- home

- Reference

- Registration of pension

Upon reaching retirement age, citizens have the right not to terminate employment contracts, but to continue their activities. Dismissal is permissible on a general basis - by agreement of the parties, or on the initiative of subordinates. No one has the right to force you to resign. If the decision is positive, it is important to ensure proper execution.

In this article we’ll talk about how to formalize an employee’s retirement.

- 2.1 What the employer pays

Who can claim an old-age pension in 2021

An old-age pension is a regular monthly cash income paid to people who have reached retirement age.

Who will even be able to retire in 2021? Familiarize yourself with the periods for changing the retirement age, the list and sample documents, as well as the nuances of the employer’s interaction with the Pension Fund of the Russian Federation. When retirement age approaches, the employee decides whether to continue working or quit. To apply for a pension, citizens can independently apply to the Pension Fund of Russia (PFR). But many companies, in order not to distract employees from the production process, themselves begin to collect information about the length of service of the future retiree, prepare and check the necessary documents. Then they submit them to the relevant government agencies, observing the deadlines established for this procedure. This is usually done by the HR department and accounting department of the enterprise.

The new pension legislation sets out the conditions and requirements for citizens who are going to apply for pension benefits in 2021 and receive them in old age.

The conditions for old age pension in 2021 are as follows:

- The retirement age for a man should be 60.5 years, and for a woman - 55.5 years.

- Future pensioners must have 10 years of insurance coverage.

- The number of pension points, also known as the IPC indicator, should be equal to 16.2 points.

Let us recall the table of retirement periods prepared by the Pension Fund and posted on the official website of the Pension Fund.

A citizen can contact the Pension Fund at any of the above periods under the conditions that we have indicated. He will be able to submit an application earlier, but payments will begin to be made as soon as the citizen turns 60.5 or 55.5 years old.

What else needs to be considered

Employers have no obligation to arrange pensions for their employees. Although some citizens make similar claims to the human resources department and accounting employees. To receive such a service, a separate agreement is concluded with the Pension Fund.

The SZV-experience form is also required for subordinates who have a civil contract. Moreover, if insurance premiums are charged on such rewards.

You can contact your supervisors for proof of experience. For example, if entries in citizen books are not confirmed by signatures. Often such certificates are required when applying for early retirement.

Important! Upon reaching retirement age, it is prohibited to fire employees for this reason alone. Otherwise, criminal liability and other unpleasant consequences arise.

We arrange a pension for an employee

Employee actions

Registration of a pension: where to start? This is the main question that concerns future retirees. The answer is simple: from collecting the necessary package of documents for transfer to the Pension Fund.

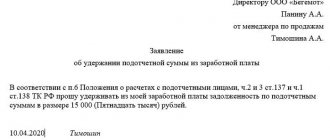

The employee himself must contact the Pension Fund with a corresponding application. The application must be accompanied by documents according to the list approved by Order of the Ministry of Labor of Russia dated November 28, 2014 No. 958n.

Main list of documents:

- statement (at the end of the article);

- passport (for citizens of the Russian Federation) or residence permit (for foreign citizens and stateless persons);

- certificate of compulsory pension insurance (SNILS);

- work book or documents confirming the duration of the insurance period. For example, papers issued by an employer upon dismissal from a job may be accepted as confirmation of insurance coverage, provided that they do not contain the basis for their issuance;

- certificate of average monthly earnings for 60 consecutive months up to 01/01/2002 during employment. Employers must provide information on average monthly earnings for 2000–2001;

- a document confirming the period of military service (copy of pages 1, 3 and 8 of the military ID);

- Bank account details for transferring payments.

Documents must be submitted to the Pension Fund of the Russian Federation at the place of residence (Clause 1, Article 18 of the Federal Law of December 17, 2001 No. 173-FZ “On Labor Pensions in the Russian Federation”). You can also attach documents on the basis of which gratitude and incentives were announced, and others necessary to confirm additional circumstances.

Actions of the personnel officer

1. Preparation of documents.

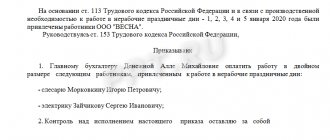

When preparing documents, the HR employee, within 10 days after the employee’s application, submits to the Pension Fund:

- information in the form SZV-STAZH (approved by Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p);

- EDV-1;

- ADV-6-1;

- explanatory note.

All forms must be completed for the period from the beginning of the year until the day of retirement age. The form indicates the type of “pension assignment”.

The insurance period is calculated by the state on the date of their completion. It includes not only the period of work at various enterprises, but also military service, caring for a child under three years of age, the time of receiving unemployment benefits, participation in paid public works, caring for a disabled person of group 1 or a person over 80 years of age. These periods are called non-insurance periods.

2. Checking and issuing a work book.

As a professional in his field, the personnel officer checks the work book for possible corrections and inaccuracies. If incorrect filling is detected, he helps the future pensioner collect relevant evidence confirming the length of service. It is necessary to ensure that all data in the documents corresponds to reality (full name, dates, numbers, etc.) in order to avoid further paperwork.

The personnel officer, upon a written application from the employee, is obliged to give him a work book for presentation to the Pension Fund of Russia, and then make sure that he returns the book back.

3. Checking information.

To verify the data provided to the Pension Fund, the employer requests an extract from the individual personal account.

4. Dismissal of a pensioner is only at his request.

If an employee wants to end his career and retire, he is fired from the day indicated in his application. He is not required to work the two weeks required upon dismissal. If an employee wishes to continue working, he cannot be fired. It is also impossible to renew an open-ended employment contract into a fixed-term one.

How can a pensioner be useful?

And yet it is absolutely wrong to write off pensioners from accounts. Do not forget that in Russia the retirement age comes much earlier than many Western European countries, and at 55 or 60 years old a person, as a rule, is in relatively good shape and of sound mind. If he does not take the dexterity and willingness to go on adventures (a distinctive feature of the younger generation), then his professional and life experience will be a good help for the management team. You can consult with them, clarify their forecasts about the future development of the industry, based on their historical knowledge (not always, of course, but often). In a good situation, a retiree can become a good and, importantly, valuable mentor for the entire production department. Is it really worth persuading him to resign if he doesn’t want to leave?

Don't miss: “From budget to commerce. How can an accountant start his professional path with a clean slate?

In any case, there is such a thing as “expectation” and there is “reality”. What the author of this article described relates more to the first. In reality, let’s admit it honestly, many people don’t like or value pensioners. Moreover, they are not treated in the best way in the corporate environment. Read the vacancy announcements - wherever you look, almost everywhere you need “young and ambitious people with a desire to earn money.” This is much more beneficial for the employer. Experience is secondary. The main desire. This makes me sad, to say the least.

Who is entitled to early retirement?

The law provides for the right to receive a pension early. Under what conditions it is provided, read the following regulations:

- Labor Code of the Russian Federation;

- Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 “On approval of lists of production, work, professions, positions and indicators giving the right to preferential pension provision”;

- Law of the Russian Federation of February 19, 1993 No. 4520-I “On state guarantees and compensation for persons working and living in the Far North and equivalent areas”;

- Federal Law of December 28, 2013 No. 426-FZ “On special assessment of working conditions.”

The conditions for assigning a preferential pension for them from 2021 still remain:

- Reaching the retirement age established separately for lists 1 and 2.

- Availability of full general insurance experience and the required number of pension points (IPC).

- Availability of the required preferential length of service.

The following categories of citizens can apply for early retirement:

- employees who have the necessary preferential length of service for working in difficult and dangerous working conditions;

- those who worked in the Far North or equivalent areas;

- teachers and medical workers with teaching (25 years) or medical (30 years) experience;

- mothers of many children who gave birth and raised five or more children up to the age of eight (they acquire the right to a pension at age 50);

- mothers (or fathers) who raised a disabled child from childhood (they have the right to retire five years earlier than the generally established age: women - at 50 years old, men - at 55 years old).

Law No. 350-FZ, which entered into force on January 1, 2019, which provides for an increase in the retirement age from 2021, changes the current system of early pensions in Russia. In particular, the new law provides for changes in the withdrawal deadlines for such preferential pensions as:

- by length of service - for teachers, health workers, creative professions;

- for residents of the Far North and equivalent territories.

For these categories of citizens, the period of working capacity will increase, starting from 01/01/2019. According to the new law, the requirements for special professional experience for these categories of workers will not change, but the deadline for processing pension payments for them will be delayed by 5 years relative to the year in which the required experience was acquired.

All changes will take place gradually, in several stages, providing for transitional provisions, during which the retirement period will gradually increase until it reaches the values provided by the bill.

It will be possible to issue pension payments to teachers and health workers in accordance with generally established requirements, that is, at 60 years old for women or 65 years old for men.

In addition to doctors and teachers, workers in creative activities (in theatrical and entertainment organizations) have the right to receive early pension payments. For them, the old law established requirements for special experience depending on the type of work - from 15 to 30 years. The new law provides for a similar increase in age for them to 55-60 years, respectively. The change for them will also occur in stages, with an annual increase of 1 year.

For citizens who, due to work in the Far North and equivalent areas, retire early, the law on pensions from 01/01/2019 also provides for a number of changes relating to increasing the period of working capacity.

It should be noted that the increase in the working period will not affect workers in the Far North and equivalent areas if they work in difficult or harmful conditions (for example, workers in ferrous and non-ferrous metallurgy, miners, railway workers, etc.). No changes are planned for them by the adopted law.

Without difficulties - nowhere

In this case, we are discussing with you a situation where a person of retirement age independently expresses a desire to retire. However, many employers have cases when an employee does not want to retire under any circumstances. Why exactly this happens, we indicated above - the elementary reluctance of a person to find himself in a vulnerable social position, but this is not the only thing we are talking about. Based on the experience of communicating with our clients, we learned that pensioners do not want to remain aloof from society. Brought up on the norms of behavior and values of the USSR, they do not want to remain aloof from society or lose their active civic position. “I will work and benefit society as long as I stand on my feet” - that’s roughly how they reason. It is worth noting that this is a very commendable view of your own life and your purpose in it. We have a lot to learn. However, this can cause a number of inconveniences for the employer. Firstly, due to their advanced age, some of these employees are not in good health. Regular payments for sick leave and the absence of an employee from the office or production are losses. Secondly, the quality of work, as well as the approach to performing official tasks, can vary from fanatical pedantry to outright negligence. Thirdly, no one will argue with this; older people often have such a grumpy character that this begins to seriously harm the atmosphere in the team. Forcibly dismissing pensioners is not accepted in our country both from a moral point of view and from the point of view of the requirements of the Labor Code. Gently “asking” to leave of your own free will may also not be the best way out of the situation, because... the person will most likely be offended. The question is, what remains to be done? Basically, nothing. Typically, in such situations, the management of the organization invites (very significant) retirees to become “freelance consultants” or “informal mentors” if we are talking about engineering, for example. De jure a person retires and quits his job, but de facto he continues to adhere to the same active life position that we mentioned above. As a solution to this problem, we can recommend that a pensioner write a book or monograph, in other words, put his professional experience on paper in order to share it with the younger generation (of course, for a decent fee). Not everyone will agree to this, and yet such cases do occur in practice.

Registration of a preferential pension

In the case of a preferential pension, the HR department prepares documents to confirm the benefit. To do this, you must provide the following to the Pension Fund:

- reference (at the end of the article);

- constituent documents;

- certificate of entry into the Unified State Register of Real Estate;

- certificate of registration with the tax authority;

- information letter from statistical authorities with OKVED;

- license or certificate of admission to a certain type of work (SRO);

- staffing schedule;

- job descriptions or production instruction cards, etc.;

- copies of workplace certification documents, certification cards, state examination reports of working conditions;

- copies of local acts describing production technology;

- copies of documents on the availability of equipment;

- other documents confirming preferential length of service.

When deadlines are pressing

An employer has the right not to renew an employment contract that has expired, even if it is a contract with an employee who has reached the age of a pensioner. This is another legitimate reason to spend it on vacation.

NOTE! If the contract was drawn up for an indefinite period, then it cannot be terminated without reason.

The employer may offer the employee to enter into a fixed-term contract in order to legally dismiss the employee when the term expires. But forcing an employee to agree to this option will be illegal, which can easily be proven in court. Fixed-term contracts with pensioners should be drawn up exclusively with their voluntary consent!

ATTENTION! Art. 59 of the Labor Code prohibits breaking existing contracts in order to conclude urgent ones in their place!

Shall we look for a compromise?

If you cannot find a justified Labor Code reason for dismissing an elderly employee who is no longer satisfactory to the employer, you can look for a way out in which “both the sheep are safe and the wolves are fed.”

For example, instead of a complete release from a position, you can offer a pensioner to switch to part-time, part-time or a shortened week.

Thus, the employee retains his job and self-respect, and the manager saves on wages and saves experienced “staff”, for example, for mentoring and other functions.

Procedure for admission and consideration

The full package of documents is provided in person or through a legal representative (notarized power of attorney).

The time for consideration of an application by the Pension Fund should not exceed 10 working days. To assign payments from the date of retirement age, we recommend that the future pensioner contact the Pension Fund a week before his birthday.

If at the time of submitting the application not all necessary documents are attached, he will be given three months to collect the missing ones. In this case, the day of application will be considered the day the application was received.

We issue a work book

The work book is the main document that confirms the employee’s length of service (Article of the Labor Code of the Russian Federation).

If a person is employed, then, of course, he turns to his employer for a work book. Moreover, usually to apply for a pension, employees ask for the original, and not a copy. The fact is that there is an explanation from the Pension Fund of the Russian Federation, according to which employees of the fund have the right to demand from the employee applying for a pension (letter from the Pension Fund of the Russian Federation dated December 29, 2005 No. 25-19/14554):

- or original work book;

- or its notarized copy.

The organization is obliged to issue the employee, upon his application, the original work book for the purpose of assigning a pension. In this case, a maximum of three working days after submitting the work book to the Pension Fund of Russia unit, the employee is obliged to return it (Article of the Labor Code of the Russian Federation).

How to increase your pension

To understand, you need to understand what pension payments consist of.

Let's divide the payments into three parts and see what they consist of and how to increase them.

From January 1, 2019, the amount of the fixed payment to the insurance pension is indexed by 7.05% and amounts to RUB 5,334.19. Such an increase is provided for in Part 8 of Art. 10 of Law No. 350-FZ of October 3, 2018, which came into force on January 1, 2019.

| Pension payments | Explanations | Size | Pension increase |

| Basic part | Paid from the budget. Paid to citizens if they have length of service. | As of 01/01/2019, the amount is 5334.19 rubles. per month. | The persons listed in Article 17 of the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” are entitled to an increase. |

| Insurance part | Determined from the amount of insurance premiums. These payments are made by the employer based on the official salary. | It is set individually depending on the value of the coefficients. Affects: age and experience. |

|

| Cumulative part | It is accumulated in the same way as the insurance part, but is increased by the income received when placing funds on the securities market. Citizens have the right to independently manage the funded portion. | Savings of citizens born in 1967 and subsequent years. |

|

Conclusion

The pensioner decides for himself whether to resign when he reaches retirement age or continue to work and receive a pension. This depends on the size of the calculated pension, as well as the size of pension supplements established by the state.

An employer needs to be understanding of its employee’s decision. Together with the personnel service employees, you need to provide your worker with all the necessary documents.

The employee, for his part, must understand that they are only helping him, and not issuing a pension for him.

Protected by the union

If the pensioner subject to dismissal is a member of a trade union organization operating at the enterprise, the employer must obtain consent from this body to terminate the employment relationship.

If there is no response to the employer’s request within a week, the union’s opinion on dismissal may not be taken into account in the future.

If a negative opinion is expressed, this does not mean that the employee cannot be dismissed: the appropriate procedure regarding the dismissal of union members will simply need to be followed.

Memo for employers

Let us summarize the important nuances regarding the dismissal of pensioners.

- Without the consent of a pensioner, it is impossible to dismiss him on the basis of age (Article 3 of the Labor Code of the Russian Federation).

- The court equates controversial reasons for dismissing a pensioner to age discrimination.

- In cases beyond the will of the parties, staff reductions or changes in the terms of the employment contract, the dismissal of pensioners occurs in the same way as other employees.

- A compromise solution may be to transfer the retired employee to a reduced schedule.

We generate individual information about the employee

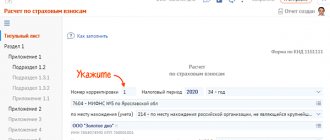

After the documents necessary for a pension to be assigned have been collected, the citizen must contact the employer with an application to provide the Pension Fund with personalized information about deductions from his salary for the current year. The employee indicates in the application the expected date of assignment of the pension in order to limit the period of payment of his insurance contributions in the current period to this date.

Within 10 calendar days after receiving this application, the head of the organization is obliged to provide to the territorial body of the Pension Fund of the Russian Federation:

- information about the citizen’s insurance experience in the SPV-2 form (data on the experience should be generated before the date of assignment and start of benefit payment, which the employee must have indicated in his application), certified by the manager’s signature and seal. The employee must be given a copy of this document (clause 4 of article 11 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”);

- inventory of the data provided according to form ADV-6-1.

Problem: proof of experience

This problem is relevant for citizens whose working activity fell during the Soviet era, namely in the 90s. Thus, during the “hard” years, most workers worked unofficially.

Orders and other personnel documentation were practically not kept. At that time, wages were not paid for months, let alone compliance with personnel discipline. It is precisely these circumstances that cause the problems of Russians when applying for pension payments.

Most companies collapsed. Those who survived were reorganized or merged into larger organizations. Company names changed everywhere. As a result, if an employee has lost documents or there is no entry in the work book for the period of work during Soviet times, then it is incredibly difficult to restore such an entry.

To confirm the fact of labor activity during the Soviet period, a full-fledged investigation will have to be conducted to find out who received the rights and powers of the organization in which the pensioner once worked.

We'll have to be patient. Prepare numerous requests, comply with proformas and deadlines for requests. Wait for official responses from authorities and other entities. However, such efforts will be rewarded. Soviet experience is calculated separately.

Forgery of documents

Providing fictitious and forged documents to the Pension Fund of the Russian Federation is far from new. Often citizens bring fakes out of ignorance that almost all information will be subject to total control.

Please note that such violations are subject to not only administrative liability, but also criminal liability. You should not assume that we are talking only about work records. They can also be punished for falsifying certificates, extracts and orders that have minimum values for the assignment of state pensions.

Thus, for providing a false document, citizens will face punishment in the form of administrative and criminal liability, which are enshrined in Article 19.23 of the Code of Administrative Offenses and Article 327 of the Criminal Code of the Russian Federation. The maximum penalty is imprisonment for up to two years.