Documentation

Deadlines for submitting a VAT return The VAT return is submitted to the Federal Tax Service on a quarterly basis electronically.

Companies on OSNO use an invoice (SCF) for VAT accounting. Universal transfer document (UDD)

The reliability of the counterparty is checked before concluding an agreement with him. This is necessary to minimize risks

Home Help Insurance premiums The line with the attribute has become one of the latest innovations for standard

Home Help Miscellaneous Officially working citizens have the right to various labor benefits according to requirements

Proper warehouse accounting and document flow allows you to effectively conduct business in modern conditions.

In general, the excise tax return is submitted and the tax is paid no later than the 25th

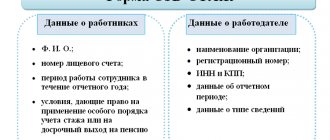

Form SZV-6-1 “Information on accrued and paid insurance contributions for compulsory pension insurance of the insured

According to the law, companies accepting payments for goods, services or work in the form of cash

Special sections of the declaration For exporters, the VAT declaration provides: section 4 - for