Minimum wage for calculating benefits in 2021

When calculating benefits from the minimum wage in 2021, the average daily salary of a specialist should not be lower than the figure determined from the minimum wage. This can happen if the employee’s income is small or there is no required six-month work experience, or there have been violations of the regime (failure of a patient to appear for a medical examination, injury due to intoxication, etc.).

Then the benefit amount is calculated from the minimum wage:

If, during the calculation, the average daily earnings turned out to be below the minimum limit, the amount of the benefit is calculated from the minimum wage, and not from the actual income of the individual. Let us remind you that, as a general rule, hospital payments are calculated from the specialist’s income two years before the year of the onset of the disease. In 2021, the years 2019 and 2021 are taken for calculation. Income includes all types of remuneration from which the employer accrued and paid mandatory insurance contributions to the state.

In addition to regular sick leave, based on the federal minimum wage, employers sometimes provide maternity benefits, that is, maternity benefits (pregnancy and childbirth). This procedure is legal in three situations:

Articles on the topic (click to view)

- Is sick leave considered income?

- What to do if you have extended sick leave for pregnancy and childbirth

- What to do if your employer does not accept electronic sick leave

- What to do if you are not given sick leave

- How many days does it take for sick leave to arrive from the Social Insurance Fund?

- What to do if the place of work is not indicated on the sick leave

- Are sick leave taken into account when calculating maternity leave?

- The employee has no income in the required pay period.

- The duration of the maternity insurance period is less than 6 months.

- The employee’s income is below the minimum possible, which means that the average daily salary is less than the minimum wage.

- We calculate the actual amount of the employee’s earnings = (Amount of income for 2021, 2021 / 730 days). Excluded days are not included. For example, these are periods of other maternity leave, sick leave, children's leave, and downtime.

- We compare the two final indicators with each other. If the salary from the minimum wage turns out to be higher than the actual one, the B&R benefit is calculated from the minimum indicator, that is, from 398.79 rubles. in a day.

- We calculate maternity benefits - to do this, we multiply the average daily earnings by the number of days on the certificate of incapacity for work, which is issued by a medical institution.

This is important to know: Are holidays paid on sick leave?

Other cases of caring for sick family members

Therefore, its maximum for 2021 will be: - 301,095 rubles 89 kopecks - with the same vacation duration of 140 calendar days (maximum average daily earnings - 2,150 rubles 68 kopecks). 2.

But there is a limit on the number of days to pay child care benefits depending on age. For example, an employee has a child who is 2 years old (the maximum number of child care days per year is 60). The child is sick twice – 45 and 40 days.

In 2021, this value has already increased to 755 thousand rubles. For comparison: in 2021, income for 2015-2016 was taken into account, and the limits then were 670 and 718 thousand rubles. respectively.

An external part-time worker has the right to receive sick leave for each place of work if he has worked for the same employers in the two previous years. Accordingly, benefits are assigned and paid for each place of work.

When is the minimum wage used when calculating sick leave?

The possibility of paying for time off work is established by two laws that apply to persons insured in the compulsory social insurance system:

- “On compulsory social insurance...” dated December 29, 2006 No. 255-FZ - for diseases that did not arise as a result of the influence of production factors, and inability to work caused by pregnancy and upcoming childbirth or the need to care for a sick relative;

- “On compulsory social insurance...” dated July 24, 1998 No. 125-FZ - for injuries and diseases received at work.

Both of these documents involve calculating sick leave payments based on the employee’s average earnings. With regard to the rules for calculating this indicator, Law No. 125-FZ (clause 1, article 9) refers to Law No. 255-FZ, which establishes that the minimum amount of an employee’s monthly income for the purposes of such calculation cannot be lower than the minimum wage (clause 1.1 Article 14).

This condition applies to situations (Law No. 255-FZ):

- the employee has a short (up to 6 months) work experience (clause 6, article 7, clause 3, article 11);

- lack of income in the billing period (during the 2 years preceding the year of disability) or receipt according to its figures of average monthly earnings, the amount of which does not reach the minimum wage (clause 1.1 of Article 14);

- the need to reduce the amount of benefits due to the employee’s violation of the regime prescribed to him by the doctor during his illness, failure to appear for an appointment at a medical institution, or the presence of a connection between the disease (injury) and the intoxication of the sick person (clause 1, clause 2 of Article 8).

In addition, the earnings from which the disability payment is accrued to persons who voluntarily insure themselves in the OSS system are considered equal to the minimum wage (clause 2.1 of Article 14 of Law No. 255-FZ).

Reduced benefit amount

The amount of sick pay may be reduced if the employee:

- violated the regime prescribed by the doctor without good reason, or did not appear on time for a medical examination or medical and social examination. In this case, the doctor will put a violation code in the line “Note about violation of the regime” on the sick leave;

- fell ill (injured) as a result of alcohol, drug or toxic intoxication or as a result of actions related to intoxication. In this case, the doctor will put the code “021” in the line “Cause of disability” on the sick leave certificate after indicating the code for the cause of disability.

In such cases, the monthly sick leave benefit should not exceed the minimum wage.

If in the area where the employee works, regional coefficients are established by law, then increase the amount of the minimum wage by them.

Determine the maximum daily allowance as follows:

| Daily Allowance Limit | = | Minimum wage | × | Regional coefficients (if the employee works in an area where they are established) | : | The number of calendar days in the month during which the period of temporary disability occurs |

Apply restriction:

- from the day of the violation, if the employee violated the regime or did not show up to the doctor on time;

- for the entire period of incapacity if the employee becomes ill (injured) due to intoxication.

This procedure is established by Article 8 of the Law of December 29, 2006 No. 255-FZ and paragraphs 21–22 of the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

Situation: Can sick leave benefits be reduced if an employee is injured in a car accident while intoxicated? The accident was not the employee's fault.

No you can not.

The amount of sick leave benefits may be reduced, for example, if an employee’s illness occurs due to alcohol intoxication (clause 3, part 1, article 8 of the Law of December 29, 2006 No. 255-FZ, subparagraph “c”, clause 21 of the Regulations, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

If an employee gets into an accident while intoxicated, but he was not the culprit of this accident (for example, he was not the driver, but a passenger), do not reduce the amount of his sick leave benefit.

Advice: even if the sick leave note indicates the fact of intoxication, the employer, based on available documents (certificates from medical institutions, materials from internal affairs bodies, state traffic police, etc.) and the employee’s explanations, decides whether to pay or not pay benefits.

Such clarifications are given in the letter of the FSS of Russia dated April 15, 2004 No. 02-10/07-1843. Although this document clarifies the rules of the old legislation, the conclusions drawn in it can be applied today (as there are no contradictions with the current rules of law).

Situation: how to determine the amount of sick leave benefits if one of the sick leave certificates presented by the employee contains a note about failure to appear for a doctor’s appointment?

The answer to this question depends on the following factors:

- is there a valid reason for the employee’s failure to show up to the doctor;

- Do sick leave certificates confirm one period of incapacity for work?

One of the grounds for reducing the amount of sick leave benefits is failure to appear without a good reason at the appointed time for a medical examination (clause 2, part 1, article 8 of the Law of December 29, 2006 No. 255-FZ, subsection “b”, clause 21 of the Regulations, approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

Advice: to determine whether the reason for failure to appear is valid or not, you can use, for example, the list approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2007 No. 74.

According to the list, valid reasons are:

1. Force majeure circumstances, that is, extraordinary, unavoidable circumstances (earthquake, hurricane, flood, fire, etc.).

2. Long-term temporary disability of an employee due to illness or injury lasting more than six months.

3. Moving to a place of residence in another locality, change of place of stay.

4. Forced absenteeism due to illegal dismissal or suspension from work.

5. Damage to health or death of a close relative.

6. Other reasons recognized as valid in court when an employee goes to court.

In this case, it is advisable to ask the employee to submit an explanatory note justifying his failure to appear at the doctor’s office. This will help justify why the employee's benefit was not reduced.

If a doctor's visit was missed for a valid reason, the employer should not reduce the amount of benefits. This conclusion follows from parts 1–2 of Article 8 of the Law of December 29, 2006 No. 255-FZ and paragraphs 21–22 of the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

If the reasons are not valid, the specific procedure for limiting the amount of benefits to the minimum wage depends on how the medical institution issued sick leave certificates confirming the employee’s period of incapacity for work.

A benefit in an amount not exceeding the minimum wage for a calendar month must be paid from the day of failure to appear for an appointment (clause 1, part 2, article 8 of the Law of December 29, 2006 No. 255-FZ, clause 22 of the Regulations approved by the Decree of the Government of the Russian Federation dated June 15, 2007 No. 375).

If successive sick leave certificates confirm one period of incapacity for work, then calculate the benefit limited by the minimum wage until the day the last sick leave certificate expires.

If each of the sick leave certificates confirms a separate period of incapacity for work, then calculate the benefit limited by the minimum wage until the day the sick leave certificate in which the violation of the regime is noted is closed.

This conclusion follows from parts 1–2 of Article 8 of the Law of December 29, 2006 No. 255-FZ and paragraphs 21–22 of the regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

What minimum wage is taken into account for sick leave?

The minimum wage, from which the disability payment is calculated, in all situations requiring the use of this parameter, is taken in the amount corresponding to its value established at the federal level and valid on the day the sick leave begins (clause 6, article 7, clause 2, art. 8, paragraph 3 of Article 11, paragraphs 1.1, 2.1 of Article 14 of Law No. 255-FZ).

In areas where the regional coefficient is applied, the value of the federal minimum wage is used in the calculation taking into account this coefficient (clause 6 of Article 7, clause 2 of Article 8, clause 3 of Article 11 of Law No. 255-FZ).

When, on the day the sick leave begins, the employee finds himself working part-time, the amount of average earnings calculated from the minimum wage is reduced taking into account the proportion reflecting the share of real work time (clause 1.1 of Article 14 of Law No. 255-FZ).

This is important to know: Sick leave for maternity leave for the unemployed

Downtime benefit

Separate restrictions are provided for the accrual of sick leave benefits when the period or part of the period of illness occurs during downtime.

For the period of illness that occurred before the downtime and continues during the downtime, pay benefits in the amount of earnings that are saved for this time. In this case, the amount of the benefit should not be more than what the employee would receive according to the general rules. This is stated in Part 7 of Article 7 of the Law of December 29, 2006 No. 255-FZ.

If the entire period of temporary disability of an employee occurs during downtime, then do not pay sick leave benefits (Clause 5, Part 1, Article 9 of Law No. 255-FZ of December 29, 2006). For more information, see How to Calculate Your Total Sick Benefit Amount.

How to calculate the amount of sick leave from the minimum wage for 2021?

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

The average daily earnings for the situation of applying the minimum wage are determined by multiplying the value of this indicator by 24 and dividing the resulting product by 730 (clause 15(3) of the appendix to the Decree of the Government of the Russian Federation of June 15, 2007 No. 375).

The value of the minimum wage established at the federal level, from 05/01/2018, is correlated with the amount of the subsistence minimum of the working-age population, calculated based on the results of the 2nd quarter of the year preceding the year of entry into force of the corresponding minimum wage (Article 3 of the Law “On Amendments...” dated 12/28/2017 No. 421 -FZ, Article 1 of the Law “On Amendments...” dated 03/07/2018 No. 41-FZ), and it should be established for the entire year from its first day.

Thus, you can find out exactly what the minimum wage will be next year without waiting for the appearance of a legislative act fixing the corresponding amount.

Insurance experience less than six months

If at the time of opening a sick leave certificate the employee’s insurance experience is less than six months, then the sick leave benefit for a full month should not exceed the minimum wage (minimum wage). If in the area where the employee works, regional coefficients are established by law, then increase the amount of the minimum wage by them.

In this case, calculate the maximum daily benefit amount:

| Maximum benefit per day | = | Minimum wage | × | Regional coefficients (if the employee works in an area where they are established) | : | The number of calendar days in the month during which the period of temporary disability occurs |

This procedure is established by part 6 of article 7 of the Law of December 29, 2006 No. 255-FZ, paragraph 20 of the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

Situation: how to determine the maximum daily benefit for an employee whose service is less than six months? During two months of illness, the value of the minimum wage changed.

Determine the maximum daily benefit separately for the first and separately for the second month based on the number of calendar days in each of them. In this case, to calculate the maximum amount of daily benefit, use the minimum wage that was established in the corresponding month.

Thus, calculate the maximum daily allowance as follows:

- from the beginning of disability until the change in the minimum wage - based on the previous minimum wage;

- from the date when the minimum wage changed until the end of the disability - based on the new minimum wage.

An example of determining the maximum daily benefit for temporary disability if an employee fell ill in one month and recovered in another. The employee's insurance experience is less than six months. During the period of illness, the value of the minimum wage changed

P.A. Bespalov was hired on October 1, 2015. Before starting work, he had no insurance experience.

From December 29, 2015 to January 12, 2021, Bespalov was ill.

Before becoming incapacitated, Bespalov worked for less than six months. The maximum maximum amount of sick leave benefits for Bespalov is 1 minimum wage per month. This value is:

- in December 2015 – 5965 rubles;

- in January 2021 – 6204 rubles.

The accountant calculated the maximum daily allowance for each of the months in which the employee was disabled.

The maximum daily benefit for days of incapacity for work in December 2015 is: 5965 rubles. : 31 days = 192.42 rubles/day.

The maximum daily benefit for days of incapacity for work in January 2016 is: 6204 rubles. : 31 days = 200.13 rub./day.

Thus, the daily allowance should not exceed 192.42 rubles. in December 2015 and 200.13 rubles. in January 2021.

Maximum amount of sick leave

Since income exceeding the specified values is not subject to social security contributions, there is no need to include them in the calculation. The maximum average daily benefit in 2021 is RUB 2,301.37. ((815000+865000)/730 days).

For less than six months of service, the payment for a full calendar month should not exceed the monthly minimum wage in 2021. To calculate sick leave in the event of such an excess, the following formula has been introduced for calculating average daily earnings (clause 20 of the Regulations on the specifics of calculating sick leave, approved by Government Resolution No. 375 dated June 15, 2007):

K - number of days (calendar) in the month of incapacity.

In the same way, the average daily earnings for the entire period of sick leave are calculated in the case of illness resulting from intoxication. For cases of patient violation of the regime and failure to appear for examination by a doctor, this calculation is applied from the day on which the violation was committed.

This is important to know: Will they give you sick leave if your back hurts?

Establishing a minimum wage

According to Art. 133 of the Labor Code of the Russian Federation, the same minimum wage (minimum wage) is established by federal law for all subjects of our country.

The employer, when calculating benefits, if the employee does not have sufficient insurance coverage or has a low average income, must proceed from the specified amount.

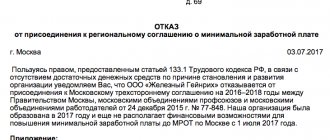

In Art. 133.1 of the Labor Code of the Russian Federation specifies that it is allowed to increase the minimum wage compared to the federal one by concluding a regional 3-party agreement.

In Art. 133 of the Labor Code of the Russian Federation, the legislator also indicated that the minimum wage should not be less than the subsistence level of the working population. The Law “On Amendments...” dated December 28, 2017 No. 421-FZ established that starting from January 1, 2019 onwards, the minimum wage is determined based on the cost of living for the 2nd quarter of the previous year. While the cost of living decreases, the minimum wage remains at the level of the previous year.

Conclusion! Thus, the establishment of a minimum wage is the responsibility of the state, which must take into account the real economic situation in the country.

For what period do you need to confirm income?

The maximum benefit in 2021 is due to a woman whose average monthly income for 2016-2017 amounted to or exceeded 61,341.4 rubles. (2017.81*30.4).

Benefits must be paid no less than calculated from the minimum wage. Based on the minimum wage, a payment is due if in the previous two years the employee had no earnings (no earnings) subject to insurance contributions or it was less than the minimum wage.

Accordingly, the amount of benefits will be: - A one-time benefit for a woman registered at a medical institution in the early stages of pregnancy - 649 rubles 84 kopecks; — One-time benefit for the birth of a child – 17,328 rubles 90 kopecks; — One-time benefit for the adoption of a child – 17,328 rubles 90 kopecks.