Documentation

2-NDFL is a document that describes all information about taxes on personal income. These

Some companies, as part of the social package provided to employees, enter into voluntary agreements in their favor.

From July 1, 2021, new forms of invoice and adjustment invoice have been introduced. There's a new one

The author of the document Dogovor-Yurist.Ru is offline Status: Legal. company rating460 84 / 6 Personal

Who submits the invoice journal Only intermediary organizations are required to submit an invoice journal to the Federal Tax Service.

New definition of current income tax Current income tax is the amount that

Home / Taxes / What is VAT and when does it increase to 20 percent?

Free legal consultation by phone: 8 A new version of the federal law on accounting has been released

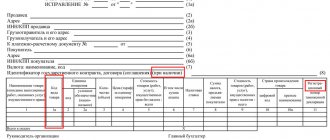

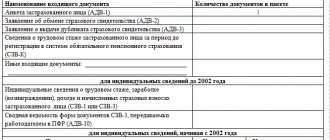

When submitting the following personalized accounting forms to the Pension Fund: ADV-1, ADV-2, ADV-3, as well as forms

Demand for due diligence Exercising due diligence when choosing a counterparty is a category of interest primarily to tax authorities