General rules

According to paragraph 6 of Article 171 of the Tax Code of the Russian Federation, during capital construction, tax amounts that are presented to the taxpayer in the following cases are subject to deductions:

- when he acquires objects of unfinished capital construction;

- when he purchases goods, works or services necessary to perform construction and installation work;

- when work on the construction or liquidation, installation or dismantling, assembly or disassembly of fixed assets is carried out by a contractor, and he submits VAT to the taxpayer.

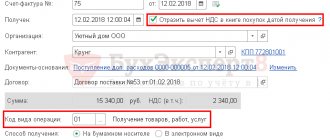

If contractors and suppliers present VAT directly to the taxpayer, then the deduction is made in accordance with the general procedure. To do this, three conditions must be met:

- the construction project is intended for VAT-taxable activities;

- the taxpayer has registered purchased goods, works or services for which he intends to claim a deduction;

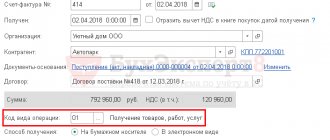

- suppliers and contractors prepared and handed over to the taxpayer invoices with VAT amounts allocated in them.

Let us remind you that in addition to the official form of the invoice approved by Government Decree No. 1137, companies can use a universal transfer document compiled on its basis (letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3 / [email protected] ).

Contract construction

If a developer builds a residential building using a contract method, then he performs only the functions of a developer. From shareholders he receives funds:

- to finance construction;

- for the maintenance of the developer (remuneration of the developer for services in organizing construction).

Account funds for construction financing in a separate subaccount to account 76, for example, “Settlements with equity holders.” When you receive them, make the following entries:

Debit 51 Credit 76 subaccount “Settlements with equity holders” - funds were received from the equity holder for the construction of the facility.

The amount of the developer's remuneration for construction organization services should be reflected in a separate subaccount to account 62, for example, “Settlements with equity holders.”

Account for remuneration received before revenue is recognized in the manner prescribed for accounting for advances received. To do this, make the following wiring:

Debit 76 “Settlements with equity holders” Credit 62 “Advances received” - an advance was received for the developer’s remuneration.

Funds for financing construction are not the income of the developer. However, subsequently, part of these funds (for example, in the amount of savings) may be recognized as remuneration to the developer. In such a situation, the amounts recognized as remuneration are included in income.

If a construction contract has been drawn up

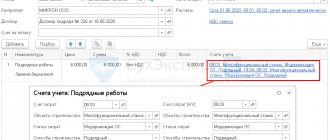

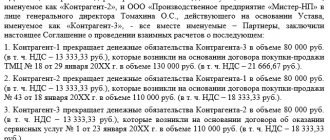

The construction contract may stipulate that the object is transferred to the customer upon completion of all construction work or in stages. However, in practice, there are often cases when, despite the absence of stage-by-stage delivery provisions in the contract, the customer transfers payment to the contractor periodically, for example, monthly. The basis for this is acceptance certificates in form KS-2 and certificates in form KS-3, as well as invoices issued by the contractor.

Meanwhile, by paying the contractor in the manner indicated above, the customer may lose the right to apply VAT deductions until the entire scope of work is accepted. From the provisions of paragraph 1 of Article 172 of the Tax Code of the Russian Federation, it follows that VAT submitted by the contractor can be deducted on the basis of an issued invoice after the work performed by him has been accepted for accounting. It is at the moment of taking into account the work performed by the contractor that the problem lies, which makes the deduction of “contract” VAT in this case risky.

The fact is that the tax legislation does not directly explain what is meant by the registration of a contractor’s work. Law No. 402-FZ “On Accounting” requires accounting to be based on federal and industry standards, but they are not yet available. Thus, based on paragraph 1 of Article 30 of Law No. 402-FZ, it is necessary to rely on the accounting rules approved by the Ministry of Finance before January 1, 2013. Let's turn to PBU 10/99 “Expenses of the organization”. According to the document, expenses must entail a decrease in the economic benefits of the organization, and such certainty exists in the case where there is no uncertainty regarding the transfer of the asset.

It turns out that before the results of the work are transferred by the contractor to the customer, the latter cannot take them into account. At the same time, forms KS-2 and KS-3 cannot be considered as acts of stage-by-stage acceptance of work performed, but are only settlement documents for advance payment. This is stated in the letter of the Federal Tax Service of Russia dated July 2, 2013 No. OA-4-13/ [email protected] , as well as in the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 No. 51.

Since the customer cannot accept the results of the work for accounting on the basis of these acts, then he also does not have the right to claim the deduction of VAT from the costs of paying for these works. Such conclusions correspond to the position of the Ministry of Finance, expressed, for example, in letter dated March 5, 2009 No. 03-07-11/52 and others. Department specialists point out that deduction of “contract” VAT is possible only when the customer takes into account the results of work in the amount specified in the construction contract.

However, in judicial practice there are cases when arbitrators took the side of customers who deducted VAT in this situation (resolution of the Moscow District dated April 19, 2012 in case No. A40-77285/11-107-332). Thus, if there is no provision in the construction contract for the phased acceptance of work, the customer may claim VAT deductions before the entire scope of work is registered at his own peril and risk. In this case, there is a high chance that the Federal Tax Service will not agree with the taxpayer, and he will have to defend his position in court.

The procedure for calculating and paying VAT by construction and installation organizations

When calculating value added tax, one should be guided by Chapter 21 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) and the Methodological Recommendations for the Application of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation.

Let's consider the procedure for calculating and paying value added tax by construction and installation organizations in accordance with the norms of part two of the Tax Code of the Russian Federation.

According to the Tax Code of the Russian Federation, VAT payers are organizations - legal entities formed in accordance with the legislation of the Russian Federation, which are responsible for paying this tax. Each construction and installation organization that is a legal entity and registered as a taxpayer, according to Article 144 of the Tax Code of the Russian Federation, calculates and pays VAT to the budget in accordance with the provisions of Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation.