Form SZV-6-1 “Information on accrued and paid insurance premiums for compulsory pension insurance of insured persons and the insurance experience of the insured person” (replacing SZV-4-1).

If the insured person had any special working conditions during the billing period, then a separate document is generated for him - form SZV-6-1.

Form SZV-6-1 contains the following information:

- personal data of the insured person;

- the amount of accrued and paid insurance premiums;

- features of recording the length of service of the insured person;

- information on the conditions for early assignment of a labor pension.

Information in the SZV-6-1 form is grouped into packs; each pack must be accompanied by a list of information in the ADV-6-3 form.

Why was a separate report on length of service introduced?

Since 2021, insurance premiums, for which previously had to be reported separately to extra-budgetary funds (except for payments for injuries), began to be subject to the provisions of the Tax Code of the Russian Federation.

Accordingly, they are supervised by the tax service. Despite the fact that most of the texts of the laws regulating the issues of calculation and payment of insurance premiums were transferred without changes to a special chapter of the Tax Code of the Russian Federation, a number of points in the procedure for working with these payments had to be changed. In particular, reporting on contributions has changed. It became consolidated, combining the main sections of those reports that were previously submitted to the Pension Fund and the Social Insurance Fund. However, when merging, the following were removed from it:

- final indicators of settlements with funds at the beginning of the year and at the reporting date;

- data on payment documents;

- tables containing personal information about the length of service of employees.

The frequency (quarterly) of the new consolidated reporting on contributions remains the same. The data on length of service excluded from it, which is of interest solely for accounting when calculating pensions in the future, is important only for the Pension Fund. Therefore, the Pension Fund retained the function of accepting reports on it. However, it was decided to change the frequency of submission of the report - it must be submitted once at the end of the year.

Since 2021, a new report has been introduced to the Pension Fund called SZV-TD. You can read more about it here.

Find out how to correctly fill out the SZV-TD in various situations in ConsultantPlus. Learn the material from K+ experts by getting trial access to the system for free.

General rules

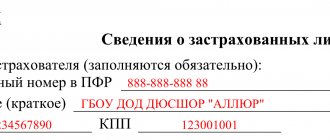

The information indicated in the headers of the forms is generally similar. In the lines “Insurant's details” the name of the merchant - IP Sidorov, as well as the registration number of the insured are indicated. An entrepreneur has two registration numbers assigned by the Pension Fund. The first is his personal number as an insurer paying contributions in the form of fixed payments, the second is as an employer making payments to individuals. In this case, write the insurance number that is assigned to the employer. It is indicated in the notice sent by pensioners upon registration. The businessman’s TIN is written next to it. The entrepreneur does not fill out the “Checkpoint” line, since this code is assigned only to organizations. Instead of the “Calculation period” field, lines appeared on the forms to indicate the reporting period, with a separate field intended for 2010. Here are cells to indicate the reporting period: “I half of the year”, “year”. Next year this line will no longer be needed. You will have to fill in the lines where the quarterly breakdown is given (Q1, half-year, 9 months, year). The line “Date of submission to the Pension Fund” remains empty. It will be filled out by the Pension Fund employee when accepting the report. This detail is not available on forms ADV-6-2 and SVV-1. Fields have appeared on the form to indicate the type of information. This information must be filled in. In the appropriate field you need to put the symbol “X”. There are three possible options. The “initial” field is marked when submitting primary information. When presenting information for the first half of the year, you need to put an “X” in this field. In the case where the submitted original form was returned to the employer due to errors contained in it, having corrected the shortcomings, the merchant also submits a form where o. The “corrective” field is marked when submitting clarifying information, that is, when it is necessary to make a correction to a report previously submitted to the Pension Fund and accepted by the fund’s employees. In this case, you must indicate the reporting period for which the information is being adjusted. The information in the correcting form completely replaces the original report, that is, it is necessary to indicate the information in full, and not just erroneous amounts or the difference when underestimating (overestimating) indicators. And the third field - “oX” in this field means that the information submitted earlier is completely canceled. In this form, you need to fill out the details of the form up to and including the “Insurance number” detail, that is, you do not need to indicate the address for sending information, the accrued and transferred amounts of contributions, and periods of work. You must fill out the header, be sure to indicate the reporting period for which the information is being canceled, and enter your full name. employees and their insurance numbers.

Who submits the experience report and to whom?

Insurers (organizations and individual entrepreneurs with employees, lawyers, notaries) fill out the SZV-STAZH for all insured persons working for them under an employment or civil law contract, including in relation to the heads of the organization who are the only participants (founders) members of organizations , the owners of their property (PFR letter dated 06/07/2018 No. 08/30755).

Individual entrepreneurs who do not have hired employees during the reporting period and have not entered into civil contracts with individuals for the provision of services (performance of work) do not submit this report.

The report on the SZV-STAZH form is filled out regardless of whether payments were made to the insured persons during the reporting period or not.

This form is submitted to the Pension Fund of the Russian Federation by organizations at the place of registration, individual entrepreneurs - at the place of residence (Clause 1, Article 11 of the Law “On Accounting” dated 04/01/1996 No. 27-FZ).

If an organization has a separate division that is registered with the Pension Fund as an insurer, then the report is submitted at the location of this separate division. Information about the length of service of employees of other separate divisions that are not registered as policyholders is included in the report of the parent organization and submitted to the Pension Fund at its location.

In addition, an extract from the SZV-STAZH form must be submitted to the insured person (Clause 4, Article 11 of the Law “On Accounting” dated 01.04.1996 No. 27-FZ):

- within 5 days from the date of application;

- on the day of dismissal;

- on the day of termination of the civil contract.

The procedure for filling out the SZV-STAZH upon dismissal of an employee differs from the generally established one. Get trial access to ConsultantPlus and get a free sample and example of completing a report in a Typical Situation.

Read about the possibility of submitting a zero report SZV-STAZH in the material “SZV-STAZH - is zero reporting submitted?”

Register of information (SZV-6-2)

Form SZV-6-2 is submitted for those employees who did not experience special circumstances during the reporting period that need to be reported to the Pension Fund. In other words, employees for whom SZV-6-1 is not compiled are included in the SZV-6-2 register. The register is compiled for employees as a whole, and not for each subordinate as SZV-6-1. This form is similar to the previous form SZV-4-2. Only the layout of the columns has changed, the table has become simpler - the relevant information is indicated in a separate column. Full name is reported here. the insured person (employee), his insurance number. In the “Address for sending information...” field, the full postal address is indicated to which pensioners will provide information about the status of the personal account of a particular employee. The column is filled in the first time information is submitted for a given employee, as well as in case of a change of address. Insurance contributions are divided into the insurance and funded parts of the labor pension. In each case, the accrued and paid amount is indicated. The new form does not indicate information about periods of temporary disability of employees, as well as about leaves at their own expense. If an employee was sick or took leave at his own expense, then a SZV-6-1 form is issued for him. The amount of accrued and paid contributions is indicated for six months of 2010 (that is, for the reporting period). Starting next year, the register will reflect information for the last three months of the reporting period. Values are recorded in rubles and kopecks. Note that if the value is round, no zeros are allowed. Thus, in Appendix 2 to the Instructions approved by Resolution No. 192p, in the example where a sample of filling out the SZV-4-1 form is given, monetary values are indicated without zero kopecks. Many details of the new form are filled out according to the rules provided for SZV-4-1. The amounts of overpaid (collected) insurance premiums are not taken into account in these lines. Only amounts related to the reporting period are written here. The dates indicated in the “Operation period” column must be within the reporting period. For an employee who has been working for you for several years, the period is indicated from January 1, 2010 to June 30, 2010. Accordingly, if you hired an employee in the first half of the year, then the period is indicated from the date of hiring to June 30, unless, of course, the subordinate didn't quit. If during the reporting period contributions were not accrued for some reason, that is, the businessman does not have information to reflect in the columns on accrued and paid contributions, information about employees still needs to be provided. The corresponding columns will remain empty.

Procedure and deadline for passing SZV-STAZH in 2021

The SZV-STAZH report form, submitted in 2021 for 2021, was approved by Resolution of the Pension Fund of the Russian Federation Board of December 6, 2018 No. 507p. In comparison with the information previously included in the quarterly reports submitted to the Pension Fund, there is nothing fundamentally new in it. Even the tables reflecting data on experience are similar.

However, the Pension Fund considered it necessary to obtain, along with information on length of service, some information that would clarify certain issues regarding the reporting employer:

- on the number of persons for whom information on length of service was generated;

- on the summary amounts of contributions accrued and paid for the year (dividing them by type of payment) and the debt on them at the beginning and end of the year;

- on the existence of working conditions that give the employee the right to early retirement, and on the number of such persons.

To reflect this data, Resolution No. 507p approved another form - EDV-1, which must be submitted along with the SZV-STAZH report.

See also “What are the differences between the SZV-STAZH form and the EDV-1 form?” .

As the deadline for submitting a report on experience, the Law “On Individual (Personalized) Accounting...” dated 04/01/1996 No. 27-FZ (clause 2, Article 11) indicates March 1 of the year following the reporting year. Law No. 27-FZ does not contain rules on shifting it if it coincides with a weekend, so if March 1 is a general day off, the report will have to be submitted earlier.

At the same time, the law also provides for exceptions to the deadline for submitting the SZV-STAZH report.

So, if the insured person submits an application for a pension, then the report must be submitted within 3 calendar days from the date of receipt of such an application (Clause 2, Article 11 of the Law “On Persuance” dated 04/01/1996 No. 27-FZ).

How to fill out the SZV-STAZH when applying for a pension and what additional documents to prepare, find out in the ConsultantPlus Typical Situation, having received trial access to the system for free.

Also, the report is submitted ahead of schedule by the insured in the event of liquidation, reorganization, termination of the status of a lawyer, the powers of a notary engaged in private practice (Clause 3 of Article 11 of the Law “On Persuchet” dated 04/01/1996 No. 27-FZ). Information on when a report must be submitted in such situations is given in the table:

| Policyholder submitting a report early | In what situation is a report submitted early? | When is the report due? |

| Legal entity in liquidation | Upon liquidation | Within one month from the date of approval of the interim liquidation balance sheet |

| In case of bankruptcy | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court | |

| Legal entity created during reorganization | When reorganizing by separating | Within one month from the date of approval of the transfer act (separation balance sheet), but no later than the day of submission of documents for its state registration |

| A legal entity merged with another legal entity during reorganization | Upon reorganization by merger | No later than the day of submission of documents for making an entry in the Unified State Register of Legal Entities on the termination of the activities of the affiliated legal entity |

| Individual entrepreneur | Upon termination of activity | Within one month from the date of the decision to terminate activities as an individual entrepreneur |

| In case of bankruptcy | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court | |

| Lawyer, notary, private practice | Upon termination of the status of a lawyer or the powers of a notary | Simultaneously with the application for deregistration as an insured |

For employers submitting information about the length of service for a number of persons exceeding 24, there is an obligation to send reports to the Pension Fund of Russia electronically (clause 2 of Article 8 of Law No. 27-FZ). When the number of employees whose data is included in the report is less than 25, then the information can be submitted on paper.

Form ADV-6-3. List of documents submitted by the policyholder to the Pension Fund of Russia

The policyholder (employer) submits this inventory together with the incoming initial (corrective, canceling) documents for 2010, which record accrued, paid contributions and insurance experience. It is certified as form ADV-6-2.

To mark the reporting period, use the same “X” icon.

In the line “Other incoming documents” the names of the forms are given, except for SZV-6-1, if they are included in the reporting. The policyholder assigns a number to the package sent along with the electronic media and enters it in the line below the table. The registration number of the pack in the territorial office of the Pension Fund of Russia is entered by the Pension Fund of Russia employee.

The total amount of contributions for the insured persons indicated in the pack is expressed in rubles and must correspond to the indicators given in the forms SZV-6-1, etc.

Rules for registration and sample of filling out SZV-STAZH in 2021

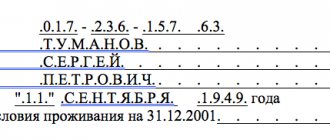

The list of information that must be reflected in reporting on length of service is provided by Law No. 27-FZ (clause 2 of Article 11), which requires the following indications for each employee:

- FULL NAME.;

- his personal account number;

- period of work during the reporting year;

- conditions giving the right to apply a special procedure for recording length of service or to early retirement.

Read about what these conditions are in the article “Special work experience - what is it?” .

Download our checklist for filling out the SZV-STAZH for 2021 and avoid making mistakes.

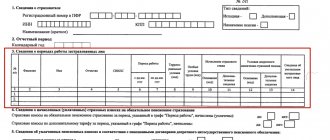

The main table of the SZV-STAZh form is intended for entering the above data. The form also contains fields for indicating the information necessary to identify the employer (its name, registration number, INN and KPP), data about the reporting period and the type of information (for the yearly report they will be initial, and in case of subsequent corrections - supplementary. In case of When submitting a report on employees applying for a pension before the end of the reporting year, the type of information will be indicated as “appointment of pension”).

Spaces are provided in the form for making notes on the presence (absence) of accrual and payment of contributions, but they are not filled out in the annual report, since they are intended for a report compiled in connection with the assignment of a pension.

The main part of the report is section 3 “Information on the period of work of the insured persons.”

In it, in order, you need to indicate the last names, first names, patronymics of the insured persons, SNILS, periods of work within the reporting year.

In this case, you need to indicate in a separate line for each employee the start and end dates of the period when he worked or did not work, for example, he was on vacation, on sick leave.

In this case, in column 11 you need to indicate additional information for each period of work. Additional information is reflected in the following codes:

| CHILDREN | Holiday to care for the child |

| DECREE | Maternity leave |

| AGREEMENT | Work under civil law contracts, including those beyond the reporting (calculation) period, payments for which were made during the reporting period |

| UVPERIOD | Working within an extended billing period |

| DLOTPUT | Staying on paid leave for employees who work under special conditions. Read more here. |

| NEOPL | Leave without pay |

| VRNETRUD | Period of temporary incapacity for work |

| WATCH | Shift rest time |

| MONTH | Transfer of an employee from a job that gives the right to early assignment of an old-age pension to another job that does not give the right to the specified pension, in the same organization due to production needs for a period of no more than one month during a calendar year |

| QUALIFY | Off-the-job training |

| SOCIETY | Performance of state or public duties |

| SDKROV | Days for donating blood and its components and rest days provided in connection with this |

| SUSPENDED | Suspension from work (preclusion from work) through no fault of the employee |

| SIMPLE | Downtime caused by the employer |

| ACCEPTANCE | Additional leave for employees combining work and study |

| MEDNETRUD | The period of work corresponding to the transfer, in accordance with the medical report of a pregnant woman at her request, from a job that gives the right to early assignment of an old-age labor pension to a job that excludes the impact of unfavorable production factors, as well as the period when the pregnant woman did not work until the issue of her employment in accordance with the medical report |

| NEOPLDOG | The period of work of the insured person under a civil contract, payments and other rewards for which are accrued in the following reporting periods |

| NEOPLAUT | The period of work of the insured person under the author's contract |

| DOPVIKH | Additional days off for persons caring for disabled children. |

| ZGDS | Information about a person holding a government position in a constituent entity of the Russian Federation on a permanent basis |

| DDG | Information about a person holding a government position in the Russian Federation |

| ZGGS | Information about a person holding a position in the state civil service of the Russian Federation |

| ZMS | Information about a person holding a municipal service position |

| PHI | Information about a person holding a municipal position on a permanent basis |

If the period was interrupted, for example, an employee quit during the year and was hired again, each period must also be indicated on a separate line.

If a report of the “Pension Assignment” type is submitted, then the end date of the period is indicated as the employee’s expected retirement date specified in the employee’s application.

If the employee’s dismissal date falls on December 31 of the year for which the SZV-STAGE form is being submitted, then in column 14 you must indicate the symbol “X”.

If an employee has the right to early retirement due to territorial conditions, then in column 8 “Territorial conditions (code)” you must indicate one of the following codes:

| Code | Name |

| RKS | Far North region |

| ISS | The area is equivalent to the regions of the Far North |

| RKSM | Far North region |

| ICSR | The area is equivalent to the regions of the Far North |

| VILLAGE | Work in agriculture |

| Ch31 | Work in the exclusion zone |

| Ch33 | Permanent residence (work) in the territory of the residence zone with the right to resettle |

| Ch34 | Permanent residence (work) in the territory of the residence zone with preferential socio-economic status |

| Ch35 | Permanent residence (work) in the resettlement zone before relocation to other areas |

| Ch36 | Work in the resettlement zone (according to actual duration) |

Note: The list of regions of the Far North and equivalent areas was approved by Resolution of the USSR Council of Ministers dated January 3, 1983 No. 12.

If an employee has the right to early retirement due to special working conditions and these conditions are documented, and insurance premiums at an additional rate or pension contributions have been paid in accordance with pension agreements for early non-state pension provision, then in column 9 “Special working conditions (code )" you must specify one of the following codes:

| 27-1 | Underground work, work in hazardous working conditions and in hot shops |

| 27-2 | Work with difficult working conditions |

| 27-3 | Work (women) as tractor drivers in agriculture and other sectors of the national economy, as well as drivers of construction, road and loading and unloading machines |

| 27-4 | Labor (women) in the textile industry in work with increased intensity and severity |

| 27-5 | Work as workers of locomotive crews and workers of certain categories who directly organize transportation and ensure traffic safety on railway transport and the subway, as well as truck drivers directly in the technological process in mines, mines, open-pit mines and ore quarries for the removal of coal, shale, ores, rocks |

| 27-6 | Work in expeditions, parties, detachments, on sites and in teams directly on field geological exploration, prospecting, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work |

| 27-7 | Work in logging and timber rafting, including maintenance of machinery and equipment |

| 27-8 | Work as machine operators (docker-mechanizers) of complex teams during loading and unloading operations in ports |

| 27-9 | Work as a crew member on ships of the sea, river fleet and fishing industry fleet (with the exception of port ships constantly operating in the port water area, service and auxiliary ships and crew ships, suburban and intracity ships) |

| 27-10 | Work as drivers of buses, trolleybuses, trams on regular city passenger routes |

| ZP12L | Working as a rescuer in professional emergency rescue services, professional emergency rescue teams and participation in emergency response |

| 27-OS | Working with convicts as workers and employees of institutions executing criminal penalties in the form of imprisonment |

| 27-PZh | Ministry of Internal Affairs of Russia and emergency rescue services of the Ministry of Emergency Situations of Russia |

| 28-SEV | Reindeer herders, fishermen, commercial hunters who live permanently in the Far North and equivalent areas |

The list of industries, works, professions, positions and indicators that give the right to preferential pension provision was approved by Resolution of the USSR Cabinet of Ministers dated January 26, 1991 No. 10.

Column 10 indicates the code of the basis for calculating the insurance period:

| SEASON | Work for a full navigation period on water transport, a full season at enterprises and organizations in seasonal industries |

| FIELD | Work in expeditions, parties, detachments, on sites and in teams during field work (geological exploration, search, topographic-geodetic, geophysical, hydrographic, hydrological, forest management and survey work) directly in the field |

| UIK104 | Work of convicts while they are serving a sentence of imprisonment |

| DIVER | Divers and other underwater workers |

| LEPRO | Work in leper colonies and anti-plague institutions |

IMPORTANT! Starting from the report for 2021, a new code “VIRUS” must be entered in column 10. It is indicated in relation to health workers who provide medical care to patients with coronavirus or suspected of it.

Column 12 “Base (code)” contains the code of the basis for the condition for early assignment of an insurance pension.

In column 13 “Additional information” you need to indicate additional information on the conditions for the early assignment of an insurance pension.

For a sample of filling out the SZV-STAZH form for 2021, see our website:

Register of contributions (SVV-1)

Information on accrued and paid insurance premiums for 6 months of the reporting period is reflected in the register in the form SVV-1. Starting next year, it will be necessary to report quarterly, so in 2011 the information in the register will be for three months of the reporting period. In the header of the form, in addition to basic information (name of individual entrepreneur, registration number, TIN, category code, reporting period), the number of insured persons according to the register is indicated. This register lists all the merchant’s employees. The table indicates the full name. employee, his insurance number, and with a breakdown into the insurance and funded parts of the labor pension, contributions accrued, additionally accrued and paid are reflected. The columns are filled in only if there were corresponding contributions during the reporting period. Please note: the “Paid” column does not reflect excess amounts of insurance premiums paid. All amounts are shown in rubles and kopecks. The table summarizes the overall results. In the line “Total according to the register” the amounts of all accrued and transferred contributions, as well as additional accruals, are written.

Responsibility for violations related to the SZV-STAZH form

In accordance with Art. 17 of the Law “On Accounting” dated April 1, 1996 No. 27-FZ, a fine of 500 rubles is imposed on the policyholder. for each insured person in case of:

- failure to submit or submit a report in violation of the deadline;

- the report contains incomplete or unreliable information.

For violation of the electronic submission form, a fine of 1,000 rubles has been established.

In addition, an administrative fine in the amount of 300 to 500 rubles will also be imposed on officials. (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

If at the time of dismissal the employee has not been issued an extract from the SZV-STAZH, then according to Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation:

- officials can either be warned or fined in the amount of 1,000 to 5,000 rubles;

- individual entrepreneurs are given a fine in the amount of 1,000 to 5,000 rubles;

- organizations can be fined 30,000–50,000 rubles.

Read about liability for violations in SZV-M in the following materials:

- “SZV-M: 500 rub. for a typo?

- “From October 1, the rules for imposing a fine for SZV-M will change”;

- “The court again did not allow the company to be fined for additional SZV-M”;

- “An accountant on sick leave - a mitigating circumstance in case of delay in SZV-M?”

Results

Information about length of service is no longer included in reporting on insurance premiums due to the fact that the tax service is now in charge of the calculation and payment of contributions intended for the Pension Fund. She has no need to obtain information about her work experience, but the Pension Fund has such a need. Therefore, the obligation to accept data on length of service remains with this fund. The report is submitted in the SZV-STAZH form once a year no later than March 01. The report for 2021 must be submitted no later than 03/01/2021 simultaneously with the EFA-1 report.

Sources:

- Tax Code of the Russian Federation

- Federal Law of 04/01/1996 N 27-FZ “On individual (personalized) registration in the compulsory pension insurance system”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

To whom is it provided?

Information about the status of an individual personal account under OPS can be provided:

- insured persons - citizens of the Russian Federation;

- non-citizens of the Russian Federation (foreigners) - in cases where they were subject to the Pension Legislation of the Russian Federation in terms of pension insurance (persons who temporarily resided and were officially employed in the territory of the Russian Federation);

- stateless persons permanently or temporarily residing in the territory of the Russian Federation, officially employed, who are subject to the OPS.