Tax system

This system is a collection of all taxes, which can be divided into the following categories depending on various factors:

- from the level - federal, regional and local;

- from the payer - for citizens, law firms and mixed;

- by form of payment - direct and indirect;

- by object - income, property and consumption.

Taxes can be classified according to other criteria.

In addition, other basic elements must be defined for the system to function. These include:

- payers;

- control agencies;

- legislative acts.

Payers can be citizens, law firms and individual entrepreneurs.

Agencies exercising control:

- Ministry of Finance;

- Federal Tax Service;

- local branches of the Federal Tax Service.

The employer provides a deduction based on notification

Legislative acts in the field of taxation are presented:

- the Constitution;

- Tax Code;

- By presidential decrees;

- Government regulations;

- Orders of the Ministry of Finance and the Federal Tax Service;

- local regulations.

For the tax system to function properly, all its main elements must function. The declaration is filled out in the prescribed form

- unity;

- integrity;

- legality;

- equality;

- justice;

- other principles.

Adequate functioning of this system allows the state, represented by its representative departments, to carry out the tasks assigned to it in the financial sphere.

Deduction from a tax agent

Until 2021, it was possible to exercise this right only after the end of the period by filling out a declaration (reporting) and submitting it to the tax department. Since 2021, it has become possible to receive a deduction from a tax agent in the reporting year.

Concept and essence

The provision of property and social deductions is carried out on the same principle as the provision of standard deductions from the employer. That is, when paying a salary, a certain part (amount) is not subject to 13% tax. In fact, the salary he receives increases by the amount of income that was intended to be withheld for personal income tax.

Additional Information! For example, if a citizen paid for his child’s education in February 2021, then he can submit the declaration only in 2021. Even if he submits it in January, he will receive a refund in April - May 2021. He will be able to receive the deduction from the tax agent starting from April-May 2021.

It all depends on how quickly he collects the list of necessary documentation confirming the right to the benefit, and also submits an application to the inspectorate to receive a notification, which will confirm this right.

The advantage of this method is that:

- no need to wait until the end of the year;

- no need to wait the four months allotted for a refund (three months for verification and one for transfer).

In this case, instead of filling out 3 personal income taxes, you will need to draw up an application so that the department issues a notification confirming the legality of receiving a deduction in a certain amount.

Instructions for filling out a declaration for personal income tax refund for an apartment

› › › › This article will provide step-by-step instructions for filling out the 3-NDFL declaration in 2021. Taxpayers will be able to find out what sheets the declaration submitted for verification should consist of, how the document is filled out, as well as some important details that must be taken into account in order to receive an income tax refund for an apartment.

- for the 2021 program for registration of 3-NDFL.

- on form 3-NDFL for 2021.

- for a completed tax return.

Individuals who want to reduce their tax base due to spending money on purchasing an apartment can print it out, enter the required information into it, send it for verification and soon receive a deduction. However, the document form must be used in a strictly defined form (put into effect on December 24, 2014 using order number MMV-7-11/671). Attention!

Before you start processing 3-NDFL for personal income tax reimbursement for an apartment, we advise you to read article number 220 of the Tax Code of Russia, which will help the taxpayer make sure that he can actually receive according to the law, or, on the contrary, understand that he does not have this right .An individual will need to indicate data on the title page of form 3-NDFL, on a sheet entitled information on tax amounts subject to refund from the budget (this is section number one), on the page requiring information about the size of the taxable base (this is the second section ), A

Receiving a deduction

What do you need to know about deductions from a tax agent in the reporting year and how to write an application?

To obtain it from the official employer, you must follow the following instructions:

- Collect a package of documents. Its list depends on the type (for the purchase of a home, treatment or education for yourself and your loved ones).

- Complete an application and submit it to the inspectorate. Attach to the completed application the collected package of documentation confirming the accuracy of the data specified in the application.

The application is drawn up on a special form approved by legislative acts. It must reflect the following information:

- to whom the application is sent (name of the department);

- who is sending the application (last name, first name, patronymic, passport details, registration address, TIN and contact phone number);

- year of origin of the right;

- deduction amount (in numbers and words);

- year of use;

- the name of the employer (his tax identification number, checkpoint and address) where the deduction will be used;

- date and signature of the applicant;

- list of applications.

The application is filled out using a special template

- Wait until the verification of the application is completed (the verification period is a month). As a rule, when the notification is ready, employees call the contact number and inform them that it is ready. It may be ready earlier, so it is better to receive calls from representatives of such departments. In addition, additional information or documentation may be requested, the absence of which will be grounds for refusal.

- Get notified. You must carefully check the correctness and accuracy of the information provided in the notification.

- Take it to work and write a statement addressed to your boss. In the application, write that based on the notification (indicate the number and date), the employee claims to receive a deduction from his salary.

Thus, the procedure for obtaining a deduction from an employer is quite simple and does not take much time. In addition, you can submit an application to the inspectorate in several ways:

- personally;

- through a representative;

- via postal service;

- using your personal account on the official website tax.ru.

The latter method allows you to save not only time, but also financial costs for drawing up the document and travel.

Reflection in 3 personal income tax

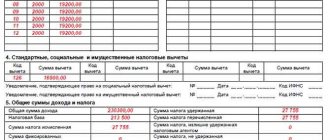

In addition to the fact that you can choose any of the methods described above for obtaining this preference, you can combine them. Let's figure out what code 311 in the personal income tax certificate 3 means. Since 3rd personal income tax is filled out based on the data specified in 2nd personal income tax, all information is transferred. Codes 311 and 312 in the personal income tax declaration 3 indicate the fact of using the deduction from the agent. In this case we are talking about a property deduction.

Code 311 in the personal income tax report 3 is indicated in the amount spent by the employer on the purchase or construction of a home. That is, if an employee bought a house and received a notice to submit for work, he fills out this line. At the same time, in the line he writes the amount that is indicated in 2 personal income taxes in the deductions section.

When filling out reports, deduction data is transferred to a separate line

Deduction code 311 is indicated in personal income tax declaration 3 on sheet D1 (line 180).

What does code 312 mean in personal income tax certificate 3? It means that the property deduction was also used in the amount of interest aimed at repaying the mortgage.

Thus, in addition to the traditional method of receiving a deduction (submitting a declaration), another method has appeared since 2021 - receiving it from the employer. The applicant has the right to choose the method convenient for him, and can also combine them.

Current legislation provides the opportunity to return personal income tax paid through a deduction from a tax agent, whose role is played by the employer. Let's find out how to exercise this right.

Deductions for personal income tax are provided in various situations - when purchasing housing and obtaining a mortgage (property), training, treatment (social), services provided under GPC agreements, for example, when receiving fees for the creation of literary, sculptural or other works (professional). Even the presence of children makes it possible to reduce the tax base for personal income tax by issuing a standard deduction upon application to the employer.

helpmsk24.ru

- We calculate the tax base.

Personal income tax In Sheet D1, you must also select the taxpayer attribute (030).

+ 800,000 rub.) x 20% = 340,000 rub.

01 The owner of a housing property for which a property deduction is claimed for personal income tax 02 The spouse of the property owner 03 The parent of a minor child - the owner of the property 13 The payer claiming a property deduction for expenses associated with the purchase of housing in the common shared ownership of himself and his minor child (children) 23 A payer claiming a property deduction for personal income tax for expenses associated with the purchase of housing in the common shared ownership of a spouse and his minor child (children) Budget classification code 3-NDFL In field “020” of Section 1 “Information on the amounts of tax to be paid (additional payment)” to the budget/return from the budget”, mark the budget classification code (BCC) of tax revenues, which is used to group items of the state budget.

Let's move on to the section "Property tax deductions". This article will provide step-by-step instructions for filling out the 3-NDFL declaration in 2021. Taxpayers will be able to find out what sheets the declaration submitted for verification should consist of, how the document is filled out, as well as some important details that must be taken into account in order to receive an income tax refund for an apartment.

- Link to completed tax return.

- Link to the 2021 program for registration of 3-NDFL.

- Link to form 3-NDFL for 2021.

Social deductions provided by a tax agent: codes

The Federal Tax Service has approved tax deduction codes in a special table that groups them by category. These three-digit digital combinations indicate a deduction, that is, an amount by which both the size of the tax base and the amount of tax charged on it can be reasonably reduced. The deduction code already provided by the employer in the reporting year is entered when filling out paragraph 4 of section of the tax agent’s reporting form - certificate 2-NDFL.

Those. A similar code confirms the amount of costs incurred for various needs. For example, code 320 means expenses for your own education or full-time education of a brother/sister under the age of 24, and code 321 means expenses for full-time education for children.

The codes for deductions for medical services are also strictly delineated - 324 is assigned to the costs of medical services and the purchase of medicines, and 326 is assigned to the costs of expensive treatment in health care facilities.

Code 325 encrypts expenses for personal insurance. A deduction from a tax agent under code 327 means expenses incurred on pension contributions transferred to the relevant non-state funds. The number 328 codes the amount of additional contributions paid to the funded part of the pension.

When can you get a deduction?

Tax deductions can be obtained:

- after the end of the year in which the right to deduction arose;

- without waiting for the end of the year.

Using the first option, the applicant will have to:

- request from the employer a certificate of income for the year - f. 2-NDFL;

- collect documents confirming expenses incurred;

- draw up a 3-NDFL declaration;

- submit the completed package of documents to the Federal Tax Service.

After checking the documents with the Federal Tax Service, the deduction amount in full (or an amount equal to the tax paid for the year) will be transferred to the applicant’s account.

When choosing this option, it is necessary to correctly reflect all the information from the 2-NDFL certificate regarding deductions already received from the employer in the declaration. They are accumulated in section 4 of the help. For example, the amount of the standard deduction for a child, professional, property deductions, etc. may be indicated there. This information should be reflected as a deduction from the tax agent in 3-NDFL, since its use affects the size of the tax base. It is necessary to take into account the received standard or other deduction by filling out the corresponding declaration sheet and recording its amount in the calculation of the deduction for which 3-NDFL is issued. You can read how to fill out the 3-NDFL declaration in our article published earlier, and in the current publication we will dwell in more detail on the second method of obtaining a deduction.

You can apply for a deduction in the current year immediately after expenses incurred. For example, to receive a deduction for treatment in this case, there is no need to draw up a 3-NDFL declaration, you will not need a 2-NDFL certificate, you will only have to confirm the expense with the relevant documents and submit them to the Federal Tax Service along with an application in the KND form 1112518 confirming the taxpayer’s right to provide social benefits deduction. You can submit a document to the Federal Tax Service in person, by post or electronically (from the taxpayer’s personal account on the Federal Tax Service website).

Within a month from the date of submission of documents, the Federal Tax Service will issue a notice of the right to deduction indicating the employer who will exercise this right of the employee. An individual should write a free-form application to the tax agent for a property deduction and submit both documents to the accounting department of his employer.

On this basis, the employer, as a tax agent, will stop withholding personal income tax from the employee’s salary from the month in which the application was submitted until the calculated deduction amount ends. The right to deduction applies only to current year income. If the amount of tax paid turns out to be less than the amount of deductions, then next year you can again report to the Federal Tax Service by repeating the described algorithm.

Thus, the employee exercises the right to a tax deduction in the reporting year, reducing the taxable base of his income and completing a minimum of documents.

Free legal consultation: ON TAX ISSUES

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness. I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence. What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice.

Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem. Working for results We are interested in the success of your business! Your victories are our victories. We are exclusively results-oriented.

Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case. Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use.

Submitting documents We take care of everything. Compilation. Collection of the necessary package of documents.

Deduction code 311 in certificate 2-NDFL

Errors in deduction codes in 2-NDFL may result in a fine. Deduction code 311 in personal income tax certificate 2 indicates a property deduction. The article contains a decoding of deduction code 311 and personal income tax reporting for free download.

Read in the article:

- For whom is it important to know the deduction coding?

- What are the dangers of mistakes?

- Code 311 - property

- Who doesn't care about encoding?

MOVING FROM “1C” TO “BUKHSOFT” Transferring data from your “1C” is now easy! BukhSoft transfers all data without loss and checks it!

Attention! The following documents will help you fill out information about your income correctly and report it to the tax authorities. Download for free:

Form of the new 2-NDFL 2019 Download for free Sample of filling out form 2-NDFL Complies with all legal requirements Form of certificate of income and tax amounts for an individual Download for free Handbook of personal income tax rates in 2021 All rates in one file. Download for free a Guide to filling out 2-NDFL in 2021. It will help you avoid mistakes. Find out all the details

The BukhSoft program will prepare 2-NDFL certificates for submission to the tax office, taking into account all changes in legislation on an up-to-date form. The form will be tested by all Federal Tax Service verification programs. Try it for free:

Fill out 2-NDFL online

A personal income tax deduction is the amount by which an individual who is a tax resident of the Russian Federation can reduce his income, taxed at a rate of 13%. The deductions established by the Tax Code include standard, professional, property, social, and investment.

Who will not receive the right to deduction using code 311

The IRS will not approve a property deduction under code 311 if you:

- are not considered a tax resident of Russia;

- you buy living space or land for development outside the territory of the Russian Federation;

- you cannot confirm the purchase and sale of the property;

- have already used their right to 2 million rubles and received a deduction earlier;

- purchased property from a relative;

- received housing as an inheritance or gift;

- did not receive income or wages from which 13% income tax would be withheld;

- did not carry out settlement of the transaction and are not the owner of the object or the legal spouse of the buyer.

For whom it is important to know personal income tax deduction code 311

Remuneration to individuals means the following monetary and non-monetary amounts received by them from firms, entrepreneurs or “self-employed” private practitioners.

- Payments and transfer of property under employment contracts as remuneration.

- Payments under GP contracts are a reward to performers for performing services or work.

- License payments under license agreements with intellectual property rights holders.

- Redemption payments to holders of intellectual property rights under agreements for the alienation of exclusive rights.

- Payments to authors of works under contracts with them.

In the listed situations, legal entities, individual entrepreneurs and “self-employed” private practitioners must fulfill the obligations of tax agents, namely:

- calculate the tax, withhold it from remunerations or other cash payments to individuals and pay the tax to the budget;

- report on payments, as well as the amounts of withheld and transferred tax.

As part of their duties, tax agents submit to the inspection:

- calculation according to Form 6 personal income tax:

Calculation according to form 6-NDFL can be generated in the BukhSoft program in 3 clicks. It is always drawn up on an up-to-date form, taking into account all changes in the law. The program will fill out the calculation automatically. Before sending to the tax office, the form will be tested by all Federal Tax Service verification programs. Try it for free:

6-NDFL online

- certificates in form 2 personal income tax:

Deduction code 311 and other deduction and income encodings are used when filling out tax reports listed in Table 1.

Table 1. Codes in tax reporting

| No. | Who uses the code | Code use cases | Reporting type |

| 1. | Tax agents (private practitioners) | When issuing certificates in Form 2 of personal income tax - when providing deductions to individuals who have received taxable remuneration from them | |

| 2. | Individual | When filling out a declaration in Form 3 of personal income tax - when they declare income from which personal income tax is not withheld, or receive a deduction through the tax office | |

| 3. | Tax agents (private practitioners) | When making payments according to Form 6 of personal income tax - when reporting the amounts of remuneration to individuals and the amount of withheld tax |

Tax deduction code 311 - property

Using deduction code 311 or 312, a property deduction is claimed when performing the transactions listed in Table 2.

Table 2. Tax deduction code 311 – property

| Deduction code | Amount that reduces the tax base | Maximum benefit limit |

| 311 | Paid expenses for:

| 2 million rub. |

| 312 | Paid interest on loans received for:

| 3 million rub. |

Individuals who:

- They are considered residents of Russia - that is, in the last 12 months before the date of application, minus 183 or more were in the country.

- In the year in which the operation was completed, we received income taxed at 13%.

- Concluded a purchase or loan transaction with a non-related party.

- We paid the transaction costs with our own funds.

Example

From the point of view of personal income tax, the driver of Symbol LLC is considered a Russian resident, his salary is 50,000 rubles. per month. In 2021, he purchased a studio in Sochi at his own expense for RUR 1,200,000. and made repairs to it, paying:

- materials worth 200,000 rubles,

- the work of a repair team costing 300,000 rubles.

To buy a home, the driver took out a loan from the bank, the interest on which was paid in the same year in the amount of 100,000 rubles. It turns out that the driver can receive a property deduction in the following amounts:

- 1,700,000 rub. (RUR 1,200,000 + RUR 200,000 + RUR 300,000) – for the cost of purchasing a studio;

- 100,000 rubles – for interest expenses.

The driver can reduce the tax base by contacting either his employer or the tax office. In any case, the amount that reduces the tax base is 1,800,000 rubles. (RUR 1,700,000 + RUR 100,000). That is, the driver can return the tax in the amount of 234,000 rubles. (RUB 1,800,000 x 13%).

Declaration 2021 code 311

Free consultation by phone Contents - Business law - Deduction from a tax agent in the reporting year, code 311 2021 A deduction from a tax agent is the amount of deduction from the employer if it was received not from the tax office, but from the employer with the permission of the tax office. Expenses for repaying interest on loans.

Interest on loans for all years is the amount of interest paid since the conclusion of the loan agreement for all years.

The deduction for previous years according to the declaration is 0 and all other fields are 0. If this is not the first time we fill it out.

We do not change the value of the contract (the “cost of the object/share” window). We take the deduction for previous years according to the declaration from line 2.8 of all previous declarations. (If there is a declaration only for last year, then this data can be calculated from it.

It is necessary to subtract line 2.10 of the declaration for the previous year from the amount of the contract (no more than 2 million). A deduction from a tax agent is the amount of a deduction from an employer if it was received not from the tax office, but from the employer with permission from the tax office. Income from production activities for 2009 amounted to 800,000 rubles.

Documented expenses associated with the extraction of this income amounted to 300,000 rubles.

When filing a personal income tax return for 2009, IP Vasyukov V.V. wrote an application to provide him with a professional tax deduction in the amount of 20% of the amount of income received.

Thus, the amount of professional deduction provided to the entrepreneur will be (900,000 rubles.

What is a 2-NDFL certificate?

Current legislation imposes quite serious obligations regarding the payment of personal income tax. persons (personal income tax). Such deductions to the budget are required to be made from almost any income. The employer must submit a certificate in Form 2-NDFL to the tax office. This certificate is necessary to control deductions. She must:

- drawn up at the end of the financial period;

- contain comprehensive information about income;

- provided on a special form;

- compiled individually for the employee.

2-NDFL contains information about income in the amount, as well as the corresponding codes. In addition, tax deductions are also included there.

Tax deduction

These are funds that the state returns from taxes paid. To some extent they compensate for certain types of expenses and reduce the tax burden. The following types exist:

- on purchased property and standard;

- to open an investment and social account;

- associated with generating income (professional).

To receive the standard deduction, you will have to make almost no effort. It is enough to inform the company’s accountant about this desire. Such payments imply a refund of tax accrued on income that was spent on the maintenance of minor children (their upbringing). In addition, the standard deduction is due to those who spent on education and treatment. People who directly invest in activities (authors, entrepreneurs, notaries) have the right to receive a professional deduction. Property involves the return of part of the funds spent on the purchase of real estate.

What do deduction codes 126-133 mean?

This value is found mainly in certificates on form 2-NDFL. Previously, instead of this and other numbers, the values 114, 115, 116 and so on up to 125 were used. However, they were canceled by the above-mentioned Order of the Federal Tax Service.

Only those persons who have a child in their care can receive a tax deduction on this basis. Moreover, the law separates biological parents and guardians:

- The values 126, 127, 128 and 129 are created for parents in their standard sense and adoptive parents;

- Codes 130 to 133 inclusive are designed for guardians, trustees and foster parents.

Help: legally, adoptive parents and guardians/adoptive parents are, although close, still different legal forms of guardianship. Adoptive parents assume parental rights for life, i.e. the child literally becomes a member of the family. Adoptive parents or guardians are those persons who have entered into a contract with the guardianship authorities; they have parental rights only until the child reaches adulthood.

The deduction is made only from the salary of an individual, and only upon reaching 280 thousand rubles of income per year. The deduction amount varies between 1,400 and 12,000 rubles depending on the number of children, their status (disabled or healthy), legal form of guardianship, etc.

The question of where to put the code can be answered like this: in the line with the value 2000, because deduction is made from salary. You can receive payments annually until the child reaches adulthood.

In what case is field 311 filled out in the 3-NDFL certificate?

An individual has the right to contact the Federal Tax Service and receive confirmation from it to apply a property deduction immediately when withholding tax on a monthly basis. Such confirmation is issued by the regulatory authority for one year.

Therefore, at the beginning of each year, if the amount of the property deduction is not fully used, personal income tax taxpayers have to submit a declaration to the Federal Tax Service in Form 3-NDFL in order to receive a new confirmation.

A similar situation arises when the taxpayer previously made a personal income tax refund in connection with the use of a property deduction, and re-submits the application in the new year.

The use of a property deduction in previous years, when requesting it in the new year, must be reflected in the 3rd personal income tax.

The legislation provides for the following code, which must be used when reflecting property deductions when issuing personal income tax certificate 2: 311 - when reflecting the amounts used for the acquisition or construction of real estate as a property deduction.

This code is used by the tax agent when filling out personal income tax certificate 2, when, on the basis of a document from the Federal Tax Service, the employee was provided with the amount of this deduction on a monthly basis.

In this case, next to this deduction it is necessary to reflect the number of the confirmation document, which gives the employee the right to take advantage of this opportunity.

Attention! According to the data reflected in personal income tax certificate 2, the taxpayer fills out personal income tax declaration 3. The amounts of previously provided property deductions must be entered in the appropriate columns of sheet D1. This is paragraph 2.5, line 180 for deduction 311.

Tax refund through accounting

An officially employed taxpayer has the right to return personal income tax monthly through a tax agent.

To do this, you need to write an application to the Federal Tax Service confirming the property deduction. This document is issued for a period of one year. It’s not cheap to build or buy your own home now. Therefore, it is difficult to select the entire amount to be returned for the reporting year. After the expiration of the one-year period, a new confirmation must be obtained. This means that individuals must annually submit a 3-NDFL declaration, where they enter the code - 311 and record the amounts from which an income tax refund has already been received.

Attention! It doesn’t matter how the individual reimburses his expenses - through the Federal Tax Service or the employer, you need to write an application for deduction and declare income in both cases.

Applied tax refunds are reflected in the organization’s reporting documentation - certificate 2-NDFL. Here they are coded 311. The code is intended to reflect the amounts spent on the construction or purchase of their own housing. In accordance with them, personal income tax is redistributed.

The code is entered in reference documents when receiving a monthly property deduction based on confirmation received from the Federal Tax Service. This means that cash in the amount of 13% of earnings will be returned to the taxpayer every month throughout the year. To receive confirmation for the next year, submit a tax return completed in accordance with the issued 2-NDFL certificate.

As mentioned above, code 311 is used by enterprise accounting departments to encrypt tax deductions received by an employee in the reporting year. It is placed in the fourth section of the document. And next to it is indicated the remaining amount from which a tax refund can be made.

Below is the information about the paper issued by the tax office confirming the right to deduct property. The serial number, date of receipt of the document and individual Federal Tax Service code are indicated here.

Important! The tax refund will be provided only from the date indicated in the confirmation certificate.

It is worth noting that to receive funds using code 311, your annual earnings should not exceed 280 thousand rubles. Above this amount, no income tax refund is possible.

What to write on line 311

Code 311 is used by the tax agent when filling out personal income tax certificate 2 for an employee if the employee was provided with a property deduction during the reporting year. In section 4 of the personal income tax certificate 2, the deduction code is entered, and next to it is the total amount of the benefit provided for it.

Below you must enter the details of the confirmation document issued by the Federal Tax Service to the employee and presented by him to his employer. The details include the document number, the date of its issue, as well as the code of the Federal Tax Service that issued it.

It must be remembered that if the deduction is provided on the basis of confirmation by the employer from the date on the document. If the document is dated February, then using a property deduction on this form in January is not allowed.

Let's look at an example.

Ivanov I.I. in March 2021 provided his employer with confirmation No. 49 dated March 15, 2021 for the right to use property in connection with the purchase of housing for a total amount of 1,500.00 million rubles.

His salary for January February amounted to 45.00 thousand rubles, March - December 210.00 thousand rubles.

Let's calculate the property deduction of Ivanov I.I. for 2021.

The total amount of income for 2021 in the company will be 255.00 thousand rubles.

Since the confirmation was issued to the Federal Tax Service employee in March, he has the right to start applying the deduction only from March. 210.00 thousand rubles does not exceed 1,500.00 thousand rubles declared in the Federal Tax Service Confirmation, therefore this entire amount (210.00 thousand rubles) is a property deduction.

In certificate 2 of personal income tax, the employer in section 4 will reflect the following:

- code 311 210000, and indicate, for example, “Confirmation No. 49 dated March 15, 2021 from the Federal Tax Service Inspectorate 4401.”

Based on the 2-NDFL certificate, when filling out the 3-NDFL declaration, sheet D1, the employee reflects:

- Line 120 (clause 1.12) - the total amount of the deduction, in our example it is 1,500,000 rubles;

- Line 180 (clause 2.5) - the amount of the deduction provided according to the certificate, in our example it is 210,000 rubles.

- Line 230 (clause 2.10) - the amount of deduction carried over to the next year, in the example it is 1,500,000-210,000 = 1,290,000 rubles.

Obtaining a property deduction from the Federal Tax Service in 2019

When returning income tax once a year through the Federal Tax Service, the declaration is filled out on the basis of the issued 2-NDFL certificates. To enter code 311, line 180 of clause 2.5 is intended. The mentioned columns are located on sheet D1.

Declaration of income in Form 3-NDFL provides not only for the provision of property returns, but also a general report on taxes paid in favor of the state. The following persons must submit this report:

- Individuals operating as individual entrepreneurs and independently calculating and paying income tax. These also include private notary and law firms.

- People who have Russian citizenship, but receive financial compensation from foreign companies.

- Individuals who have additional income from the sale of unused property or its transfer to other persons on a lease basis. This category includes receiving expensive gifts or lottery winnings.

Important! The right to a personal income tax refund arises only from the year in which residential property was acquired through purchase, self-construction or participation in shared construction. Only pensioners are allowed to carry forward deductions to previous years.

When receiving a property deduction under code 311, a 3-NDFL declaration is submitted for the entire calendar year. This means that the tax will be returned as a total amount from the moment the right to property arises. The calculation is submitted after the end of the tax year. The deadlines established for filing a declaration under standard conditions may not be observed when receiving only a property deduction. This document can be submitted after April 30.

A personal income tax refund received by filing a tax return does not have a statute of limitations. That is, you can receive a deduction both after 12 months and after several years. This right is limited to the three preceding years. This means that if you bought an apartment in 2010, and submitted documents for deduction only in 2019, you can return income taxes only for 2021, 2017 and 2021.

In what case is line 312 filled in?

The legislation establishes that the property deduction may include interest paid by the taxpayer to the bank under a mortgage or other loan agreement.

To use these amounts as a deduction, the employee needs to request a certificate from the bank about the amounts of interest repaid during the year, fill out a personal income tax declaration 3, and if there is not enough income to return personal income tax amounts for the past year, transfer the amount of interest repaid to the next year.

In this case, the employee can use this benefit immediately based on tax confirmation, or at the end of the next year, claim a refund in connection with the use of a property deduction.

If the employee chooses the first option, then his employer, when filling out personal income tax certificate 2 at the end of the year, will have to use a special code 312 - when reflecting the amounts used to repay interest on mortgages and other loan agreements when purchasing real estate.

This confirmation, as in the previous case, is issued only for one year. In order for the remaining amounts to be used as a benefit in subsequent years, the employee must again submit 3-NDFL to the Federal Tax Service. To the previously declared deduction amount, an individual can add interest paid by him in subsequent years.

Attention! The deduction amounts reflected under code 312 must be reflected in the 3 personal income tax declaration. They must be entered in paragraph 2.9, line 220, which is located on sheet D1 of this report.

What to write on line 312

If an employee, in accordance with the notification provided, is provided with a deduction from the Federal Tax Service for interest paid in connection with mortgage lending, then the responsible person, when drawing up a 2-NDFL certificate, must use property deduction 312. Thus, when entering information in section 4 of the certificate form, it is necessary to enter this code, and opposite it indicate the total amount of benefits provided for it for the year.

In addition, the law requires that the same section below indicate the details of the notification issued by the Federal Tax Service about the right to this benefit - the serial number, date of issue and code of the Federal Tax Service that issued it.

It must be remembered that deductions can be provided only from the month indicated in the notification. Setting up benefits “retroactively” is not allowed. If a discount on both the purchase of housing and interest is provided at the same time, the second will not take effect until the first is fully spent.

Let's consider filling out the documents. According to the notice, the total amount of the deduction is 286,500 rubles, which was not provided in previous years. For the reporting year, the amount of the deduction used was 198,756 rubles. This figure is entered together with code 312 in the table in section 4 of the 2-NDFL certificate.

Below the table you must provide information about the notification. For example, this will be document No. 313 dated June 10, 2018, issued by the Federal Tax Service No. 2316.

When filling out the 3-NDFL declaration on sheet D1, you must:

- Line 130 (clause 1.13) indicates the total amount of interest paid - in our case it is 286,500 rubles.

- Line 190 (clause 2.6) - the amount of the provided deduction under code 312 is transferred here from the 2-NDFL certificate. In the example, this is 198,756 rubles.

- Line 240 (clause 2.11) - the remainder of the deduction is entered here if it is not fully spent in a given year. In our example, you need to enter here: 286500-198756=87744 rubles.

What to do if the report has not been verified?

The report may not pass verification due to errors. In this case, the FSS sends a negative protocol to the company. If the organization received this protocol, the report is considered not submitted. The accountant needs to remove all the shortcomings and then send the document again. The date the paper was sent is the date it was accepted by the fund. The Fund accepts a document only after it has passed all stages of verification.

If the document is accepted by the FSS only after the 25th, the company will be held accountable. In particular, a fine of 5% of accrued contributions for the reporting period is imposed. The minimum fine is 1,000 rubles. The corresponding instruction is contained in paragraph 1 of Article 26.30 of Federal Law No. 125.

Question: Does the organization participating in the pilot project need to reflect the payment of maternity benefits to the employee in Form 4 - FSS? View answer