Documentation

Home Help Registration of a pension Upon reaching retirement age, citizens have the right not to terminate their employment

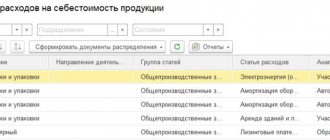

Direct and indirect costs Direct costs are the costs associated with the production of a particular type

What is downtime? Downtime occurs if an enterprise is forced to stop operations for a while. To idle time

List of violations To fill out and submit 6-NDFL without errors, we strongly recommend that you refer to the letter

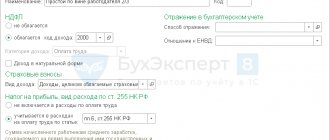

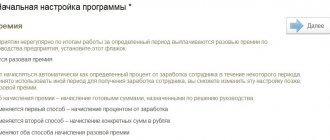

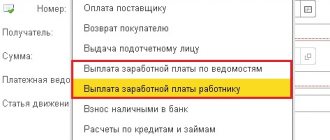

In this article, 1C experts talk about setting up calculation types in “1C: ZUP 8” ed.

Accountants whose organizations are on the simplified tax system periodically complain that KUDiR in 1C Accounting 3.0

The length of service for sick leave is the duration of the employee’s work activity, which must be taken into account when

lori-0006459598-bigwww.jpg Similar publications Personal income tax reporting includes reporting

Information about pre-retirees is a new reporting mandatory for all employers without exception. New

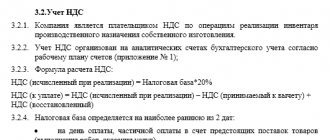

What should be in the VAT accounting policy The VAT accounting policy may include: