lori-0006459598-bigwww.jpg

Related publications

Personal income tax reporting includes the reporting of the tax agent-employer - certificate 2-NDFL, calculation in form 6-NDFL, as well as a tax return submitted by individuals themselves - form 3-NDFL. During a desk audit or tax monitoring, inspectors of the Federal Tax Service may notice discrepancies, contradictions or inconsistencies between the submitted reports, identify errors, and request clarification from the tax agent. We will consider below how to respond to such a requirement from the tax inspectorate.

3-NDFL Samples of filling

Personal Income Tax and Tax Deductions Professional personal income tax deductions.

. New form 3-NDFL Applications for personal income tax refund Download List of Documents for personal income tax refund

The Federal Tax Service has approved a new form of personal income tax return (form 3-NDFL), taking into account the latest changes.

The changes made to the declaration form are related to recent amendments to the Tax Code. Adjustments have been made to the following appendices: - appendix 2 “Income from sources outside the Russian Federation...”; — Appendix 5 “Calculation of standard and social tax deductions, as well as investment tax deductions...”; — Appendix 7 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate.”

The barcodes on a number of pages on the tax return will also change. In Appendix 5 line 3.2.1 appeared

“Amount paid for medicinal products for medical use”

.

Let us remind you that now citizens have the right to include in the “medicinal” deduction the costs of purchasing any medications prescribed by a doctor. The updated form 3-NDFL comes into force on 01/01/2021 and is applied starting from the submission of the declaration for 2021. Order of the Federal Tax Service dated 10/07/2021 No. ММВ-7-11/ [email protected] 3-NDFL Order and form for 2021.pdf 3-NDFL for 2021.xls 3-NDFL for 2021.PDF.

. Personal income tax is calculated as a percentage of income without including tax deductions and amounts exempt from taxation into the tax base.

Personal income tax is paid on all types of income received in a calendar year, both in cash and in kind (salaries and bonus payments, income from the sale of property, royalties for intellectual activity, gifts and winnings).

Filing a personal income tax return

The following individuals must submit a declaration:

How to write an explanation to the tax office regarding personal income tax

Having received from the Federal Tax Service a request for clarification, you must respond to it within 5 days (clause 3 of Article 88, clause 2 of Article 105.29 of the Tax Code of the Russian Federation). Currently, there is no provision for liability for failure to comply with such a requirement. But from January 1, 2021, changes to the Tax Code will come into force, in which special attention is paid to explanations: according to Article 129.1 of the Tax Code of the Russian Federation, for failure to provide explanations when requested, tax authorities will have the right to fine the taxpayer 5,000 rubles, and if the requirement is ignored again, the fine will increase up to 20,000 rubles.

The Federal Tax Service may have many reasons to request clarification from tax agents: discrepancies in the amounts of accrued, withheld and transferred tax, a significant decrease in the amount of an employee’s income compared to the previous period, incorrect application of deductions, discrepancies between indicators in Form 6 Personal Income Tax and Certificates 2 Personal Income Tax, etc. .d. Here we will look at how to write an explanation to the tax office regarding personal income tax in some cases. Please note that there is no established form for explanations on personal income tax, so the content of your answer can be arbitrary, the main thing is that it is reasonable and convincing.

A typo or other technical error has crept into the reporting. For this reason, a variety of discrepancies may arise in any reporting. For example, in the 2-NDFL certificate, the amount of accrued and withheld personal income tax does not correspond to the tax transferred to the budget, or the amount of income, tax deductions, etc. is incorrectly indicated. The explanation must indicate that the cause was a technical error and attach the corrected statements. Explanations to the tax office regarding personal income tax. Sample:

To the Head of the Federal Tax Service of Russia No. 77 for Moscow

INN 7701111111/KPP 770000000

Explanations

In response to your request No. 0001-222-33/123 dated April 15, 2016, we report the following:

in the certificate submitted by us in form 2-NDFL for 2015 to Sidorov I.I. a technical error was made, which resulted in a discrepancy between the amounts of calculated and transferred tax. Personal income tax on the income of Sidorov I.I. was transferred to the budget on time and in full.

Corrected certificate 2-NDFL for 2015 for Sidorov I.I. submitted to the Federal Tax Service on April 18, 2016 (attached a copy).

Attachment: copy of certificate 2-NDFL for 2015 for Sidorov I.I.

General Director Petrov V.V.Petrov

A written explanation to the tax office regarding personal income tax may be needed if there is a discrepancy between the 2-NDFL certificate and the 3-NDFL declaration. This situation is possible if a company employee has filed an income statement for himself, which indicates not only the salary at his main place of work, but also the income he received from other sources. The Federal Tax Service may have suspicions about “gray” salary schemes in the company and non-payment of personal income tax. Since the employee is not obliged to report all his sources of income to you, indicate this in the explanation and confirm the accuracy of your reporting. Sample:

To the Head of the Federal Tax Service of Russia No. 77 for Moscow

INN 7701111111/KPP 770000000

Explanations

In response to your request No. 0001-222-33/456 dated April 19, 2016, we report the following:

in the certificate we previously submitted in form 2-NDFL for 2015 to Smirnova P.P. income received for 2015 in the amount of 670,000 rubles is reflected. The specified data on income paid to Smirnov P.P. at Alliance LLC are reliable. Information about other sources of income for Smirnova P.P. Alliance LLC does not have it.

General Director Petrov V.V.Petrov

Sample of filling out 3 personal income tax

» » Good afternoon, dear readers!

The exception is income that is not taxed.

It’s April now, which means the deadline for filing a personal income tax return (that is, 3-NDFL) is about to pass, and I’m noticing panic among my friends.

Relations with the tax authorities in our country are rightly feared and they have little understanding of what is required of an ordinary citizen. It is only known from advertising that this instance greatly interferes with peaceful sleep. No need to panic! Now I will tell you in detail how not to get confused in these documents, how, where and when to submit them, and we will also look at what information is entered into the forms.

I would like to note right away that if you want to return the tax deduction after purchasing real estate or paying off a mortgage, which is why you are preparing 3-NDFL, then you don’t have to rush - in this case it is submitted at any time of the year. And I would even advise waiting until mid-May so that the wave of “mandatory” declarations, which must be submitted by April 30, subsides.

Now let's take a closer look at all the declarations.

The annual campaign for individuals to submit income declarations for 2021 is already underway.

The final reporting date this year is May 2, 2021.

For many, this kind of reporting to the tax service has already become traditional, but this year there are a number of nuances that should definitely be taken into account. We'll talk about them in this article. We will also consider a sample of filling out the declaration.

We recommend reading: Judge's refusal to accept a statement of claim

So, the first innovation is that, unlike in previous years, there is no need to submit a declaration if the tax agent did not withhold the tax. Starting this year, an individual is obliged to pay tax after receiving the appropriate notification and receipts from the tax authorities. These documents are prepared by tax authorities based on information provided by tax agents about the impossibility of withholding personal income tax.

The maximum period for transferring such tax is December 1 of the year following the reporting year.

The next innovation is a change in the procedure for calculating tax on personal income received from the sale of real estate purchased from the beginning of 2021.

Explanatory note to the tax office: when it needs to be submitted

Situations when tax authorities have the right to request clarification during desk audits are given in paragraph 3 of Art. 88 Tax Code of the Russian Federation. These include:

- Identification of errors or contradictions in the declaration, as well as inconsistencies between the declaration indicators and the information available to the tax authorities. In this case, inspectors will require clarification of discrepancies or correction of reporting.

- Submission of an updated declaration or calculation in which the amount of tax payable is less than that originally submitted. Here, tax authorities have the right to demand explanations for the changed indicators.

- Submitting an income tax return with a loss. In this case, controllers will ask you to justify the loss.

Payment of personal income tax at the expense of employers

Federal Law No. 325-FZ of September 29, 2019 allows for the collection of personal income tax debt at the expense of employers. Now payment of tax at the expense of tax agents is not allowed (clause 9 of Article 226 of the Tax Code of the Russian Federation).

From 2021, an exception to the general rule will apply. Payment of personal income tax at the expense of organizations and individual entrepreneurs will be allowed in the event of unlawful non-withholding or incomplete withholding of personal income tax by the tax agent. Personal income tax will be allowed to be collected from employers in cases where unpaid personal income tax is accrued based on the results of a tax audit (Clause 16, Article 2 of Federal Law No. 325-FZ of September 29, 2019).

Is there a fine possible if the requirement is ignored?

Tax liability for failure to comply with the inspection's requirement to provide explanations to the Tax Code of the Russian Federation has not been established. Art. 126 of the Tax Code of the Russian Federation does not apply to this situation, since we are not talking about the requisition of documents (Article 93 of the Tax Code of the Russian Federation), but Art. 129.1 is not applicable, since this is not a counter check (Article 93.1 of the Tax Code of the Russian Federation).

Administrative liability under Art. 19.4 of the Code of Administrative Offenses of the Russian Federation in this case cannot be attracted either. This article applies for failure to appear at the tax authority, and not for refusal to give explanations, which the Federal Tax Service of the Russian Federation itself draws attention to (see clause 2.3 of the letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12837).

Thus, tax authorities have no right to fine people for failure to submit explanations. But still, despite the absence of legal grounds for the fine, it is more appropriate to provide explanations, since this is in the interests of the taxpayer himself. After all, refusal to do so may result in additional tax charges and sanctions, which will then require time and money to appeal.

For information on the procedure for requesting clarification during an on-site audit, read the article “How tax authorities request clarification from a taxpayer .

Types of requirements

Requirements vary. I would like to add: good and bad, but the second comparison somehow does not fit the requirements of the tax authority. We can say that requirements are normal, bad and very bad.

“Normal” include the provision of documents aimed at conducting desk and counter checks. As a rule, the tax office requests a very large number of documents, including those that it does not have the right to demand. And this is where, if you carefully study the requirement, you may not need to answer some points.

“Bad” includes demands sent as part of an assigned on-site tax audit. It’s already clear here: an on-site tax audit is serious and long-lasting. Therefore, such demands must always be answered. Otherwise, inspectors may consider that the documents may be destroyed, hidden, changed or replaced with others and seize the originals.

“Very bad” - requirements related to the payment of taxes, penalties and fines. If the tax inspectorate sent such a demand, then it is clear that the organization did not have the means to pay taxes on time or did not pay them on purpose. In both cases, it is unlikely that everything will be fine with your business. If you are not ready to pay your debts voluntarily, your current account may be blocked and taxes will be written off forcibly.

Now let's look at each type of requirement in more detail.

Explanatory note to the tax office regarding VAT

If, when checking the VAT return, the inspectorate identifies errors, inconsistencies, or contradictions, it will ask for clarification. In this case, you will receive the request in the form approved by order of the Federal Tax Service of Russia dated May 8, 2015 No. ММВ-7-2 / [email protected] (Appendix 1 to this document).

It is necessary to answer it electronically from 01/01/2017 (clause 3 of article 2 of the law dated 05/01/2016 No. 130-FZ), since all taxpayers submitting electronic reports for this tax are obliged to do so by the text of clause 3 of art. 88 Tax Code of the Russian Federation. Explanations submitted in any other way are regarded as not provided.

Those taxpayers who still have the opportunity to submit a VAT return on paper can also submit explanations on paper, drawing them up in any form.

For information on how to fill out an explanation in connection with failure to submit form 6-NDFL, read the article “Filling out an explanation to the tax office for 6-NDFL - sample” .

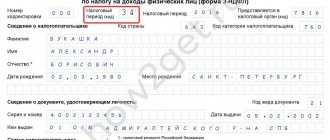

Sample of filling out tax return 3-NDFL

> > > March 11, 2021 A sample of filling out 3-NDFL may be needed if you need to pay tax on income for the past year or return personal income tax.

To do this, a declaration is submitted to the Federal Tax Service. Let's look at the algorithm for completing the 3-NDFL declaration, as well as a sample of filling out the form. Documents and forms will help you: Drawing up a 3-NDFL tax return may be needed in 2 cases:

- If in the reporting year personal income tax was paid in excess (and there is no way to return it through a tax agent) or expenses were incurred for which personal income tax can be reimbursed from the budget (property or social deductions). In this situation, it is important to understand how to fill out 3-NDFL so that there are no problems with tax refunds. It would be useful to get acquainted with a sample of filling out 3-NDFL for the corresponding deductions.

- If in the reporting year income was received on which tax was not withheld (for example, from the sale or rental of property, from entrepreneurship, donations, winnings). In this case, you need to find out how to correctly fill out 3-NDFL for the income on which you need to pay tax. In this case, it is advisable to find a corresponding sample of filling out 3-NDFL.

How to fill out the 3-NDFL declaration on income received?

If the 3-NDFL tax return is prepared on the basis of income, the sheets related to income must be filled out. Example - Appendix 1 of the 3-NDFL declaration for income received in the Russian Federation. If it is possible to use the right to deductions for these incomes, you must also fill out the sheets corresponding to these deductions.

The declaration must be accompanied by documents confirming the correct completion of the 3-NDFL declaration, as well as copies of documents giving the right to deductions. The declaration is drawn up separately for each calendar year and submitted to the Federal Tax Service no later than April 30 of the following year (unless it is a holiday).

If for some reason it is not presented for any of the past 3 years (from 2016 to 2021), you need to fill out

Written explanation to the tax office regarding personal income tax (sample)

→ → Current as of: December 14, 2015 Tax authorities cannot conduct desk audits in relation to the submitted 2-NDFL Certificates, because These certificates are not a tax return or calculation (,).

However, this does not mean that inspectors do not study the received Certificates at all.

Moreover, if they identify any inaccuracies in them, they will ask the tax agent to provide written explanations on personal income tax ().

And it is better not to ignore such requests.

Otherwise, officials of an organization or individual entrepreneur may be fined in the amount of 2,000 rubles. up to 4000 rub. (). In fact, there are many reasons to ask the tax agent for clarification on personal income tax.

For example, the agent may be asked to explain why the amounts for a particular employee's income differ or why deductions were incorrectly applied. Or, for example, inspectors may inquire about the reasons for the reduction in the amount of personal income tax paid this year compared to that listed last year, if such a reduction exceeds 10% (). Written explanations on personal income tax are issued in any form.

The main thing is to give a reasoned answer. The Tax Code does not establish a deadline for providing explanations on personal income tax, but you should not delay your response. You can focus on the period allotted for giving explanations during a desk audit of the declaration - 5 working days from the date of receipt of the relevant request ().

A sample of possible explanations is given below. Inspectorate of the Federal Tax Service of Russia for the city of Dmitrov MO 141800, MO, Dmitrov, st. Pushkinskaya, 73 from Snezhinka LLC INN 5007123456/KPP 500701001 OGRN 1125007509780 141800, Moscow region,

Dmitrov, st. Sovetskaya, 3 Contact person: Ch. accountant Snegurochkina E.P. Contact telephone number Explanations In response to your request for explanations (ref.

No. 13-15/12684 dated April 20, 2015) regarding discrepancies in the amount of withheld and transferred personal income tax, we inform you that in the submitted Certificate in form 2-personal income tax for Morozov E.M. contains a technical error. Withheld from the income of Morozov E.M.

Personal income tax is transferred to the budget on time and in full.

Results

If tax officials have questions regarding the reporting submitted to the Federal Tax Service (inconsistencies in figures, clarification with a tax reduction, declaration with a loss), they will ask the taxpayer for clarification. You should not ignore such a request (it is sent in the form of a demand): comprehensive explanations will help resolve questions and avoid possible checks caused by inconsistencies in reporting. Explanations can be given both on paper and electronically. But if we are talking about issues related to the VAT return, then taxpayers submitting such a declaration electronically must also provide explanations on it electronically.

When to Provide Explanations

When conducting an inspection, the inspector has the right to request written explanations. Situations in which it is mandatory to provide an explanatory note to the tax office upon request (we offer a sample for NPOs) are specified in clause 3 of Art. 88 Tax Code of the Russian Federation:

- Errors in submitted reports. For example, inaccuracies or inconsistencies are identified in the declaration. In this case, tax authorities require you to provide justification for these discrepancies or send a corrective report.

- In the adjusting statements, the amounts payable to the budget are significantly lower than in the initial calculations. In such a situation, the inspector may suspect a deliberate understatement of the tax base and payments and will demand an explanation for the changes.

- The submitted income tax return reflects losses. In any case, you will have to justify unprofitable activities to the Federal Tax Service, so you can prepare an explanatory note on losses in advance.

The inspection request must be responded to within 5 working days from the date of official delivery of the request - such norms are enshrined in clause 3 of Art. 88, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation. In special cases, the Federal Tax Service will have to notify the receipt of a tax request (Letter of the Federal Tax Service of the Russian Federation dated January 27, 2015 No. ED-4-15/1071).

Appendix 7 of the tax return 3-NDFL - sample filling

> > > March 11, 2021 Appendix 7 of the 3-NDFL declaration - a sample filling will be needed for those who purchased or built residential real estate and want to receive a tax deduction for expenses incurred for this.

Our article will tell you how to fill out this declaration sheet correctly. Documents and forms will help you: Appendices No. 6 and No. 7 in 3-NDFL are filled out by individual taxpayers who:

- are tax residents of the Russian Federation;

- carried out a transaction (transactions) with real estate, which gives them the right to a tax deduction in the reporting year in accordance with.

However, at the same time:

- Annex 6 reflects the formation of a deduction associated with the sale of property named in subparagraph. 2 p. 2 art. 220 Tax Code of the Russian Federation.

- Appendix 7 calculates the deduction associated with the purchase of property specified in subparagraph.

3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation;

In this material we will look at the procedure for forming Appendix 7, which is filled out in the following cases:

- if the personal income tax payer purchased land under a residential building or suitable for building such a house on it;

- if the personal income tax payer purchased residential real estate (apartment, house, etc.);

- if the payer built the house himself;

- if for the purposes of the above purchase or construction the payer took out a loan at interest and paid the interest.

For all these reasons, the personal income tax payer can reduce the amount of tax withheld from him and request a refund from the budget of the personal income tax amounts previously transferred for him. To receive a tax deduction (and refund), the payer needs:

- submit to your tax office documents confirming his expenses on the grounds set out in subparagraph. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation;

For a list of documents submitted to obtain a property deduction, see

in the material "".

- write for the period;

- draw up and submit a 3-NDFL declaration indicating your income (for example, by place of work in the reporting year)

How to compose

When drawing up an explanatory note, we are guided by the following rules:

- We compose a response on the organization’s letterhead. If there is no such form, in the header of the document we indicate the full name of the institution, INN, KPP, OGRN and address.

- We indicate the number and date of the requirement for which the explanatory note is being drawn up. It is permissible to write a response to several tax requests at once.

- If there are errors or inconsistencies in the report, double-check the report to eliminate typos or typos.

- In the descriptive part of the explanatory note, we reveal in detail and consistently the circumstances of the situation that needs to be explained.

- When answering a request, rely on the facts and document the circumstances. Attach copies of documents to the answer, if any. For example, attach to the explanatory note a copy of the additional agreement to the contract with the provision for increasing prices.

If the inspector requires an explanatory note regarding inconsistencies in the value added tax return, the response will have to be sent electronically. An exception to the rules is reserved for organizations that report VAT on paper. If the institution reported electronically, but provided a response to the request on paper, then the tax office will consider such explanations not provided. Such norms are prescribed in the Letter of the Federal Tax Service dated January 27, 2017 No. ED-4-15/1443.

How to make sure that your 3-NDFL declaration is checked easily and quickly?

Good evening friends! I haven’t written for a long time, now it’s a “hot” time for preparing reports (regarding foreign brokers) and declaring income and there is no time to write articles, but there is so much I want to tell.

But today I decided to write about such a document - as an explanatory note or an explanation of what it is convenient to call this document. Several years ago I decided to use such a document in my work. Why is it needed and to whom? If you trade through a foreign broker and you have not just a report in a foreign language, but also your own, translated “in rubles” and into Russian, several types of income, dividends, commissions that must be distributed between types of income, etc. I advise and recommend that in addition to the report, give the inspector this explanatory note as part of the package of documents for declaration.

If I can attach a sample of such a note here in the article, then very good (for downloading).

But just in case, I’ll now post here an example-template of such an explanation. I’ll show you how to distribute commissions and how to write explanations.

Believe me, the tax inspector will thank you when he has a “clear picture” before his eyes, all he has to do is check the “mathematics” and that’s it.

And one more thing - when you submit documents through the Taxpayer’s Personal Account, attach your files separately and give them names according to their meaning. This is such advice for you. You don’t need to attach scanned documents without a name, you don’t need the computer to come up with names for them, it’s complicated and confusing.

Let each document have its own precise name.

And now I give you, as an example, a template of an explanatory note for you: In the Federal Tax Service ______________.

____________________IFTS code ____________From ____________________TIN ___________________ Explanations for tax return 3-NDFL for 2021 For 2021, I received income from a source located outside the Russian Federation.

In particular, this is a brokerage company___________________________.Calculation

What happens if you don’t respond to the Federal Tax Service’s requirement?

No matter how much the inspectorate threatens with punishment, tax officials cannot fine or issue an administrative penalty for the absence of an explanatory note:

- Article 126 of the Tax Code of the Russian Federation is not a basis for punishment, since the provision of explanations does not apply to the provision of documents (93 Tax Code of the Russian Federation);

- Article 129.1 of the Tax Code of the Russian Federation is not applicable, since a request for written explanations is not a “counter check” (93.1 of the Tax Code of the Russian Federation);

- Article 19.4 of the Code of Administrative Offenses is not an argument; punishment is applicable only in case of failure to appear at the territorial inspection.

Similar explanations are given in paragraph 2.3 of Letter No. AS-4-2/12837 of the Federal Tax Service of Russia dated July 17, 2013.

Personal income tax accrued incorrectly

The error occurs infrequently, but still occurs. If the tax authorities have discovered an incorrectly calculated tax, the organization will have to not only prepare an explanatory note, but also generate corrective statements (certificate 2-NDFL).

For such a situation, an explanatory note in any form is suitable. If you don’t know how to write an explanatory note correctly, a sample will help you cope with the task.

Errors and discrepancies regarding VAT

Value added tax is the fiscal liability where accountants make the most mistakes. As a result, discrepancies and inaccuracies in reporting are inevitable.

The most common mistakes are when the amount of tax accrued is less than the amount of the tax deduction claimed for reimbursement. In fact, the reason for this discrepancy can only be the inattention of the person responsible for issuing invoices. Or a technical error when uploading data.

In the explanatory note, please include the following information: “We inform you that there are no errors in the purchase book, the data was entered correctly, timely and in full. This discrepancy occurred due to a technical error when generating invoice No.____ dated “___”______ 20___. Tax reporting has been adjusted (indicate the date the adjustments were sent).”

To return tax (receive a deduction) for 2021 (until February 19, 2018)

For a tax refund when buying a home. Sample (example) of filling out a declaration for a tax refund (property deduction) when buying or constructing a home, for example, when buying an apartment, in PDF format.

For a tax refund when buying a home and a mortgage. Sample (example) of filling out a declaration for a tax refund (property deduction) when buying or constructing a home, for example, when buying an apartment, and paying interest on a mortgage (payment of mortgage interest) in PDF format.

For a tax refund on training expenses. Sample (example) of filling out a declaration for a tax refund (receiving a social tax deduction) on training costs in PDF format.

For a tax refund on treatment expenses Sample (example) of filling out a declaration for a tax refund (receiving a social tax deduction) on treatment expenses in PDF format.

For a tax refund when receiving a standard tax deduction Sample (example) of filling out a declaration for a tax refund when receiving a standard tax deduction in PDF format.

When selling property, for example, a car or apartment. Sample (example) of filling out a declaration when selling property, for example, a car or apartment, in PDF format.

Reporting discrepancies

Quite often there are situations when the same economic indicator has different values in the presented forms of fiscal reporting. Such discrepancies are caused by the fact that for each tax, fee, contribution, individual rules for determining the taxable base are established. And if tax authorities require you to provide an explanatory note on this issue, provide explanations in free form. In the text, indicate specific reasons why the discrepancies arose.

Also, the reason for such inconsistency may be different norms and rules of tax accounting in relation to a number of specific situations. Write down the circumstances in an explanatory note.

It is welcome to provide explanations with references to the norms of the current fiscal legislation. Even if the company is wrong (incorrectly interpreted the norms of the Tax Code of the Russian Federation), the Federal Tax Service will provide detailed explanations, which will help avoid larger mistakes and fines in future activities.

Requirements under counter checks

There are only two reasons for making such demands:

- when a desk or field tax audit is carried out in relation to a specific counterparty , they are required to provide documents (information) relating to the activities of the taxpayer being audited;

- outside the framework of tax audits - when they can request documents (information) on any counterparty, regardless of whether any tax control measures are carried out against him or not, but only in relation to a specific transaction completed.

Reducing the tax burden

This issue is of particular interest to tax authorities. Thus, representatives of the Federal Tax Service constantly monitor the volume of revenues to the state budget. If they decrease, the reaction is immediate: demands with the provision of an explanatory note, an invitation to the manager to a personal meeting with a representative of the Federal Tax Service, or an on-site desk audit (a last resort).

In such a situation, you cannot hesitate; you must immediately provide explanations to the Federal Tax Service. In the explanatory note, describe all the circumstances and facts that influenced the reduction in tax payments. Confirm the facts with documents or provide economic justification. Otherwise, the Federal Tax Service initiates an on-site inspection, which may take several months.

What to write in an explanatory note:

- Reduction of salary taxes. The reasons may be staff reduction, enterprise restructuring, or reduction in wages.

- A decrease in profits may occur due to termination of contracts with customers. A copy of the additional agreement on termination of the contract should be attached to the explanatory note.

- Increased costs as a result of decreased profits. The justification may be expansion of activities (increasing production volumes, opening a new branch, division, retail outlet), changing suppliers or increasing prices for inventories and raw materials (attach copies of contracts).

There can be quite a few reasons for reducing the tax burden. We will have to look into each specific case.