An invoice for payment – a document that absolutely all entrepreneurs use in their work, regardless of what level they work at and what area of business they belong to. As a rule, an invoice for payment is issued after a written agreement is concluded between the parties, as an addition to it, but sometimes it can be issued as an independent document.

It is the invoice for payment that gives the buyer of goods or consumer of services grounds to pay for them. The invoice can be issued for both prepayment and post-factum payment.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Purpose and composition

Initially, the invoice did not have the same semantic load as the other document. Its main purpose was:

- provide the payer with details for transferring funds;

- confirm that the details belong to the supplier organization;

- indicate the subject of payment (goods, work, services), quantity, price, amount;

- certify all information with the signatures of responsible persons and the seal of the organization.

Subsequently, commercial relations became more developed, and the invoice for payment in some cases (for one-time transactions) began to serve as an agreement and contain all contractual terms.

What mandatory details should the invoice for payment contain, how to fill it out - let’s look at it in more detail.

First of all, there is no unified form. Organizations have the right to develop and approve by order of document flow their individual form containing the necessary information. But there are details that must be included in the invoice, and certain requirements are imposed on them.

The preparation of an invoice for payment is usually automated in an accounting program and consists of five parts:

- General information.

- Salesman.

- Buyer.

- Product part.

- Responsible persons, performer, full name, phone number.

Instructions for preparing an invoice for payment

From an office management point of view, this document should not cause any particular difficulties in developing and filling out.

At the top of the document information about the recipient of the funds is indicated. Here you need to indicate

- full name of the company,

- his TIN,

- checkpoint,

- information about the bank servicing the account,

- account details.

Next, in the middle of the line, write the name of the document, its number according to internal document flow, as well as the date of creation.

Then the payer of the invoice (also the consignee) is indicated: here it is enough to indicate only the name of the company that received the goods or services.

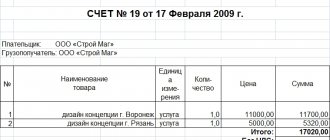

The next part of the document concerns the services directly provided or goods sold, as well as their cost. This information can be presented either in a simple list or in the form of a table. The second option is preferable, as it avoids confusion and makes the score as clear as possible.

In the first column of the table of services provided or goods sold, you must enter the serial number of the product or service in this document. In the second column - the name of the service or product (without abbreviations, concisely and clearly). In the third and fourth columns, you must indicate the unit of measurement (pieces, kilograms, liters, etc.) and quantity. In the fifth column you need to put the price per unit of measurement, and in the last column - the total cost.

If the company operates under the VAT system, then this must be indicated and highlighted in the invoice. If there is no VAT, you can simply skip this line. Then, below the right, the full cost of all goods or services is indicated, and under the table this amount is written in words.

Finally, the document must be signed by the organization’s chief accountant and manager.

First part - general information

This part contains registration data:

- Name;

- number;

- date of;

- invoice payment deadline.

Pay attention to the last line.

Given the floating exchange rate of the Russian ruble against other currencies, the terms of delivery also change. Therefore, the seller has the right to specify the number of days during which the invoice is valid for payment.

The second part is supplier information

The second part consists of the following:

- Name of the supplier according to the statutory documents. This name must be indicated in the payment order. If it is incorrect, the bank will reject the transfer.

- Bank payment details of the supplier organization (detailed).

- Name of the shipper (provider of services, works). This detail is indicated if the payment is made to the parent organization, and the consignor is its structural unit.

The third part is buyer information

It contains information:

- The name of the payer, his registration data according to the constituent documents.

- Name of the consignee. As in the case of the seller, the payer may be the parent organization, and the recipient may be its separate division.

In this case, it is not necessary to provide the buyer’s bank details.

But if the contract specifies a specific bank and this is important for the seller, then the buyer’s bank details should be entered in accordance with the contract.

Tax payments for a third party: postings from the debtor

No other payment requires strict adherence to payment deadlines, like the group of tax payments (taxes, fees, insurance premiums). If in most cases it is possible to agree with the counterparty on the postponement of deadlines or to achieve payment in installments, with tax payments the situation is much more complicated. For late tax payments, the taxpayer suffers in all areas:

- financially - forced to pay penalties and fines for any delay in tax payments (including if there is a delay of 1 day);

- reputational - thanks to the Transparent Business service, information about unpaid taxes, fees and contributions by the taxpayer is not closed. When assessing a potential partner, if such information is available, interested parties may decide the issue of a potential partnership not in his favor;

- in the main business activity - if the company plans to participate in competitions to obtain profitable orders. Among the mandatory criteria for selecting applicants for execution of an order may be the requirement that there are no unpaid taxes and fees.

As a result, the issue of timely payment of tax payments is always acute for most taxpayers. And the possibility of repayment of such amounts by third parties becomes particularly relevant. Moreover, from 2021 this possibility is directly provided for in Art. 45 of the Tax Code of the Russian Federation.

The following entries are made in the accounting records of the taxpayer for whom tax payments are being made:

The fourth part is commodity

This part should reflect in detail all the characteristics of the product (work, service):

- Name;

- manufacturer of the product or its origin;

- labeling, article number, classification and other description of the product;

- quantity;

- Price without VAT;

- VAT rate and amount;

- total amount.

The product part is summarized by the total amount payable on the invoice in figures, words in rubles and kopecks.

If the seller uses a special tax regime, then the rate should be “0%” or “excluding VAT”. And complete the total amount payable with the words “VAT is not subject to.”

Is an invoice required?

The legislation of the Russian Federation does not regulate the mandatory use of an invoice in business documentation; payment can be made simply on the terms of an agreement. However, the law calls the conclusion of an agreement an indispensable condition of any transaction. An invoice does not exist separately from the contract; it is a document accompanying the transaction. It represents, as it were, a preliminary agreement on payment according to the conditions established by the seller - the price that the buyer of the product or service must pay.

The invoice makes calculations much more certain, so entrepreneurs prefer to use it, even if this condition is not specified in the terms of the contract.

IMPORTANT! Since the requirement for an account is not legally required, it does not relate to accounting reporting documents, but is intended for internal use.

Fifth part - responsible persons and executor

Despite its apparent simplicity, this part should be taken seriously. It is the persons who signed the invoice for payment who will be responsible for the accuracy of the information and its compliance with the terms of the contract.

Often, distortion of information in the invoice leads to erroneous transfers of funds.

The details of the executor-employee who generated and issued the document and his direct telephone number are also necessary. There will be an opportunity to contact him if you have any questions, clarify existing information or obtain additional information.

After signing, you can say that the invoice for payment is completed.

List of useful services for preparing accounting documents

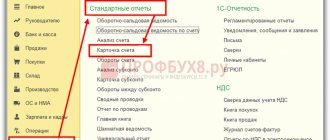

Kontur.Accounting

- Fast invoicing with step-by-step instructions

- Sending a document by email to the buyer

- A large number of services for accountants (automatic reporting, calculation of vacation pay and much more)

kub-24.ru

Convenient online invoicing software.

It is possible to configure automatic uploading of a logo, organization seal and electronic signature to the manager. The document is sent to the buyer by email.

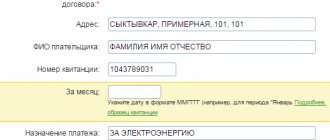

issue-invoice.rf

Online service for invoicing and maintaining accounting documents (primary documentation). Using the service, you can create an Invoice, Act, Consignment Note TORG-12, Invoice, UPD and Sberbank Receipt (PD-4). Created documents can be saved, printed, or sent by email.

Discharge procedure

If the terms of the contract require the buyer to make an advance payment, the invoice will be issued first. Based on it, the accountant will generate the entire package of documents for delivery. Namely, he will issue a delivery note, a delivery note from the warehouse, and an invoice.

If payment is made upon delivery of goods (performance of work, provision of services), then an invoice for payment is generated on the basis of shipping documents (the same package of documents as above).

All these papers are interconnected and usually have one serial number, which greatly simplifies the tracking and control of commodity transactions.

Some organizations use the invoice number as an internal coding for delivery transactions. The numbers and letters in it are not random, as it seems at first glance, but carry information about the batch of goods, the materially responsible person, the warehouse, and the like.

Can I issue an invoice from an individual?

Since individuals who are not registered as individual entrepreneurs do not pay VAT, and an invoice can only be issued by an organization or individual entrepreneur with VAT, this function is not directly available to them .

Any serious company will not pay an invoice issued by an individual, exposing itself to taxes. Or you will have to register as an individual entrepreneur/closed joint stock company/LLC in order to be able to issue invoices, or draw up an agreement with an organization for the provision of a certain type of service, and it makes payment as an individual for the work performed. So, from a legal point of view, an individual and invoicing are incompatible concepts.

Information on how to obtain a copy of an individual’s TIN via the Internet is contained in this article. If you are wondering whether notification of the opening of a current account to the tax office or other authorities is required, find out about it here.

Additional Information

At the discretion of the organization, the invoice may contain the following additional information:

Reason for display. It can be:

- contract for the supply of goods (works, services);

- buyer's request to reserve a consignment of goods;

- invoice for the delivery of goods;

- and others.

Conditions for receiving goods. For example:

- pickup;

- receipt from a transit warehouse;

- delivery of goods by the supplier to a specific address;

- and others.

If, according to the terms of the agreement, the invoice is issued in a foreign currency, and payment is required to be made in Russian rubles, then you can and should indicate which rate will be valid for payment.

You can specify how long the supplier guarantees the availability of the goods specified in the document.

If the reporting period ends, you can specify a specific end date for receipt of the goods by the buyer. Thereby preventing the presence of an advance from the buyer on the reporting date, which is necessarily reflected in the VAT return.

Don't make mistakes!

Let's look at the most common inaccuracies that entrepreneurs can make when registering an invoice.

- The signature has not been decrypted. A painting alone is not enough: there must be information about who signed it. In the online version of the document, such an error cannot be made, since it requires an electronic signature.

- Missing invoice deadlines. The date of issue of the invoice must coincide with the date of issue of the invoice and not exceed 5 days from the date of release of the goods or provision of the service.

- Delay in receiving an invoice for VAT deduction. The tax deduction for tax purposes must be claimed in the same tax period in which the document confirming this, that is, the invoice, was received. To prevent this problem, it is necessary to store evidence of the date of receipt of invoices (mail notices, envelopes, receipts, entries in the incoming correspondence journal, etc.).

- The dates on the invoice copies are mixed up. Both parties to the transaction must have identical copies, otherwise the invoice does not prove the legality of the transaction.

- "Hat" with errors. If there are inaccuracies in the names of organizations, their tax identification numbers, addresses, etc. the document will be invalid.

IMPORTANT INFORMATION! If the organization issuing the invoice notices an error, it has the right to correct it in the text of the invoice. To do this, the incorrectly recorded indicator is crossed out and the correct one is put in its place. The change made is certified by the manager’s signature, and, if necessary, by a seal, and the date on which it was made is noted. Other organizations are not authorized to make corrections to the invoice.

Application area

Invoices for payment are mainly circulated between legal entities. They can be submitted either electronically, or via mobile or fax - the main thing is that the document is read clearly.

But what if the seller is an individual entrepreneur? Don’t get lost - all the details in this case will be the same. The requirements for issuing an invoice for payment are the same. And it will be signed by the individual entrepreneur himself in three persons - for himself, for the accountant and for the contractor.

There may be such an option - the buyer is an individual. How to be in this case? What to indicate? What will be the procedure for issuing an invoice for payment? In this case, data about the individual is entered - his full name, passport details, place of permanent registration, actual place of residence, telephone number and other necessary information.

Account elements

There is no specific form for drawing up an invoice, but there are mandatory components that must be contained in it.

- Requisites individual entrepreneur or LLC (both seller and buyer):

- name of the enterprise;

- legal form of organization;

- legal address of registration;

- Checkpoint (for legal entities only).

- Information about the bank servicing the transaction:

- name of the banking institution;

- his BIC;

- numbers of current and correspondent accounts.

- Payment codes:

- OKPO;

- OKONH.

- Account number and date of its registration (this information is for internal use of the company; numbering is continuous, starting from the beginning every year).

- VAT (or lack thereof). If VAT is present, its amount is indicated.

- Last name, initials, personal signature of the compiler.

FOR YOUR INFORMATION! According to the latest legal requirements, printing on the invoice is not required.