An accounting certificate refers to primary documentation and is a kind of universal document, since it is used in accounting and reporting for both accounting and taxes. It is generally applicable and widespread, because its use is in demand in a wide variety of situations. As the name of the document suggests, its preparation is the responsibility of specialists in accounting departments.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

When is it issued?

As a rule, only the company’s accountant is responsible for filling out the accounting certificate form . Senior management is not involved in this process.

Basically, this certificate is necessary when the rest of the “primary” data has already been collected, but for accounting, an additional calculation of some indicator is needed. In practice this could be:

- accounting certificate - calculation of interest, including on a loan;

- accounting certificate - calculation of benefits (for pregnancy and childbirth , etc.);

- accounting certificate - daily allowance calculation;

- accounting certificate calculating compensation for delayed wages (Article 236 of the Labor Code of the Russian Federation);

- accounting certificate - income tax calculation;

- accounting certificate calculating 5 percent VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation);

- accounting certificate - calculation of penalties;

- accounting certificate - calculation of cost distribution;

- accounting certificate - calculation for write-off of gasoline;

- accounting certificate-calculation as an appendix to the certificate of incapacity for work , etc.

Rules for document execution

An accounting certificate can be written either on a regular A4 sheet or on the organization’s letterhead; it can be drawn up either by hand or printed on a computer. But in any case, it must be certified with the original signature of the employee who wrote it. It is not necessary to certify a document with a seal, since since 2021, legal entities by law have every right not to use seals and stamps in their work.

The preparation of a certificate must be treated with the same care and attention as any other type of primary document. The more detailed it is, the fewer questions it will raise during verification.

Only reliable information should be included in the certificate, and if any errors are discovered during the writing process, it is better not to correct them, but to write a new corrected version of the document.

After compilation, some types of certificates must be registered in the internal journals of the organization. For example, an accounting certificate must be entered into the sales book if it reflects the amount of VAT on the residual value of fixed assets transferred to the authorized capital of the company.

What is the form of an accounting statement?

sample accounting certificate established by law . This means that for the accounting policy, it is advisable to develop its form independently, taking into account all the features of the enterprise and its document flow. And to approve it by a separate order of the head of the enterprise.

Also see “Order on approval of accounting policies for 2021: sample.”

If you are in doubt about how to correctly draw up a sample accounting certificate , be guided by Article 9 of the Law

- Company name;

- the essence of the operation and the calculation for it;

- Date of preparation;

- FULL NAME. responsible persons.

Also see “Details of accounting documents: basic and mandatory”.

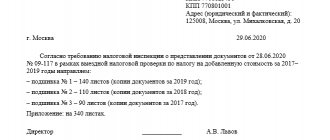

The following is an example of an accounting statement :

On our portal, you can download the accounting certificate, if it suits you, here.

Also see “Accounting statement: how to draw it up correctly.”

The role of the document in accounting

Any business operation in the life of an institution must be reflected in accounting, and this topic is far from new for accountants.

Each fact of activity must be documented. Making entries without supporting primary documentation is unacceptable. For most operations of the financial and economic activities of an enterprise, special unified forms of primary documentation are provided. The use of unified forms is not necessary, and forms can be developed independently or existing ones can be modified. However, many organizations prefer to use unified forms of primary and accounting registers.

But not all events in the economic life of an economic entity can be reflected on special forms. For certain types of transactions there are neither forms nor accounting standards. But this does not mean that such facts can be hidden, that is, not reflected in accounting. It is for such operations that special forms of primary documentation are provided - accounting certificates.

An accounting certificate can reflect absolutely any operation: from the calculation of wages or vacation pay to the formation of the cost of the finished product or the cost of paying taxes to the budget. This primary documentation form is universal and allows you to disclose the mandatory details for registering facts in accounting.

Fixed assets

Section 2 of the notes to the balance sheet and income statement consists of four tables.

2.1. Availability and movement of fixed assets.

2.2. Unfinished capital investments.

2.3. Changes in the value of fixed assets as a result of completion, additional equipment, reconstruction and partial liquidation.

2.4. Other use of fixed assets.

Table 2.1 contains information about the availability and movement of the company’s fixed assets. The data in the columns of the table is reflected separately for fixed assets, and separately for profitable investments in material assets. The information is provided broken down into groups of fixed assets and income-generating investments, respectively. The data is for the reporting and previous years.

The presence of groups of fixed assets and income-generating investments is reflected in the columns “At the beginning of the year” and “At the end of the period.” The amount of accumulated depreciation must also be entered here.

In the column “Changes for the period” you should enter information about the receipt, disposal, revaluation of groups of objects, as well as the amount of depreciation accrued on them.

Please note: in the case of revaluation of objects, the current market value or current (replacement) cost is given in the “Original cost” columns.

EXAMPLE. REFLECTION OF FIXTURES AND INCOME INVESTMENTS Fixed assets

At the beginning of the reporting year, a building and a car used by the administration were listed on the balance sheet of JSC Aktiv. Their initial cost was, respectively, 1,000,000 rubles.

and 180,000 rubles, and accrued depreciation – 240,000 rubles. and 36,000 rubles. In addition, in the reporting year, “Active” built a warehouse with an initial cost of 1,300,000 rubles. The amount of depreciation accrued on existing and acquired objects in the reporting year was: - for a car - 24,000 rubles; - for buildings – 64,000 rub. Income investments

Let's assume that the main activity of JSC Aktiv is car rental. At the beginning of the reporting year, the company had 10 rental cars with a total original cost of 1,000,000 rubles. The amount of depreciation accrued on them was 250,000 rubles. During the reporting year, it increased by another 200,000 rubles. In June of the reporting year, Aktiv bought another car worth 180,000 rubles. (excluding VAT). For the year, depreciation was accrued on it in the amount of 18,000 rubles. The total amount of depreciation accrued for the reporting period was 218,000 rubles. (200,000 + 18,000). Thus, depreciation is accrued in the amount of: - at the beginning of the reporting year - 250,000 rubles; - at the end of the reporting year - 468,000 rubles. (250,000 + 200,000 + 18,000). The accountant will fill out Table 2.1 as shown on page 34 (to simplify the example, data for the previous year is not given).

Table 2.2 reflects the cost of unfinished capital investments.

Unfinished capital investments include:

- Construction in progress;

- unfinished operations for acquisition, modernization and other similar actions with fixed assets. The information is provided broken down into groups of fixed assets. Data is entered for the reporting and previous years.

Capital investments are reflected in columns with a breakdown of “At the beginning of the year,” “Changes during the period,” and “At the end of the period.”

Let us remind you that in the balance sheet form there is no line to reflect information on unfinished capital investments. Therefore, such information is reflected in line 1170 “Other non-current assets”.

On line 1140, costs for unfinished capital investments cannot be indicated, since they do not meet the requirements according to which the asset is taken into account as an item of fixed assets (clause 4 of PBU 6/01).

Table 2.3 should contain data on changes in the value of fixed assets as a result of completion, additional equipment, reconstruction and partial liquidation.

The rows of the table separately indicate the increase and decrease in the value of fixed assets. An increase can occur as a result of completion, additional equipment and reconstruction, and a decrease can occur due to partial liquidation.

Information about an increase or decrease in value is indicated for each fixed asset whose value has changed.

The data in the columns of Table 2.3 are for the reporting and previous periods.

Table 2.4 reflects information about other uses of the company's fixed assets. Here, in particular, information about the cost is indicated:

- fixed assets that are leased or leased and are listed both on the company’s balance sheet and behind it;

- fixed assets transferred for conservation;

- real estate that has been put into operation and is actually used, but is under state registration;

- other fixed assets used (for example, transferred or received as collateral, but used by the company).

The columns of Table 2.4 indicate their cost:

- at the reporting date (column 2);

- December 31 of the previous year (column 3);

- December 31 of the year preceding the previous one, i.e. the year before last (column 4).

Sample filling: correcting an error in accounting

Let's look at how to correctly draw up an accounting certificate on a unified form using current examples. The accountant of the NPO Dobrovol, when reconciling the results for January 2021, revealed that inventories in account No. b/n in the amount of 15,000 rubles were capitalized twice. To correct the error, a corresponding entry was made in accounting and an accounting certificate was issued.

A sample of filling out accounting certificate 0504833 will look like this:

The concept of a penalty, what is the difference from a fine

Before starting a discussion of the entries and nuances of accounting and tax accounting for penalties, it is important to understand their semantic meaning. Penalty (penalty), according to paragraph 1 of Article 175 of the Tax Code of the Russian Federation, is a certain amount of money that the taxpayer organization is obliged to pay, in addition to the amount of the tax itself. A penalty is a sanction for late payment of obligations (payment of tax, fee, advance payment) to the budget of the Russian Federation.

In Russian tax legislation there is a division between the concepts of penalties and fines. If a penalty has the meaning of “punishment” for late payment of obligations, then a fine is also a type of punishment, but more serious, it is a sanction for a tax offense, according to Article 114 of the Tax Code of the Russian Federation. Both of the above “penalties” fall under the category of tax sanctions from the point of view of accounting purposes.

Important point : a penalty is charged for each calendar day of delay in depositing funds into the budget to pay off obligations for taxes and fees, and the days of delay are counted from the day following the day of payment of the tax or fee until the day the obligation is repaid (inclusive).

Certificate of write-off of the “creditor”

Overdue accounts payable, for which the time for filing a claim has passed, the enterprise is obliged to include in non-operating income. This is how clause 18 of Art. 250 Tax Code of the Russian Federation. Usually this is done during an inventory and is accompanied by the preparation of an accounting certificate for writing off accounts payable . It should include:

- full information about the debt (contract number, links to the “primary”, etc.);

- calculation of the limitation period.

EXAMPLE At Guru LLC, on March 30, 2021, an inventory of settlements with counterparties was carried out, as a result of which an accounts payable to Septima LLC was identified in the amount of RUB 143,000. The statute of limitations on it expired on March 13, 2017.

Here is an example of how to write an accounting statement for this situation:

| LLC "Guru" ACCOUNTING REPORT No. 24 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS PAYABLE As a result of the inventory of settlements with counterparties on March 30, 2021, accounts payable to the limited liability company "Septima" were identified (TIN 7722123456, KPP 772201001, address : Moscow , Shosseynaya St., 7, building 9), for which the statute of limitations has expired (Act of Inventory of Settlements with Buyers, Suppliers, Other Debtors and Creditors dated March 30, 2017 No. 2-inv). This debt arose under the contract for the supply of goods dated April 25, 2014 No. 63-p. Clause 3.8 of the said agreement establishes the payment deadline - until March 15, 2014 (inclusive). The amount of debt for goods supplied is 145,000 rubles, including VAT - 26,100 rubles. The statute of limitations expires on March 13, 2017. Thus, accounts payable in the amount of 145,000 rubles are subject to inclusion in non-operating income for income tax for the first quarter of 2021 on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation and write-off in accounting. Chief accountant_____________Shirokova____________/E.A. Shirokova/ |

Remember: the accountant must correctly determine the statute of limitations, as this affects the result of calculating income tax. To avoid mistakes, refer to Articles 196, 200 and 203 of the Civil Code.

Results

Accounting statements are primary documents for business operations that do not have other supporting documents for their implementation.

Most often, such operations involve corrections, additional calculations or clarifications. An important point for drawing up a certificate is to indicate in it the mandatory details inherent in the primary document, as well as to correctly state the essence of the business transaction being justified. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Rules for drawing up an accounting certificate

Let's define the key rules for drawing up a document:

- The document is drawn up by the responsible person upon its announcement or appointment. For example, an accountant or chief accountant.

- The form must be filled out by hand (in blue or black ink) or using a computer. If the institution uses a special program or website for accounting, then the form is filled out using software.

- Corrections to the document are acceptable. They are entered in accordance with established requirements: the incorrect entry is crossed out, the correct information is written next to it, certified by the signature of the responsible person, transcript and seal.

- The accounting certificate is signed by the executor and the chief accountant. In some institutions, the form may be sent to the manager for signature.

Accounting certificates should be filed together with documentation in the appropriate accounting register. For example, correcting errors in payroll: the accounting certificate is filed with time sheets, statements and orders.

Varieties

There are several types of accounting statements designed for different business situations:

- settlement;

- about correcting errors;

- for the public sector;

- samples of books certificates on separate VAT accounting;

- about debt write-off;

- intended for court.

Each of them has its own compositional features that allow one to competently confirm the legitimacy of a particular fact.

Red reversal

The scope of application of accounting certificates is quite diverse. The document can confirm settlement transactions, detail information about a specific event, and contain information about separate accounting, as well as make corrective entries. Among the mentioned operations, there are separate entries with negative numerical values - the so-called red reversal.

This operation is used not only for error correction, to correct incorrect values, but also for special types of events. For example, to write off trade margins or to adjust material and production costs.

The peculiarity of the operation is that the accounting entry itself is prepared in the same way as an erroneous entry. But the amount in this case is reflected with a minus sign. All so-called disadvantages in accounting are usually recorded in red. Hence the name of the operation - “red reversal”. For clarity, let's look at an example.

Based on the results of the audit, an overcharged amount was identified for insurance premiums on the salaries of key personnel for March. 100,000 rubles were credited, but 97,000 rubles were needed. The surplus amounted to 3,000 rubles.

The postings will be as follows:

| Contents of operation | Debit | Credit | Sum | A document base |

| Insurance premiums accrued | 20 | 69 | 100 000 | Payroll for the reporting month |

| Corrections made using the red reversal method | 20 | 69 | — 3000 | Accounting certificate, payslip |

Who is obliged to attach explanations to the financial statements?

An explanatory note is required as part of the annual reporting of all organizations that maintain full accounting records.

An exception is organizations entitled to simplified accounting:

- small businesses;

- non-profit organizations;

- participants of the Skolkovo project.

Such entities have the right to report on a reduced set of accounting forms and are not required to provide explanations, or provide them only in relation to the most important information, without which it is impossible to assess the financial condition of the company.