What should be in the VAT accounting policy

VAT accounting policies may include:

- description of synthetic and analytical VAT accounts used in the company;

- document flow technology for VAT accounting;

- a list of documents confirming the legality of VAT deductions and requirements for their execution, including forms (invoice, UPD, UKD, etc.);

- forms of used accounting certificates and calculations (for calculating tax deductions, VAT amounts to be restored, etc.);

- the order of numbering of invoices in the presence of separate divisions;

- formulas and algorithms for separate VAT accounting;

ConsultantPlus experts explained in detail how to describe the methodology for maintaining separate VAT accounting in the accounting policy. If you do not have access to the K+ system, get a trial online access for free.

- algorithm for confirming the legality of applying the zero VAT rate (responsible persons, list of documents submitted to tax authorities, etc.);

- list of persons authorized to sign invoices (UPD, UKD);

- list of responsible persons for processing and sending VAT returns via TCS;

- algorithms for preparing and signing documents related to VAT calculations (purchase books, sales books, etc.);

- other aspects (the procedure for filing and storing invoices and other documents related to the calculation of VAT).

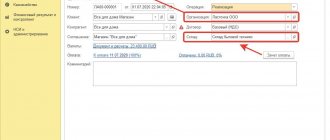

Setting up accounting policies for tax accounting purposes in 1C: Accounting ed. 3.0

Published 03/22/2020 23:31 Author: Administrator Accounting policy is the very first document approved after opening a business. It indicates the main parameters of the enterprise’s operation and will be used in the future by both accounting employees and the manager when making management decisions. Let's look at the nuances of setting up accounting policies for tax accounting purposes in this article.

When drawing up accounting policies, it is necessary to be guided by the regulatory framework, that is, current legislation. Due to changes made to the tax code, tax accounting policies must be reviewed annually. If there are no changes, the program will automatically extend it for the next year.

To fill out or edit an accounting policy for tax accounting purposes, you must go to the “Main” section and select “Taxes and reports”. Another way to open this setting is to select the “Accounting Policy” item in the “Main” section and at the bottom of the window follow the “Setting up taxes and reports” link.

In the window that opens, the left side is presented in the form of tabs, each of which is a separate tax. On each tab there is a link “History of changes”, by clicking on which you can view the data entered in previous periods.

On the first tab you need to select the tax system you are on. Depending on the choice made, the number of bookmarks and their names will change. For example, when choosing a general taxation system, the main sections are “VAT” and “Income Tax”. And when choosing a simplified taxation system, the main tab will be “STS”.

Let's go through all the sections.

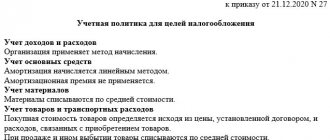

On the “Income Tax” tab, during initial setup, the current tax rates are automatically entered. If your business applies reduced income tax rates, you can change these values manually. Let us recall that the tax rate paid to the federal budget is established by Chapter 25 of the Tax Code of the Russian Federation, and the regional rate is established in the laws of the constituent entities of the Russian Federation.

In tax accounting, there are two methods for calculating depreciation - linear and non-linear methods. When putting a fixed asset into operation, it is possible to choose the method of calculating depreciation according to accounting. As for the tax authorities, it will be determined based on the current settings. And it cannot be changed before commissioning a new fixed asset to use a different method. At this stage, it is important to decide on what method you will use to calculate depreciation for all fixed assets and intangible assets, because you can change the method no more than once every five years (Article 259 of the Tax Code of the Russian Federation).

Working clothes and special equipment, depending on their cost and useful life, are written off as expenses using one of three methods: linear, cost repayment upon transfer to operation, and write-off in proportion to the volume of products (works, services).

If you know in advance that your enterprise plans to purchase workwear or special equipment only costing less than 100,000 rubles, then you can safely set the “One-time” flag. But if there is a possibility of purchasing more expensive special items, then it is better to select the “Indicated upon commissioning” item. In this case, when entering the document “Transfer of materials into operation” in the “Warehouse” section, you will have the opportunity to select the method you need for each individual unit.

The formation of reserves for doubtful debts in tax accounting, unlike accounting, is not mandatory for organizations. This item is left at your discretion. To make the right choice for you, we recommend reading our article These difficult reserves - creating a reserve for doubtful debts in 1C: Accounting.

According to Art. 318 of the Tax Code of the Russian Federation, all costs of an enterprise are divided into direct and indirect. Direct expenses are those that directly affect the calculation of the cost of manufactured products, and when closing the month, debit 20 of the account is closed to debit 90.02. These usually include the cost of materials required for production, rental of production space, wages and insurance premiums accrued to production employees, and others. All other costs are indirect, and when closing the month they are closed as a debit to account 90.08. Using the “List of direct costs” link, you can check and edit the list of costs related to direct costs.

Nomenclature groups are introduced to determine the cost of manufactured products, as well as when performing work and providing services. They are also used for analytical purposes, to divide revenue by groups of goods produced or services provided. More detailed information about this can be found in the video Why are item settings in 1C: Accounting so important? — fragment of the webinar

Article 286 of the Tax Code of the Russian Federation determines the procedure for paying advance payments for income tax. Thus, organizations whose revenue for the previous four quarters did not exceed 60 million rubles can only pay quarterly advance payments. If this criterion is violated, they switch to paying monthly advance payments based on estimated profits.

Enterprises have the right to switch to paying monthly advance payments, calculated based on actual profits, by notifying the tax authority no later than December 31 of the year preceding the tax period.

The next section that requires configuration is “VAT”.

Article 145 of the Tax Code of the Russian Federation specifies organizations and individual entrepreneurs who, when applying the general taxation system, are exempt from fulfilling VAT obligations as taxpayers. If your organization is classified as such, you should check the “Organization is exempt from VAT” flag.

Separate accounting of input VAT is required for taxpayers carrying out transactions that are subject to VAT simultaneously with non-taxable ones, or taxed at a rate of 0%.

The flag “VAT is charged on shipment without transfer of ownership” allows VAT to be charged when entering the document “Sales (deed, invoice)” in the “Sales” section with the type of operation “Shipment without transfer of ownership.”

The “Control the share of deductions” flag allows you to protect your company from tax audit in terms of the VAT deductions you claim. There is a detailed article on this topic on our website Safe share of VAT deductions.

The program provides 5 options for registering invoices for advance payments.

The default setting is “Register invoices always when receiving an advance.” When you select this option, invoices will be recorded for each amount received, except for those credited on the same day. This option is recommended by the program developers as the safest, because... it is this that allows you to track the fact of missing registration of an advance invoice. When performing routine VAT accounting operations, the program will independently generate all missed advance invoices.

If you choose other options, be sure to check that invoices are generated correctly at the end of the reporting period.

According to paragraph 3 of Art. 168 of the Tax Code of the Russian Federation, the seller must issue an invoice to the buyer for the amount of the prepayment within 5 calendar days after receiving it, if shipment against payment is also made within 5 days. In this case, select the “Do not register invoices for 5 calendar days” option.

The third option involves issuing advance invoices only for amounts that have not been credited at the end of the month. This is usually used for continuous long-term supplies of goods and services to the same buyer.

The next option is intended for organizations that are ready to defend the position that payments are not recognized as advance payments if the shipment and payment of the goods occurred in the same tax period.

According to clause 13 of Art. 167 of the Tax Code of the Russian Federation, organizations with a production cycle exceeding six months have the right to consider the moment the tax base arises on the day of shipment. For them, the last possible option is provided.

On the “Property Tax” tab, the tax rate is indicated in accordance with the law of the constituent entity of the Russian Federation.

Let us remind you that from 2021 only real estate is subject to property tax. If an organization applies property tax benefits specified in Chapter 30 of the Tax Code of the Russian Federation or in regional legislation, the corresponding flags are set:

• “All property is exempt from tax” - when selecting this item, you must indicate the benefit code;

• If the benefit does not provide for a complete tax exemption, but a reduction in the rate, then the “This is a reduced rate” flag is set;

• If the benefit provides for a reduction in the amount of tax, and not a percentage, then the “Tax reduced by” flag is set;

• If an organization applies several benefits, then for each of them it is necessary to create a separate sheet of Section 2. But if there is only one benefit, then there is no need to fill out Section 2 separately for each property. The flag “If there is one benefit, fill out one sheet of section 2 of the declaration” is responsible for this setting.

There are cases that the benefit does not apply to all property, but only to certain objects. Their data must be filled in using the link “Objects with a special taxation procedure”.

Using the link “Procedure for paying taxes locally,” you can specify several tax authorities to which you will subsequently transfer the tax.

According to accounting rules, property tax expenses should be reflected in the same expense accounts as depreciation on these objects. Depreciation can be calculated both on account 20, in the case of using equipment for production processes, and on account 26 or 44, if they are involved in trade or used by administrative and management personnel. Accordingly, using the link “Methods of reflecting expenses”, you need to configure the debit of which expense accounts will be accrued for property tax.

On the “Personal Income Tax” tab, you can select the method of applying standard deductions. Previously, only the first option was possible, but after the letter of the Ministry of Finance of the Russian Federation dated October 7, 2004 No. 03-05-01-04/41, the second method was added to the program. Later, the Ministry of Finance changed its decision, so by default the switch is set to “cumulative total”. Now each organization independently decides which option to use.

On the “Insurance Premiums” tab, select the insurance premium rate applicable to your organization and indicate the rate of contribution for accidents.

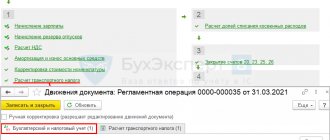

Using the “All taxes and reports” link, you can set up the calculation procedure for transport, land, water and many other taxes if they are relevant for your organization.

To obtain a printed form, you must go to the “Main” section, select the “Accounting Policy” item, click on the “Print” button and select “Tax Accounting Policy” from the drop-down list. If desired, the printed form can be edited, printed or saved outside the program.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Alina Kalendzhan 04/09/2020 21:31 I quote Alexander:

I quote Alina Kalendzhan: I quote Alexandra: Hello! If the salary calculation is carried out in Zup 3.1., will the personal income tax and insurance premiums be set up differently? Tell me where to read. Thank you

Good afternoon, the accounting policy settings will be the same.

If you do not calculate payroll in the 1C: Accounting program, then in the “Salaries and Personnel” section in the “Salary Settings” item, you need to set the flag that you keep records in an external program. Thank you. I'll check the box. I meant setting up accounting policies regarding personal income tax and insurance premiums. Or, after installing Salary Accounting in an external program, the personal income tax and income tax settings in the accounting policy will not be displayed? I'm not in the office right now, so I can't look. Good afternoon. The setting will look the same, but it will not affect anything, since the accruals are made in a different program. Quote 0 Alexandra 04/09/2020 19:46 Quoting Alina Kalendzhan:

I quote Alexander: Hello! If the salary calculation is carried out in Zup 3.1., will the personal income tax and insurance premiums be set up differently? Tell me where to read. Thank you

Good afternoon, the accounting policy settings will be the same.

If you do not calculate payroll in the 1C: Accounting program, then in the “Salaries and Personnel” section in the “Salary Settings” item, you need to set the flag that you keep records in an external program. Thank you. I'll check the box. I meant setting up accounting policies regarding personal income tax and insurance premiums. Or, after installing Salary Accounting in an external program, the personal income tax and income tax settings in the accounting policy will not be displayed? I'm not in the office right now, so I can't look. Quote 0 Alina Kalendzhan 04/08/2020 15:29 I quote Alexander:

Hello! If the salary calculation is carried out in Zup 3.1., will the personal income tax and insurance premiums be set up differently? Tell me where to read. Thank you

Good afternoon, the accounting policy settings will be the same.

If you do not calculate payroll in the 1C: Accounting program, then in the “Salaries and Personnel” section in the “Salary Settings” item, you need to set the flag that you keep records in an external program. Quote 0 Alexandra 04/07/2020 14:08 Hello! If the salary calculation is carried out in Zup 3.1., will the personal income tax and insurance premiums be set up differently? Tell me where to read. Thank you

Quote

Update list of comments

JComments

What does a sample VAT accounting policy look like for 2021?

VAT does not belong to the category of mandatory tax payments paid by all firms and entrepreneurs without exception.

For example, if an individual entrepreneur or company applies a special regime and does not perform the duties of a tax agent for VAT, there is no need to pay attention to value added tax issues in the accounting policy.

Considering the specificity of working with VAT for different companies and entrepreneurs, information about the procedure, accounting methods, reporting and other VAT-related nuances can be formatted in different ways, for example:

- separate accounting policy - this option can be used by VAT taxpayers if there are numerous nuances in calculating this tax (complex structure of branches, working with foreign counterparties, combining taxation regimes, etc.);

- annex to the accounting policy - usually in this form the methodology for separate VAT accounting is drawn up, without which it is difficult to confirm the legality of tax deductions when carrying out activities subject to and non-taxable for VAT and in other cases;

Our section on separate VAT accounting will help you to correctly implement this method.

- a special chapter (section, subsection) of the accounting policy - if the obligation to pay VAT must be fulfilled due to the requirements of the Tax Code of the Russian Federation and standard accounting and settlement approaches are applied (there is no need for separate accounting of VAT, there are no benefits, etc.).

View a sample VAT accounting policy on our website:

Separate accounting

In all cases when a taxpayer, along with activities subject to VAT, carries out non-taxable transactions, he is obliged to keep separate records of them. According to paragraph 4 of Art. 170 of the Tax Code of the Russian Federation, tax amounts presented by sellers of goods (work, services), property rights to such taxpayers:

— taken into account in the cost of goods (work, services), property rights used to carry out transactions not subject to VAT;

- are accepted for deduction in accordance with Art. 172 of the Tax Code of the Russian Federation on goods (work, services), property rights used to carry out transactions subject to VAT;

- are accepted for deduction or taken into account in the cost of goods in the proportion in which they are used for the production and (or) sale of goods (work, services), property rights, transactions for the sale of which are subject to taxation (exempt from taxation), - for goods ( works, services), including fixed assets and intangible assets, property rights used for the implementation of both taxable and non-taxable (exempt from taxation), in the manner established by the accounting policy adopted by the taxpayer for tax purposes.

The specified proportion is determined based on the cost of shipped goods (work, services), property rights, transactions for the sale of which are subject to taxation (exempt from taxation), in the total cost of goods (work, services), property rights reflected for the tax period.

It must be recalled that taxpayers who do not comply with the requirements for maintaining separate accounting are deprived of the right to deduct VAT amounts, as well as to include these amounts in expenses for the purpose of calculating income tax.

From the above it follows that the amount of “input” VAT must be distributed in proportion, the basis for which is the cost of shipped goods (work, services), property rights. The transfer of ownership in this case does not matter. The base should be calculated for the tax period in which property (work, services), property rights intended for taxable and non-taxable transactions were acquired.

Is it necessary to change the VAT accounting policy for 2021?

According to current legislation, changes to the company's accounting policy are made, including when regulations governing the calculation and payment of tax are changed.

Thus, from January 2021, the VAT rate in the Russian Federation was increased to 20%. In this regard, the taxpayer, in the order to change the accounting policy, should have specified the procedure for calculating tax, as well as the algorithm for accounting for transitional advances. Because Having received an advance in 2018 and calculating tax on it at a rate of 18/118, the taxpayer upon shipment in 2021 had to present the buyer with a tax calculated at a rate of 20%.

Read how to calculate VAT during the transition period here.

It is necessary to make changes to the accounting policies from 2021 (or from any new tax period 2020-2021) if:

- the company plans to carry out operations exempt from VAT (for example, issue loans to counterparties) - a separate VAT accounting methodology must be developed and included in the accounting policy;

We talked about how separate accounting for VAT is carried out - principles and methods - in this material.

- the current accounting policy details the specifics of tax calculation or VAT reporting, which will change from next year due to legislative innovations (for example, if the accounting policy specifies the applicable form of the VAT return and specifies the algorithm for filling it out, and the form of the VAT return changes);

Read about what other legislative innovations regarding VAT need to be taken into account in your accounting policies in our review of VAT changes.

A sample VAT accounting policy for 2021 is also available in ConsultantPlus. Get free demo access to K+ and learn the nuances of compiling this document.

Taxable period

Please note that the tax period for VAT is a quarter, which means that the basis for calculating the proportion can be determined only at the end of the quarter (Letters of the Ministry of Finance of Russia dated November 12, 2008 N 03-07-07/121, Federal Tax Service of Russia dated July 1, 2008 N 3-1-11/150 and dated 06/24/2008 N ShS-6-3/ [email protected] ). This procedure should be followed even if a fixed asset or intangible asset used in transactions subject to or not subject to VAT is registered in the first month of the quarter and it is necessary to determine the amount of VAT that is included in the initial cost of this property.

The procedure for assigning VAT to the initial cost of property must be set out in the accounting policy of the enterprise. There may be different options for this (see example 1).

Example 1. Option 1. The basis for calculation at the time of registration of property is assumed to be equal to the data based on the results of the previous quarter. Then, at the end of the quarter, when the proportions of shipments for operations subject to and not subject to VAT are known, corrective operations are carried out.

Option 2. The basis for calculation at the time of registration of property is assumed to be equal to a certain average value. Then, based on the results of the quarter (tax period), corrective operations are carried out.

As noted above, the basis for calculating VAT amounts is the cost of goods (work, services) shipped and property rights. Example 2 shows options for calculation formulas for tax amounts to be deducted and included in the purchase price, which should be reflected in the Accounting Policy.

Example 2.

VAT calculation = VATtot. x SOP / OSB,

where is NDSvych. — the amount of VAT on goods (works, services), property rights used in taxable and non-VAT-taxable transactions, which can be deducted;

VAT total — the total amount of VAT on goods (works, services), property rights for the tax period;

SOP - the cost of products subject to VAT, shipped in the period when goods (work, services), property rights were purchased;

OSB is the total cost of products shipped during the tax period.

VATzat. = VATtot. x SNP / OSB,

where is VAT zat. — the amount of VAT on goods (works, services), property rights used in transactions subject to VAT and not subject to VAT, included in their cost;

VAT total — the total amount of VAT on goods (works, services), property rights for the tax period;

SNP - the cost of products not subject to VAT, shipped in the period when goods (work, services), property rights were purchased;

OSB is the total cost of products shipped during the tax period.

9.6. Elements of accounting policies when applying the simplified taxation system

Taxpayers using the simplified taxation system have the right to:

• choose a tax regime;

• select an object of taxation;

• choose a method for evaluating purchased goods purchased for further sale;

• reduce the tax base in the tax period by the amount of the loss received based on the results of previous tax periods.

9.6.1. Selecting a tax regime

In accordance with clause 2.1 of Art. 346.12 of the Tax Code of the Russian Federation, introduced by Federal Law No. 204-FZ of July 19, 2009 “On Amendments to Certain Legislative Acts of the Russian Federation” and clause 3 of Art. 346.12 of the Tax Code of the Russian Federation, organizations whose income for 9 months of the current year did not exceed 45 million rubles, with an average number of employees for the tax period of no more than 100 people and with a residual value of fixed assets and intangible assets not exceeding 100 million rubles. has the right:

• switch to a simplified taxation system;

• apply other taxation regimes provided for by the legislation of the Russian Federation.

If, at the end of the reporting (tax) period, the organization’s income exceeded 60 million rubles. and (or) during the reporting period there was a non-compliance with the requirements established by paragraphs. 3 and 4 tbsp. 346.12 Tax Code and clause 3 of Art. 346.14, then this organization loses the right to apply the simplified tax system from the beginning of the quarter in which the specified excess and (or) non-compliance with the specified requirements was committed.

Individual entrepreneurs can switch to a simplified taxation system if the average number of employees for the tax (reporting) period does not exceed 100 people.

Organizations and individual entrepreneurs listed in paragraph 3 of Art. do not have the right to apply the simplified taxation system. 346.12 Tax Code of the Russian Federation.

Individual entrepreneurs, in addition to the usual simplified taxation system, have the right to switch to a simplified taxation system based on a patent.

It should be noted that in accordance with clause 2.1 of Art. 346.25.1 of the Tax Code of the Russian Federation, introduced by Federal Law No. 158-FZ of July 22, 2008, individual entrepreneurs using a simplified taxation system based on a patent have the right to attract employees, the average number of whom for the tax period should not exceed five people.

A patent is issued at the choice of the taxpayer for a period from 1 to 12 months (clause 4 of article 346.25.1 of the Tax Code of the Russian Federation). The tax period is the period for which the patent was issued. The types of business activities for which it is permitted to apply a simplified taxation system based on a patent are indicated in paragraph 2 of Art. 346.25.1 Tax Code of the Russian Federation.

Individual entrepreneurs can switch to a simplified taxation system based on a patent on the territory of a constituent entity of the Russian Federation only after the said subject has adopted the relevant law.

9.6.2. Selecting a taxable object

In accordance with Art. 346.14 of the Tax Code of the Russian Federation, taxpayers applying the simplified taxation system have the right to recognize as an object of taxation:

• income;

• income reduced by the amount of expenses.

The taxpayer can change the object of taxation annually.

It should also be borne in mind that participants in a simple partnership agreement or a property trust management agreement use only income reduced by the amount of expenses as an object of taxation.

9.6.3. Choosing a method for evaluating purchased goods purchased for further sale

In accordance with paragraph 2 of Art. 346.17 of the Tax Code of the Russian Federation, for tax purposes, a taxpayer has the right to use one of the following methods for valuing purchased goods:

• at the cost of the first acquisitions (FIFO method);

• at the cost of recent acquisitions (LIFO method);

• at average cost;

• by unit cost.

The chosen method for valuing purchased goods is indicated in the accounting policy of the organization. The consequences of using each of the listed methods are discussed in § 4.2.2.

9.6.4. Using the right to reduce the tax base in a tax period by the amount of loss received based on the results of previous tax periods

In accordance with paragraph 7 of Art. 346.18 of the Tax Code of the Russian Federation (as amended by Federal Law No. 158-FZ of July 22, 2008), a taxpayer who uses income reduced by the amount of expenses as an object of taxation has the right to:

• reduce the tax base calculated at the end of the tax period by the amount of the loss received based on the results of previous tax periods in which the taxpayer applied a simplified taxation system and used income reduced by the amount of expenses as an object of taxation. In this case, a loss is understood as an excess of expenses determined in accordance with Art. 346.16 of the Tax Code of the Russian Federation, over income determined in accordance with Art. 346.15 Tax Code of the Russian Federation;

• carry forward losses to future tax periods within 10 years following the tax period in which these losses were received;

• transfer to the current tax period the amount of losses received in the previous tax period.

A loss not carried forward to the next year may be carried forward in whole or in part to any year out of the next nine years. If losses are received in more than one tax period, they are carried forward to future tax periods in the order in which they were received.

The taxpayer is obliged to keep documents confirming the amount of the loss incurred and the amount by which the tax base was reduced in each tax period for the entire period of exercising the right to reduce the tax base by the amount of the loss.

It should also be borne in mind that the loss received by the taxpayer when applying other taxation regimes is not accepted when switching to a simplified taxation system; losses incurred when applying the simplified taxation system are not accepted upon transition to other taxation regimes.

What's happened

The need to maintain separate accounting for VAT arises both when an organization has export operations (not subject to value added tax) and when conducting other business transactions that are subject to VAT.

The main purpose of separate VAT accounting is the distribution of input tax in order to subsequently accept it for deduction.

All input value added tax allows deduction of the application of the “5% Rule” on expenses related to both taxable and non-taxable VAT transactions, which include general business expenses.

In this article you will learn how to apply the “Five Percent Rule” for VAT in 2021 and will be able to see a detailed example of the calculation. When combining UTII and OSNO, this rule does not apply.

Advice for organizations conducting transactions that are subject to VAT

If an organization conducts operations that are subject to value added tax and only occasionally receives income from loans (or pays with bills of exchange from third parties), then it is recommended to include in the accounting policy such provisions on the use of the “Five Percent Rule” for VAT.

The use of this rule allows the organization to determine the amount of general business expenses that fall on non-taxable operations in proportion to the share of direct expenses for these operations in the total amount of expenses associated with the sale of products.

When applying the “Five Percent Rule”, if the organization provides loans, the share of expenses for non-VAT-taxable transactions will be equal to 0. Thus, it will be possible to take all VAT on general business expenses as a deduction.

If an organization is engaged in operations that are not subject to value added tax on an ongoing basis, then in order to calculate the share of expenses for these operations, accounting should be organized in such a way that the following information is generated separately:

1. About the cost of sales, which are subject to VAT.2. About the cost of sales, which are not subject to VAT.

3. About other costs associated with implementation:

- subject to VAT (for example, on the sale of fixed assets);

- exempt from VAT (for example, sales of securities).

4. About other expenses that are not related to sales (for example, interest received by the company on loans).

To make it more convenient to keep track of transactions, it is recommended to open separate sub-accounts. In addition, you can maintain separate registers.

We add that the organization should decide on the optimal procedure for calculating the share of general business expenses that fall on operations not subject to value added tax.

For example, the share of general business expenses attributable to operations that are not subject to VAT can be taken equal to one of the following ratios:

- the share of direct expenses for operations that are not subject to VAT in the total direct expenses for all operations that are related to the sale;

- the share of revenue from operations that are not subject to VAT in the total amount of sales revenue.

No less important is the issue of tax policy for separate accounting in relation to transactions that are not subject to VAT. It is worth paying attention to such points that are associated with the grounds for performing such operations, namely:

1. What preferential regimes are associated with taxation.2.

Are there any tax transactions that are not provided for in Article 149 of the Tax Code of the Russian Federation.3.

Availability of the right to exemption from VAT in case of insufficient amount of revenue received.

4. Sales of products (services or works) to other countries.

Maintaining separate accounting for VAT: what to pay attention to

The vast majority of organizations deal with both taxable and non-taxable value added tax products.

Let us remind you that separate accounting for this tax is carried out according to the output VAT - at the cost of the products that were shipped. In this case, products may be subject to VAT or exempt from it. VAT included in the product price must also be taken into account.

However, there is no single methodology for maintaining separate VAT accounting. That is why you can use a convenient order for organization. The most important thing is that when maintaining separate accounting, transactions subject to VAT and those not subject to VAT are clearly distinguished.

The procedure for maintaining separate VAT accounting chosen by the organization must be enshrined in the general accounting policy of the company.

Failure to maintain correct separate VAT accounting may result in tax authorities recovering all input tax on items purchased for use in transactions that are and are not subject to value added tax. Such actions by tax officials will lead to the organization having shortfalls in VAT, which means fines and penalties cannot be avoided.

The Ministry of Finance believes that if there are no transactions on exempt units of goods from VAT, then this is the basis for exempting the organization from maintaining separate accounting for value added tax.

Maintaining separate accounting for VAT when exporting: main points

Separate accounting for VAT when exporting products is required. In this case, the raw materials that were used in the process of export operations (the amount of operations) must be submitted to the Federal Tax Service in the form of a declaration with a zero rate.

The norms of the current Russian legislation do not provide for a clearly defined methodology for determining the input VAT of goods for export.

A convenient accounting method is chosen by the organization independently.

The accounting procedure should be fixed in the relevant documents (in orders related to the accounting policy of the enterprise).

If the organization did not previously assume that it would export goods and applied regular input VAT on a general basis, then the tax that was paid can be restored. To do this, the organization submits a declaration (updated) and pays tax.

If for a quarter the total share of expenses for the acquisition, as well as for the production of products, is no more than 5% (of all total expenses that are aimed at the production and sale of goods), then the organization is exempt from maintaining separate accounting for VAT. That is, input VAT submitted by suppliers (in one or another quarter) can be deducted.

Example

Taxable expenses of the organization – 8,000,000 rubles. Tax-free expenses – 400,000 rubles. Expenses for general business needs amounted to 2,000,000 rubles.

The calculation will be carried out using the following formula:

| Costs associated with sales not subject to VAT (per quarter) / Total costs associated with sales (per quarter) X 100% ≤ 5% |

400,000 rubles: (8,000,000 rubles + 2,000,000) x 100% = 4%

The amount in our example was 4%, which is less than 5%, which means that the organization has the right to maintain separate accounting for input value added tax. In addition, it has the right to accept all input VAT as deduction for the reporting period.

Source: https://my-biz.ru/buhgalteriya/pravilo-5-procentov