 at 09:34 # Reply

It is not the amount of the simplified tax system that is reduced by the amount of fixed payments, but the tax base for calculating the simplified tax system. That is, fixed contributions to pension insurance are counted as expenses. And in the text of the article it is written as Natalya commented. Check this moment!!

Larisa 02/16/2016 at 04:31 pm # Reply

Tatyana, good afternoon! If your declaration under the simplified tax system indicates the amount of 11859312 rubles, then payments to the Pension Fund will be: fixed payment to the Pension Fund of 18610.80, FFOMS - 3650.58, but 1% to the Pension Fund will be: (11859312-300000) *1% = 115593, 12. Next, 115593.12+18610.80 = 134203.80, this is less than 138627.84, which means you pay to the Pension Fund: 1% - 115593.12, fixed amount 18610.80, and FFOMS - 3650.58. All the best to you and good luck!

02/14/2019 at 22:11 # Reply

Not true. When calculating 1%, expenses are also taken into account. This is contained in the Resolution of the Constitutional Court of the Russian Federation of November 30, 2016 No. 27-P, as well as in paragraph 27 of the review of judicial practice of the Supreme Court of the Russian Federation No. 3 (2017) approved by the Presidium of the Supreme Court of the Russian Federation on July 12, 2017. I sued the Pension Fund and my accruals for 2014-2015 were removed and all the money was returned. She filed an application with the court in March 2021, the decision was made on March 16, 2018. I myself am a former tax inspector. Read carefully Income Art. 346.15 procedure for determining income under the simplified tax system and art. 346.16 procedure for determining expenses. The RF CA confirmed that the procedure for determining income and expenses is similar to OSNO.

12/30/2017 at 03:10 pm # Reply

I shoveled almost $200,000, earned almost $1000 (per month). This is a business.

02/14/2019 at 22:03 # Reply

The payment is calculated as income minus expenses and takes 1%. Read the definition No. 304-KG16-16937 and the resolution of November 30, 2016 No. 27-P of the Constitutional Court of the Russian Federation, review of judicial practice of the Supreme Court of the Russian Federation No. 3 (2017), paragraph 27, approved by the Presidium of the Supreme Court of the Russian Federation on July 12, 2017.

Oleg 03/09/2016 at 14:44 # Reply

New kbk

Good afternoon. I am an individual entrepreneur on the simplified tax system. During 2015 Along with fixed payments to the Pension Fund, I paid 1% on income over 300,000 rubles. on the KBK fixed payment of the insurance part of the pension. Now I find out that from January 1, 2021, this payment must be made to another KBK. I still have an unpaid amount (1% of income over 300,000 rubles), which I will pay before April 1 for a new KBK, but what about the amounts that I paid in 2015? Will they be counted?

Natalia 03/12/2016 at 15:00 # Reply

Oleg, good afternoon. Your payments made in 2015 will be counted. In 2015, one BCC was in force for fixed payments and 1% payments; from 2021, different BCCs are in effect.

Alexander 03/17/2016 at 21:33 # Reply

new individual entrepreneur

Hello. Still in the process of opening a private enterprise. I plan income-expenses of 15%. — I understood correctly that the maximum turnover with such a system is 60 million, or rather 45, because the deflation coefficient is correct? — What will be the tax for the whole year with a turnover of 45 million, profit of 1.5 million? Or is it easier to change taxation?

Natalia 03/17/2016 at 22:24 # Reply

Alexander, good evening. Income under the simplified tax system cannot exceed 60 million rubles. in year. If your difference between income and expenses is 1.5 million rubles, then the simplified tax system tax will be 15% of this number - 225,000 rubles. As far as I understand, you have not yet chosen a taxation system. Just in case, let me remind you that after registering an individual entrepreneur, you have 30 days to submit an application to choose a tax system. Which one to choose is up to you.

Oksana 03/21/2016 at 09:16 pm # Reply

1%

Is it possible to reduce the amount of single tax for 2015 by the amount of payment of 1% for 2014 made in 2015

Natalia 03/22/2016 at 14:00 # Reply

Oksana, good afternoon. You can reduce the single tax for 2015 by the amount of payment of 1% to the Pension Fund for 2014, made in 2015. The principle of calculation is a cumulative total - you count the total amount of income received in 2015, multiply by the tax rate, get the amount, and then reduce it by all advance payments of the simplified tax system made in 2015, and by all payments for individual entrepreneurs to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund made in 2015, including 1%.

Maxim 03/24/2016 at 09:33 # Reply

What if the simplified tax system is 15% and you paid at least 1% of the proceeds? Then can I deduct last year’s 1% contributions to the Pension Fund? Does the presence of employed workers make a difference?

Natalia 03/24/2016 at 09:57 # Reply

Maxim, good afternoon. With the taxation system you have chosen - simplified tax system (income-expenses) 15%, the entire amount of insurance premiums paid during the tax period both “for yourself” and for employees is taken into account in expenses included in the taxable base. Therefore, you need to transfer the calculated minimum tax to the simplified tax system (income-expenses) of 15% in full. The amount of insurance premiums “for yourself” and for employees can be deducted under the simplified taxation system (income) of 6%.

Nadezhda 03/22/2016 at 11:16 am # Reply

Good afternoon. Please tell me, can I pay more contributions to the Pension Fund and Compulsory Medical Insurance than necessary? That is, round the amount to 5000 rubles. and 1000 rub. respectively. And in the 4th quarter, pay the missing difference from what was paid for 3 quarters and what needs to be paid for the year? You can, of course, pay as expected, but it would be more convenient for me, if possible.

Natalia 03/22/2016 at 14:02 # Reply

Nadezhda, good afternoon. You can pay fixed contributions to the Pension Fund and the Federal Compulsory Medical Insurance Fund throughout the year in any amount as you wish. The main requirement is to pay the full amount of contributions calculated from the minimum wage established for each calendar year by December 31.

Individual entrepreneur 03/23/2016 at 12:16 # Reply

shame on the Pension Fund

The pension fund decided to make a plan for entrepreneurs. Peel them off like sticky. Now all individual entrepreneurs will begin to close. Well, how can you calculate contributions like this? These are enslaving conditions. For an entrepreneur, not all of the proceeds are considered his income. He buys goods for sale and incurs a lot of expenses. For example, I am an individual entrepreneur on the general taxation system. I sold goods for 5 million rubles, and spent 4.5 million rubles on purchase and transportation. I still have an income of 500 thousand rubles. I paid personal income tax on this income - 13% - 65 thousand. I have 435 thousand rubles left in my pocket. I earned this for the whole of 2015. And what of this amount remaining at my disposal, in addition to fixed advance payments to the Pension Fund, should I still pay the maximum amount - 152 thousand rubles? And then what? How should I feed my family? 283 thousand remain. This is a month - I earned a little more than 23 thousand on average? What a disgrace. It can't be considered that way.

Natalia 03/24/2016 at 09:46 # Reply

Hello, why do you pay 13% personal income tax? Do you use OSNO? If you used the simplified tax system, you would pay 6% on income - half as much.

Stanislav 12/23/2016 at 18:00 # Reply

Constitutional Court decision

Good evening, there is decision number 27 KS dated November 30, 2016, which clearly states that the Pension Fund must take into account expenses when calculating and that the pension fund accrued incorrectly

Alina 03.23.2016 at 12:19 # Reply

strange calculation of insurance premiums to the Pension Fund

That's an understatement - strange. It will simply cut down all entrepreneurs at the very roots. They do not earn enough to pay 1% to the Pension Fund on income exceeding 300 thousand rubles. After all, not everything that they received at the cash desk or in their current account is their income. What about the expenses? Well, it's somehow very unfair. But everywhere they say that small business is precious. The road to where?

Anna 03/25/2016 at 04:21 pm # Reply

Tax reduction for 2015 for individual entrepreneurs with employees

Good afternoon. I have an individual entrepreneur on the simplified tax system. For 2015, taxes accrued (6%) amounted to 780,272.00. I have employees. For them I paid a contribution of 40,000 rubles, and I also paid a fixed payment to the individual entrepreneur for 2014 of 22,000 in 2015, as well as 1% on amounts exceeding income for 2014 of 86,000 rubles, also paid in 2015. Tell me what payments I can use to reduce my tax. Thank you in advance.

Natalia 03/25/2016 at 07:30 pm # Reply

Anna, good evening. An individual entrepreneur on simplified taxation system (STS) income who has employees can reduce the advance payment under the simplified tax system by the amount of insurance premiums paid (in the reporting period) for employees and fixed payments for individual entrepreneurs (but not more than 50% of the tax amount). Those. You can reduce 780,272.00 by 50% of all contributions paid in 2015 (40,000+22,000+86,000):2.

Evgenia 03/28/2016 at 10:15 am # Reply

Good afternoon I am an individual entrepreneur on the simplified tax system. In 2015, I paid fixed contributions to the Pension Fund. But 1% of income exceeding 300,000 rubles was paid in March 2021. Can I reduce the advance payment for the first quarter of 2021 to the tax office? Or can this 1% still be taken into account in 2015? Thank you

Natalia 03/28/2016 at 09:04 pm # Reply

Evgenia, good evening. The advance payment for the 1st quarter of 2021 can be reduced by contributions paid during the 1st quarter of 2016 (this applies to both 1% and fixed contributions).

Elena 03/30/2016 at 07:59 pm # Reply

Hello! How can an individual entrepreneur on a patent calculate the 1% excess of 300,000 rubles? from potential income 720,000 rubles. for six months for the Pension Fund. Thank you.

View all Next »

And what to do next?

This is all good, of course, but what to do now? If your tax office did not listen to the opinion of the Supreme Court and assessed the contribution to the Pension Fund “in the old fashioned way,” then you need to write requests and demand a recount. Refer to the position of the Supreme Court and the Determination of the Constitutional Court.

If the contributions were calculated correctly, but you paid them without taking into account expenses, and you have an overpayment, then there are two options: leave the overpayment for future payments or return the money to your current account. To get a refund, you need to fill out and send the appropriate application to the tax office (KND 1150058).

And if this is not enough for you, then you can try to “recapture” your insurance premiums for 2021 and 2021. Judging by the comments under our video, some tax authorities recalculate the contribution for these years simply upon application, without any dispute.

History of insurance premiums

| Year | Amount, rub. |

| 2020 | 40,874.00 (+1% of income from amounts over RUB 300,000) |

| 2019 | 36,238.00 (+1% of income from amounts over RUB 300,000) |

| 2018 | 32,385.00 (+1% of income from amounts over RUB 300,000) |

| 2017 | 27,990.00 (+1% of income from amounts over RUB 300,000) |

| 2016 | 23,153.33 (+1% of income from amounts over RUB 300,000) |

| 2015 | 22,261.38 (+1% of income from amounts over RUB 300,000) |

| 2014 | 20,727.53 (+1% of income from amounts over RUB 300,000) |

| 2013 | 35 664,66 |

| 2012 | 17 208,25 |

| 2011 | 16 159,56 |

| 2010 | 12 002,76 |

| 2009 | 7 274,4 |

| 2008 | 3 864 |