Many who have heard that a 3-NDFL declaration can be filed 3 years in advance try to contact the Federal Tax Service as soon as possible, not understanding when they have such an opportunity and when they do not. Let's try to figure out who can apply for a personal income tax refund for 3 years at once, and who is deprived of such a right by virtue of Russian Legislation. You will find all instructions for filling out property, social (for treatment and education), standard and investment (IIS) deductions by clicking on the link of the same name. In the same article we will prepare a general theoretical basis for understanding the situation.

When preparing 3-personal income tax for 3 years, you need to fill out three separate declarations and should start from the earliest year. An important aspect is that you should have received income taxed at a personal income tax rate of 13% for this period, because... These funds will be refunded.

What it is?

Current regulations provide for the opportunity for any citizen of the Russian Federation to submit documents for a refund of personal income tax paid for the past three years after purchasing an apartment. This opportunity is provided to those who have purchased a plot of land for construction and any other property for living. This right is granted to citizens of the Tax Code of the Russian Federation, and its purpose is to stimulate an increase in transactions for the purchase and sale of real estate, as one of the main industries that are engines of economic growth.

Thus, if the buyer of the premises has worked officially for at least the last three years, which means he has paid all taxes established by law, and purchased residential real estate, then he has the right to receive a property tax deduction. Its maximum value is 13% of the cost of purchasing a home or interest on a mortgage. If a plot of land was purchased on which a cottage was built, then when determining the amount of compensation, the costs of connecting it to utility networks, designing, and calculating estimates will be taken into account. The amount to be returned to the applicant should not exceed the personal income tax actually paid to the budget.

Necessary documents to receive a tax deduction for 3 years

- Declaration in form 3-NDFL

- Application addressed to the head of the tax authority at the place of registration for the provision of a property deduction

- Application addressed to the head of the tax authority at the place of registration for an income tax refund to your personal account

- Certificate of income in form 2-NDFL for the last 3 years of work (from all places of work for the reporting year)

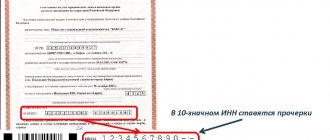

- Copy of the passport

- Copy of TIN certificate

- A copy of the apartment purchase and sale agreement

- Copy of the Certificate of registration of ownership of the apartment

- A copy of the transfer deed for the purchase and sale of an apartment

- A copy of the receipt of money

When returning income tax on mortgage interest, in addition to the specified list, you will need to attach the following documents:

- Loan agreement for the purchase and sale of an apartment

- Certificate from the bank on interest paid for the reporting year

When can I get a property tax deduction?

The right to receive a personal income tax refund arises only when there are confirmed expenses in a number of areas. In particular:

- Purchase or construction of residential real estate, which includes apartments, houses (cottages), rooms and other types of premises where a person can live, and which comply with existing sanitary rules.

- Purchasing a plot of land with or without an existing residential building. In the second case, the type of permitted use of the land plot must allow the construction of residential premises on it.

- Mortgage interest. In this case, credit resources should be used for the purchase or construction of residential real estate. Some banks offer borrowers loans secured by real estate to carry out routine repairs or purchase furniture. If there are loans for such purposes, personal income tax compensation will not be made.

- Carrying out finishing of housing, in case of purchasing it from a developer without one. When registering ownership of housing purchased on the secondary market, repair costs are also not compensated.

Current regulations stipulate that personal income tax deductions are prohibited in the following situations:

- If the housing was purchased from persons who can be considered interdependent (spouses, close relatives, etc.).

- When a person in previous periods enjoyed the right to receive a property tax deduction. It is prohibited by law to issue it more than once.

How is the amount of property tax deduction for previous tax periods determined?

The amount of tax already paid that an applicant can recover is limited by two criteria. The first is the costs incurred in the process of purchasing a home or its construction. The second is the amount of personal income tax that was transferred to the budget.

Current legislation provides for the opportunity to return no more than 13% of the amount spent on the purchase or construction of housing. However, the maximum amount when calculating the amount of compensation should not be more than two million rubles. In other words, if the price of the object was five million rubles, then the amount of personal income tax subject to compensation will still be 260 thousand rubles (13% of two million).

Within one year, you can receive a deduction in an amount not exceeding the amount of personal income tax transfers during that year (this amount, as a rule, is about 13% of total income). You can receive compensation for several years until the entire amount due under the law is paid from the budget.

When purchasing a home with a mortgage, you must take into account the date of purchase. If this event occurred before the end of 2013, then personal income tax is subject to compensation on the entire amount of interest; no restrictions are provided for by current regulations. If the acquisition took place after January 1, 2014, then the amount of interest that is taken into account when providing a deduction is limited to three million rubles, that is, no more than 390 thousand rubles will be reimbursed.

How to fill out a declaration taking into account deductions for previous years?

Deduction for previous years of declaration and the amount carried over from the previous year.

These concepts raise many questions when filling out the 3-NDFL tax return for the return of a property tax deduction.

To understand once and for all, you need to answer the questions:

- What it is?

- Where does it come from?

- How is it calculated?

- How to fill out 3-NDFL?

- What exactly and where should I write in the declaration?

What is a deduction?

The phrase “deduction for previous years of declaration” refers to the topic of property deduction. This means that you can return income tax or personal income tax when purchasing any housing: a house, apartment, room, land.

And again new questions arise. What is income tax? And how can I return it?

Income tax is the portion of funds that individuals pay to the government on their income. It would be correct to call it the personal income tax, or personal income tax. The rate of this tax for Russian citizens is 13%.

As a rule, personal income tax is withheld by tax agents, who are employers. For example, if a citizen receives a salary of 10 thousand rubles, the employer will most likely withhold 13% tax from him, which is 1,300 rubles. And he will receive 8,700 rubles in his hands.

This income tax is refundable. Today there are five types of tax deductions:

- standard;

- social;

- property;

- professional;

- deductions for securities.

In order to take advantage of the property deduction and return the withheld income tax, you must fill out a 3-NDFL declaration.

Where does the deduction for previous years of declaration come from?

To date, the amount of property deduction is 2 million rubles. And 13% of this amount can be returned. And this is 260 thousand rubles.

Now you need to compare this with salary. Let it be 25 thousand rubles per month - or 300 thousand rubles per year. The withheld personal income tax for the year will be 39 thousand rubles. Now let's compare tax relief and income tax. The benefit is more than six times your actual income for the year. How to be?

For the past year, you can only get a refund on the real amount of income - three hundred thousand rubles. That is, 39 thousand is returned. What benefit will remain unspent? You need to subtract 2 million 300 thousand, and you get 1 million 700 thousand rubles.

How to fill out the 3-NDFL declaration when selling an apartment?

How to get a tax deduction for previous years, read here.

How to fill out the 3-NDFL declaration for the annual return of mortgage interest, read the link:

When can you use it again? Only next year, when new income appears and, accordingly, withheld personal income tax.

Now attention! 300 thousand rubles is a deduction for previous years of the declaration. One million 700 thousand rubles is the amount that carries over to the next year.

How to calculate the amount of deduction for previous years of declaration?

Where does the amount transferred from last year come from?

A simple example has already been discussed. You need to complicate the problem and make a calculation. So, we bought an apartment worth 3 million rubles. Accordingly, you can take advantage of a property deduction of 2 million rubles. In the first year, the year the apartment was purchased, the buyer’s salary was 300 thousand rubles. The next year he earned 400 thousand rubles. And a year later his income became 500 thousand rubles.

In the example, the declaration is submitted specifically for this third year, while it is assumed that a refund has already been received for all previous years.

You should add up the income for previous years. This amount will be a deduction for previous years of the declaration. It should be repeated that 500 thousand rubles were earned in the year for which the 3-NDFL declaration is now being submitted. That is, this is the current amount of income, and not for the previous period.

Well, another small problem, now for subtraction. From the 2 million tax credit, all income for three years must be deducted. The result will be 800 thousand rubles. This amount will be the balance carried over to the next year.

Here, income for the current year was taken into account, since it will be used in the current declaration when calculating the refund amount. Therefore, next year the deduction will decrease by the amount received. In the example, the deduction for previous years of the declaration is 700 thousand rubles. The amount carried over to the next year is 800 thousand rubles. You should remember the conditions of this problem.

Next, using a specific example, we will consider what exactly needs to be written down and on what lines, and what numbers should be reflected in the declaration form.

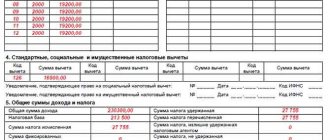

You should consider a living example of exactly which lines should be filled out in the 3-NDFL declaration. The conditions of the problem remain the same. Income for the previous three years was 300, 400 and 500 thousand, respectively.

So, the declaration for the first year is filled out.

An apartment was purchased last year, and this is the first time a deduction has been received for this period. In the column “Amount of actual expenses incurred for the purchase of housing”, write the amount of the tax deduction equal to the cost of the apartment - or 2 million if the cost exceeds this amount.

In the example, an apartment was bought for 3 million. Possible deduction – 2 million rubles.

The size of the tax base is income for the year - 300 thousand rubles.

The balance of the property tax deduction carried over to the next year is 1 million 700 thousand rubles.

What should the declaration look like for next year?

“The amount of expenses actually incurred for the purchase of housing” - the number from last year’s declaration is repeated here.

“The amount of property deduction accepted for accounting for the previous tax period” is a deduction for previous years of the declaration. Since last year the income was 300 thousand rubles, and they received a refund from it, then this number is written here too.

“The balance of the property tax deduction transferred from the previous year” is 1 million 700 thousand rubles.

The size of the tax base is 400 thousand rubles. This is income for the year.

Now all that remains is to calculate the balance of the property tax deduction that carries over to the next year. Income for previous years is subtracted from the tax deduction amount of 2 million rubles. In this case, it was only 300 thousand rubles. Income for the current year is also deducted - 400 thousand rubles. As a result, the balance carried over to the next year is 1 million 300 thousand rubles.

Now the declaration for the third year is being filled out. The amount of actual expenses incurred remains the same - 2 million rubles.

The amount of property deduction accepted for accounting for the previous tax period is a deduction for previous years of the declaration.

Since last year the income was 400 thousand rubles, and the year before 300 thousand rubles, then when these two figures are summed up, the result is 700 thousand rubles.

The balance of the property deduction transferred from the previous year is 1 million 300 thousand rubles.

The size of the tax base in the current year is the income received during the year - 500 thousand rubles.

All that remains is to calculate the balance of the property tax deduction that carries over to the next year. Again you need to subtract. The income for previous years is subtracted from the tax deduction amount of 2 million rubles. This is 700 thousand rubles. And also for the current year - 500 thousand rubles. And the result is a number - 800 thousand rubles.

In all subsequent years, the 3-NDFL declaration is filled out according to the same scheme. And this continues from year to year until the due tax deduction is fully returned.

Was the Recording helpful? No 37 out of 55 readers found this post helpful.

Features of provision

It is important to remember that you can only apply for deductions once in your life. This rule applies to housing that was purchased before the end of 2013. The amount of costs, however, is absolutely not important. Even if there is a fact of compensation of only 10 thousand rubles, you cannot apply a second time. If the property was acquired later, the right to deduction can be used an unlimited number of times, and its total amount should not exceed that established by law.

It must be taken into account that the legislation provides for two types of property deductions. The first is the main one, it reimburses previously paid personal income tax on the entire cost of purchasing a home, and the second is the mortgage. Its main task is to reimburse personal income tax on mortgage interest that has already been paid by the borrower. Therefore, if before 2014 a citizen used his right to receive the main deduction, this does not deprive him of the opportunity to receive a personal income tax refund when purchasing real estate using a mortgage. Thus, when purchasing it, you need to evaluate all the possibilities of paying for it. It is quite possible that buying with a mortgage will end up being cheaper due to the compensation received.

Declaration 3-NDFL for 3 years for treatment, education, deduction for IIS and for children.

Social, standard and investment deductions can only be obtained in relation to the income of the periods in which you incurred expenses. However, given this feature, 3-personal income tax for 3 years can also be submitted. If you spent money on training, put money into IIS in 2021, then you need to fill it out for 2021. You cannot indicate 2021 expenses on your 2021 return. If you had no income for the year in which payment for treatment was made, then you will not be able to return the previously paid personal income tax, because it simply wasn't there.

At the same time, there is an important detail: if the costs of these deductions exceed the personal income tax withheld by the employer, then the remainder of the unused maximum amount is not carried over to subsequent years, but is burned out.

Taking into account the nuances outlined above, every resident of the Russian Federation can submit 3-NDFL in 3 years. We hope this article was useful, and you will independently submit documents for 3 deductions at once, using the information from our website, and get incredible pleasure from the long-awaited reunion of money with your wallet and from the work done on your own.

How to get a property deduction for previous years?

To receive a personal income tax refund, you must complete the following procedures:

- Collect and submit supporting documents to the tax office;

- Wait for the results of checking their correctness by the regulatory authority and confirmation that you can receive a deduction for the apartment;

- Receive transferred funds.

You can collect and prepare all the necessary forms yourself, or you can turn to professionals. In the first case, there is a high probability of an error, which may result in a refusal to deduct. It should be borne in mind that refusal does not mean that it is impossible to submit the package of documents again. However, there are losses of time, and taking into account inflation, they also turn into monetary losses.

By contacting specialists, you can receive when all the documents have been generated, correctly executed and submitted to the regulatory authority. This will significantly save time and increase the likelihood of a positive decision (refusal in this situation is possible only if you try to receive a refund again or exceed the limit amount).

Results

The need to submit a 3-NDFL declaration for a period exceeding one year arises either when correcting errors identified in previously submitted reports, or to obtain deductions, or in case of filing a report late.

Regardless of the number of years the reporting will relate to, it is compiled separately for each year using a form relating specifically to this period. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

In what cases do you need to fill out the 3rd personal income tax declaration?

3 Personal income tax must be filled out by lawyers, individual entrepreneurs, notaries, and in some cases, individuals. The main income of individuals is recorded in the 2nd personal income tax declaration, and the additional income should be displayed in the 3rd personal income tax if the taxpayer:

- sold real estate or other property that was owned for less than the minimum period of ownership;

- received money from securities transactions;

- received income from renting out real estate;

- accepted money or property through a gift agreement from individuals who are not close relatives;

- received dividends;

- earned money in other ways (selling maternity capital, winning a lottery);

- received income from sources located outside the Russian Federation.

Another reason for an individual to fill out a declaration is the need to obtain a tax deduction. This is an amount that can reduce your tax base. Another definition is a refund of part of the tax. Tax deductions are divided into several groups:

- standard;

- social;

- property;

- professional.

The most common cases when an individual may be entitled to a tax deduction are the purchase of real estate or property, expensive treatment, or education.

To return part of the tax, you must provide documents confirming the right to deduct. For example, in the case of treatment, you need to save contracts with medical institutions and receipts for medications. In the case of buying a car - a purchase and sale agreement and a certificate from the traffic police. In the case of mortgage payments - receipts for payment of bank debt. If we consider the situation with training, you need to attach a certificate from the university to the declaration.

Types of tax deductions

Types of tax deductions vary depending on the grounds on which they arise. The main types include:

- Standard. This is an amount that is returned to certain categories of citizens (Chernobyl liquidators, disabled children), as well as payments for minor children.

- Social types of tax benefits. They are received after spending on education, health, charity, voluntary pension insurance and life insurance. In the latter case, a deduction is issued if the insurance is for more than 5 years.

- IIS. Benefits are also provided for individual investment current accounts. These are special accounts that are designed to work with securities.

- Property deduction. If a citizen has purchased real estate, including with a mortgage, then he is provided with tax benefits. This also applies to the purchase of land, construction, and renovation of an apartment in a new building.

For each type of deduction, there is a limit on the maximum amount by which the tax base is reduced.

You can receive a deduction for training in the following cases:

- for your own studies (the form is not important);

- for the education of children under 24 years of age, but only in full-time education; in addition to a university, it can be a fee-paying school, kindergarten, or any other educational institution;

- Full-time education for a brother or sister (also up to 24 years old).

Documents confirming payment for education must be in the name of the recipient of the payments, otherwise it will not be possible to receive the benefit.

Attention! If the property is mortgaged, then there is a deduction for the amount spent on mortgage interest, and the limit on this benefit has been increased.

Who can issue a refund?

Any citizen who independently pays income tax or has an employer and an official salary as a tax agent has the right to a refund of paid taxes.

There are groups of persons who cannot claim the deduction:

- those who have already enjoyed this right before;

- non-tax residents of the Russian Federation;

- if the living space was purchased at the expense of the state or the employer;

- students, pensioners and groups of people without official income receiving various benefits.

Important! If parents bought an apartment for a minor child, then they can take advantage of the deduction for him.

Where to write the balance when filling out the declaration

if the payer built the house himself;

Deduction for previous years in the 3-NDFL declaration: what to write

The Tax Code in Chapter 23, devoted to income tax, provides citizens, under certain conditions, with the opportunity to return previously paid tax or not pay it in the future. This opportunity is called the right to deduction. Deductions are given in Articles 218 - 221 of the Tax Code of the Russian Federation.

What is a deduction? This is an amount that is deducted from the tax base when calculating personal income tax. Reducing your basis reduces your tax, and the difference between the tax before and after the deduction is applied is what you get.

Important!

The Tax Code of the Russian Federation provides maximum amounts of compensation, but if your expenses are less than these amounts, then you can only return within the limits of actual expenses.

Example 1

According to Article 219 of the Tax Code of the Russian Federation, the maximum deduction for expenses on one’s studies is 120,000 rubles, but Gavrilova’s actual expenses are less - only 40,000, which means that her tax base will be reduced by 40,000.

The second limitation is the tax base itself. If it is less than the deduction, then the refund will be calculated based on the base.

Example 2

The first limit is actual expenses and the maximum amount. Gavrilova’s actual expenses are 150,000, and the maximum compensation under Article 219 is 120,000 rubles. Therefore, the maximum compensation value is taken for calculation.

The second limit is the base. Gavrilova’s base is less than the maximum deductible amount, therefore, the base is taken for calculation. Those. The smallest value is always taken. As a result, 100,000 rubles will be deducted from the base, and the base will become zero. This difference is the amount for calculating compensation.

In this case, the method of receiving compensation depends on the will of the payer:

- for past periods - as if retroactively; is possible only if the right to deduction arose in previous years, at least in the past year;

- for future periods - the method of obtaining from a tax agent, or from the employer: after receiving a response from the Federal Tax Service on the 3-NDFL declaration, an application is submitted to the employer so that he does not collect income tax from the salary for the period until the amount of the deduction is exhausted.

In the first case, there is a refund of the tax amounts paid, and in the second - receiving wages without charging 13%. The return can cover the past 3 years - if the right to it also arose 3 years ago or earlier. If the right arose earlier, then you can still only return it for the last 3 years; all previous years “burn out.”

So, what is a deduction for previous years in 3-NDFL - this is a refund of the tax paid for these years, subject to the conditions of Chapter 23 of the Tax Code of the Russian Federation. To return for 3 years at once, you must submit 3 separate declarations with separate income certificates (for each year), checks, etc. Documents that have not changed can be attached only to one report, for example, contracts, licenses, etc.

Important!

For each year, you must fill out the form that was in effect at that time.

and 3-NDFL for tax deductions and declaration of income for different periods can be found at the link .

How to calculate deductions for previous years in the 3-NDFL declaration - based on 2-NDFL certificates. You need to contact the accountant at your place of work and request certificates for each year. These certificates contain the most important information - how much income tax was paid for you by your employer when calculating your salary. The certificate will contain separate amounts by month and a total for the entire year.

Next, you need to calculate the expenses to be reimbursed, for example, for study, for 3 years. Please note what date is indicated on the receipt; if you paid for the entire course in September 2015, then these expenses are not included in the compensation, but if the transaction was made in 2016, starting from January 1, then you can reimburse the expenses. Compare expenses with the limits under the Tax Code of the Russian Federation and the base.

Example 3

Despite the fact that the expenses took place over the past 4 years, Gavrilova cannot reimburse them for the first year. For the remaining courses she will return 78,000 rubles. Total: 78,000 + 78,000 + 78,000 = 234,000 rubles. She will be able to compensate for the fifth year only next year.

If you have questions or need help, please call Free Federal Legal Advice.

The call throughout Russia is free 8 800 350-94-43

In total, Gavrilova will receive income tax refunds for 4 years.

Sample of filling out the declaration

Filling out tax documents is a complex procedure and not everyone knows what to write in the declaration in the column “Deduction for previous years on the declaration.” As an answer to this question, you can give an example of filling.

The conditions remain unchanged - income for the last 3 years is 300,000, 400,000 and 500,000 rubles.

In the first year, the citizen has just purchased housing, so he receives the deduction for the first time. The actual cost of purchasing the property is a tax deduction equal to the price of the property. If the price of the home is above 2 million, then the deduction will be equal to this number.

The tax base is the real profit for the year, namely 300,000. The balance of tax withholding is 1.7 million. This is the data that needs to be included in the declaration.

At the same time, a citizen’s salary subject to income tax is 480 thousand rubles per year.

Example of determining the remainder

Consider the following situation: a certain Andrey Petrovich Novikov became the owner of an apartment, the cost of which is 3,500,000 rubles. For the last ten years, he has paid the same amount for personal income tax - 8,500 rubles. The amount of the deduction in this case is 260,000 rubles, since the price of the apartment is significantly more than two million rubles.

Thus, after registering a reduction in the tax base for the purchase of a property, Andrei Petrovich will first be accrued 8,500 rubles. Then next year, as well as in each subsequent year, he will receive the same amount until he is paid 260,000 rubles.

The deduction that will remain after accruing 8,500 rubles for the first year will be equal to 251,500, for the second year - 243,000 (251,500 - 8,500), for the third - 234,000 and so on.

To begin with, an individual should sum up all the monetary compensation that he has already received to date.

The balance of the property tax deduction transferred from the previous year: how to calculate

The largest income tax deduction for citizens is property: 260,000 for housing and up to 390,000 for mortgage interest. Therefore, the return of these amounts is often extended over several years, especially for those individuals who pay much less personal income tax per year than they could potentially return, i.e., their property deduction is greater than their income for the year.

Is it possible to return personal income tax for years earlier than the year of acquisition?

If the personal income tax paid is not enough to return the entire declared amount, the balance of the tax deduction is carried over to subsequent tax periods.

Example

In 2021, a citizen bought an apartment and registered ownership. In 2021, he claimed a property deduction in the amount of 2 million rubles by filing a declaration for 2021. 80 thousand rubles were withheld from his income in 2021. Personal income tax. Considering that the entire amount of tax to be refunded is 260 thousand rubles. (2 million x 13%), for 2021 80 thousand rubles will be returned, and the remainder of the deduction will be in the amount of 180 thousand rubles. (260,000 – 80,000) will carry over to the next year 2021, and so on until the entire deduction has been used. A return will need to be filed for each year in which the deduction is applied.

When claiming a deduction, you must take into account that the tax will be refunded only for the year in which ownership rights arose and for later years. Taxes cannot be refunded for periods preceding the year in which the right to a property deduction was obtained.

Example

Ownership of the apartment was registered in 2021. However, the deduction is claimed by the owner only in 2021. In this case, you can return the tax for 2021, because... this is the year the right to the deduction arose, and for 2021. But for 2021 and earlier periods, the property deduction no longer applies.

But there is still one exception to this rule. If the owner of the acquired property is a pensioner, the property deduction can be transferred to tax periods preceding the year of formation of the transferred deduction balance, but for no more than three periods (clause 10 of Article 220 of the Tax Code of the Russian Federation). It does not matter whether he continues to work or has already retired.

Example

The pensioner left his job in 2021, and a year earlier (in 2018) purchased an apartment. In 2021, he can claim a property deduction by filing a return for 2021, and transfer the remainder of the deduction to the three previous years when he had taxable income - 2021, 2016 and 2015 (they also need to submit returns). If the balance of the deduction is still not exhausted, it can be transferred to 2019, taking into account those months when the pensioner still received income subject to personal income tax.

In the case where the deduction is not claimed by the pensioner immediately, but several years after registration of property rights, the number of periods to which it can be transferred is reduced. That is, by declaring his right not in 2021, but for example, in 2021, the periods for which our pensioner will be able to receive a property tax deduction are 2021, 2021 and 2021

If real estate was purchased by a non-working pensioner, the possibility of receiving a deduction will depend on the periods in which he had taxable income. So, if the pensioner from our example stopped working in 2014, he would no longer be able to return the tax, since in 2015, 2021 and 2021. he received only a pension and personal income tax was no longer paid on his income.