Documentation

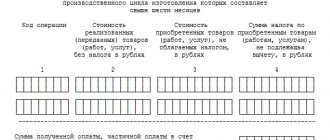

Interest on loans must be reflected in the VAT return. These operations bring

Employer reporting Olga Yakushina Tax expert-journalist Current as of September 10, 2019 Employer, being a tax

Organizations and entrepreneurs that are tax agents must annually provide information on income according to

Lately submitted reports (calculated at the maximum up to RUR 150,000) In July 2021

How to draw up an application for the policyholder In most cases, the application is sent to the accounting department or the human resources department

Why were new control ratios for calculating insurance premiums introduced? All primary and updated

What characteristics of furniture are considered for write-off? When it comes to furniture, we mainly have

Accountant's calendar for March 2021 In 2021, companies report not only

Tax system This system is a set of all taxes that can be divided into the following

FSS pilot projects on direct payments and electronic sick leave are gradually covering all