Home / Complaints, courts, consumer rights

Back

Published: 09/07/2018

Reading time: 5 min

0

444

In accordance with Law No. 14 of January 26, 1996 of the Civil Code of the Russian Federation, Article No. 1102 “Obligation to return unjust enrichment,” the recipient is obliged to return erroneously transferred funds, except for the cases specified in Article No. 1109 of the same law.

- How to return erroneously transferred funds What urgent actions need to be taken

- Voluntary return

- Refund through court

But at the same time, the transferred funds are no longer considered the property of the sender, therefore, in accordance with Law No. 395-1 of December 2, 1990 “On Banks and Banking Activities,” returning them, with the exception of a peace agreement, is possible only through the court.

Legal regulation

When making payments, an organization may allow an overpayment due to:

- inattentiveness of employees filling out documents;

- unreliability of information from the accounting service about the amount of payment.

Transfer of excess funds can be carried out:

- employee of the organization;

- to the counterparty;

- government agencies (treasury, tax service, inspectorate, etc.).

The obligation of a person who unreasonably receives any property from another entity to return it is provided for in Article 1102 of the Civil Code of the Russian Federation. When an organization transfers excess funds, the person who receives such amounts receives an illegal material benefit.

Even if funds in excess of the norm are transferred by the organization independently, the receipt of such a benefit by another entity is unreasonable and on the basis of Art. 309 of the Civil Code of the Russian Federation creates an obligation to return overpaid amounts.

Unilateral refusal to fulfill obligations and unilateral changes in its conditions under current legislation are not allowed, regardless of who receives these sums of money. Therefore, when an error is identified, the affected company may resort to various methods to protect its interests. And first, on behalf of the organization, a notice must be sent to the enriched entity.

Incorrectly addressed money arrived in the current account: postings

For the recipient of funds to whose current account money was mistakenly received, a posting reflecting the receipt of unidentifiable funds will be made at the time the payment document is linked to the accounting accounts.

A similar amount is debited to account 76, and this is done by posting Dt 76 Kt 51 (52).

Accordingly, if the erroneous payment is returned to the counterparty's current account, the posting will be reversed: Dt 51 (52) Kt 76. The exchange rate difference when returning currency will be reflected by the posting Dt 91 Kt 76 or Dt 76 Kt 91.

If, in relation to a payment reflected as an error, a decision arises to take it into account as payment for a future or already completed sale of goods (performance of work, provision of services), then on the basis of written information received from the payer, an entry will be made Dt 62 Kt 76 with the ensuing hence the VAT implications.

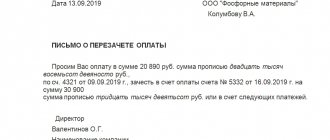

Document structure

A letter (notice or notification) about excessively transferred funds is drawn up in any form. The legislation of the Russian Federation does not determine the structure of this document. However, in order for the unjustly enriched person to be provided with the most complete information, the text of the letter should indicate:

- business name of the company sending the letter;

- outgoing document number and date of its preparation;

- full name of the addressee (name of the enterprise, address, full name of the manager);

- address to the manager (for example, “Dear Pyotr Petrovich!”);

- actual data (date, time of transfer of funds, payment order number, amount, how much it exceeds the required payments);

- reasons for the overpayment (calculator error, late submission of information to a specialist, etc.);

- a request to return amounts paid in excess of the norm;

- the exact amount of funds to be refunded;

- bank details to make a refund;

- initials and position of the person signing the document.

The letter can indicate legislative acts that establish obligations to return unjustifiably received amounts, as well as notify the counterparty of the negative consequences that will result from ignoring the request for a return.

The return notice may be signed:

- the head of the organization or his deputy (subject to confirmation of his authority);

- chief accountant;

- by any employee of the enterprise, provided that the signature is affixed with the official seal of the company.

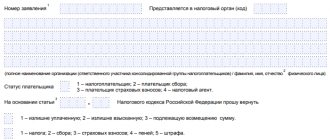

To return funds, some organizations (banks, government settlement authorities) ask you to fill out an application using a special form. In this case, the sample or form is issued by the organization itself.

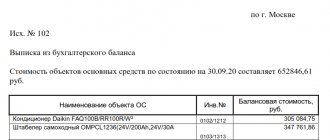

Documents confirming unjust enrichment can be attached to the letter requesting the return of funds, namely:

- money orders;

- bank account statements;

- acts of reconciliation of mutual settlements.

Results

All actions with a payment transferred to a counterparty by mistake are carried out with a written indication of their nature on the part of the payer.

In this case, the funds can be offset against settlements on existing relationships. In the accounting of both the recipient and the payer, the amount of the erroneous payment is reflected in account 76. In correspondence with this account, both parties will show the cash flow for the return: Dt 76 Kt 51 (52) - for the returning party, Dt 51 (52) Kt 76 - at the recipient of the refunded funds. Returning an erroneous payment has no tax consequences. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Compilation deadlines

The Civil Code of the Russian Federation does not contain any mention of the maximum time limit for sending an appeal with a demand for the return of unjustifiably received amounts of money. Based on the general statute of limitations, an application to a person who has unjustifiably enriched himself can be filed within three years from the moment the organization learned or should have learned about the excessive payments made.

However, it is considered in good faith to notify the counterparty within a reasonable time after identifying an accounting error. In civil law, this period usually does not exceed 7-10 days.

To whom is it sent and how is it transmitted?

A letter about excessively transferred funds must be sent to the manager, even if it is signed by an accountant or other specialist of the affected organization. No one other than the manager can give orders for the payment of funds to third parties. And it is better for the chief accountant not to take on such responsibility.

The person who has received unjust enrichment may not satisfy the request stated in the document. In this case, the organization sending the letter must take care of evidence that the addressee received the request. Therefore, it is better to send a refund notification:

- through the office or reception of the head, provided that the second copy of the letter is affixed with a company stamp, date and signature of the employee who received the document;

- according to the acceptance certificate, which will indicate the signature of the official who received the letter;

- by a valuable letter with a description of the addition, if the counterparty refuses to independently accept the notice.

If the funds are not returned voluntarily by the counterparty, the refund of overpaid amounts must be made in court.

Cancellation of an outstanding payment

If an erroneous payment was made, but the person realized it in time and, as soon as possible, wrote an application to the bank to cancel the transfer of funds, the bank has the opportunity to cancel the transaction and return the funds to the previous account or send them to the newly specified details.

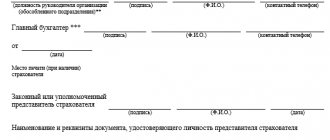

To do this you need to fill out an application

:

- The appeal itself is submitted to the general director (or other authorized person) of the bank.

And in the header of the application the payer’s details are indicated: - Full name; — residential address; — passport data; - contact phone number. - Next, the statement itself is written about the request for a refund or cancellation of the erroneously made payment. And, if necessary, new card or account details where the funds should be transferred.

- If desired, you can indicate and provide a payment receipt or any other documents confirming the fact of an erroneous transfer of funds in the attachments.

- At the end there is a date and signature of the applicant.

sample application for refund in .doc format (Word)

Errors

Among the possible errors encountered when drawing up a notice of overpaid amounts of money, it is worth highlighting:

- incorrect filling of bank details for return;

- absence of the official seal of the organization (if the letter is not written on company letterhead and signed not by the head, but by another official);

- unreasonable demand (lack of data on payment and amount of overpayment).

If there are such errors, the refusal to refund will be lawful.

Erroneous funds transfer

Regardless of how the erroneous payment was made (SMS, ATM, Internet), first of all it is necessary to submit an application to the bank via an application (letter).

It is worth remembering that in most cases it will not be possible to return the money in this way. The bank, according to its own laws and documents (bank secrecy), does not have the ability to cancel a monetary transaction without the consent of the person in whose favor the funds were transferred. And the recipient may well refuse to return the funds or simply ignore the request sent to him. In such conditions, the only possible solution is to independently contact law enforcement authorities. It is necessary to provide a statement that a person has received a sum of money that was transferred to him by mistake, and that he refuses to return (or ignores) the funds mistakenly transferred to his account or card. After which, the authority’s employees will make a request to the bank to obtain information regarding the owner of the card or account, followed by an investigation and a final court decision.

It’s quite difficult to make a mistake when transferring money to a card or account. The reason lies in the fact that the last digit in the number is randomly generated, but connected according to a special system with the previous numbers. Following this information, accidentally indicating someone else’s number is quite difficult, but still possible.

I mistakenly transferred money to someone else’s card: how to get the money back?

Nowadays, money transfers have become commonplace. But the downside of technological progress can be called incidental situations in which the money goes to another recipient.

Through inattention or because of haste, an incorrect recipient's card number is entered and the money ends up in someone else's account. What to do in this situation?

Let's consider 2 options for the development of further events:

How to return erroneously transferred money to a Sberbank card?

After this, you need to come to the nearest bank branch and leave an application addressed to the manager with a request for a refund, attaching a receipt or check. Such an application is considered within 30 days.

You can get your money back even in case of fraud, but you must notify the bank about it within 24 hours . First, call the hotline, then file a report with the police about fraudulent activities committed against you.

How to return a payment through Sberbank online?

The Sberbank website (https://online.sberbank.ru/) provides an additional payment return service.

When sending money to a card after 21:00, the payment transaction is performed only from 9:00 the next day . This gives the sender time to cancel the incorrect payment before it is processed.

You can identify a payment that has not yet been processed by the bank by the status “Executed by the bank.” Click on the payment line, then click the “Cancel” button. The money will be returned to the card before the payment document is processed by the bank.

Funds will also not be transferred in the following transaction statuses:

- "Interrupted";

- “Rejected by the bank”;

- "The application has been cancelled."

Recipient's responsibility

By a court decision, the recipient who has not returned illegally obtained funds within a reasonable time is obliged to return them to the payer with interest accrued for the entire period of untimely return according to the rules regulated by Article 395 of the Civil Code of the Russian Federation:

- Interest is calculated based on the current key rate established by the Central Bank of Russia

- If the payer proves in court other losses incurred as a result of untimely return of funds (for example, he was unable to pay a bank loan on time, for which the creditor imposed penalties), the illegal recipient, by court decision, is obliged to additionally compensate for these losses

- The sender, if there is strong evidence, has an additional right to compensation for moral damages caused in connection with the illegal retention of excess funds by the buyer

When the courts consider cases of untimely return of money received by public utilities, the defendant is also additionally subject to a fine of up to half the amount of illegally retained financial resources.

Example. JSC Vityaz mistakenly transferred funds to LLC MAF in March of this year in the amount of 2 million rubles. On March 25, representatives of the joint-stock company sent an application to the head of MAF LLC for the return of excess money.

The LLC administration did not respond to the statement and claim sent on April 10, 2021. On May 12 of this year, the joint-stock company filed a lawsuit. On June 10, a court decision was made to recover 2 million rubles from MAF LLC for illegal enrichment, interest on the amount of illegal detention of other people’s funds, legal costs, and state duty.

Interest is calculated based on the key rate of the Central Bank of the Russian Federation for the period - 7.25% per annum. For example, MAF LLC fully transfers illegally received money on June 20, 2021. The period of delay - from April 2 (7 days from the date of receipt of the application) to June 20 is 79 calendar days. Interest for one day of delay is 2 million rubles x 7.25 / 365 days = 397.26 rubles, for the entire period of delay - 79 x 397.26 = 31,384 rubles.

In practice, the speed of return of erroneously transferred money largely depends on the integrity of the counterparty who received these funds. The trial in court can drag on for several months and does not fully compensate for the material and moral losses of the sender who made the mistake. Therefore, before sending money from accounts, you should strictly adhere to the internal control system established for all employees, for example:

- Visual recheck of payment by another employee

- If this is not possible, it is better for the sender to look at the payment again with a fresh look to see a random error

Self-control will allow you to get rid of unnecessary worries and save labor costs.

Top

Write your question in the form below

Who should I write to?

If an erroneous payment is detected, it is recommended to act in the following sequence:

- Contact the banking institution through which the payment was made to cancel the transaction. The chief accountant or a person authorized to communicate with financial institutions can contact the bank.

- If the transaction could not be canceled and the money has already gone to the recipient’s account, you need to contact the recipients of the payment and tell them about the situation, and also ask to return the funds without unnecessary red tape and troubles.

- If the counterparty does not want to cooperate voluntarily, a letter is drawn up indicating the reason for the incorrect payment and a request to return the money.

- If the counterparty does not want to make a refund, prepare for legal proceedings.

On liability provided by law for non-return of payment

The protection of the payer's funds, erroneously or excessively transferred to the counterparty, is ensured by the state in accordance with the provisions of the Civil Code of the Russian Federation.

Thus, the norms of the law are established for persons who unlawfully withhold and do not return funds within the prescribed period, which is recognized by law as unjust enrichment:

personal liability and obligation of financial compensation (Article 1102 and Article 1109 of the Civil Code of the Russian Federation);

the amount of interest that the recipient of the payment is obliged to pay if he wrongfully withholds and does not return the funds within the prescribed period (clause 4 of Article 487, and Article 395 of the Civil Code of the Russian Federation).

You can always view the full texts of regulatory documents in the current edition in ConsultantPlus.

Sometimes an incorrect number in a bank card number can deprive a person of his honestly earned money forever. If you react quickly, the refund will be completed without serious problems, but what to do if the money has already been transferred to someone else’s account? Should we rely on a voluntary return or can we avoid going to court? Let's try to figure it out.

Why do organizations transfer money to the wrong address?

There may be several reasons for this unpleasant situation:

- Firstly, there may be an error in the details of the counterparty. Such inaccuracies can creep into documents when they are received by fax, which is due to the specifics of this type of communication. An accountant may also make a mistake when typing a payment order. With electronic document management, such errors are very rare, since the data can be immediately imported into a payment order.

- Secondly, there may be a mistake by the banking institution. Such cases are very rare, but they do happen.

- Thirdly, money can be transferred again under an already executed agreement. Situations like this are not that rare. There are many reasons: from the inattention of the accountant to the deliberate issuance of a duplicate invoice by the counterparty.

- Finally, thirdly, there may be a deliberate distortion of the details so that the funds go to the address desired by the attackers. This scheme involves fraud.

Voluntary return

The case where funds were mistakenly transferred to a legal entity is more favorable. First, it is worth negotiating peacefully, but if the problem is not resolved, send an official complaint to the organization.

The claim can be submitted to the organization in person by putting an incoming mark on your copy, or sent by mail with notification. A legal entity is obliged to respond to the complaint in writing, but if this does not happen, it should contact law enforcement agencies.

The case where an error occurred in a transfer between individuals is much more complicated. The bank does not have the right to disclose personal information about its client, as a result of which the victim cannot contact the other party. In this case, you need to contact the police, who will make an official request to the bank.

If neither peaceful negotiations, nor a claim, nor an appeal to the police helps, the next step is to file a lawsuit.

What information should be in the letter

- Full name of the sender or director of the company. If the company transferred funds, its name should be indicated.

- Politely contact the recipient or company representative who received the erroneous transfer. Offer to voluntarily return the funds. Also warn that if the letter is refused or ignored, you will have to go to court.

- Try to explain briefly, but clearly, how exactly the funds were transferred to the wrong account. Please inform that you are enclosing a check or other payment document with the letter to confirm such a transfer. The amount of the erroneous transfer will also be indicated here.

- Although the recipient must return the money to the account from which the transfer was made, it is still recommended to indicate the details where the funds should be transferred.

- At the end of the letter the date of completion and the signature of the sender are indicated.

Naturally, before you write a letter, you have to find out exactly where the money was transferred. This way you will not only know who to send the letter to, but also get acquainted with other information about the recipient. After all, the integrity of the recipient or the head of the company determines how quickly you will receive the money back.

This is important to know: Supplement to pension for children: amount of payments

How to return erroneously transferred money

How to return the money transferred by mistake?

Many organizations, as well as ordinary citizens, have to transfer funds daily.

Neither accountants, nor entrepreneurs, nor bank employees are insured against making an erroneous payment.

The situation is unpleasant, but not hopeless. How to return money paid by card by mistake?