Documentation

A new KND form 1151111 for the 4th quarter of 2021 has been introduced. What has changed in the document?

Tax reporting: features of formation and submission to the Federal Tax Service Main features that determine the procedure for submitting reports

RSV-2 - “Calculation of accrued and paid insurance contributions for compulsory pension insurance in

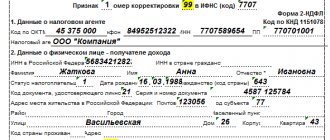

3-NDFL (form according to KND 1151020) - tax return form for personal income tax

The article discusses the procedure for registering invoices in “1C: Accounting 8” when advances are received from the buyer.

Order of the Federal Tax Service of the Russian Federation dated September 16, 2011 No. ММВ-7-3 / [email protected] established the procedure for providing

New rules for offset and refund of overpayments will come into force on October 1, 2021

Each enterprise is required to have its own seal. The imprint gives the documentation legal force, allowing it to be used

Hi all! Today the topic of our conversation will be of a slightly accounting nature: we will talk about

The new version of Law 54 Federal Law has quite radically changed the rules for using online cash registers for individual entrepreneurs,