2-NDFL is a document that describes all information about taxes on personal income. These funds are sent by the employer to the budget, since it is he who is responsible for paying the taxes of his employees. The certificate is filled out in accordance with the established form; the company’s seal must be located in the appropriate place.

How to draw up and indicate severance pay in papers, code in 2-NDFL - is regulated by the tax legislation of the Russian Federation. The accounting department is responsible for issuing such documents, and their production time is up to 3 days.

Last payment

Severance pay is financial assistance provided for by the Labor Code of the Russian Federation, which is paid to those who are fired not for “bad” articles of the normative act (committing an immoral offense, absenteeism, drunkenness in the workplace). All categories of dismissed persons designated in a special Law have the right to receive severance pay, regardless of position, length of service, job function performed, gender and social status. This assistance is also paid to working pensioners, who have equal rights to able-bodied employees.

In addition, depriving pensioners of “compensation” is regarded as discrimination against employees based on age, which, in turn, threatens sanctions from the employer’s administration.

The purpose of paying severance pay is to provide financial support to dismissed employees during the job search period. Also, such assistance can be called material compensation for the loss of a job due to the “indirect fault” of the employer (for example, when staffing is reduced, when it is impossible to move to another locality due to the company changing its location) or incentive assistance to those who are obliged to repay the state a debt by resigning due to reason for the need to undergo urgent military or alternative service.

Who is entitled to severance pay?

Chapter 27 of the Labor Code of the Russian Federation establishes an exhaustive list of categories of dismissed persons who are entitled to payment of severance pay.

These are persons who are forced to terminate their employment relationship with their employer due to:

- The refusal is transferred to another area along with the enterprise when it changes its location;

- Refusal to perform a labor function due to a change in significant working conditions or provisions of the employment contract;

- Inconsistencies between the qualifications and skills of the employee and the position held;

- Inability to perform a job function due to a sharp deterioration in health;

- Reinstatement of the employee in whose place the dismissed person is working;

- Gross violation by the employer of the norms of the current labor legislation (systematic or one-time), the provisions of a collective or labor agreement

- Conscription for compulsory military or alternative service. With these dismissal formulations, the employee receives assistance in the amount of two weeks' average earnings.

- Liquidation, reorganization, bankruptcy of an enterprise. reduction of an employee's position.

In this case, the dismissed person has the right to severance pay equal to average monthly earnings.

A collective and/or employment agreement may contain clauses that provide for an increased amount of severance pay or its payment for a longer period than established by law. When drawing up contractual documentation, it is necessary to take into account the rule in which the position of the parties to the agreement can only be improved in comparison with existing legal norms.

For example, according to the law, upon dismissal due to staff reduction, severance pay is paid in the form of one-time assistance for the month following the date of dismissal. In special cases, the second month (very rarely - the 3rd) after dismissal is paid, provided that the former employee cannot find a job for reasons beyond his control and has registered with the local employment service within 2 weeks from the date of dismissal. The provisions of the collective agreement may extend the term of payments or increase their amount. Reducing the quantity and/or quality of goods provided for by regulations is considered illegal.

Income tax

Include the costs of paying employees severance pay, average earnings for the period of employment and compensation upon dismissal as part of labor costs. Moreover, expenses can include both benefits paid in accordance with labor legislation and additional compensation provided for in an employment or collective agreement. This follows from paragraph 1 and paragraph 9 of Article 255 of the Tax Code of the Russian Federation and is confirmed in the letter of the Ministry of Finance of Russia dated January 30, 2015 No. 03-03-06/1/3654.

The procedure for reflecting severance pay (average earnings for the period of employment, compensation upon dismissal) in tax accounting depends on the method of accounting for income and expenses that the organization uses.

If the organization uses the accrual method, include the amount of severance pay (severance compensation) as part of direct or indirect expenses. The moment of recognition of expenses depends on whether they relate to direct or indirect expenses (Article 318 of the Tax Code of the Russian Federation).

If an organization is engaged in the production and sale of products (works, services), determine the list of direct expenses in the accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Attention: when approving the list of direct expenses in the accounting policy, please note that the division of expenses into direct and indirect must be economically justified (letter of the Ministry of Finance of Russia dated January 26, 2006 No. 03-03-04/1/60, Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/2952). Otherwise, inspectors may recalculate income tax.

Thus, severance pay accrued to employees directly involved in production should be taken into account as part of direct expenses. The severance pay accrued to the administration of the organization is classified as indirect expenses.

Severance pay (dismissal compensation), which relates to direct expenses, should be taken into account when calculating income tax as you sell products in the cost of which they are taken into account (paragraph 2, clause 2, article 318 of the Tax Code of the Russian Federation). Payments classified as indirect expenses should be taken into account when calculating income tax on the last day of the month in which they were accrued (clause 2 of Article 318, clause 4 of Article 272 of the Tax Code of the Russian Federation).

Include the payment of average earnings for the period of employment (for the second to sixth months) as part of indirect expenses. Even if it is paid to former employees of the main production, then at the time of payment they cannot be called participating in the production (paragraph 7, paragraph 1, article 318 of the Tax Code of the Russian Federation).

If an organization provides services, then direct costs can be taken into account, as well as indirect ones, at the time of their accrual (paragraph 3, paragraph 2, article 318 of the Tax Code of the Russian Federation).

In trade organizations, all these payments will be indirect expenses (paragraph 3 of Article 320 of the Tax Code of the Russian Federation). Therefore, take them into account when calculating income tax in the month in which they were accrued.

An example of reflection in accounting and taxation of severance pay to an employee dismissed due to staff reduction. The organization applies a general taxation system

Yu.I. Kolesov works as a driver at Alpha LLC (an organization that provides services). On May 5, he was fired due to staff reduction, of which he was notified in a timely manner.

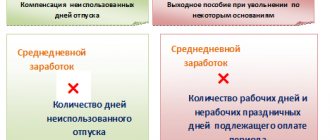

Kolesov’s average daily earnings were 500 rubles/day. Upon dismissal, he was paid severance pay in the amount of average monthly earnings for the first month after dismissal (from May 5 to June 4). In this period, according to Kolesov’s work schedule (five-day work week), there are 22 working days. The severance pay was: 500 rubles/day. × 22 days = 11,000 rub.

The accountant made the following entries in accounting:

Debit 26 Credit 70 – 11,000 rub. – severance pay accrued;

Debit 70 Credit 50 – 11,000 rub. - severance pay was issued.

The accountant reduced the taxable profit for May by 11,000 rubles. Severance pay is not included in the calculation of other taxes and contributions.

Certificate 2-NDFL about income

Personal income tax (NDFL) is a deduction that is made from all income of a citizen. It is calculated as a percentage of the funds received; the amount of taxation directly depends on the presence or absence of citizenship of a person. Tax rates also change depending on where the funds originate.

The employer is responsible and accountable only for those deductions that he makes personally from the salaries of his employees. The citizen himself must report for other income and this should be done at least once a year. Individual entrepreneurs who have employees, as well as legal entities, are required to calculate personal income tax on a monthly basis and transfer it to the budget in the prescribed manner. Reporting under 2-NDFL allows tax authorities to monitor the accuracy and completeness of deductions, as well as maintain general records of the income and expenses of employees.

Tax deductions, regardless of the frequency of their payment, always have a general annual accounting, therefore, when moving from one employer to another, it is extremely important to provide information about previously deducted amounts at the new place of work. This procedure allows you to calculate your total annual income and correctly calculate taxes and fees.

Main purpose

Certificate 2-NDFL allows you to provide complete information about how much income was received by an individual at this enterprise, as well as how much money was withheld from him. Employers pay taxes for each person working for them, but an individual can only obtain information about themselves, because this data is confidential. Certificate 2-NDFL allows you to make such an individual selection from the general tax report.

Information about wages received and interest deducted from it can only be obtained from your employer. This document is often requested by employees throughout their employment. It is impossible to do without it when obtaining a loan, applying for subsidies and benefits. This form allows you to prove not only the declared income, but also the fact that the person works and regularly receives certain amounts.

Upon dismissal, a certificate in form 2-NDFL makes it possible to correctly calculate the total amount of income for the current calendar period, and, accordingly, calculate tax deductions. Typically, the form contains information about amounts for the year, but may contain fewer months.

The certificate is filled out using a special template, which must contain:

Name of the legal entity and indication of its banking, tax and payment details

Particular attention is paid to the individual code, which determines under what number the company is registered in the tax register. Passport details of the employee to whom it is issued, including not only his full name and passport number, but also the registration address of the individual. The tax rate applicable to a given employee. Income amounts monthly and total. The total amount of calculations. If during the period under review the hired person had other deductions, then they are also indicated

If during the period under review the hired person had other deductions, then they are also indicated.

Income and deduction codes

When filling out tax forms, a coded system for entering information is used.

This allows you to save space for entered information and systematize data processing. Each type of income and deduction has its own unique code. The full table of accepted codes is quite extensive and allows you to specify any amount, as well as explain why it was charged or withheld.

The most common income codes are:

- Salary – 2530.

- Vacation compensation – 2012.

- Disability benefit – 2300.

- Remuneration for labor – 2000.

- Encouragement awards - 2002.

- One-time financial assistance from the manager - 2762.

Each tax deduction has its own code, which upon dismissal must be entered opposite the amounts calculated from wages.

Income code severance pay in case of layoff

The answer was prepared by: Expert of the Legal Consulting Service GARANTSuldyaykina Valentina The answer passed quality control on July 22, 2017. Personal income tax is considered a direct tax in Russia, which is subject to withholding from any income transaction of an individual as a percentage. The article also indicates those incomes on which the tax amount is not calculated.

Tax residents who reside on the territory of Russia become personal income tax payers. This can be any individual who is in the territory for more than 183 days during the year. At the same time, the employee does not travel outside of Russia for a period of more than six months.

Tax residents who are not located in Russia pay taxes. For example, military or government officials.

In case of reduction In case of reduction, taxation is withheld from the wages due for the time worked, as well as for the period of unused vacation.

Rules for document execution

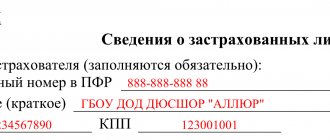

The type of declaration was approved on October 30, 2015. The mandatory requirements when filling out 2nd personal income tax include completing the following fields:

Information about the employer, details. Reductions are allowed only in accordance with the statutory acts

- information about the recipient of the profit - individual. face;

- profit subject to taxation;

- deductions that were applied in the reporting period;

- the amount of profit and personal income tax.

In the information field about the agent, you must indicate complete information about the legal entity.

In the information column about physical the person is told the following:

- Last name, first name, patronymic;

- citizenship and status as a taxpayer;

- place of registration and place of residence;

- passport details.

Profit on which personal income tax is withheld is reflected by month. At the same time, indicate the code of income and tax deductions indicating the amounts. If physical the person had the right to other deductions - social or property, this information is reflected in certificate 2 and indicates that such a right was presented.

The form must be certified by the manager or other authorized person and stamped. The certificate is considered invalid without a stamp.

In relation to the calculation of 2nd personal income tax, the registration procedure applies: corrections are not allowed, if errors are detected, a new form is issued as soon as possible.

For misrepresentation of information or delay in time, administrative sanctions are applied to the tax agent.

Certificates upon dismissal upon written request of the employee

Article 84.1 of the Labor Code approves the procedure for dismissal and lists the list of documents that the employer is obliged to issue to the employee on the last day of work.

This type includes:

- Certificate of income of the employee, taking into account severance pay upon dismissal;

- on insurance amounts to the Russian pension fund;

- about your work experience in the company.

Declaration 2 of personal income tax refers to the type of certificates that are issued upon written request. A legal entity cannot deny this right to a former employee, since the indicators in these certificates relate only to the employee and the work, until dismissal, contains private information relating to a specific person.

When issuing a declaration upon written application, the following are taken into account:

- Information is provided only free of charge;

- the declaration is submitted no later than 3 days from the date of registration of the application;

- Not every organization has a personnel employee who will prepare papers on the experience of physical persons. persons in this company. In this case, if the employee quits, the responsibility for issuing falls on the accountant.

Certificates from the Pension Fund contain personalized accounting information. This information is necessary for accumulating contributions at a new workplace.

The employee has been reinstated

Situation: is it necessary to withhold personal income tax and charge insurance premiums for the amount of mandatory payments upon dismissal if the employee has been reinstated?

Answer: yes, it is necessary.

As a general rule, the amount of severance pay and other payments upon dismissal provided for by law (with the exception of compensation for unused vacation) is not subject to personal income tax and insurance contributions (within the established standard).

However, if the employee has been reinstated, the amounts that were previously paid in connection with the dismissal cannot be considered compensation. After all, they will be taken into account when paying the employee a salary for the period of forced absence (clause 62 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2). Therefore, personal income tax must be withheld from the amount of such payments and contributions for compulsory pension (social, medical) insurance and contributions for insurance against accidents and occupational diseases must be calculated (subclause 6, clause 1, article 208, part 1, article 7 of the Law of July 24 2009 No. 212-FZ, paragraph 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ).

Compensation for unused vacation in 2021

All other benefits, including those determined by the collective agreement, are not subject to taxes. What income code should be indicated for vacation pay in the 2-personal income tax certificate? After all, all this can be determined by a collective and labor document, on the basis of which the employer acts. Terms Paid on the day of dismissal in the form of an average monthly salary.

For the second month before the employment period, a similar amount is offered as remuneration. If there is a court ruling or an order from the Labor Exchange, then a similar payment is paid to the previous paragraphs, and for the third month. Payments Citizens who have the following situation receive a two-week benefit:

in connection with the transfer of an employee to another workplace.

simplified tax system

If an organization applies a simplified tax regime with the object of taxation “income minus expenses”, include the amount of severance pay and average earnings for the period of employment in expenses that reduce the single tax. Moreover, you can take into account in expenses both benefits paid according to the norms of labor legislation, and additional compensation provided for by an employment or collective agreement (subclause 6, clause 1, clause 2, article 346.16, clause 9, article 255 of the Tax Code of the Russian Federation). These amounts reduce the single tax at the time of payment to the employee (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

An example of reflection in accounting and taxation of severance pay to an employee dismissed due to staff reduction. The organization operates on a simplified basis, pays a single tax on the difference between income and expenses

Alpha LLC uses a simplified approach to the “income minus expenses” object.

Yu.I. Kolesov works as a driver at Alfa. On May 5, he was fired due to staff reduction, of which he was notified in a timely manner.

Kolesov’s average daily earnings were 500 rubles/day. Upon dismissal, he was paid severance pay in the amount of average monthly earnings for the first month after dismissal (from May 5 to June 4). In this period, according to Kolesov’s work schedule (five-day work week), there are 22 working days. The severance pay was: 500 rubles/day. × 22 days = 11,000 rub.

In accounting, the accountant reflected the transaction with the following entries:

Debit 26 Credit 70 – 11,000 rub. – severance pay accrued;

Debit 70 Credit 50 – 11,000 rub. - severance pay was issued.

The accountant reduced the single tax base by expenses in the amount of 11,000 rubles. Since the severance pay does not exceed three average monthly earnings, this payment is not subject to personal income tax and insurance contributions.

If an organization applies a simplification with the object of taxation being income, then the amount of severance pay (average earnings for the period of employment, compensation upon dismissal) does not affect the calculation of the single tax (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Personal income tax code compensation for unused vacation upon dismissal

When an employee is dismissed, the accountant issues a personal income tax certificate 2 to be submitted at the new place of work. The document reflects information about all employee benefits that are taxed.

In addition to wages, the employee is paid compensation for vacations not taken.

Since such amounts are taxable, accountants are interested in the question of what income code in Certificate 2 of the Personal Income Tax indicates compensation for unused vacation.

Sometimes employees are unable to rest on time; many, when changing jobs, have leftover vacation leaves, then they are replaced with a cash payment (subject to personal income tax). The tax rate is 13%, transferred on the last working day along with the calculation. If a person took a vacation in advance, upon dismissal, the “extra” days are withheld from the final calculation.

Compensation for unused vacation personal income tax code 2017

Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices

In addition to the benefits of hiring employees, the company has a number of responsibilities. The employer must calculate and transfer mandatory contributions to Russian state funds. Responsibilities also include the need to perform the functions of a tax agent for income tax.

Income code compensation for unused vacation upon dismissal 2018

The answer to this question has been repeatedly given by both tax authorities and the Ministry of Finance, including in the letters that we mentioned earlier: regardless of the start and end dates of the vacation, the period for receiving income will be the month in which the vacation pay was actually paid.

136 Labor Code of the Russian Federation). But in the 2-NDFL certificate, the salary for the month must be shown in one amount, because the date of receipt of income is considered to be the last day of the month for which the salary was accrued. 3. The OKATO codes of structural divisions are incorrectly indicated. Personal income tax goes in the context of OKATO, multiplying the number of cards and personal accounts without limitation.

We recommend reading: Website of the Federal Bailiff Service FSSP

What income code should be indicated for vacation pay in the 2-NDFL certificate?

Clause 2 Art. 230 of the Tax Code of the Russian Federation defines the employer’s obligation to provide tax authorities with 2-NDFL certificates every year. They must be compiled reflecting payments received from the enterprise by month of accrual, codes of types of income and separate divisions, as well as indicating tax deductions that the recipient of payments uses.

Thus, any incorrectly filled in details of the income certificate of individuals (including income code - 2021 for compensation for unused vacation) can formally be recognized as unreliable information.

Often, the subjects responsible for generating the 2-NDFL certificate in the case we are considering choose code not 4800, but 2000 “Remuneration received by the taxpayer for the performance of labor or other duties” or 2012 “Amounts of vacation payments”. However, payment for vacation not taken is compensatory in nature, and therefore indicating code 4800 seems more correct.

Compensation upon dismissal personal income tax code 2018

- Income code for compensation for unused vacation upon dismissal in 2021

- Online magazine for accountants

- Compensation for unused vacation upon dismissal in 2018: income code

- What income code should be indicated for vacation pay in the 2-personal income tax certificate?

- Personal income tax when paying severance pay

- Ipc-zvezda.ru

- Personal income tax from severance pay upon dismissal

In the document, wages are indicated as two separate amounts. The Labor Code of the Russian Federation states that salaries must be paid twice a month. According to the 2-NDFL certificate form, the salary for 30-31 days is shown as one amount.

The date of receipt of income is designated as the last day of the month in which salaries were calculated

It is also important to correctly indicate the personal income tax code in 2021. Employees who have worked for the organization for at least two weeks can receive compensation upon dismissal.

If an employee worked for less than half a month, then compensation for vacation is not included. The decision is made on the basis of paragraph 35 of the Rules on regular and additional leaves. The resolution was approved back in 1930.

If an employee worked for a company for at least 5 and a half months during the working year, then he is entitled to 28 calendar days of vacation.

An example of how severance pay is reflected in certificate 6-NDFL

To transfer the example data to the calculation of 6-NDFL, we will supplement the conditions of the proposed example.

Example 2

On April 12, 2019, on the day of dismissal, the employee was paid severance pay in excess of the non-taxable limit of RUB 25,000. The amount of personal income tax on the paid severance pay is 3,250 rubles. (25,000 × 13%).

The tax was transferred to the budget on April 15, 2019.

04/12/2019 is Friday, therefore, in line 120, the day of tax transfer should indicate the next business day after the day the money was issued to the dismissed person - Monday, 04/15/2019.

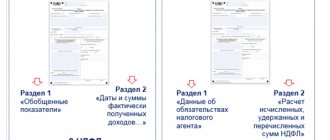

Let's fill out sections 1 and 2 of the 6-NDFL calculation for the 1st half of 2021 for this severance pay:

| Line number | Line name | Entered data |

| 010 | Tax rate, % | 13 |

| 020 | Amount of accrued income | 25 000,00 |

| 040 | Amount of calculated tax | 3250 |

| 060 | Number of individuals who received income | 1 |

| 070 | Amount of tax withheld | 3250 |

| 100 | Date of actual receipt of income | 12.04.2019 |

| 110 | Tax withholding date | 12.04.2019 |

| 120 | Tax payment date | 15.04.2019 |

| 130 | Amount of actual income received | 25 000,00 |

| 140 | Amount of tax withheld | 3250 |

Completed sections 1–2 of the 2021 6-NDFL calculation look like this:

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

The report on the employee must be submitted to the Federal Tax Service by July 31, 2019 (clause 2 of Article 230 of the Tax Code of the Russian Federation, letter of the Federal Tax Service dated August 1, 2016 No. BS-4-11/ [ email protected] ). In addition to the example indicators, the report should include data on all other employees of the company, their payments and taxes on these payments.

Vacation compensation code 2021

Income code - vacation pay has an individual 4-digit number - is required for affixing in the 2-NDFL certificate. Let's consider what it can be. Why should vacation time be taken into account separately from basic earnings? The current personal income tax code in 2021 for vacation pay and for its compensation. What accrual period for the vacation pay income code should be in the 2-NDFL certificate? Results Why should vacation be taken into account separately from basic earnings? Vacation payments to an employee are one of the forms of social guarantees provided for in Art. 114 Labor Code of the Russian Federation. But they cannot be considered as wages, since during vacation the employee de facto does not work.

- three times the average monthly salary - for ordinary employers;

- sixfold - in the Far North and equivalent areas

2301 fines and penalties paid by an organization on the basis of a court decision for failure to voluntarily meet consumer requirements in accordance with the Law of the Russian Federation dated 02/07/92 No. 2300-1 2611 bad debt written off in the prescribed manner from the balance sheet of the organization 3021 income in the form of interest (coupon ), received by the taxpayer on the circulating bonds of Russian organizations, denominated in rubles and issued after January 1, 2021 Deductions 619 positive financial result on transactions accounted for in an individual investment account Where the income code is indicated for compensation upon dismissal in 2021 Income codes are needed when filling out a certificate 2-NDFL.

Frequently used codes for types of income and deductions

Create a reminder for yourself by copying the income and deduction codes that are relevant for your enterprise into a text file so as not to look for the necessary codes in complete lists. For complete lists of codes for types of income and deductions, see the ConsultantPlus portal.

Frequently used taxpayer income codes

| Code | Name of income |

| 1010 | Dividends |

| 1201 | Income received in the form of insurance payments under insurance contracts in the form of payment for the cost of sanatorium and resort vouchers |

| 2000 | Remuneration received by a taxpayer for performing labor or other duties; salary, allowance not subject to paragraph 29 of Article 217 of the Tax Code of the Russian Federation and other taxable payments to military personnel and equivalent categories of individuals (except for payments under civil contracts) |

| 2001 | Directors' remuneration and other similar payments received by members of the organization's governing body (board of directors or other similar body) |

| 2002 | Amounts of bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, employment agreements (contracts) and (or) collective agreements (paid not at the expense of the organization’s profits, not at the expense of special-purpose funds or targeted revenues) |

| 2003 | Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted revenues |

| 2010 | Payments under civil contracts (except for royalties) |

| 2012 | Amounts of vacation payments |

| 2013 | Amount of compensation for unused vacation |

| 2014 | The amount of payment in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in the part exceeding in general three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the regions Far North and equivalent areas |

| 2300 | Temporary disability benefit |

| 2520 | Income received by a taxpayer in kind, in the form of full or partial payment for goods, work performed in the interests of the taxpayer, services rendered in the interests of the taxpayer |

| 2530 | Payment in kind |

| 4800 | Other income |

For a complete list of income type codes, see the ConsultantPlus portal.

Commonly Used Taxpayer Deduction Codes

| Code | Name of deduction |

| 104 | 500 rubles per taxpayer belonging to the categories listed in subparagraph 2 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation |

| 105 | 3000 rubles per taxpayer belonging to the categories listed in subparagraph 1 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation |

| 126 | For the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the parent, spouse of the parent, adoptive parent who is supporting the child |

| 127 | For the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the parent, spouse of the parent, adoptive parent who is supporting the child |

| 128 | For the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the parent, spouse of the parent, adoptive parent who is providing for the child |

| 129 | For a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II, to the parent, spouse of the parent, adoptive parent who is providing for the child |

| 130 | For the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the guardian, trustee, adoptive parent, spouse of the adoptive parent, who is supported by child |

| 131 | For the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the guardian, trustee, adoptive parent, spouse of the adoptive parent, who is supported by child |

| 132 | For the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24, a guardian, trustee, foster parent, spouse of a foster parent, for providing for which the child is |

| 133 | For a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II, to a guardian, trustee, foster parent, spouse of the foster parent, supported where the child is located |

| 134 | Double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to a single parent, adoptive parent |

| 135 | Double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the sole guardian, trustee, foster parent |

| 136 | Double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to a single parent, adoptive parent |

| 137 | Double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the sole guardian, trustee, foster parent |

| 138 | Double the amount for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to a single parent, adoptive parent |

| 139 | Double the amount for the third child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the sole guardian, trustee, foster parent |

| 140 | In double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II to the only parent, adoptive parent |

| 141 | Double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24 who is a disabled person of group I or II to the sole guardian, trustee, foster parent |

| 142 | In double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the parents of their choice based on an application for refusal of one of the parents receiving a tax deduction |

| 143 | In double the amount for the first child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the adoptive parents of their choice based on an application for refusal of one of the adoptive parents parents from receiving a tax deduction |

| 144 | In double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the parents of their choice on the basis of an application for refusal of one of the parents receiving a tax deduction |

| 145 | In double the amount for the second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the adoptive parents of their choice based on an application for refusal of one of the adoptive parents parents from receiving a tax deduction |

| 146 | In double the amount for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the parents of their choice based on an application for refusal of one from parents from receiving a tax deduction |

| 147 | In double the amount for the third and each subsequent child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to one of the adoptive parents of their choice based on an application for refusal one of the adoptive parents from receiving a tax deduction |

| 148 | Double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24 who is a disabled person of group I or II, to one of the parents of their choice based on an application for refusal of one from parents from receiving a tax deduction |

| 149 | Double the amount for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, who is a disabled person of group I or II, to one of the adoptive parents of their choice on the basis of an application for refusal one of the adoptive parents from receiving a tax deduction |

| 311 | The amount spent by the taxpayer on new construction or the acquisition on the territory of the Russian Federation of residential houses, apartments, rooms or shares (shares) in them, the acquisition of land plots or shares (shares) in them provided for individual housing construction, and land plots or shares ( shares) in them, on which the purchased residential buildings or share(s) in them are located |

| 312 | The amount aimed at repaying interest on targeted loans (credits) actually spent on new construction or the acquisition on the territory of the Russian Federation of a residential building, apartment, room or share(s) in them, the acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or shares (shares) in them on which the purchased residential buildings or share (shares) in them are located, as well as for repayment of interest on loans received from banks for the purpose of refinancing (on-lending) loans for a new construction or acquisition of the specified objects on the territory of the Russian Federation |

| 320 | The amount paid by the taxpayer in the tax period for his education in educational institutions, for the education of his brother (sister) under the age of 24 years in full-time education in educational institutions - in the amount of actual educational expenses incurred, taking into account the limitation established by paragraph 2 of Article 219 of the Tax Code Code of the Russian Federation |

| 321 | The amount paid by a taxpayer-parent for the education of his children under the age of 24, by a taxpayer-guardian (taxpayer-trustee) for the education of his wards under the age of 18 in full-time education in educational institutions, by a taxpayer performing the duties of a guardian or trustee over citizens , their former wards, after the termination of guardianship or trusteeship in cases where the taxpayer pays for full-time education of citizens under 24 years of age in educational institutions - in the amount of actual educational expenses incurred, but taking into account the limitation established by subparagraph 2 of paragraph 1 of Article 219 of the Tax Code Code of the Russian Federation |

| 324 | The amount paid by a taxpayer in the tax period for medical services provided by medical organizations, individual entrepreneurs engaged in medical activities, to him, his spouse, parents, children (including adopted children) under the age of 18, wards under the age of 18 years (in accordance with the list of medical services approved by the Government of the Russian Federation), as well as in the amount of the cost of medicines for medical use (in accordance with the list of medicines approved by the Government of the Russian Federation), prescribed by the attending physician and purchased by the taxpayer at his own expense – in the amount of expenses actually incurred, but subject to the limitation established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| 325 | Amounts of insurance premiums paid by the taxpayer in the tax period under voluntary personal insurance contracts, as well as under voluntary insurance contracts for their spouse, parents, children (including adopted children) under the age of 18, wards under the age of 18, concluded them with insurance organizations that have licenses to conduct the relevant type of activity, providing for payment by such insurance organizations exclusively of medical services in the amount of actual expenses incurred, but taking into account the limitation established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| 326 | The amount of expenses for expensive treatment in medical organizations, from individual entrepreneurs carrying out medical activities - in the amount of actual expenses incurred |

| 327 | The amount of pension contributions paid by a taxpayer during the tax period under a non-state pension agreement (agreements) concluded by the taxpayer with a non-state pension fund in its favor and (or) in favor of family members and (or) close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adoptive parents and adopted children, grandparents and grandchildren, full and half (having a common father or mother) brothers and sisters), disabled children under guardianship (trusteeship), and (or) in the amount of insurance premiums paid by the taxpayer in the tax period under a voluntary pension insurance agreement (agreements) concluded with an insurance organization in his own favor and (or) in favor of a spouse (including a widow, widower), parents (including adoptive parents) ), disabled children (including adopted children under guardianship (trusteeship), and (or) in the amount of insurance premiums paid by the taxpayer in the tax period under a voluntary life insurance agreement (agreements), if such agreements are concluded for a period of at least five years , concluded (concluded) with an insurance organization in its own favor and (or) in favor of a spouse (including a widow, widower), parents (including adoptive parents), children (including adopted children under guardianship (trusteeship), – in the amount of actual expenses incurred, taking into account the limitation established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| 328 | The amount of additional insurance contributions paid by the taxpayer during the tax period for a funded pension in accordance with Federal Law dated April 30, 2008 N 56-FZ “On additional insurance contributions for a funded pension and state support for the formation of pension savings” - in the amount of actual expenses incurred, taking into account the limitation, established by paragraph 2 of Article 219 of the Tax Code of the Russian Federation |

| 620 | Other amounts that reduce the tax base in accordance with the provisions of Chapter 23 “Tax on personal income”, part two of the Tax Code of the Russian Federation |

For a complete list of codes for types of deductions, see the ConsultantPlus portal.

In accounting programs and specialized programs for preparing and submitting reports, codes for types of income and deductions used to generate 2-NDFL certificates are updated automatically.

Certificate of income upon dismissal

A certificate of income upon termination of an employment contract is not included in the package of mandatory forms, but must be provided upon request of the person being dismissed. In addition, it can be requested even after the contract is terminated; the organization has no right to refuse to issue it, and the document must be prepared within three days.

To receive a 2-NDFL certificate along with all other documents upon dismissal, the employee will not need to take any additional actions. Theoretically, he is simply obliged to notify the employer of his desire; the request is expressed to personnel officers, accountants or the manager himself. Verbal wording should be sufficient to satisfy the need.

If for some reason the employer refuses to issue a document or, citing his employment, dissuades from receiving it, it is better to insure yourself with a written request.

A written request for the preparation of a form can be expressed in any form

What matters is not how it is written, but how it is presented.

When writing an application, two important points should be observed:

- In the text of the petition, clearly state your request, indicating the deadline for its submission.

- Register the form upon submission. This can be done by submitting it to the employer directly or by sending the document by registered mail.

With a written request, the employer will not be able to refuse the request, according to legal norms.

Purpose of certificate 2-NDFL

Personal income tax certificate 2 upon dismissal allows you to confirm the presence of official income for the previous period and show that income tax was paid.

This document may be needed:

- For submission to the tax office.

- When contacting banking organizations to obtain loan amounts.

- For a new employer to confirm your income and payments.

A new employer can use it to:

- Calculation of hospital compensation.

- Providing a tax deduction for children.

- Accrual of other compensations and benefits.

Expanding the scope of the requirement for this document does not allow us to say with certainty where the form may be needed for each specific dismissed person, so it is better to fill it out upon dismissal so as not to waste time obtaining it later.

Before issuing a certificate, you should decide what financial information needs to be included in it. In order not to be confused with which amounts are included and which are excluded from the form, you should understand the main thing - only information that is subject to taxation is recorded.

The following material payments cannot be taken into account:

- A benefit paid in the event of staff reduction or liquidation of an enterprise.

- State compensation for time on maternity leave and parental leave.

- Compensation for moral or physical harm caused.

- Other amounts not subject to income tax.

When filling out the form itself, indicate the following information step by step:

- The year for which information is provided.

- Serial number of the form and date of registration.

- Code of the tax authority where information about the tax paid is submitted.

- Details of the employer as a legal entity.

- Information about the dismissed person, his full name, Taxpayer Identification Number, citizenship and residential address.

- The tax rate at which deductions are made.

- Income monthly and total.

- Deductions made each month from accrued amounts.

The certificate is certified by the chief accountant of the enterprise and its director. The signatures are sealed, after which the document is handed over to the employee.

Taxation of payments upon staff reduction with personal income tax and insurance premiums

A reduction in the number or staff of an organization’s employees is one of the grounds for termination of an employment contract at the initiative of the employer (clause 2 of part one of Article 81 of the Labor Code of the Russian Federation). When terminating an employment contract on this basis, the employer is required to comply with the procedure provided for by labor legislation. Failure by the employer to carry out at least one of the measures established by law when dismissing employees, provided for in Art. 84.1 of the Labor Code of the Russian Federation, may be the basis for the court to declare the dismissal illegal and lead to the employee’s reinstatement at work.

On the day of dismissal, the employer is obliged to pay the laid-off employee all amounts due to him from the employer (Article 84.1, Article 140 of the Labor Code of the Russian Federation):

1. Wages for the time actually worked in the month of dismissal.

2. Compensation for all unused vacations (if any). Yes, Art. 127 of the Labor Code of the Russian Federation stipulates that upon dismissal, an employee is paid monetary compensation for all unused vacations. This rule applies regardless of the grounds for termination of the employment contract. Please note that if an employee is dismissed due to staff reduction before the end of the working year for which he has already received annual paid leave, no deduction is made for unworked vacation days (part two of Article 137 of the Labor Code of the Russian Federation).

3. Severance pay in the amount of average monthly earnings. From part one and part two of Art. 178 of the Labor Code of the Russian Federation it follows that the employee is paid:

- on the day of dismissal - severance pay in the amount of average earnings;

- if during the second month from the date of dismissal the employee does not find a job - the average earnings for that month;

- If within two weeks from the date of dismissal the employee applied to the employment service and was not employed by him within three months from the date of dismissal, then in exceptional cases, by decision of the employment agency, the employee is paid the average salary for this third month.

4. Additional compensation in the amount of average earnings, calculated in proportion to the time remaining before the expiration of the notice period for dismissal, if the employment contract is terminated with the written consent of the employee before the expiration of the two-month notice period for staff reduction. The fact is that according to the general rule enshrined in part two of Art. 180 of the Labor Code of the Russian Federation, the employee must be warned by the employer personally and against signature of the upcoming dismissal due to staff reduction at least two months before the dismissal. The notice must indicate the specific date of dismissal. At the same time, by virtue of part three of Art. 180 of the Labor Code of the Russian Federation, the employer, with the written consent of the employee, has the right to terminate the employment contract with him before the expiration of the period specified in part two of the same article of the Labor Code of the Russian Federation, paying him additional compensation in the amount of the employee’s average earnings, calculated in proportion to the time remaining before the expiration of the notice period for dismissal .

According to paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, when determining the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

Subclause 6 of clause 1 of Art. 208 of the Tax Code of the Russian Federation determines that remuneration for the performance of labor or other duties, work performed, service provided, or the commission of an action in the Russian Federation for tax purposes refers to income received from sources in the Russian Federation.

Thus, wages for the time actually worked in the month of dismissal are the employee’s income, subject to personal income tax at a rate of 13% (Article 224 of the Tax Code of the Russian Federation).

According to paragraphs. 1 clause 1 art. 223 of the Tax Code of the Russian Federation, when receiving income in cash, the date of actual receipt of income is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties. Let us remind you that according to clause 2 of Art. 226 of the Tax Code of the Russian Federation, the organization from which or as a result of relations with which the taxpayer received income is obliged to calculate, withhold from him and pay the amount of tax.

As for the compensation payments due to an employee upon staff reduction, in accordance with clause 3 of Art. 217 are not subject to personal income tax on all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits established in accordance with the legislation of the Russian Federation), related, in particular, to the dismissal of an employee.

The opinion of the regulatory authorities on the issue of calculating personal income tax when reducing staff is expressed in letters from the Ministry of Finance of Russia dated 02/17/2006 N 03-05-01-03/18 and dated 02/09/2006 N 03-05-01-04/22, Federal Tax Service of Russia for the city. Moscow dated 06/18/2009 N 20-14/3/061778, dated 08/21/2006 N 28-10/73963, dated 08/29/2005 N 28-11/61080.

They, in particular, indicate that compensation payments related to the dismissal of an employee, paid in accordance with Art. 178 of the Labor Code of the Russian Federation, namely:

- severance pay in the amount of average monthly earnings;

- average monthly earnings for the period of employment.

Here we draw your attention to the fact that an employment contract or collective agreement may establish increased amounts of severance pay.

In accordance with Art. 255 of the Tax Code of the Russian Federation, severance pay paid to dismissed employees in excess of the norms established by Art. 178 of the Labor Code of the Russian Federation, refers to accruals to employees released in connection with the reorganization or liquidation of the taxpayer, reduction in the number or staff of the taxpayer’s employees, and therefore reduces the tax base for corporate income tax.

However, if an employee upon dismissal due to staff reduction is paid severance pay in increased amounts, then the amount of severance pay that exceeds the amount established by Art. 178 of the Labor Code of the Russian Federation, is subject to personal income tax (see letters of the Ministry of Finance of Russia dated September 14, 2009 and December 15, 2008 N 03-03-06/2/168, dated September 26, 2008 N 03-03-06/1/546).

Regarding the additional compensation paid to the employee in the amount of average earnings in proportion to the time remaining before the expiration of the notice of dismissal, the Ministry of Finance of Russia spoke in letter dated March 11, 2009 N 03-04-06-01/54. Where he said that this payment also falls under clause 3 of Art. 217 Tax Code of the Russian Federation.

As for compensation for unused vacations, this type of compensation is excluded from the list of non-taxable compensation payments associated with the dismissal of employees (paragraph six of paragraph 3 of Article 217 of the Tax Code of the Russian Federation). Consequently, monetary compensation for unused vacation paid to an employee is subject to personal income tax in the generally established manner (letters from the Federal Tax Service of Russia for Moscow dated May 7, 2008 N 28-10/044275, Federal Tax Service of Russia dated March 13, 2006 N 04-1-03/133 ).

Documents issued upon dismissal

The dismissal procedure is strictly regulated by law. When carrying out this, the main thing is to make a full settlement with the employee and hand over to him all the documents due. In fact, the parties must close mutual claims against each other so as not to subsequently raise documentation to resolve additional issues. Receiving all the required forms in hand allows the dismissed person to save time in the future on additional trips to the former employer to obtain documents that were not previously collected.

When terminating an employment contract with an employee, the employer is obliged to hand over to him:

- A work book with a record of work in this organization.

- Medical record, if available.

- Education documents, provided that their originals were kept by the employer. We are not talking about diplomas, but about certificates of advanced training, certificates of skills acquired in the process of work, and so on.

- A certificate that will allow you to make accruals for sick leave in future work in the event of an employee’s illness.

- When an employee is laid off, he is issued a certificate for the employment center.

At the request of the person being dismissed, he is given:

- Copies of orders for admission and dismissal.

- Certified copies of incentive and transfer forms.

- Certificate of income for the last 12 months in form 2-NDFL.

All papers require proper completion and certification; the employer must adhere to established registration standards.

> > 2 personal income tax severance pay 2021 “

Personal income tax is charged only on the following payments (paragraph 1, 6, 8, paragraph 3, Article 217 of the Tax Code of the Russian Federation) in these cases, severance pay is paid as follows: in the amount of two weeks' average earnings, severance pay is paid in the following cases: by an employment contract or a collective agreement may provide for other cases of payment of severance pay, as well as establish increased amounts of severance pay, with the exception of cases provided for by this code.

Obligation of the employer to issue documents to the employee

Issuing a certificate upon dismissal is not the right, but the obligation of the employer without reminders from the individual. persons about this need. If the certificate is not issued on time, this is done after the employee applies in a short time. This norm is enshrined in Article 62 of the Labor Code.

Upon dismissal of an individual The employer provides a certificate only upon oral request from the employee, who clarifies for what period he needs the calculation. However, if it is provided on time, it is better to support the request with an application for extradition.

The company acts as a tax agent who makes monthly payments to individuals. persons - employees of the organization for the payment of earnings, in addition, accrue, withhold and transfer personal income tax to the treasury.

In practice, situations are not uncommon when, upon dismissal, the 2nd personal income tax report from the last place is not issued on time due to the formation of a debt to the employee, as well as when errors are discovered in the company’s accounting.

After a written application from the employee, the 2nd personal income tax report is issued no later than three days, only if, if this deadline is violated, the individual. the person will contact the labor inspectorate.

The number of report copies is not regulated. If necessary, after dismissal, the employee makes a written request to the head of the company to issue several forms, and he does not have the right to refuse.

Vacation compensation upon dismissal in 1s 8.3 accounting

Next, in the “Reflection in accounting” part of the window, indicate:

- Method: the one that suits you for attributing costs.

- If you are a UTII payer, also select the option you need.

Click the “record” button. This is what should happen: Get 267 video lessons on 1C for free: Accrual and calculation of vacation in 1C 8.3 upon dismissal Now let’s move on to the document for calculating vacation pay in 1C Accounting. As I said earlier, you must calculate the amount of compensation manually.

Let's create a new document. Since the employee is resigning, the final payment can also be made in this document. But I still advise you to make separate documents, there will be less confusion.

Adjustment of 2-NDFL

If the tax service has identified inconsistencies and found inaccuracies, they will have to be corrected. The company's accountant is required to make new calculations. When entering corrected information in the form, a code of 01 or more is entered in a line specially designated for this, which corresponds to the number of corrections.

It is impossible to correct errors in an already completed form; the accountant will have to draw up a new form, marking it as correcting previously submitted information. Each correction is subject to mandatory penalties.

Corrected forms are submitted with the actual filing date included. They must be transferred to the tax service using standard methods for the organization:

- Electronic.

- In paper version.

When filling out a corrective report, only corrected data is entered into it.

Upon dismissal on the last working day, the employer must provide the employee with a certificate of his income in form 2-NDFL. If the employer himself does not issue this document to the employee, then the employee has the right to independently ask the employer for it at the time of dismissal or later upon a written request in the application form.

In the latter case, the employer is obliged to issue a 2-NDFL certificate within three days from the date of the employee’s application.

The certificate includes data on amounts paid to the employee from January of the current year to the day of dismissal. All accrued payments are reflected, with the exception of those from which income tax was not withheld, for example, severance pay not exceeding three months' earnings.

Accrued severance pay in excess of three months' earnings, as well as compensation for unused vacation days, are also included in the list of income subject to 2-NDFL reporting.

How to reflect in 2-NDFL income that is taxed at different rates

If during the year an individual was paid income taxed with personal income tax at different rates, for each of them it is necessary to fill out a separate page of the certificate, as well as the Appendix to it (clauses 1.19 and 4.2 of the Procedure for filling out the 2-NDFL certificate).

On the second and subsequent pages of the help you need to fill out:

- fields “TIN”, “KPP”, “Page number”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number” and “Submitted to the tax authority (code)”;

- section 1;

- section 2;

- section 3 – when reflecting standard, social and property deductions, by which income taxed at a rate of 13% was reduced.

In empty fields you need to put a dash.

| See also: How to fill out a 2-NDFL certificate |

Payments not specified in the Labor Code of the Russian Federation

The Labor Code of the Russian Federation does not establish such grounds for canceling an employment agreement with an organization as termination of the agreement on the initiative of mutual consent and the employee’s retirement.

There are other cases not specified in the Labor Code. When such situations arise, it is difficult for the employer to classify payments as compensation due to the procedure for taxing these amounts with income tax on preferential terms.

The legislation does not establish grounds for expanding the list of benefits. Article 217 of the Labor Code of the Russian Federation stipulates that partial payment of personal income tax is possible only in the case of payments fixed at the level of federal and local legislation.

A number of charges do not apply to them:

- Severance pay.

- Average monthly salary received while working.

- Compensation payments to dismissed managers, their deputies and chief accountants of the company (at the initiative of the owner of the company’s property or by decision of the competent government agency), if their amount exceeds the SMZ three times (in the Far North - 6 times). This is enshrined in Article 181 of the Labor Code of the Russian Federation.

It turns out that the employer has the right to independently determine the list of grounds for calculating compensation upon cancellation of an employment agreement (both regular and increased amounts). This is possible even in case of dismissal by agreement of the parties (Article 78 of the Labor Code of the Russian Federation).

Tax deduction code for payment of severance pay for staff reduction

This rule applies regardless of the reason for the employee’s dismissal, i.e.

Let's return once again to the text of paragraph 3 of Art.

217 Tax Code. It follows from it that the total amounts of severance pay and average earnings for the period of employment accrued to the employee in accordance with the current legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government within the limits established in accordance with the legislation of the Russian Federation are clearly not subject to personal income tax. Mandatory payments Amounts of severance pay and average earnings for the period of employment accrued to the employee on the basis of Part.