A sick leave certificate is a document that confirms that a citizen is temporarily disabled. It is issued by a medical institution. The completed certificate is provided to the employer, who then sends it to the Social Insurance Fund to accrue benefits to the employee. It is important to understand who, when and how fills out the sick leave certificate.

Sick leave codes and their interpretation

- 43 – if the employee was exposed to radioactive radiation;

- 44 – work is performed in the Far North;

- 45 – the employee has an established disability group;

- 46 – the employment contract was concluded for a period of up to six months;

- 47 – the insured event occurred within 30 days from the date of dismissal;

- 48 – the employee violated the treatment regimen for a valid reason;

- 49 – if the disease lasts more than 16 weeks;

- 50 – if the disease lasts more than 20 weeks;

- 51 – the employee did not have time to earn enough to pay for the insurance premium or the amount of earnings is less than the minimum wage.

Code 01 is the most common. It denotes any disease with the exception of diseases included in the special lists of the Ministry of Health. Domestic injuries and accidents not related to the patient’s work are coded 02. All types of quarantine for infectious diseases are coded 03. Industrial injuries include not only injuries received directly at the workplace, but also those received on the way to or from work.

Possible values

Please note that the disability codes on the sick leave certificate reflect typical situations that are important to the employer. Disease codes on sick leave certificates indicate not only difficulties for workers, but also for their relatives, whom they care for. Moreover, some diseases are not indicated at the request of the employee. Also see “How to pay for sick leave for child care under the new rules.”

Special cases

For example, disease code “01” on a sick leave certificate simply means illness. If a company employee with a general illness asks for help, they enter code “01” on the sick leave certificate, which means for the employee that they will be paid in full for such illness. The sick leave code “01” will tell the accountant how to calculate the payment.

“If there is an obvious unfavorable clinical and work prognosis, no later than four months from the date of the onset of temporary disability, the patient is sent to undergo a medical and social examination in order to assess disability, and in case of refusal to undergo a medical and social examination, the certificate of incapacity for work is closed. With a favorable clinical and work prognosis, no later than ten months from the date of the onset of temporary disability in conditions after injuries and reconstructive operations and no later than twelve months in the treatment of tuberculosis, the patient is either discharged to return to work or sent for a medical and social examination.”

The employer must be prepared to compensate for the entire period the employee undergoes treatment. In a number of situations, a citizen can provide a medical order for transfer to another position

according to your health condition.

The company will be obliged to provide the citizen with a new place of employment or remove the person from performing professional duties. In this situation, the employee must be provided with temporary disability benefits. This rule is enshrined in Article 73 of the Labor Code of the Russian Federation and Federal Law No. 77 of June 18, 2021

.

Violations of the regime

It is not enough to know what code 2 means on a sick leave certificate. This code can be supplemented with other digital designations that allow the employer to reduce the amount of payment. In accordance with the provisions of Order of the Ministry of Social Development of the Russian Federation No. 347n dated April 26, 2021

, in the “regime violation mark” line, the following codes may be present:

What is sick leave? This is a medical document that indicates the reasons for a person’s temporary disability and on the basis of which he can receive (for the entire period of absence from work) a certain amount of money.

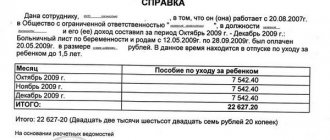

Let's say citizen Ivan Ivanovich Ivanov was absent from work due to a domestic injury (or due to the flu) for 10 days (note, calendar days). Ivan Ivanovich’s average daily earnings is 1,600 rubles, and his insurance experience is 7 years. The benefit amount will be 12,800 rubles (1,600 x 10 x 80%). Of these, 3840 rubles (1600 x 3 x 80%) will be paid by the employer, and the remaining amount will be 8960 rubles from the Social Insurance Fund.

When 44 is put on the certificate of incapacity for work

Many personnel officers have a question about whether it is necessary for foreign citizens. According to Article 66 of the Labor Code of the Russian Federation, everyone who works under an employment contract must have a work book, which means foreigners must have exactly the work book of the established form. Work books or other replacement documents from foreign countries are not accepted, with the exception of old work books of the USSR. If the insured event occurred during the period from the moment of conclusion of the employment contract until its complete termination, the date is set from which the employee would begin to perform his duties. The next line is intended to indicate the insurance period, in which you should write the number of full years and months. In the column intended to record the period of payment of the due benefit, you must indicate the start and end dates of the illness. Information on average earnings and average daily earnings is entered in the corresponding lines, in accordance with law number 255-FZ of December 29, 2006. Then the amount of benefit paid by the Social Insurance Fund is indicated. In the “Total accrued” line, you must enter the total amount of benefits intended to be paid to the employee, taking into account personal income tax.

Please note => Is it possible to pay for preparation for school with maternity capital?

Example 2. Adjustment of the amount of sickness benefit in the bulletin

Citizen K.D. Bundovskaya brought her sick leave to the accounting department at her new place of work. Since she did not submit a certificate of earnings from her previous job on time, she was awarded benefits based on the actual minimum wage.

Finally, the necessary certificate was prepared and handed over to K.D. Bundovskaya to the accounting department at the new place of work. The question arose about recalculating the benefit taking into account new data on the average salary (hereinafter abbreviated as SR). In fact, the recalculated benefit amount should be greater.

Information about social security and social benefits has already been entered into the ballot form. No more than 3 amounts are subject to change or editing. As you know, making 3 or more edits to a ballot is prohibited. The way out of this situation will be as follows. Recalculation is done on a separate sheet. Next, it is attached to the existing ballot form, which remains unchanged, without corrections.

Conditions for calculation on sick leave

Note. The amount of the benefit is indicated, calculated in the manner established by the norms of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, must be reflected in full without deducting personal income tax amounts. see Letter of the Federal Social Insurance Fund of the Russian Federation dated 09/08/2011 No. 14-03-14/15-10022 in the line “ SNILS ” the insurance number of the individual personal account in the compulsory pension insurance system of the recipient of the corresponding type of benefit is indicated in accordance with the insurance certificate of state pension insurance;

What do disability codes mean on sick leave?

- One of the most common disease codes on sick leave is 01 . It reflects the fact that the employee has contracted a common illness, such as ARVI. If this code is indicated on the sick leave, the employer calculates sick leave compensation in the usual manner established in paragraph 1 of Art. 14 of Law No. 255-FZ.

- In turn, what does sick leave code 02 mean ? The fact that the employee suffered an injury not related to work. The presence of sick leave code 02 implies that the employer has the same obligation to calculate the amount of compensation according to the general rules (in particular, taking into account the employee’s length of service).

- The fact of injury at work is reflected on the sick leave using code 04. In this case, the enterprise must pay the employee compensation for sick leave in the amount of 100% of his average earnings (Clause 1, Article 9 of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ). This is a fundamental difference between the employer’s responsibilities compared to when the cause of incapacity 01 is indicated on the sick leave and the amount of compensation depends on the length of service.

Thus, deciphering the disease code on the sick leave sheet 01 , 02, 04 must necessarily be done taking into account the possible presence of the 3 considered codes in the document. Their presence directly affects the size of the company’s obligations for sick leave compensation.

Please note => Who has property tax benefits?

Answers to frequently asked questions

Question No. 1: If the employee’s TIN is not indicated on the ballot, will this be considered an error? Will such sick leave be accepted?

Today, the TIN code is indicated at the discretion of the employer.

Question No. 2: What to do if the Social Insurance Fund returned sick leave due to an error?

The ballot is returned in a certain order. The FSS first makes the appropriate notes, indicating the reason why the form was declared invalid (due to which it was returned). It is then handed over to the employer.

Further actions are taken depending on the specified reason. You will need to correct the error, if possible, or make a duplicate of the sick leave.

For your information, the Social Insurance Fund has the right to formalize and transfer to the employer a justified refusal to assign social benefits without returning the sick leave certificate.

What you need to know about disability certificate codes

- general illness - 01;

- domestic injury (outside of work) - 02;

- quarantine (being among infectious patients) - 03;

- occupational injury or its consequences - 04;

- maternity leave - 05;

- prosthetics in hospital - 06;

- occupational disease - 07;

- sanatorium treatment - 08;

- caring for a relative - 09;

- poisoning - 10;

- sick leave due to a child’s illness - 12;

- socially significant disease - 11.

Information about diseases and their causes is updated once every 10 years, and its next revision is scheduled for 2021 . When registering sick leave, not the entire multi-volume ICD database is used, but only those inclusions that contain important information about dangerous diseases.

How to fill out a sick leave form as an accountant or personnel officer

To correct errors made when filling out this section, the erroneous entry is carefully crossed out, the correct entry in place of the erroneous one is entered on the back of the certificate of incapacity for work, confirmed by the entry “corrected believe”, the signature and seal of the employer (for an employer - an individual, a seal is affixed if available) . Errors may not be corrected by correction or other similar means.

- 43 – if the insured person belongs to the category of persons exposed to radiation who, in accordance with the legislation of the Russian Federation, have the right to benefits when assigning and calculating benefits for temporary disability, pregnancy and childbirth;

- 44 – if the insured person started working in the Far North and equivalent areas before 2007 and continues to work in these areas;

- 45 – if the insured person has a disability;

- 46 – if an employment contract (service contract) is concluded with the insured person for a period of less than 6 months. This code is not entered if code “11” is indicated in the line “Cause of disability”;

- 47 – if the illness (injury) occurred within 30 calendar days from the date of termination of work under an employment contract, performance of official or other activities, during which the person is subject to compulsory social insurance in case of temporary disability and in connection with maternity;

- 48 – for a valid reason for violating the regime (if the corresponding code is entered in the line “Notes about violating the regime □□”);

- 49 – if the duration of the illness exceeds 4 consecutive months – for insured persons who were disabled on the day of the insured event. This code is not entered if code “11” is indicated in the line “Cause of disability”;

- 50 - if the duration of the disease exceeds 5 months in a calendar year - for insured persons who have a disability on the day of the insured event. This code is not entered if code “11” is indicated in the line “Cause of disability”;

- 51 – in the case specified in part 1.1. Article 14 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, when the insured person at the time of the insured event works part-time (part-time, part-time working day);

Please note => Receive an extract from the Unified State Register with the tax digital signature

We take into account “northern” features when calculating social insurance benefits

Do not forget that northerners do not need to increase the maximum amount of payments for calculating benefits (for payments of 415,000 rubles, for payments of 463,000 rubles) by the regional coefficient. This value is the same throughout Russia.

Northerners who began working in the Far North and equivalent areas before January 1, 2021 must be paid benefits in the amount of 100% of average earnings, even if their work experience is still less than 8 years. It does not matter how long they worked before this date. In the line “Conditions of appointment” in the sick leave of such an employee, you need to indicate the code. But for northerners who began working in the northern territories after January 1, 2021, benefits are paid taking into account the length of insurance coverage. So, a situation is possible when an employee with extensive insurance experience will receive a temporary disability benefit in a smaller amount than one who has less experience, but part of it covers the time of work in the North until January 1, 2021. However, this rule does not apply, if the amount of temporary disability benefits is less than 100% due to circumstances not depending on the employee’s length of service:

Disease codes on sick leave certificates

In the form of a certificate of incapacity for work of the 2011 sample, there are several cells in which certain codes must be entered. The main ones are the disease codes on the sick leave certificate. They were approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n. Let's take a closer look at what this or that code means. If there are no such “additions”, the “additional code” cells are not filled in. And the last disability codes on the sick leave certificate are the “change code”. It is filled in with a two-digit disease code (shown in the first table) if the cause of the disease has changed. If the cause of disability has not changed, the code is not filled in.

Sick leave codes

A certificate of temporary incapacity for work is drawn up on a form, the form and content of which are regulated by law. Most of the document must be filled out by the attending physician, who does not prescribe the name of the patient’s disease, but enters specialized codes on sick leave certificates in the “Cause of disability” column. Refusal to comply with medical prescriptions means the patient’s refusal to take prescribed medications, to undergo medical procedures required for recovery, as well as leaving the clinic independently without notifying the attending physician.

Disability codes on sick leave

On the sick leave (approved by Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 N 347n) some information is indicated in encrypted form. Thus, special codes for the reasons for incapacity for work on a sick leave certificate replace a verbal description of what served as the reason for issuing a certificate of incapacity for work. The meaning of disability codes on a sick leave certificate is established by law, i.e., employees of medical organizations use uniform approved codes when filling out sick leave certificates (Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n). 12 This code is indicated if sick leave is issued in connection with an illness of a child under 7 years of age and his illness is included in a special list (Order of the Ministry of Health and Social Development of the Russian Federation dated February 20, 2008 N 84n) 13 This code is reflected in sick leave if it is issued in connection with care for a disabled child 14 This code is entered on the certificate of incapacity for work if it is issued to care for a child whose illness is associated with a post-vaccination complication, or for a malignant neoplasm 15 Code “15” means that temporary disability is caused by the need to care for an HIV-infected child

general information

What does sick leave mean? With the help of a sick leave certificate, an illness, injury or other physiological problem of an employee is registered. The form is sometimes called differently - a sheet of temporary incapacity for work. It is allowed to be prescribed only by doctors who have passed a special check by the FSS. An employee can count on payments if the form was correctly filled out and submitted to the enterprise administration within the established time frame.

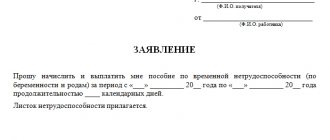

Registration procedure

The employee is also a participant in the registration process, but he practically does not fill out anything. All he needs to do is consult a doctor in a timely manner and obtain a certificate of incapacity for work. Then it is necessary (within compliance with the deadlines) to provide the completed form at the place of work.

For persons subject to self-isolation and under medical supervision on an outpatient basis, certificates of incapacity for work are issued from the day the temporary incapacity for work is established in connection with sanitary and anti-epidemic measures and are closed on the day the temporary incapacity for work ends.

The specified citizens who are covered by state social insurance and for them, as well as by themselves in cases provided for by the legislation on state social insurance, are paid compulsory insurance contributions to the budget of the state extra-budgetary fund for social protection of the population of the Republic of Belarus for social insurance, and are issued a certificate of incapacity for work for the period of stay in self-isolation.

Svetlana Matsuleva

When drawing up such certificates of incapacity for work, in the position “Type of VN”, “15” is indicated - carrying out sanitary and anti-epidemic measures (in the certificates of incapacity for work of the “old” form - type of disability “quarantine”). In the position of the certificate of incapacity for work “VN reason code according to f. 4 of state statistical reporting” indicates the code of the reason for temporary disability in accordance with the state statistical reporting form “82” (exemption from work due to quarantine). In the “mode” position the number “2” (stationary) is indicated.

In order to protect medical confidentiality, equated to personal information about a person (Article 23 of the Constitution of the Russian Federation), a specific diagnosis is not indicated on the temporary disability certificate . Some disease codes on Russian sick leave allow you to find out the area of the disease in the same way as the specialization of the attending physician.

What does code 01 mean on a sick leave certificate?

- if the failure to appear at the doctor’s office was for an unexcused reason, the amount of benefits due from the date of violation of the regime is calculated based on the minimum wage;

- however, if the reason was valid (for example, the employee was busy caring for a sick child), the accountant has the right to pay for such sick leave according to the general rules, without reducing the amount of benefits.

- 017 – inpatient treatment at a sanatorium;

- 018 – to undergo sanatorium-resort treatment after an accident at work during illness;

- 019 – during treatment at the Research Institute of Rehabilitation and Balneology;

- 020 – extension of maternity sick leave;

- 021 – in case of illness caused by alcohol or drug intoxication.

24 Dec 2021 marketur 199

Share this post

- Related Posts

- Housing for Large Families 2021 in Surazh, Bryansk Region

- How to rent an apartment daily without getting scammed

- Disclaimer: This commercial proposal is not an offer.

- Rules for driving through a two-lane ring road 2019

List of additional ciphers

In addition to the main fields, the document has additional columns. This is “Add. code" and "Code. ism". The first field contains the following list of data:

- 017 – the sick person is being treated in a special sanatorium;

- 018 – sanatorium treatment is associated with an industrial injury;

- 019 – the patient is undergoing rehabilitation at the Research Institute of Balneology;

- 020 – increased maternity leave;

- 021 – illness or injury occurred under the influence of alcohol, drugs or other substances.

How much does code 021 reduce the amount of charges?

Code 021 reduces the amount of insurance payments for the entire duration of the treatment process. In this case, the calculation is carried out not on the basis of average earnings, but on the basis of the minimum wage.

This principle of calculating the insurance amount applies even if the patient does not have any indication of violating the regime.

Field "Code. "izm" is filled in if the diagnosis has changed during treatment. If changes are not required, the field remains blank.