The reliability of the counterparty is checked before concluding an agreement with him. This is necessary to minimize the risks of invalidation of the cooperation agreement. From the letter of the Federal Tax Service dated July 24, 2015 No. ED-4-2 / [email protected] the following criteria for assessing potential threats follow:

- the powers of the head of the counterparty company do not have documentary evidence;

- the actual address of the counterparty cannot be determined;

- there is no information about this legal entity in the Unified State Register of Legal Entities;

- Doubts arise regarding whether the counterparty has the ability to fulfill the terms of the contract.

Exercise due diligence when selecting contractors.

The concepts of “due diligence” and “unjustified tax benefit” were first introduced by Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 N 53 “On the assessment by arbitration courts of the validity of a taxpayer receiving a tax benefit.” The Plenum pointed out that when assessing the activities of a company, one must look at 2 (two) important aspects of its life:

- The reality of the transaction;

- Exercise due diligence.

Paragraph 10 of Resolution No. 53 clarifies that a tax benefit can be recognized as unjustified only if inspectors prove the following:

- the taxpayer acted without due diligence and care;

- the taxpayer should have been aware of violations committed by the counterparty.

This position is still relevant today! Tax officials are trying to prove the fact that the transaction is fictitious (unreal) and the lack of due diligence. Taxpayers are trying to prove that they showed this very diligence and that at the time of the transaction no negative business factors were identified.

Here are some court decisions where exercise of caution has helped taxpayers in disputes with the tax inspectorate.

- Determination of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated November 29, 2016 N 305-KG16-10399 in case N A40-71125/2015

- Resolution of the Arbitration Court of the Moscow Region dated March 31, 2015 in case No. A41-26399/14 for ANT Firm LLC

- Resolution of the Court of Justice of the West Siberian District dated 07/08/2016 N F04-2454/2016 in case N A46-9814/2015

Download a sample due diligence policy

Exclusion from the Unified State Register of Legal Entities is equivalent to liquidation;

- “Checking against the list of invalid Russian passports.” Here you can check the passport details of the counterparty's manager.

We advise you to make copies of all Internet pages and attach them to the dossier on the counterparty. You can obtain an extract from the Unified State Register of Legal Entities from your tax office with information about the counterparty. This is a paid procedure:

- 200 rub. for providing a statement on paper within 5 working days from the date of submission of the request;

- 400 rub. for providing a paper statement on the next business day from the date of submission of the request.

By registering on the Federal Tax Service website, you can receive a free extract using the service “Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs about a specific legal entity/individual entrepreneur in the form of an electronic document.” The statement will be signed with an enhanced qualified electronic signature.

Why do you need to check the supplier before the transaction?

In my opinion, caution in choosing a supplier, carried out before the start of the relationship, helps to minimize:

- Banking risks;

- Tax risks;

- Entrepreneurial risks.

Banking risks are associated with the possibility of receiving “Refusals to carry out transactions.” If the supplier is not reliable from the point of view of banks, then by making a payment for him, it is quite possible to get an entry in the “black list” N 639-P. This has a bad effect on business, as it leads to additional losses and blocking of bank accounts.

Tax risks are associated with the fact that when making transactions with an unreliable partner, you can lose expenses that reduce the tax base and VAT. In addition, you will have to pay penalties and fines. If you are unable to pay your tax obligations, you may be subject to subsidiary liability.

Entrepreneurial risks are always associated with the fact that by trusting someone who does not deserve this trust, you can lose your property. When assessing the possibility of concluding a contract, you need to pay attention to the solvency of the applicant and the ability to fulfill its obligations under the contract. Many of the above risks can be avoided if you responsibly choose who to do business with. Excellent price quality of a transaction is not the main sign of a successful transaction. We need to think about its further consequences and understand all the risks.

Clarify what kind of business is being conducted - small or medium

It is necessary to check in the register what type of counterparty it is. This will demonstrate the level of turnover of the firm with the number of employees in the organization. Small companies can have up to one hundred employees, and medium-sized ones from 101 to 250 people, according to official data. Fly-by-night companies or fraudulent organizations will not employ so many people.

Regulations for verification of counterparties. How will it help?

Let’s imagine a situation where a company has a clearly defined procedure for analyzing a candidate before concluding a contract. Employees follow internal requirements and cut off many dangerous options in the bud. For example, when concluding a contract for processing products, you are offered an excellent price, but upon initial inspection it turns out that the processor does not have

- required production capacity;

- human resources;

- the required OKVED code to complete the transaction.

Most likely, such a candidate is unlikely to cope with the task assigned to him. It may be necessary to continue further search for someone who will meet all the necessary conditions.

advocatus54.ru

If a counterparty refuses to provide the requested documents, the manager assigns such a counterparty the category “counterparty with risks,” which is noted in the counterparty’s legal file. 3. Legal matter of the counterparty. 3.1. The counterparty's legal file is formed simultaneously with the formation of documents for concluding an agreement. 3.2. In order to formalize the legal case of the counterparty, the manager requests documents and information on the list from the counterparty. The request for documents and information is placed in a legal file. 3.3. The counterparty's legal file includes: a) information on the method of obtaining information about the counterparty (printing advertisements in the media; recommendations from partners or other persons; the counterparty's website; memo from the manager about the source of information about the counterparty); b) extract from the Unified State Register of Legal Entities (incl.

Internet; — preparation and sending by registered mail with notification to the Federal Tax Service at the place of registration of the future counterparty with a request to confirm (refute) the fact of bad faith of the future partner; — verification of the authority of the person signing the contract on behalf of the counterparty, which includes: — verification of documents identifying the person signing the contract on behalf of the counterparty; — if the agreement on behalf of the counterparty is signed by the director of an enterprise (not a separate division), it is necessary to check the powers of the director of this person (from the order appointing a person as a director, from the minutes of the Meeting of the founders of the enterprise, etc.); — if the contract is signed by any other person on behalf of the counterparty, the power of attorney must be verified (mandatory signature of the head and seal of the organization; date; period for which the power of attorney was issued; scope of the person’s powers).

Regulations for verification of counterparties. What must be included in it?

It is important to pay sufficient attention to the following factors:

The procedure for checking a candidate before making a transaction:

- How is the verification carried out?

- What facts of the availability of property, capacities, warehouse areas and other resources may be, how this is recorded: photos, video shooting of objects, etc.

- What Internet resources should be used, what to pay special attention to, how information is recorded.

Storage order and volume of required information:

- As a rule, an organization that cares about reducing its risks establishes the maintenance of “personal files” for everyone with whom contracts were signed. “Personal files” collect all the data obtained during the analysis. These are documents, photos, videos and other documents that we managed to collect.

- When checking a counterparty on online resources, it is important to correctly record the information received. To do this, screenshots are generated, which are printed and signed by the responsible persons. Do not forget that the time for drawing up the document must precede the signing of the contract. This is the only way to prove that all precautions were taken before the transaction, and not during the tax audit.

Signs of dishonesty of the counterparty, what to pay special attention to.

Such markers of bad faith were pointed out by the 53rd Plenum of the Supreme Arbitration Court of October 12, 2006. It would be useful to include them in your internal Regulations and strictly analyze the activities of the audited companies:

- failure to fulfill the terms of the transaction due to inconsistency in the time and location of property and material resources;

- lack of the required conditions for achieving results due to a lack of managerial or technical personnel, fixed assets, production assets, warehouses, vehicles;

- there are no mandatory expenses for the type of activity;

- there are no production capacities and other required resources in sufficient quantities;

- the organization was created less than 6 months before the business transaction;

- irregular nature of activity; violation of the law in the past;

- one-time, non-typical nature of the operation;

- carrying out the transaction at a place other than the location of the counterparty;

- using a chain of intermediaries.

Perhaps the mere presence of some of the above factors in a candidate does not mean that he cannot be worked with. But, if several factors indicate this, and in some cases one is enough, then, most likely, you should think about it and refuse further cooperation.

You can find more detailed information on what to look for when assessing a candidate for a deal in my article:

How to exercise due diligence when choosing a counterparty?

conclusions

If your company has not implemented the Contractor Verification Regulations, then no matter how you check individual counterparties, the inspection may accuse you of not checking them enough

. This means they did not exercise due diligence.

Procedures for obtaining information, identifying risks, collecting and recording information about the counterparty must be prescribed in the relevant Regulations

. A correctly drafted Regulation places the responsibility for obtaining information about contractors on various services and employees of the company, thus removing the head of the company from the area of responsibility.

Here are the online portals that I recommend using when checking a counterparty!

When analyzing the possibility of working with a particular partner, use:

- https://pb.nalog.ru/ - “Transparent Business” service, the current status of the counterparty, its tax system are checked, an extract from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs is saved

- https://service.nalog.ru/svl.do - the absence of information about disqualified managers and owners of companies is checked

- https://fssprus.ru/iss/ - service of the Bailiff Service, checking the availability of writs of execution.

- https://kad.arbitr.ru/ - information about the counterparty’s participation in arbitration processes is checked

- https://www.vestnik-gosreg.ru/ - information about non-operating legal entities and companies that are in one or another stage of liquidation is checked.

- https://services.fms.gov.ru/info-service.htm?sid=2000 - information about the validity of the passport of the manager/owner of the company is checked

- https://service.nalog.ru/bi.do - information about the blocking of company accounts by the Federal Tax Service (presence of unpaid taxes or unfiled reports)

In the “personal file” of the new partner, along with the agreement, place printouts from the official sources above for storage.

Attention, be careful!

1. Remember that no amount of printouts from commercial systems can prove that you carefully and carefully approached the selection of a candidate. Courts do not accept such evidence and here's why. As you know, all commercial systems take information from official sources. Data may be distorted, truncated, or not updated. Commercial systems are not responsible for incorrect information. Technical glitch and that's it! Therefore, use and record in your “personal file” screenshots and documents only from official websites of government services.

2. Remember, you need to be careful when choosing a counterparty not on formal grounds ! Many businessmen believe that it is enough to request copies of constituent documents, certificates of state registration. registration and extract from the Unified State Register of Legal Entities and everything will be in chocolate! This approach is a utopia. Arbitration practice confirms this:

- AS of the Krasnodar Territory in case A32-2566/2016;

- AS of Moscow in case A40-112921/16-20-966.

Formal collection of evidence is not enough; other verification actions are also required. Write them down in your internal regulations and follow them. This is the only way to protect your business from fines and additional charges!

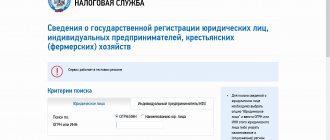

Extract from the Unified State Register of Legal Entities

You can obtain an extract from the Unified State Register of Legal Entities from your tax office with information about the counterparty. This is a paid procedure:

- 200 rub. for providing a statement on paper within 5 working days from the date of submission of the request;

- 400 rub. for providing a paper statement on the next business day from the date of submission of the request.

By registering on the Federal Tax Service website, you can receive a free extract using the service “Providing information from the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs about a specific legal entity/individual entrepreneur in the form of an electronic document.” The statement will be signed with an enhanced qualified electronic signature.

How to check the reliability of a foreign counterparty?

When a regulatory authority finds out that a Russian company, either inexperienced or deliberately, begins to cooperate with a dubious domestic enterprise, the first is charged with tax evasion and is subject to inspection by tax inspectors.

If she is suspected of partnering with an unreliable foreign counterparty, then the Federal Tax Service, along with the customs service, currency and export control authorities, will be involved in studying her work. In this regard, you should find out how you can check a foreign legal entity before planning joint activities.