- home

- Reference

- Insurance premiums

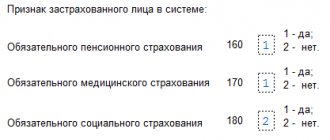

The line with the attribute has become one of the latest innovations for standard forms with calculations for insurance premiums. At first, this was due to the fact that the Federal Tax Service was now responsible for the document itself, as well as for payments. Many employees still doubt which sign to use in this or that case.

In the article we will discuss which payment attribute to set in Appendix 2 of the calculation of insurance premiums.

What does it mean

First, you should understand what this indicator means and how it can be deciphered. Disability and maternity benefits are paid to insured persons based on certain rules.

There are two mechanisms for these rules, which are recorded in the Procedure for filling out contributions.

- With direct payments and code 1, when benefits are directly paid by the FSS.

- Credit system. The organization is responsible for transferring compensation. Expenses are reimbursed from the Social Insurance Fund. Then use code 2.

The following benefits are paid to employees directly from the social insurance fund:

- When caring for children with disabilities, four days of vacation are paid.

- In the case of caring for children under 1.5 years old.

- Benefit for women who register their pregnancy in the early stages.

- Sick leave, including due to pregnancy and childbirth.

How to reflect severance pay and other payments upon dismissal in the RSV

The dismissal of employees in general cases is accompanied by the issuance or transfer of funds in the form of wages for time worked and compensation for unused vacation. Both of these payments are subject to insurance premiums. Therefore, both wages and compensation for unused vacation in the DAM will be included in full in all sections 1, 2, 3, where contributions are calculated, and will form the basis for them.

Certain situations, such as dismissal due to staff reduction or liquidation of an organization, oblige the employer to make additional payments, such as:

- severance pay;

- compensation for early dismissal;

- average earnings for the period of employment within three months;

- compensation upon dismissal of a director or chief accountant.

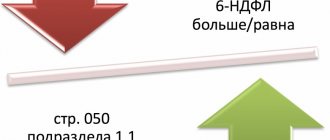

If the amount of these payments (with the exception of clause 2, which is completely not subject to contributions) does not exceed three or in some cases six times the average earnings, they are not subject to contributions. The amount exceeding the specified limit will go into the base for calculating contributions - lines 050 of subsections 1.1 and 1.2 and line 040 of Appendix 2.

In section 3 of the DAM, severance pay in case of layoffs and other similar payments are reflected in the total amount - line 140, and inclusion in the base (line 150) depends on compliance with the above conditions.

The ready-made K+ solution will help you deal with the taxation of all payments related to dismissal due to staff reduction. Get trial online access to the system and study all the latest data.

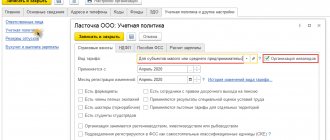

Which one should you set?

The indicator of payments depends on whether the organization participates in the project from the Social Insurance Fund “Direct Payment” of 2011. Before this, only an offset system was in effect, in which all expenses were reimbursed by employers. But the financial situation of companies does not always allow them to be fully responsible for resolving this issue. The project was created to eliminate existing problems.

Employees receive direct payments from the Social Insurance Fund faster, and there are other positive aspects:

- Reducing litigation between parties.

- There is no need to withdraw a lot of money from business circulation.

- Employers must pay only for compulsory social insurance.

- The transfer of full benefits is guaranteed regardless of the current position of management.

Attention! Government Resolution No. 294 of 2011 will be the main document to study in this case. The column is marked with 1 or 2 depending on which side the payments are coming from.

Direct system or credit system - what is the difference

The main purpose of introducing a pilot project is to improve the financial situation of both employers and staff. The advantages of the direct system for employees are, first of all, the speed and convenience of payments. Money is transferred promptly, in any way convenient for an individual (to a card, by postal transfer, to a bank account) and in full. The fact that the employer has available funds does not matter.

It is also more profitable for the employer if the payments are made by the Social Insurance Fund. There is no need to withdraw your own funds from circulation, waste time on calculating benefits, or bear responsibility for the correctness and completeness of calculations. After all, when an employee brings in sick leave, it is necessary to accrue benefits to him and then pay him. If the employer is conscientious, problems usually do not arise. However, cases of delay or even complete non-payment of money are not uncommon. This led to labor disputes and conflicts. Changing the credit system to a direct one at the legislative level makes it possible to directly issue money to employees without affecting the budget of employers.

Read: How to make an adjustment according to the RSV

Features of filling out Appendix 2

Appendix 2 of the First Section of the calculation of insurance premiums is information that is recorded by almost all employers and payers of contributions. This is usually associated with sick leave and maternity. The most questions arise about filling out this part of the reporting.

First of all, the numbers are entered in lines 070, 080, 090. Secured contributions are taken into account here.

Line 080 is devoted to the amounts of expenses reimbursed by the territorial division of the FSS of Russia as part of insurance for the facts of maternity and the occurrence of various diseases. It is necessary to indicate information regarding the month in which the calculations were actually made.

Line 090 is the difference between the numbers from line 060 of the same Appendix and 070. The totals for line 080 are added to the result. If the region belongs to the participants of the pilot project from the Social Insurance Fund, then the obligation to fill out line 090 is eliminated.

Types of insurance premiums

Insurance contributions include: insurance contributions for compulsory pension insurance (OPI), paid to the Pension Fund of the Russian Federation; insurance contributions for compulsory social insurance for temporary disability and in connection with maternity, paid to the Social Insurance Fund of the Russian Federation; insurance premiums for compulsory medical insurance (CHI), paid to the Federal Compulsory Medical Insurance Fund of the Russian Federation; insurance premiums for injuries (insurance premiums for compulsory social insurance against industrial accidents and occupational diseases).

Reimbursement from the Social Insurance Fund: how it is recorded in writing

Example - if the payment was made in May, then the information is recorded on line 080 in the column for month 2 in the second quarter.

As a result of calculations, negative or positive numbers are usually obtained. The calculation does not indicate amounts with a minus sign in front. What is needed is the difference itself, and a negative or positive value is fixed using the numbers 1 or 2. In the first case, contributions are greater than costs, in the second, vice versa.

In this case, simultaneous filling is required for the following lines:

- 110, 120.

- 113, 128.

- 112, 122.

- 111, 121.

Legal basis

Issues of insurance premiums are regulated by a number of federal laws.

Chief among them is Federal Law No. 212-FZ of July 24, 2009, which introduced a system of insurance premiums in the Russian Federation. Law 212-FZ establishes: the circle of contribution payers; If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

taxable object and base; insurance premium rates; the procedure for paying insurance premiums and monitoring their payment; liability for violation of legislation on insurance premiums; the procedure for appealing acts of regulatory authorities and actions (inaction) of their officials.

If there is a discrepancy with the accounting data

With such discrepancies, fair doubts may arise that the document is generally filled out correctly. For example, the actual costs of the company are reimbursed by the Social Insurance Fund. But according to calculations, it turns out that there is a serious debt of the enterprise to the regulatory authorities, which is not true. Money that has already been reimbursed is added to the assessments accrued for the period.

But in such a situation they do not consider that a mistake has been made. The calculation is filled out in accordance with the general instructions from the Procedure.

The large total amount is recorded in the final line 110 of the first section and in line 090. But only the amount of the contributions themselves is paid to the Fund.

Reference! When all the information is transferred to the card for calculating the budget, the controlling services will immediately see overpayments and arrears. There will be no additional debts; everything will be recalculated automatically.

On paper or electronically?

There are several ways to submit the DAM for the 1st quarter of 2021:

- On paper - if the number of employees is no more than 10 people.

If during the reporting period you paid income to a maximum of 10 employees, the calculation can be submitted both on paper and electronically.

- In electronic form - if the number of employees is 11 people. and more.

If in the 1st quarter of 2021 income was paid to more than 10 employees, the DAM is submitted exclusively in the form of an electronic document signed with an electronic signature. It is sent to the Federal Tax Service via telecommunication channels (TCC) through electronic document management operators.

Let us remind you that in 2021, the calculation was submitted electronically if the average number of employees who received income for the previous period exceeded 25 people.

Checking the correctness of filling

Control ratios make it easier to verify the specified data and its reliability. In most accounting programs, such ratios are checked automatically. The applications simply will not allow you to enter incorrect numbers. Letters from the Federal Tax Service of Russia also contain information on control ratios - this is relevant when entering information independently.

Reconciliation of calculations with the budget can be ordered from the tax service.

Payers of insurance premiums

Payers of insurance premiums (policyholders) are those persons who are required by law to pay contributions to compulsory social insurance.

Payers of insurance premiums include: 1. Persons making payments and other remuneration to individuals (under employment or some civil contracts): heads of peasant farms; individuals who are not recognized as individual entrepreneurs, but use the hired labor of other individuals to solve their everyday problems (for example, when a nanny for a child or a housekeeper is hired). If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

2. Individual entrepreneurs, lawyers, notaries, private detectives and other persons who carry out private practice, pay insurance premiums for themselves and do not make payments to other individuals. If the payer of insurance premiums simultaneously belongs to several specified categories (for example, a notary with employees), then he calculates and pays insurance premiums for each basis.

Object of taxation of insurance premiums

For organizations and individual entrepreneurs, the object of taxation is payments and other remunerations accrued: - in favor of individuals working under civil law contracts and employment contracts, the subject of which is the performance of work, provision of services, with the exception of remunerations accrued in favor of individual entrepreneurs, lawyers, notaries and other persons engaged in private practice; on the alienation of the exclusive right to works of science, literature, and art; publishing license agreement; a license agreement granting the right to use a work of science, literature, or art; – in favor of individuals subject to compulsory social insurance in accordance with current legislation.