Balance sheet profit is the profit received before tax for the reporting period from all types of activities of the organization and reflected in its accounting. The amount of balance sheet profit can be determined by calculation using data from the accounting registers, balance sheet and income statement.

The goal of entrepreneurial activity is the systematic receipt of profit from the use of property, sale of goods, performance of work or provision of services (Clause 1, Article 2 of the Civil Code of the Russian Federation). Profit as an object of accounting refers to the sources of financing the activities of an economic entity (clause 4, article 5 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”). Therefore, balance sheet profit is an important indicator used to analyze and evaluate the activities of an organization and characterize the financial result of such activities.

What is it and where can I see it?

At the end of the reporting period, management needs comprehensive information about the return on assets and profitability of the enterprise. Accordingly, it is necessary to know the amount of revenue and expenses. For this purpose, a balance sheet is prepared.

The balance sheet is not only information for reporting to the Federal Tax Service, it is a source of data for analyzing the current activities of the enterprise and making forecasts. This is a document showing the financial position of an enterprise at the reporting date, the value of assets and the amount of capital of the organization, as well as the amount of its liabilities.

As for revenue, there is no separate line for it in the balance sheet. This, surprising at first glance, circumstance is explained by the fact that the assets and liabilities of the enterprise are reflected in the balance sheet at the moment in question. Whereas the sold product or service is no longer an asset. And the financial results, which include revenue, are reflected in the income statement.

Sometimes it is still possible to define a line item for revenue on the balance sheet. This is a case where the finished products sold were not paid for. Revenue from the sale of finished products is usually represented by the following entry: Debit of account 62 “Settlements with buyers and customers” – Credit of account 90 “Sales”, subaccount “Revenue”. Read about which accounting account revenue can be displayed in here.

Thus, customer debt equal to revenue from the sale of goods and services of the enterprise will be reflected in line 1230 “Accounts receivable”.

Attention! Balance sheet revenue in line 1230 is indicated including VAT, and in the profit and loss statement net revenue is indicated - this is the amount reduced by the VAT charged on revenue.

Balance sheet profit analysis

Enterprises use the BP indicator to analyze work. BP analysis allows not only to identify factors influencing the enterprise’s profit, to determine the reasons for failure to meet the income plan, but also to develop a strategy for the development of financial management.

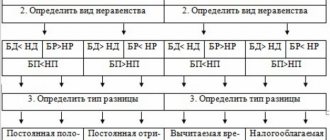

The business process is also influenced by the methods of recording transactions recorded in the accounting policies of the enterprise.

To learn how to correctly draw up an enterprise’s accounting policy, see the material “How to draw up an organization’s tax policy?”

Thus, an enterprise can influence its financial result (FP) by choosing an accounting method.

Calculation formula

The development strategy of any enterprise is based on data on sales prices and production scales. These categories are determined based on the experience of previous periods, taking into account all external factors. And revenue is a general indicator that gives an idea of the dynamics of the organization’s development.

Revenue is the sum of all funds received by the enterprise during the period under study from the sale of goods, services, and property rights. It can be expressed both in cash and in kind and calculated without taking into account value added tax and excise taxes (we talked about what is considered sales revenue in more detail here).

It is this indicator that is taken as the main one when calculating income and profit from core activities. It excludes expenses and amounts received from activities not related to the sale of goods and services.

The calculation algorithm is quite simple. Sales volume and unit cost information are required. If the price changes during the reporting period, it is necessary to calculate revenue taking into account each change.

Revenue is calculated taking into account the volume of sales completed and the cost in effect at the moment. Discounts, VAT, excise taxes and export tariff charges are not taken into account.

Today, there are two methods by which revenue is calculated:

- Cash (based on actual sales volume).

- Accrued (based on the fact of receipt of income, regardless of whether payment has already been received or not).

Cash is used for internal assessment of the enterprise’s activities and is not reflected in the reporting.

The calculation method is as follows: TR = Res.p (n) + GP - Res.p (k) , where:

- Res.p (n) and Res.p (k) – balances of finished products at the beginning and end of the reporting period.

- GP – finished products that are planned to be sold.

All calculations are expressed in monetary terms.

This indicator is calculated, as a rule, based on the results of the period, once a quarter and annually. The price and volume of products sold are internal information and are not reflected in the financial statements.

We provide more details about the formulas used to calculate revenue in a special article.

Examples of problem solving

EXAMPLE 1

| Exercise | Determine the balance sheet profit of the enterprise if the following data are known: Sales income (revenue) – 17,000 thousand rubles, Product cost – 10,000 thousand rubles, Income from a bank deposit – 500 thousand rubles, The amount of dividends is 350 thousand rubles, Lease payments – 260 thousand rubles, Fines for unfulfilled obligations – 400 thousand rubles, |

| Solution | First of all, it is necessary to determine the profit from sales: PP = B – C PP = 17,000 – 10,000 = 7,000 thousand rubles. Profit from non-operating operations will be: VP = 500 + 350 – 400 – 260 = 190 thousand rubles. The balance sheet profit formula for an enterprise is as follows: BP=PP+VP BP = 7,000 + 190 = 7,190 thousand rubles. |

| Answer | BP=7190 thousand rub. |

EXAMPLE 2

| Exercise | Calculate profit from sales and balance sheet profit of the enterprise using known data: Revenue – 1,200 thousand rubles, Sales costs – 25 thousand rubles. Production costs – 269 thousand rubles. Tax payments 50 thousand rubles, Profit from non-operating operations (NP) – 360 thousand rubles, Profit from the sale of fixed assets – 500 thousand rubles. |

| Solution | Profit from sales of products will be determined using the following formula: RP = B – W – N RP = 1,200 – 25 – 269 – 50 = 856 thousand rubles. The balance sheet profit formula for an enterprise is as follows: BP=RP+PR+VP BP=856 + 360 + 500 = 1,716 thousand rubles. |

| Answer | RP = 856 thousand rubles, BP = 1,716 thousand rubles. |

Book profit is profit before tax. It is one of the key indicators when assessing business performance. Its value is used to determine the basis for calculating tax liabilities.

Reflection of the indicator in section 1

Despite the fact that the balance sheet does not have a special line for accounting for revenue , it nevertheless contains a number of indicators, the consideration of which gives an idea of it.

The first section of the balance sheet is almost entirely, in one way or another, related to revenue.

For example, if there is a decrease in the residual value of intangible assets or fixed assets at the end of the reporting period (year), then most likely there was a sale of some objects. And as a result, the company gained revenue.

If investments in material assets are reflected in the balance sheet, then this predicts the emergence of revenue from the enterprise in the future , possibly as an additional type of activity.

In the column on financial investments, you can also track the company’s revenue. The management of a stable and profitable enterprise is always interested in further development and expansion. And to increase capital, financial investments are often used, which are secured precisely by the company’s profit, generated from revenue.

Loss before tax

If the resulting operating profit indicator is negative, this means that expenses exceeded financial income, that is, there is a loss .

From the point of view of economic theory, this is the same indicator, only with a different sign, but for an enterprise the difference is colossal.

If it is not a profit, but a loss before tax, it undoubtedly follows that the enterprise is in a bad financial position, that funds are distributed incorrectly or that the activities are ineffective. In any case, this is a reason to immediately take appropriate action.

Losses must be written off before income tax is calculated for a specific time period. The basis for including expenses in the “Losses” column are the provisions of the letter of the Ministry of Finance of the Russian Federation dated January 16, 2013. No. 03-03-06-/2/3.

Reflection of the indicator in section 3

The third part of the balance sheet reflects information about the company's revenues. When preparing the income and expense report, the amount of net profit goes to retained earnings and after that is reflected in the balance sheet, in the third section.

You can trace the connection to revenue in another way. So, for example, in order to create reserve capital and increase it, an enterprise needs to make a profit , which is impossible without revenue.

There are cases when the revenue indicator of an enterprise is very low, and in terms of other characteristics of the main activity the enterprise is even unprofitable. But the profit can be high.

This situation may arise, for example, in the case of an enterprise fulfilling a socially significant, but unprofitable, from a profit point of view, order. Accordingly, in this case, the source of profit is other income of the enterprise.

From our separate publications you can learn about how revenue differs from turnover, cost and other concepts, as well as what gross revenue is.

Bibliography

- Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ

- Astakhov V.P. “Accounting (financial) accounting. Textbook" - M: "Expert Bureau", 2000. -250 p.

- Astakhov V.P. “Theory of Accounting” - M: “Expert Bureau, 2004. -351 p. — ISBN 5-86065-031-9

- Veshchunova N.L., Fomina L.F. “Accounting at enterprises of various forms of ownership” - M: 2000. -640 p. -ISBN: 5-7978-0068-3

- Kondrakov N.P., Kondrakov I.L. "Accounting in budgetary organizations." – M: “Prospekt” - 2001. -267 p. -ISBN 5-900984-19-2.

- Murakhovskaya I.S. “Accounting and reporting. Collection of normative documents and reference materials" - M: 2000. - 278 p.

- Posherstnyak E.B., “Cash transactions” - M: “Gerda”, 2003. -185 s. — ISBN 5-7978-0054-3

- Tokarev I.N., “Accounting” - M: “ID FBK Press”, 2002. -278 p.

- Raizberg B. A., Lozovsky L. Sh., Starodubtseva E. B. Modern economic dictionary. 5th ed., revised. and additional - M.: INFRA-M, 2007. - 495 p.

The policy of enterprises is aimed at obtaining profit from economic activities. The result of this activity for a certain period is balance sheet profit.

The total summed profit of an organization from products sold and income received that are not the main activity for a certain period of time, which is included in the financial report, is called balance sheet profit.

The dimensions of these indicators are identified by the organization’s policies and legal acts, which allow the organization to make decisions on its own aimed at generating financial income using the accounting method.

Balance sheet profit is calculated once a month, year or quarter. The result is an assessment of the balance sheet and accounting items. They are based on the organization’s manufactured, sold products in kind or completed, rendered services and works. This is net profit, everything else is the result of the redirection of income in the previously conducted activities of the enterprise.

Relationship with current assets

All information on current assets is reflected in the second section of the balance sheet. And an indicator of the company’s revenue can be the amounts that have been received by the company’s cash desk or into its current account. These amounts are reflected in the line “Cash and equivalents” of the second section of the balance sheet and, in fact, are the organization’s revenue.

The cash balance makes it possible to analyze the success of cash flow management at the enterprise. If large sums of money are reflected in the balance sheet, then it is possible that the company’s activities bring high profits, and managers do not have time to put them into circulation.

If the balances are low, then there may be a competent distribution of funds received from the sale of goods or services. That is, management acquires assets in a timely manner and makes financial investments, efficiently managing the finances of the enterprise.

But in this case, it is necessary to pay attention to the profitability of the enterprise, because small amounts of balances on the balance sheet may indicate a shortage of the company’s own funds.

Important! An important point is whether the proceeds go to the company’s cash desk or to a current account. Since upon receipt at the cash desk, it is possible to exceed the established limit, which is an administrative offense (Article 15.1 of the Administrative Code).

More information about the procedure for recording revenue when it is received at the cash desk or into an account can be found here.

The procedure for calculating this limit is determined by the instruction dated March 11. 2014 No. 3210-U.